Mission Produce Contends With Soft Pricing And Ongoing Inflation

Olesia Shadrina

A Quick Take On Mission Produce

Mission Produce (NASDAQ:AVO) reported its FQ4 2022 financial results on December 22, 2022, missing revenue and EPS estimates.

The firm grows and distributes fresh avocados and other produce in more than 25 countries.

I’m on Hold for AVO until ongoing inflation pressures abate and pricing support returns.

Mission Produce’s Overview

Oxnard, California-based Mission was founded to develop an integrated avocado supply chain, from sourcing to production and distribution.

The firm produces avocados on its own land as well as sources avocados from third-party growers to provide customers with year-round supply.

Management is headed by Founder, President, and CEO Mr. Stephen Barnard, who was previously in the lettuce and avocado divisions of Santa Clara Produce and has served in senior leadership roles in various industry trade association trade groups.

The company’s primary offerings include:

-

Ripening

-

Bagging

-

Custom packing

-

Logistical management

-

Merchandising & promotional support

-

Training

The firm sells its produce through distributors via a global distribution network.

The U.S. is the company’s largest single market, and the Hass avocado accounts for approximately 95% of avocados consumed in the U.S. and 80% of avocados consumed on a global basis.

Market & Competition

According to a 2020 market research report, the global market for avocados is expected to grow from an estimated $14 billion in 2020 to $19 billion by 2027.

This represents a forecast CAGR of 4.8% from 2020 to 2027.

The main drivers for this expected growth are increased consumption of avocados in China, which is expected to grow at a much higher CAGR of 7.4% from 2020 to 2027.

Also, the markets of Canada, Japan, and Germany are expected to grow at 4.3%, 2.6%, and 3%, respectively, growing at a slower rate than the overall growth rate.

Major competitive or other industry participants include:

-

Calavo Growers (CVGW)

-

Fresh Del Monte Produce (FDP)

-

Westfalia

-

Del Rey Avocado Company

-

Henry Avocado

-

Olivado USA

-

Superior Foods Companies

-

The Horton Fruit Co.

-

Salud Foodgroup Europe B.V.

Mission Produce’s Recent Financial Performance

-

Total revenue by quarter has produced the following trajectory:

Total Revenue (Seeking Alpha)

