Warby Parker Q3 Results: Revenue Growth Deceleration Is Concerning (NYSE:WRBY)

Scott Olson/Getty Images News

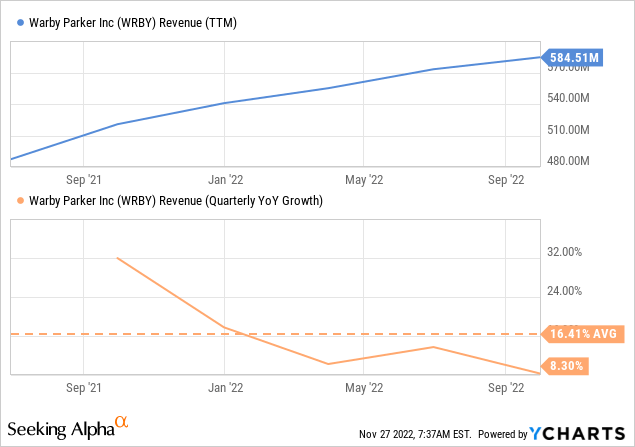

Warby Parker’s (NYSE:WRBY) growth has been disappointing for several quarters now. The company stated in the past that its long-term net revenue growth target was 20%+, but recently the growth rate has decelerated to close to 8%. For the third quarter net revenue of approximately $149 million was an increase of only 8.3% over the same period last year. Guidance for Q4 is for growth to come in between 4% and 8.7%, so it does not look like growth is getting back on track any time soon.

There were some positives in the quarter too. Average revenue per customer increased nearly 7% y/y, and reached a new high of $258. Importantly, the main driver for this increase was not price increases, but rather a higher percentage of customers purchasing multiple products. The company also continues to open new stores, with 13 new stores in Q3 and on track to open 40 stores by year end. Stores are generating $2.1 million in revenue per year on average, with four wall margins in line with its historical target of 35%. Stores on average pay back the company’s investment within 20 months. Store productivity suffered as a result of the pandemic, but has been recovering. In the third quarter store productivity came in at 82% of 2019 levels, and exited September with productivity at roughly 85% of 2019 levels. During the earnings call management said that it is safe to assume that store openings should be around 40 for next year too.

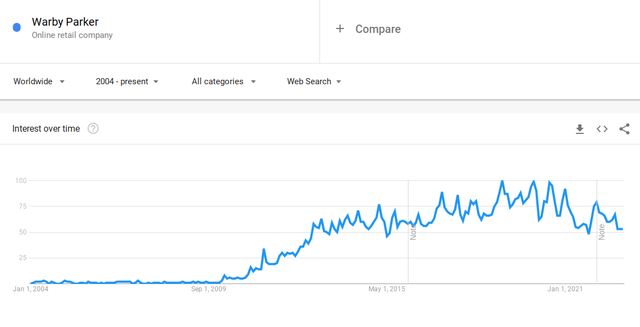

While stores are recovering, the e-commerce is seeing growth moderate. The company did not go into much detail but did say that e-commerce growth moderated versus the first half of the year. Using Google Trends we can see that the trend indeed is not very encouraging, with interest peaking around the 2019-2020 period. This is disappointing because e-commerce growth was supposed to be a big part of the opportunity with Warby Parker. When it went public the company had said that e-commerce as a percent of the total eye-wear market was only ~7.7%, giving Warby Parker significant room to expand. Instead, it is increasingly looking like growth will have to come from the brick-and-mortar side of the business.

Financials

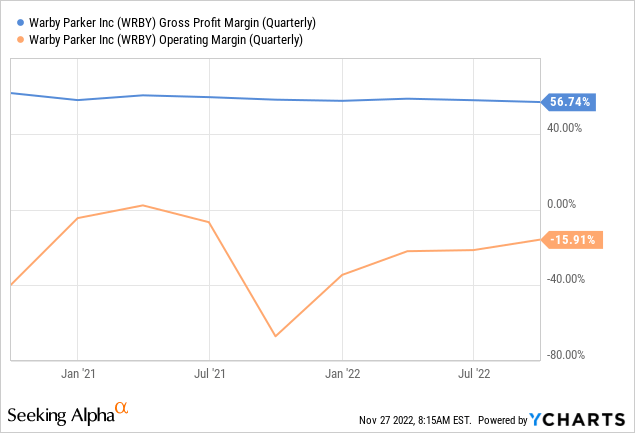

GAAP operating margins for the company remain negative, as can be seen in the graph below. Meanwhile adjusted gross margin in Q3 2022 came in at 56.9% compared to 58.7% in Q3 2021. The primary driver of the decrease in gross margin was the continued growth in contact lenses, which are a lower margin type of product.

