nattul/iStock via Getty Images

We previously covered Petrobras (NYSE:PBR) in May 2024, discussing why we had reiterated our Buy rating despite the volatility observed in its stock prices, the dramatically ousted CEO, and the FQ1’24 dividend payout miss.

Thanks to its inherent undervaluation and rich forward dividend yields, we believed that the risk/ reward ratio remained highly attractive despite the moderate volatility.

Since then, PBR has already offered a total return of +6.6% (including dividends), out performing the wider market at +5.4%.

With its FQ2’24 dividends stable on a sequential basis, paid out from the “2023 extraordinary dividends that were withheld by the board in March,” it is apparent that the Brazilian oil/ gas producer’s dividend investment thesis remains highly attractive.

This is significantly aided by the Fed’s projected pivot and the higher for longer crude oil spot prices, resulting in our reiterated Buy rating.

PBR’s Stock Underperformance Triggers Its Rich Dividend Yields

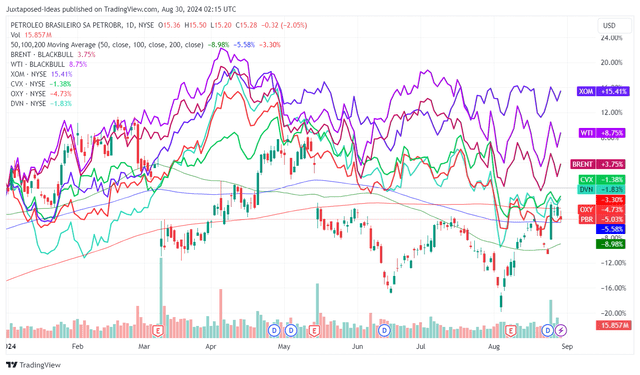

PBR YTD Stock Price

Trading View

It goes without saying that PBR has underperformed many of its major oil/ gas peers, with part of the discount attributed to its state-run status, the inherent volatility of the country’s political scene, and the numerous leadership changes over the past few years.

Combined with the uncertain payment of the 2023 extraordinary dividends, it is unsurprising that market sentiments remain mixed.

This is worsened by the mixed FQ2’24 top/ bottom-line performance, as PBR reports revenues of $23.46B (-1.2% QoQ/ +2.1% YoY), adj net incomes of $3.06B (-36.3% QoQ/ -48.5% YoY), and Free Cash Flow of $6.14B (-6.1% QoQ/ -8.6% YoY).

The last metric is important indeed, since the oil/ gas producer has revised its quarterly dividend policy (including share repurchases) to be at least 45% of its Free Cash Flow, down from the previous policy at 60% – subject to the company’s gross debt levels of below $65B.

By FQ2’24, PBR continues to report a reasonable gross debt level of $59.63B (-3.5% QoQ/ +2.8% YoY), allowing the management to pay out returns of ~$2.54B including dividends and share repurchases (inline QoQ/ -59% YoY), or the equivalent 41.3% of its Free Cash Flow (inline QoQ/ -51.2 points YoY).

Much of the top-line tailwinds are attributed to the relatively stable production levels at 3,737 Mboed (-3% QoQ/ +1.1% YoY) and the higher realized prices at Brent crude of $84.94 per barrel (+2% QoQ/ +8.3% YoY).

These well balance PBR’s one-time Tax Transaction worth approximately $8B, which triggered the impact on its FQ2’24 net incomes by -$2.1B.

Even so, August 2024 has already brought forth a relatively lower Brent spot prices of ~$79 per barrel, with it potentially contributing to a sequentially lower Free Cash Flow generation, worsened by the heavier capex weightage by +7.6% sequentially in H2’24.

While this development may be well balanced by the $2.75B remaining on its Capital Remuneration Reserve, PBR investors may want to temper their H2’24 dividend expectations indeed, as the OPEC+ also “relaxes their output curbs.”

While the US EIA expects the Brent oil spot prices to remain elevated at ~$85 per barrel through 2025, up from the average of $65 per barrel observed in 2019, it is uncertain if we may continue to see these numbers.

This is attributed to “the slowing demand growth in China and the higher supplies from outside OPEC+” – with the demand supply imbalance potentially triggering a further softening of Brent spot prices.

As a result, readers may want to monitor to the ongoing development in the oil/ gas industry, since PBR’s prospects are inherently linked to the volatile commodity spot prices.