-

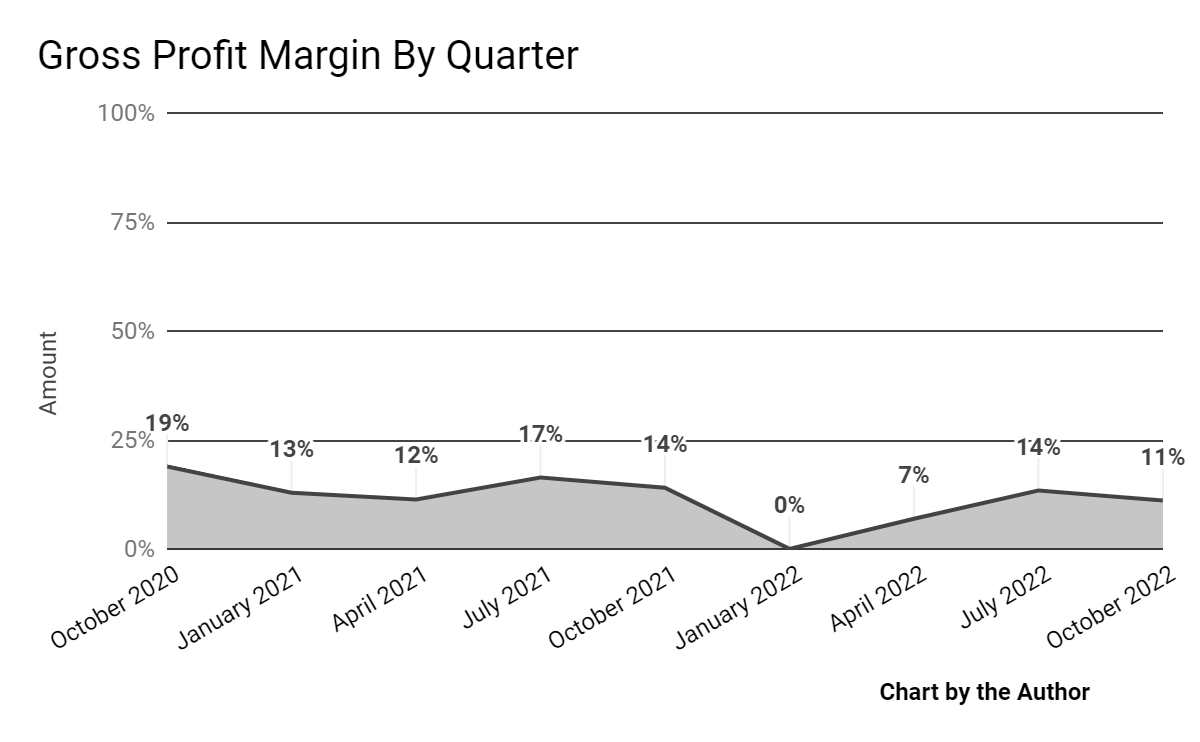

Gross profit margin by quarter has trended lower, per the following chart:

Gross Profit Margin (Seeking Alpha)

-

Selling, G&A expenses as a percentage of total revenue by quarter have remained within a narrow range:

Selling, G&A % Of Revenue (Seeking Alpha)

-

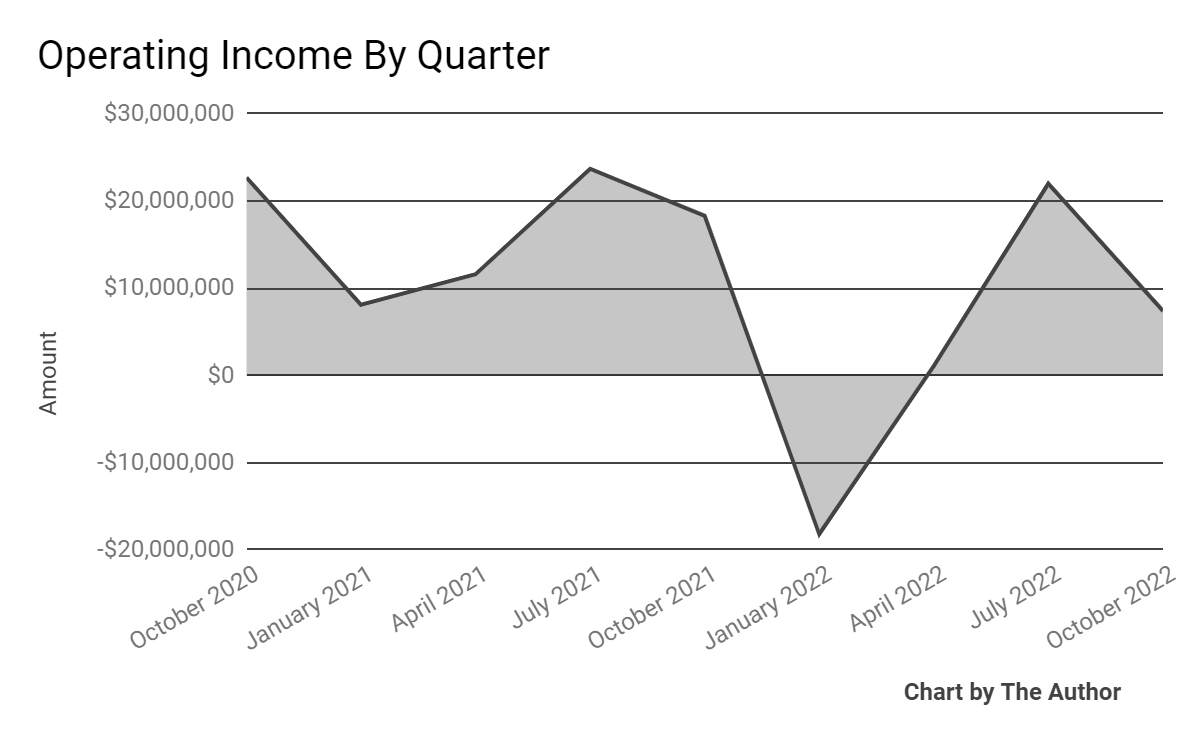

Operating income by quarter has fluctuated seasonally as shown below:

Operating Income (Seeking Alpha)

