Sam Edwards

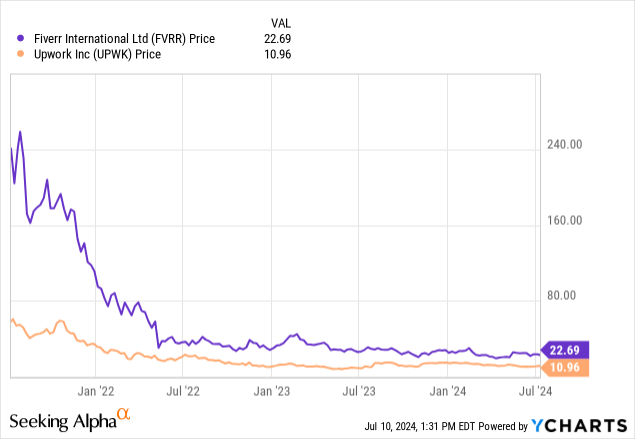

I nearly picked up shares of Fiverr International (FVRR) following its appearance in the recent edition of the Rare Stock Picks listicle. The Buy recommendation was offered by buy-side analyst, Enrique Boente. But a deeper look into the company’s financials and disclosures surfaced some concerns, and I knew I was going to take a pass.

I then moved on to Upwork (NASDAQ:UPWK), Fiverr’s larger peer. For those who don’t know, both of these companies offer online services marketplaces. It’s almost like a Kijiji for services instead of products. Now, if I understand correctly, the services don’t have to be rendered online, but in most cases, they are. The two websites upwork.com and fiverr.com mostly contain freelancer offers to do web design, IT, accounting, legal, or writing tasks. White-collar work, mostly.

My Investment Interest

The draw for me, as an investor, was multifold. First, I don’t tend to have a lot of services-related companies in my portfolio. I probably should, and these companies are also not necessarily positively correlated with the health of the economy. If the economy hits a rough patch, and companies lay off large numbers of employees, many of those people might try to find some work projects through platforms such as Upwork and Fiverr, bolstering them.

Also, I tend to be a contrarian investor. Not always, and sometimes I jump onto a ride as it’s already rising, but it’s my nature to search for appealing companies near the bottom, hoping business performance might improve.

In an environment when markets seem to be making new highs every day, these two stocks could definitely qualify as contrarian picks.

I discovered that these 2 companies are almost identical studies. I’ll be focusing on Upwork here, but adding some comparisons to Fiverr. Upwork is headquartered in San Francisco, and Fiverr has its offices in Israel.

Upwork Financials

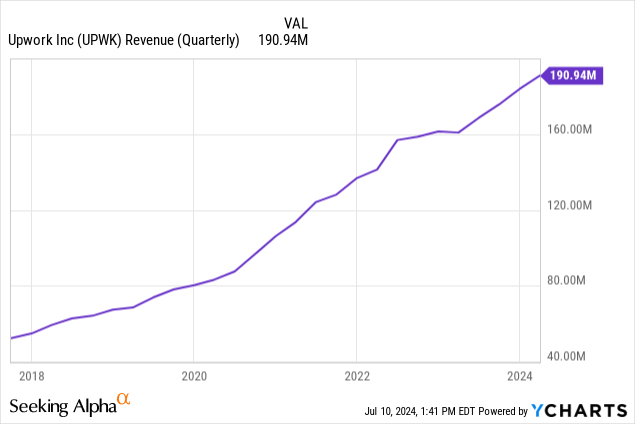

Investors looking at Upwork will see a pretty healthy top line. Revenues have been steadily increasing, rising from $164 million in 2016 to $719 million over the past twelve reported months. The below chart reflects quarterly revenue.

In studying the annual revenue, the significant growth in 2021 left me suspecting there was an acquisition here. However, I didn’t see anything acquisition activity on the cashflow statement, and in reviewing the 10-K for 2021 the word “acquisition” appears frequently, but Upwork is referring to user acquisition. COVID obviously led to a lot more people seeking online work. It’s noteworthy that there’s been no real sign of a drop-off once the pandemic passed. The same goes for Fiverr.