PBR’s Intermediate-Term Oil/ Gas Prospects

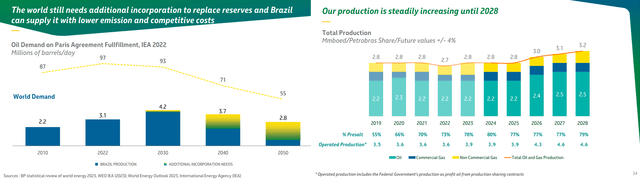

PBR

Even so, we believe that PBR remains well positioned to generate profitable spreads while paying out rich dividends in the intermediate term, despite the potential volatility/ normalization in spot prices.

This is attributed to its low Total Cost of Oil Produced at $34 per boe, with its spreads remaining excellent assuming a further moderation in Brent spot prices nearer to pre-pandemic levels of $65s.

At the same time, PBR’s sustained capex efforts are expected to deliver a robust growth in total productions at a CAGR of +5.66% between 2025 and 2028, with it likely to well balance the lower spot prices upon the normalization in macroeconomics over the next few years.

PBR’s Long-Term Renewable Prospects

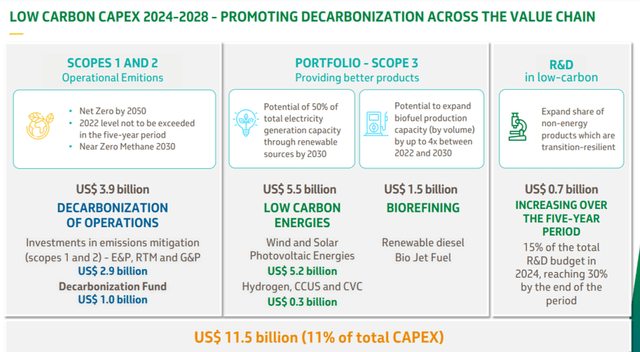

PBR

Lastly, despite the near-term electrification delays, it is undeniable that the world is looking towards renewables for their long-term decarbonization efforts, with PBR already diversifying their capex with low carbon/ bio-refining efforts.

While these efforts are unlikely to be top/ bottom-line accretive over the next few years, we believe that the 11% ratio to its overall capex remains reasonable enough – allowing the management to consistently pay out rich dividends during the ongoing transition.

So, Is PBR Stock A Buy, Sell, or Hold?

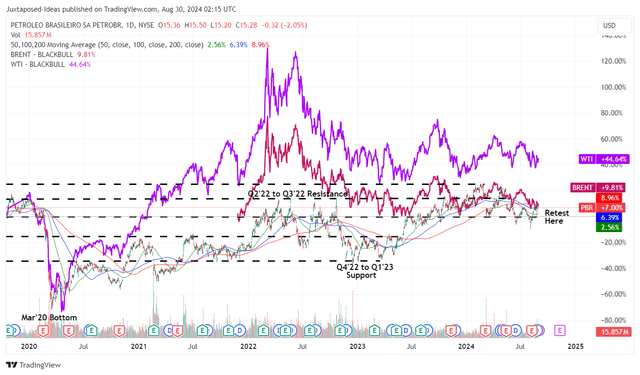

PBR 5Y Stock Price

Trading View

For now, PBR has continued to chart lower highs and lower lows on a YTD basis, similar to the moderating WTI and Brent crude oil spot prices.

Even so, we welcome the moderation, since it remains highly compelling as a dividend stock with the estimated YTD payout at $2.38 per ADR share and rich yields of 15.5%, based on the stock price of $15.28 at the time of writing.

Much of this phenomenon is attributed to PBR’s inherent undervaluation at FWD P/E valuations of 6.47x, compared to its major oil/ gas peers, such as Exxon Mobil (XOM) at 13.68x, Chevron (CVX) at 12.58x, Occidental Petroleum (OXY) at 14.82x, and Devon (DVN) at 8.34x.

Even when comparing to XOM’s forward dividend yields of 3.26%, CVX at 4.47%, OXY at 1.55%, and DVN at 4.53%, it is undeniable that the former continues to offer an attractive dividend story despite the inherent volatility.

As a result, we are reiterating our Buy rating for opportunistic investors seeking rich dividend yields, with the Fed likely to pivot by 25 basis points in the upcoming September 2024 FOMC meeting and the resultant moderation in the US Treasury Yields to between 3.67% and 5.10%.

Do not miss this dip.

It goes without saying that PBR is not for the faint hearted and for those seeking stable quarterly incomes, given its variable dividend policy as discussed above. Combined with the updated dividend policy, investors may want to size their portfolios according to their risk appetite and portfolio allocation as well.