-

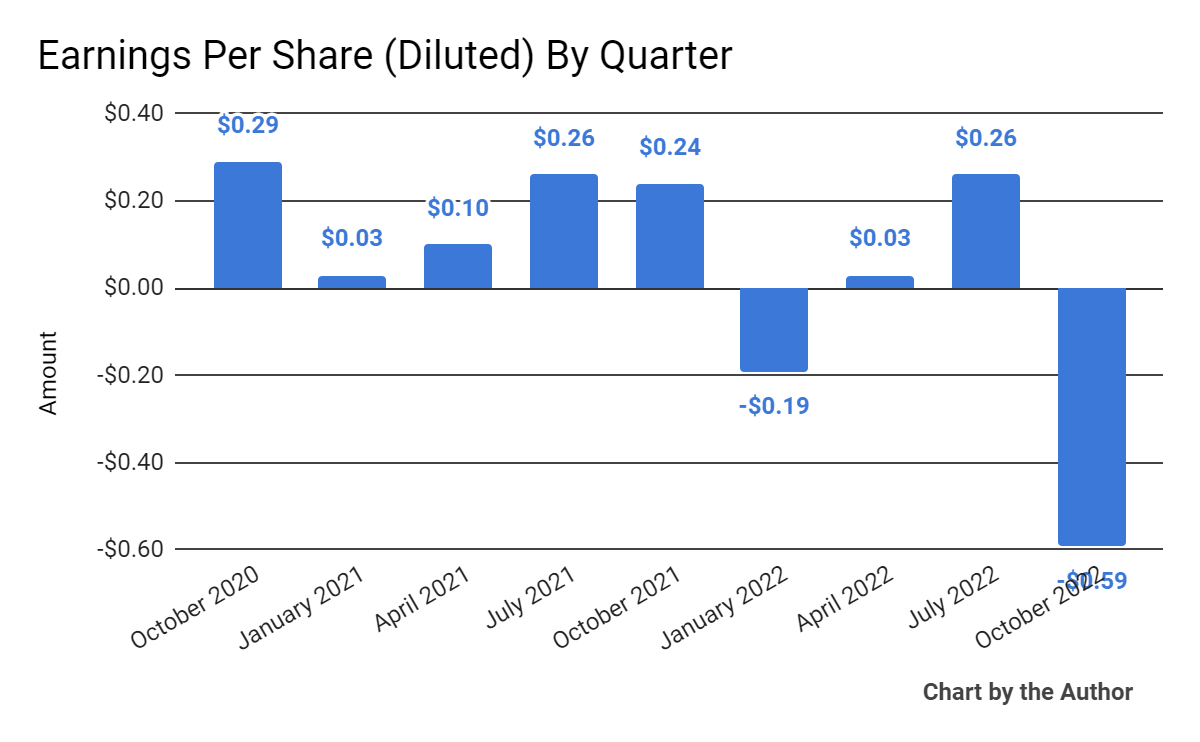

Earnings per share (Diluted) produced sharply negative results in the most recent quarter:

Earnings Per Share (Seeking Alpha)

(All data in the above charts is GAAP)

