ZeroFox: There Is Still Upside To The Stock (NASDAQ:ZFOX)

Just_Super

Thesis update

This is an update to my original thesis for ZeroFox (NASDAQ:ZFOX).

While 3Q revenues of $43 million were higher than expected, cash flow was less than anticipated due to one-offs such as the SPAC-related expenses. Management only increased 2H23 guidance by $1 million despite the $2 million beat, which I believe to be conservative. Despite this, I remain confident that ZFOX has the financial wherewithal to reach FCF breakeven and that the long-term opportunity will prove fruitful. At the end of the day, ZFOX is operating in a promising industry with ample room for expansion.

My core thesis remains unchanged. This explosion of online personas and brands has proven too much for corporate IT departments to handle. For a long time, keeping an eye on digital possessions and weeding out fake profiles was a labor-intensive, hands-on process. ZFOX is able to automatically monitor, detect, and fix social media accounts that have been hacked or are fraudulent, saving its customers time and stress. All in all, ZFOX provides a fully automated solution to remediation, which is the most time-consuming part of security and digital marketing teams.

Earnings takeaway

When ZFOX will begin to generate profits is my primary concern, and I imagine it is for other investors as well. ZFOX has $53 million in cash and $35 million in incremental debt as of the 3Q, and despite not disclosing profitability targets, the company is confident it can reach FCF breakeven with these resources. Profitability, in my opinion, has increased in significance for investors in today’s more challenging macro environment. On the positive end, management has stated that, despite an abnormally high operating cash flow burn of $22 million in FY23 (due to SPAC expenses of $14 million), they anticipate FCF to return to normal levels of around $8 million in FY24. Also on the plus side, I think that the 72% non-GAAP gross margins of its subscription business, which is growing faster, should help drive future potential profits.

Earnings update

All told, ZFOX raked in $43.0 million in revenue on the back of $70.3 million in ARR and $46.6 million in billings. The -$22.1 million operating cash outflow was larger than expected (-$7.7 million). The consensus estimate was for -$0.12, but the actual GAAP EPS was -$6.03.

In spite of sluggishness in Europe, ZFOX demonstrated similar global demand from both new and existing customers. ZFOX’s smaller size and emerging market were cited as reasons why it is less susceptible to the effects of larger macro trends, which is good news because it reduces the company’s vulnerability to market volatility. Although cyber may be more resistant to the effects of a more difficult macro environment than other verticals, it will still be impacted. In spite of the fact that the results failed to demonstrate the existence of macro impacts, I am confident that ZFOX will eventually uncover such evidence. To put it bluntly, I think ZFOX shareholders should prepare for higher short-term stock price volatility because it’s only a matter of time ZFOX gets impacted. However, ZFOX may have a better long-term opportunity with vendors who have few customers and/or businesses who are more centered on point solutions than the larger, broader platform. Despite my confidence in the market’s potential, I anticipate 2023 to be a more difficult year.

Another positive thing to note is, I believe that ZFOX’s core ARR growth has picked up speed. I did this by deducting my estimate of IDX subscription ARR (between $3 and $5 million) and the OPM contract’s ARR of $83 million from, which resulted in an implied core ARR of $66 million. This implies around 30% increase from the same period last year, up from the 24% increase seen in the previous quarter. In light of the increasing resistance encountered by competing cyber vendors in recent weeks, I see this growth as encouraging. I believe that the foundations of this growth are a significantly expanded salesforce and a strong pipeline.

Guidance

In 2H23, ZeroFox expects sales between $84 million and $86 million. This range is $2 million higher at the low end than the previous forecast but represents lower revenue in 4Q than 3Q. Though it maintained that it was not experiencing any outsized effects from macro, ZFOX was steadfast that their recommendations were prudent. We should get more updates on FY24 on the upcoming earnings call. In light of the current macro environment, I agree that cautious advice is warranted, though quantifying how much caution is necessary is tricky without access to more background information.

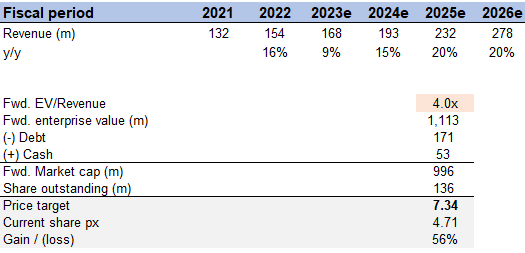

Valuation

My model has been updated to account for the near-term weakness in 2023 and a more cautious tone. Nonetheless, the model suggests considerable upside from the stock’s current price. I agree that ZFOX should seek profits today in order to please investors, but it should continue to invest all of its resources in order to grow once the environment improves, which is the central assumption of my model (growth reaccelerates in 2024).

Own estimates

Conclusion

In conclusion, I maintain my view that ZFOX’s potential upside is considerably higher than its current level. ZeroFox, a provider of enterprise cybersecurity software, is intrinsically linked to the burgeoning digital asset market due to its focus on external cyber threats and risks. ZeroFox’s approach to external cyber threats stands out in an industry that is still intensely competitive and fragmented.