Adjusted SG&A for Q3 2022 came in at $82.2 million or 55.2% of revenue, an increase of approximately 60 basis points y/y. We believe SG&A remains too high, and the lack of operating leverage is concerning. The company did say they were reducing costs and being more disciplined with expenses in general and that some of those efforts should show up in future quarters.

Growth

Growth decelerating to ~8% is disappointing, however there are some reasons to believe there might be some hope that growth will recover. For example, the company currently only has 190 retail stores out of the 900+ potential the company estimates it can reach. It is planning on opening ~40 stores next year, for a store count growth of roughly 20%. Another reason for optimism is that the average revenue per customer is also continuing to increase. Maybe if the economy cooperates the company can get back to the 20% target.

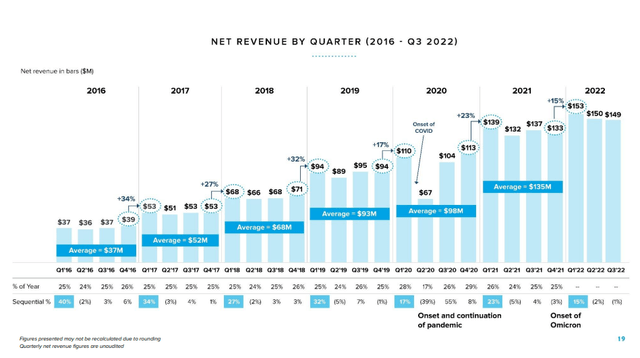

The reason we still want to give the company the benefit of the doubt with respect to its growth potential, is that historically it has done a terrific job growing the business as can be seen in the graph below.

Warby Parker Investor Presentation

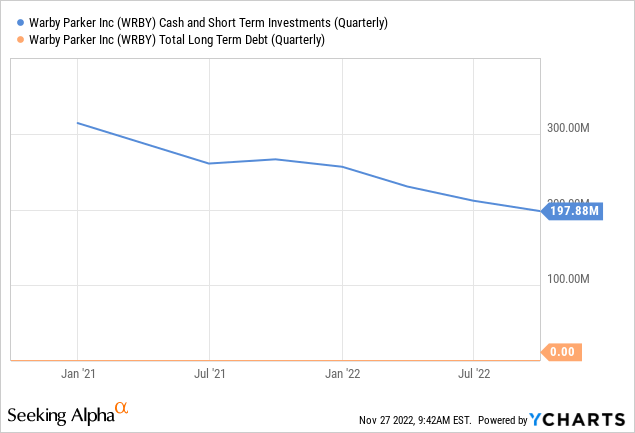

Balance Sheet

Warby Parker finished the quarter with ~$198 million in cash and short-term investments, and basically no long-term debt. The company has been consuming cash as it funds its growth and operations, particularly new store openings.

Guidance

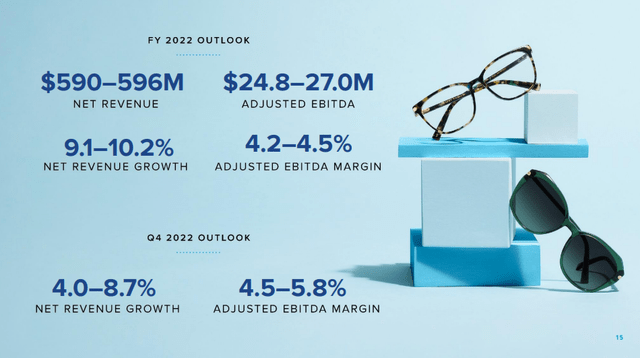

Guidance for the next quarter and all of FY22 is shown below. As previously mentioned, net revenue growth is guided at only 4% to 8.7%. It will be extremely interesting to see what the company guides for next year. To support the current share price we believe the company has to return to at double-digit revenue growth.

Warby Parker Investor Presentation

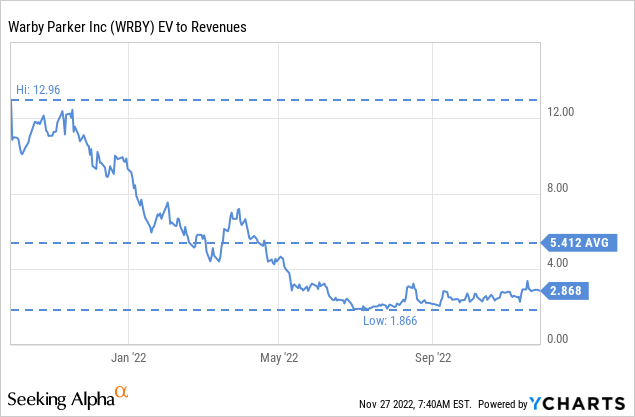

Valuation

Shares are currently trading with an EV/Revenues multiple of close to 3x. For a retailer this is relatively high, and still reflects an expectation of higher growth in the future. We don’t think ~8% growth will be able to support the share price where it is today.