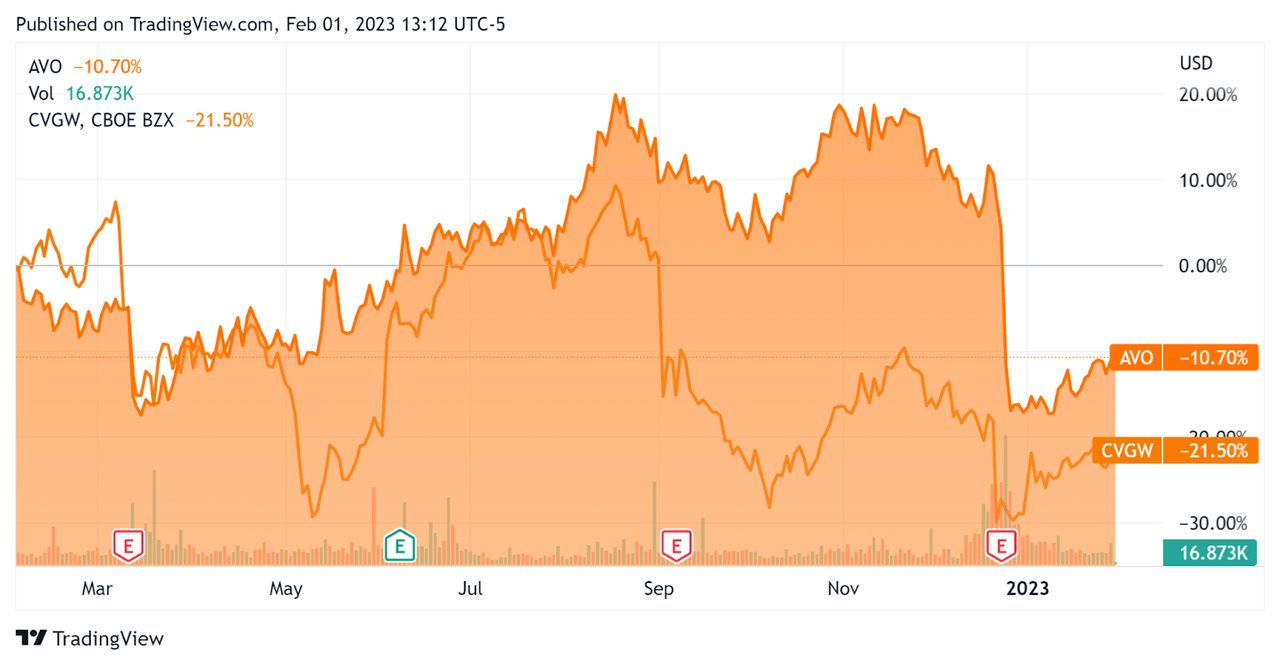

In the past 12 months, AVO’s stock price has fallen 10.7% vs. that of Calavo Growers’ drop of 21.5%, as the chart below indicates:

52-Week Stock Price Comparison (Seeking Alpha)

Valuation And Other Metrics For Mission Produce

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure (TTM) |

Amount |

|

Enterprise Value/Sales |

1.0 |

|

Enterprise Value/EBITDA |

28.3 |

|

Revenue Growth Rate |

17.3% |

|

Net Income Margin |

-3.3% |

|

GAAP EBITDA % |

3.6% |

|

Market Capitalization |

$866,408,510 |

|

Enterprise Value |

$1,048,508,480 |

|

Operating Cash Flow |

$35,200,000 |

|

Earnings Per Share (Fully Diluted) |

-$0.49 |

(Source – Seeking Alpha)

As a reference, a relevant partial public comparable would be Calavo Growers; shown below is a comparison of their primary valuation metrics:

|

Metric (TTM) |

Calavo Growers |

Mission Produce, Inc. |

Variance |

|

Enterprise Value/Sales |

0.5 |

1.0 |

88.7% |

|

Enterprise Value/EBITDA |

22.4 |

28.3 |

25.9% |

|

Revenue Growth Rate |

12.8% |

17.3% |

35.0% |

|

Net Income Margin |

-0.5% |

-3.3% |

536.5% |

|

Operating Cash Flow |

$50,230,000 |

$35,200,000 |

-29.9% |

(Source – Seeking Alpha)

Commentary On Mission Produce

In its last earnings call (Source – Seeking Alpha), covering FQ4 2022’s results, management highlighted the drop in prices due to the start of the new Mexican season, although ‘the speed of the decrease greater than expected.’

The company has experienced continued cost inflation and other factors, which have resulted in what management considers to be ‘temporary margin compression.’

However, the firm continues to develop its Peruvian crop distribution as part of its broader strategy to build out a global sourcing network.

As a result, management’s strategic vision is to ‘propel the avocado category forward in Europe’ just as it has in the U.S.

As to its financial results, total revenue was essentially flat year-over-year, although volumes increased 6% due to a larger Peruvian harvest and increased Mexican volume.

The company’s international farming segment was negatively impacted by cost inflation and other factors.

SG&A expenses were up by $4 million to $19.5 million from higher employee costs via stock-based compensation and other costs.

For the balance sheet, the firm ended the quarter with $52.8 million in cash and equivalents and $139.4 million in total debt.

Over the trailing twelve months, free cash used was $26 million, of which capital expenditures accounted for $61.2 million. The company paid $3.6 million in stock-based compensation.

During the quarter, management wrote off a non-cash expense of $49.5 million in goodwill related to its Peruvian reporting unit.

Looking ahead, management guided to lower CapEx spend for its core avocado business while it expects avocado pricing to be ‘down approximately 20% to 25%’ while the company continues to fight inflationary pressures.

Regarding valuation, the market is valuing AVO’s EV/EBITDA results at a premium to competitors such as Calavo Growers.

The primary risk to the company’s outlook is continued cost inflation and the potential for a slower ramp-up in sales to Europe in a downward pricing environment.

So, in the near term, I’m on Hold for AVO until inflation pressures abate or pricing power returns.