Volume Breakout Report: June 25, 2022

Jira Pliankharom/iStock via Getty Images

Wall Street has an old saying – volume precedes price. The idea is major investors and insiders quietly try to acquire shares before a breakout in price. In practice, there is some validity to the statement. However, strong price gains often occur on lower than typical volume. Conversely, high-volume “selling” is a rotten development for pricing. In what situations should investors focus their attention, when it comes to high-volume buying?

I thought I would start a short regular listing on some of my research formula results looking for extraordinarily high-volume trading days in smaller and mid-cap equity names. These companies specifically have a history in my work of exhibiting strong short-term momentum breakouts. Occasionally, this list will include big winners over the next several weeks, while some will fizzle out and decline in price, and still others will continue to entertain investment gains for months. I am not doing extensive fundamental research on each, but will instead give a brief summary of business operations and any valuation ideas that come to mind.

Readers/investors need to engage in more extensive due diligence on their own and carefully contemplate whether any pick fits their investment criteria for risk/reward swings in portfolio construction. Again, I think this is a foundational starting point for readers, who do not have access to quant sorting technology and databases. Enjoy!

Here is the inaugural VBR list, based on trading over the past week on Wall Street, in no particular order of importance. Stocks are included using a specific set of formulas regarding positive momentum characteristics I have developed over many years, in conjunction with high-volume days with short-term price uptrends. My proprietary formulas include as many as 15 different technical trading areas of computer review.

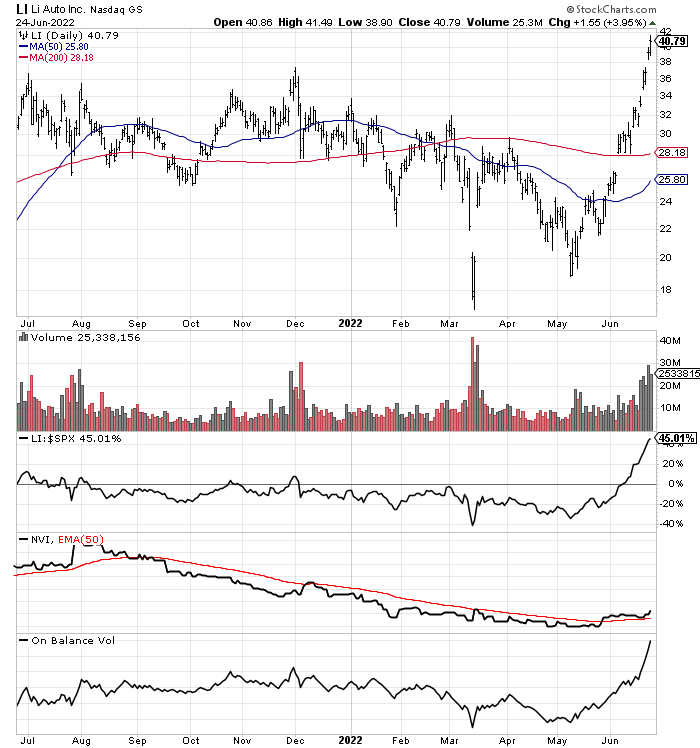

Li Auto

A major Chinese electric vehicle manufacturer, Li Auto (LI) witnessed a tremendous streak of daily buy interest to new 52-week highs. It appears the whole EV sector bounced nicely from recent weakness, with LI standing out on longer-term charts. The company reported a big jump in customer orders during the week here.

StockCharts.com

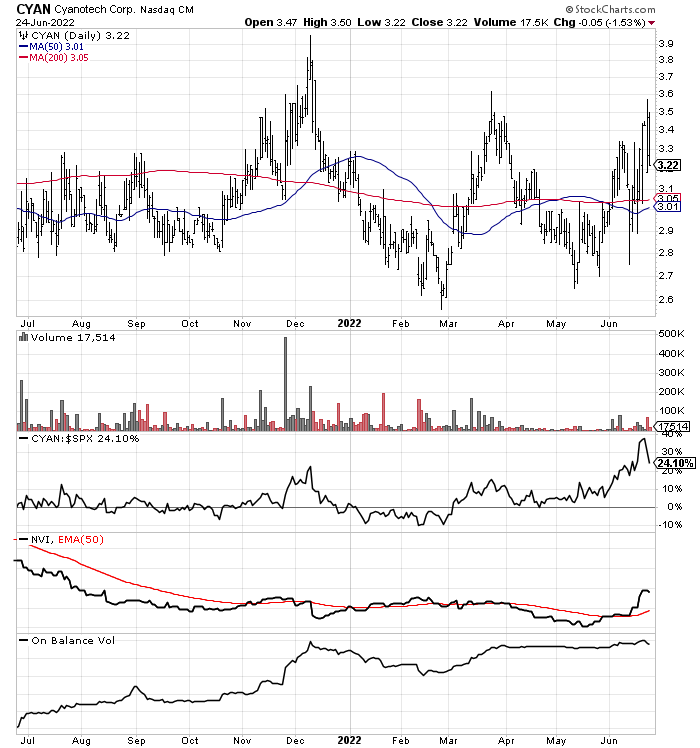

Cyanotech

Cyanotech (CYAN) is a company I mentioned in a previous full-length article, when a similar volume buying pattern appeared in March here. I own a small position in this health product and integrated algae growing outfit in Hawaii. Improving margins and sales are noteworthy. The stock trades below book value, and just introduced a new supplement in June. CYAN has solidly outperformed the overall U.S stock market in 2022.

