Weber: Potential Higher Offer (NYSE:WEBR)

Scott Olson

Weber Inc. (NYSE:WEBR) is a $1.9bn market cap manufacturer of gas, charcoal and other grills. WEBR has been majority-owned by PE firm BDT Capital since 2010. Since the IPO in 2021, BDT has retained a controlling 89% stake, with 62% of the voting power. In October, BDT came out with a bid to acquire shares of WEBR minority shareholders at $6.25/share. The offer will be evaluated by WEBR’s special committee of directors. Notably, BDT has stated it is not interested in other alternatives, e.g. sale to a third party. While counterbids are unlikely, I think the special committee will attempt to negotiate a higher offer. The market apparently agrees.

The current bid seems highly opportunistic and comes near all-time lows with a 50%+ discount to 2021’s IPO price. TTM EBITDA doesn’t reflect WEBR’s earnings potential, and on normalized earnings, it looks like the bid needs a price bump. WEBR’s performance has suffered this year amid industry-wide decline from pulled-forward demand in 2021 and high inflation. As a result, the business generated only $48m in TTM EBITDA compared to much higher levels of $189m-$227m in 2019-2020. Having said that, some points suggests current EBITDA will inflect going forward, likely returning to or even exceeding pre-pandemic levels:

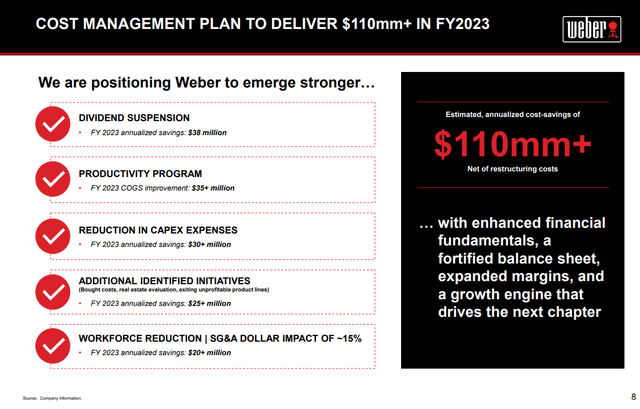

- WEBR has recently initiated significant cost-cuts, including a dividend suspension (previously $0.04/share per quarter), a reduction in capital expenditures and SG&A cost cuts (such as management headcount reduction). Savings are expected to be very material at $110m+ in FY2023 (ends Sep). On an EBITDA basis, management expects this to result in $75m in incremental earnings.

WEBR FYQ3 2022 Investor Presentation

- Management has been quite confident about gross margins – 30% TTM – returning to pre-pandemic levels of 40%+. Notably, since June the company has already observed sizeable decreases (5-20%) in key raw materials (such as steel) and freight costs. Raw materials and transportation are the primary components of WEBR’s COGS. Just a 2% increase in TTM GM would uptick TTM EBITDA by an incremental $25m. WEBR’s CFO during Q3’22 earnings call:

So that’s what we’re seeing. I would say, overall in the supply chain environment, we still believe our unique global manufacturing footprint gives us a significant advantage to navigate the challenges that we’re all facing out there. Inflation pressure remains high, but we have seen decreases across some of our key raw materials that really, since June, we’ve seen a decrease anywhere between 5% and 20%, depending on the raw material. And then inbound freight, we’ve seen trending down about 10% to 20%. So certainly, that will — assuming that trend continues, that will be positive news as we head into our — work through our fourth quarter and into next year.

[…]

As part of structural dynamics in gross margin, I would say, like I mentioned, we’re starting to see some normalization of commodities, inbound freight costs. So that will help our gross margin as we move forward. From a structural dynamics and how we think about — you’ve heard me talk about our make resell strategy, we are still 100% committed to that strategy and very excited about the results we’re seeing in Poland. So as you know, Chris, our Poland plant has been operational since October of 2021 and continues to exceed expectations. So we produced about 500,000 units of kettles and Qs in 2022. We’re expected to produce about 560,000 kettles and Qs in 2023. We just completed a 250,000 square foot expansion to serve as a regional distribution center for our very large EMEA business. So we have confidence that our make resale strategy is working. So from fundamental aspects of gross margin, I guess my answer would be no. We don’t see any structural changes.

- WEBR has been impacted by FX headwinds given the weakness of major currencies against USD this year. FX headwinds have lowered YTD EBITDA by $37m. Having said that, headwinds have already started subsiding since Sep’22 with DXY down 9%. Notably, a significant portion of WEBR’s grills and related products are manufactured in the US, meanwhile, products are sold in numerous geographies across the world – 55% in the Americas, 37% in EMEA and 8% in APAC.

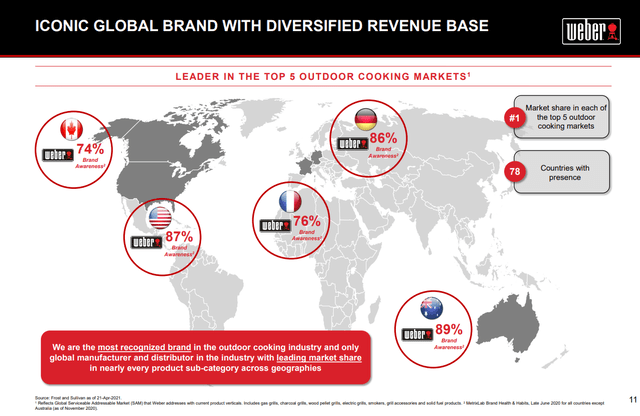

- On the demand side, there is further long-term growth runway, with the industry expected to grow at 5-7% CAGR until 2028. Importantly, WEBR is the global leader in the five largest grill markets, with a 24% global grill market share. Given WEBR’s high brand awareness (80%+ globally) and existing reach with retailers, the company might outpace the industry’s growth. Historically, WEBR has grown at a 10% CAGR clip (since 1980) without any significant slowdown during economic recessions. Importantly, any further sales growth would drive a disproportionate increase in earnings due to the high operational leverage of the business.