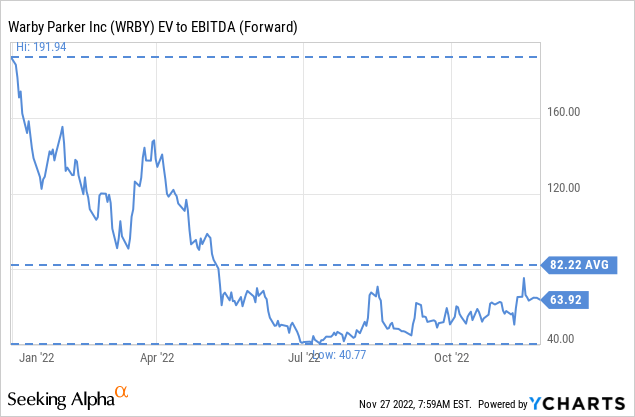

Likewise the forward EV/EBITDA is high at ~63x and reflects an expectation that earnings should grow rapidly the next few years.

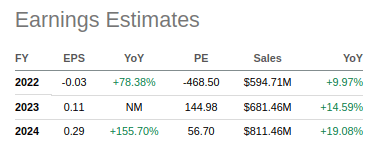

The table below shows average analyst estimates of earnings in the coming years for Warby Parker, as compiled by Seeking Alpha. Based on estimated earnings for FY2024 shares have a forward FY24 p/e ratio of ~56x.

Seeking Alpha

So what do we think is the fair value for the shares? Depends on the growth rate. If we take analyst estimates for the next two years, then assume a 30% EPS CAGR until FY33, and using a 3% terminal growth rate with a 10% discount rate, we estimate a net present value of ~$19. Unfortunately it will be very difficult for earnings to grow this fast unless the company brings revenue growth back to 20%+.

| EPS | Discounted @ 10% | |

| FY 23E | 0.11 | 0.10 |

| FY 24E | 0.29 | 0.24 |

| FY 25E | 0.38 | 0.28 |

| FY 26E | 0.49 | 0.33 |

| FY 27E | 0.64 | 0.40 |

| FY 28E | 0.83 | 0.47 |

| FY 29E | 1.08 | 0.55 |

| FY 30E | 1.40 | 0.65 |

| FY 31E | 1.82 | 0.77 |

| FY 32E | 2.37 | 0.91 |

| FY 33E | 3.08 | 1.08 |

| Terminal Value @ 3% terminal growth | 43.93 | 14.00 |

| NPV | $19.79 |

Risks

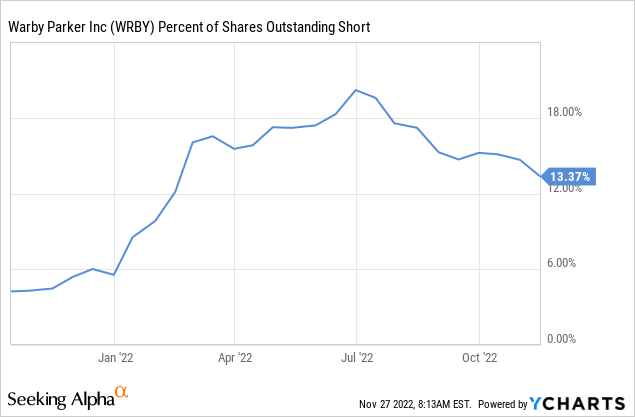

We believe that the biggest risk for Warby Parker investors is that the share price still has significant growth expectations. If growth remains at the current ~8% for an extended period of time or decelerates further, we would not be surprised to see shares drop significantly. It is also worth considering that the company has a high percentage of its shares outstanding sold short, although this percentage has been coming down the last few months. Finally, the company has yet to achieve positive GAAP operating margins.

Conclusion

We found Q3 results and guidance disappointing, and we are therefore changing our rating from ‘Buy’ to ‘Hold’. Growth deceleration is concerning, especially on its e-commerce website. New store openings should help growth, but unless the e-commerce side of the business contributes, we don’t see growth recovering to the long-term target of 20%+. The share price does not currently offer much in the form of margin of safety, and we believe it still reflects expectations of high growth in the future.