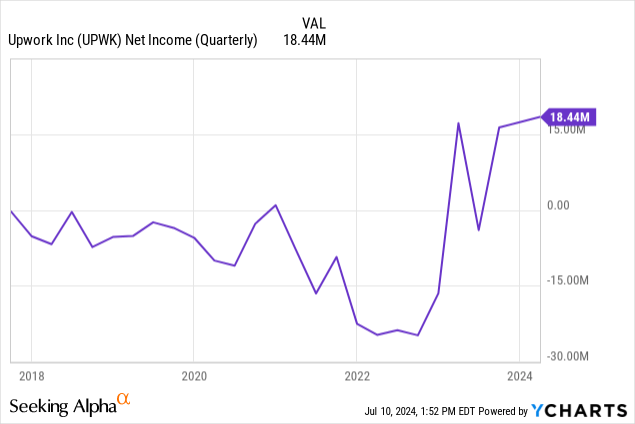

What has been much less pretty is the bottom line. The company has struggled with profitability ever since its founding (original name was regrettably Elance-oDesk – no idea why that didn’t catch on!).

Shareholders have seen Upwork’s net income turn positive during recent reports, which is a rare bout of consistency. Quarterly net income has been steady in the $16 million – $19 million range over the past 3 reports. That’s amounting to EPS of about $0.13 per quarter, so a run rate somewhere in the vicinity of $0.50 annual EPS. Non-GAAP EPS was $0.22 in the most recent quarter, and analysts are expecting to see it come in at $0.93 for the year, of revenues of about $780 million (+13% y/o/y).

Operating Cashflows have been less impressive, though, and less steady. Interestingly, this is the opposite for Fiverr, which is still struggling to post any notable net income, but the cash flows look more impressive.

The Rub

Both Upwork and Fiverr are carrying interesting balance sheets. Both companies have quite substantial cash (C&E) holdings, but also large debt positions. So what’s going on here?

| C&E | L-T Debt | Market Cap | |

| Upwork | $491 m | $356 m | $1,510 m |

| Fiverr | $489 m | $456 m | $902 m |

Well, in 2021, Upwork issued $570 million of convertible notes back when interest rates were almost nil. These notes carry a 0.25% interest rate. The company repurchased about $210 million of these notes last year. The outstanding position of ~$356 million currently costs the company less than $1 million per annum.

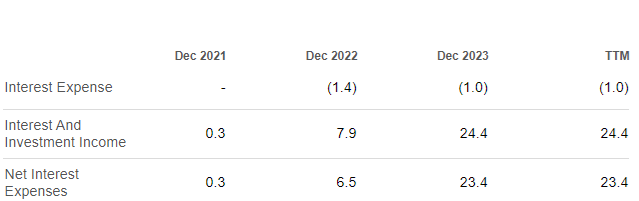

Meanwhile, the company has earned nearly $25 million of interest income in the past year.

Seeking Alpha

So while Upwork’s financial performance has improved, even on an EBIT and EBITDA basis, the bottom line doesn’t look nearly as rosy as it first seemed. Regardless of whether the company refinances the long-term notes in 2026 (when they mature) or extinguishes the debt with their cash, net interest income will likely shrink to a fraction of what they’ve been posting recently. Removing ~$20 million from UPWK’s bottom line makes everything look a whole lot less appealing.

Funny enough, Fiverr even managed to outdo Upwork and issued zero-coupon (0%) convertible debt during the pandemic. That $460 million of debt is set for refinancing in 2025, a year ahead of Upwork.

Stock-Based Compensation

Both Upwork and Fiverr are also reporting sizable amounts of share-based compensation (SBC). In fact, the amounts are almost identical. Upwork and Fiverr have each reported about $70 million in SBC over the past 12 months.

For the uninitiated, Stock-Based Compensation is a non-cash charge on the income statement, but it’s added back when calculating Operating Cash Flows (OCF). Adjusting for this (since I view SBC as a real cost, not a phantom one), Upwork’s OCF over the past 12 months would flip from ~+$42 million to about -$30 million, while Fiverr’s positive OCF is essentially neutralized.

Valuation And Recommendation

At first glance, Upwork, the largest of the 2 publicly-traded online work marketplace companies, looks compelling. These are contrarian investments that may benefit if the economy hits a rough patch, providing useful portfolio diversification. That may still be the case.

The valuation for UPWK looks reasonably attractive at slightly above 20x GAAP EPS (run rate of past 3 quarters) based on a current trading price of $10.80. Plus, the company has begun to deliver meaningful cash flow from operations.

A closer look reveals things are not as tasty as they appear. Removing the short-term net interest income boost brings UPWK’s GAAP EPS down to about the $0.37 range, making the true GAAP P/E to nearly 30x. Peer Fiverr’s ~breakeven results would turn into net losses for the same reason.

Meanwhile, cash flows look better than they reasonably should be as a result of substantial share-based compensation.

As a result, I’d rate both companies a Hold here. I might take another look at UPWK if the share price returns to a new 52-week low, or if the economy takes a real dive.