WEBR FYQ3 2022 Investor Presentation

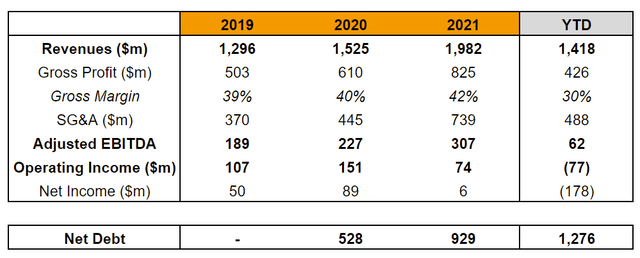

These arguments suggest that once WEBR earnings normalize, the business should be able to generate $180m+ in normalized EBITDA going forward – in line with pre-pandemic levels. At normalized earnings, WEBR trades at 15x EV/EBITDA – in line with the closest public comp COOK that trades at 15.2x 2019 EBITDA. However, COOK is a much smaller peer ($0.4bn mcap) with only 3% US grill market share vs WEBR’s at over 20% as of 2021. Hence, I think WEBR deserves a premium multiple to COOK. The current offer doesn’t reflect that and will likely get negotiated upwards.

Another interesting aspect suggesting that the special committee might renegotiate a higher offer is the reputation of WEBR’s independent board members. One of the independent directors, Magesvaran Suranjan, currently serves as the President of several regions at Procter & Gamble and is a director at several government organizations, such as Singapore Economic Development Board. Another independent director Melinda Rich currently serves as Chairman of a multinational food producer Rich Products (multibillion annual revenues) as well as a director on the board of M&T Bank – a $29bn market cap US-based bank – among other leadership roles. These board members might very well be unwilling to tarnish their reputations by disregarding minority shareholder interests by potentially accepting a low-ball acquisition bid from BDT.

Weber Business and Financials

Weber manufactures gas, charcoal, electric and other grills (75% of 2021 revenues) as well as related outdoor cooking products (25%). The company sells products through wholesale (international retailers), retail (Weber.com, branded retail stores and other) and e-commerce channels (Amazon, Wayfair and online platforms of retailers). The majority of revenues – 80% as of 2021 – comes from the wholesale segment where WEBR partners with leading retailers, such as Walmart, Costco and Lowe’s. WEBR has seven manufacturing facilities, including in the US and Poland (opened in 2021).

The current offer comes at an opportunistic time amid 1) significant decline in WEBR’s operational performance YTD and 2) management turnaround and subsequent cost restructuring. On the financial front (as shown in the table below), the business has been severely impacted by contracting customer demand from elevated 2021 levels. Slowing consumption has driven a slower retail traffic in both online and in-store sales channels. The decrease in the grill segment has been explained by increased travel since the pandemic, heightened inflation and major heat waves across key markets. According to Cleveland Research Center, sales in the grill category in the US have fallen 26% YTD – more than the 16% decline in foot traffic in US home improvement retailers. From the cost perspective, the business has been impacted by higher freight costs and fuel surcharges. WEBR’s Q3’22 sales and EBITDA (reported in Aug’22) came in weak and the company subsequently withdrew FY2022 guidance. For reference, in Q2’22 WEBR guided for $140m-$180m in FY2022 adjusted EBITDA.

Company Filings

On the management side, in Jul’22 WEBR appointed a new CEO, Alan Matula. The new CEO has subsequently initiated the cost-cutting measures described above. Notably, Alan Matula appears to have significant leadership and business transformation experience – from Q3’22 earnings call:

As you saw in our announcement, from a few weeks ago, I’m Alan Matula, and I’ve been part of the Weber team for nearly a decade. Most recently, I led the company’s R&D organization, IoT and digital initiatives as well as our global IT function. Prior to Weber, I spent 35 years at Royal Dutch Shell and leadership roles that span from all major business segments, corporate functions and technology organizations. Most notably for today’s call, I have almost 4 decades of experience focusing on global business transformation, cost management and leading the business through unprecedent time of change.

BDT Capital

BDT is a large and reputable PE firm with $33bn in AUM and investments across private and public companies. The buyer seems reputable – recently BDT agreed to merge with MSD Partners which is an investment vehicle of billionaire Michael Dell. Interestingly, BDT’s founder Byron Trott has been regarded as the banker to the world’s richest individuals, including Warren Buffett, due to close business ties with them.

BDT acquired a controlling stake in Dec’10 at a reported total consideration of $65m in equity and $150m in debt.

Risks

- Two weeks after the non-binding acquisition proposal from BDT, WEBR and BDT entered into a loan agreement whereby WEBR will be able to borrow $61m by the time Q3’22 results are released, with a possibility to borrow another $150m. Interestingly, BDT will lend money at 12% interest rate. This could potentially suggest that the controlling shareholder might simply continue lending money at attractive interest rate while continuing to maintain near-full control of the company.

- It is worth noting that WEBR has a high short interest – 35% of float. While there have not been any short squeezes since the IPO in 2021, the expectation of a higher bid might be a reason why WEBR is currently trading above the offer price as short positions would have to be covered if a potential acquisition transaction was completed.

Conclusion

The recent attempt by BDT to buy out WEBR’s minority shareholders seems highly opportunistic, coming at near all-time share price low and at a quite low valuation on normalized EBITDA. Considering that WEBR’s true earnings power is likely to show in the medium to long term, I expect BDT will be willing to raise the current bid.