StockCharts.com

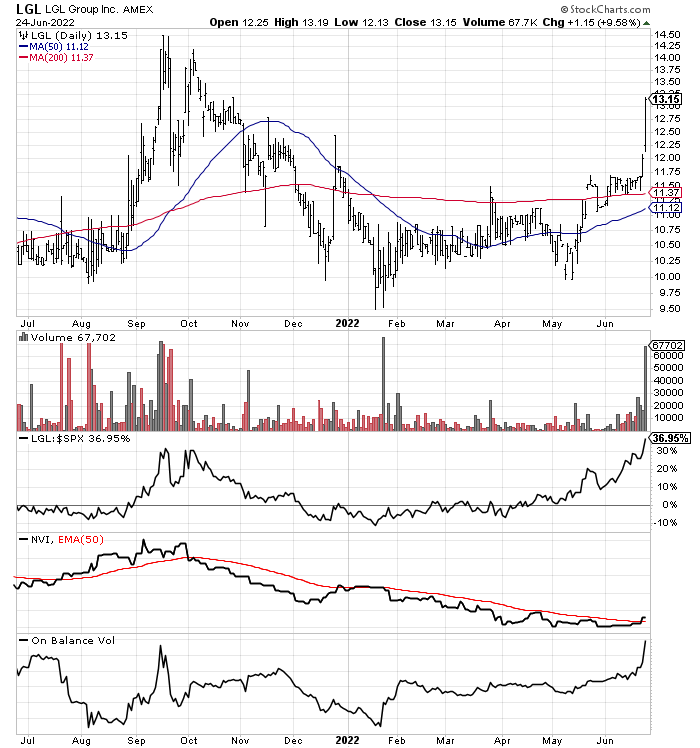

The LGL Group

The LGL Group (LGL) is based in Florida and manufactures infrastructure equipment for the telecommunications and computer networking industries. It designs, manufactures and markets frequency and spectrum control products sold throughout the world, operating under two segments, Electronic Components and Electronic Instruments. LGL is slightly profitable, while trading close to cash liquid, almost no liability, accounting book value.

StockCharts.com

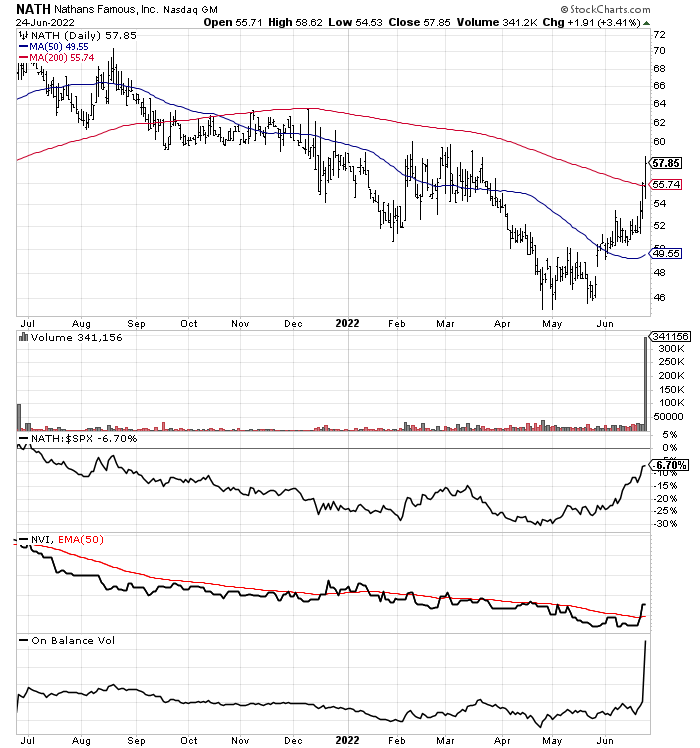

Nathan’s Famous

A minor New York restaurant and brand licensing company, Nathan’s Famous (NATH) is the hot dog and related meat investment king. Spices, French fries, onion rings, pickles/sauerkraut, and mozzarella sticks are other products the company markets. NATH appears to have a decent balance sheet and earns a high 10%+ profit margin on record trailing sales currently.

StockCharts.com

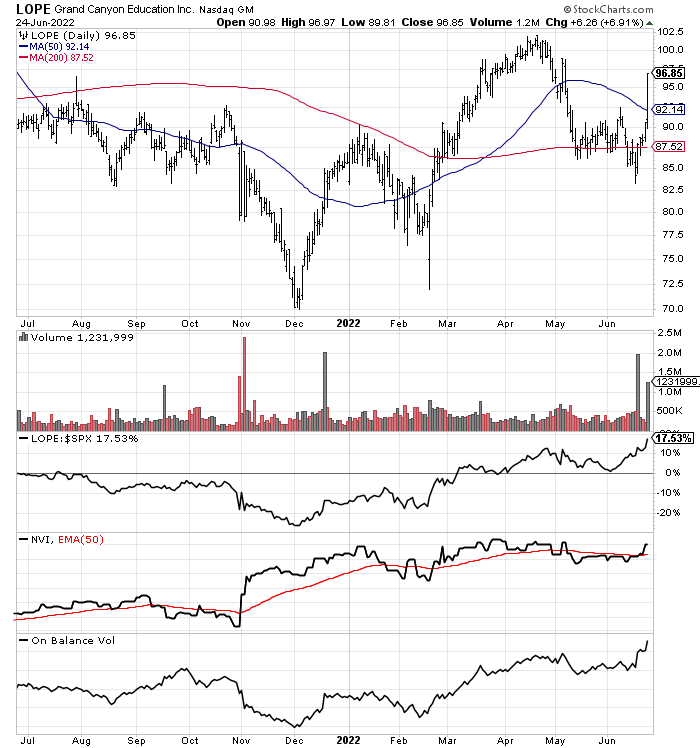

Grand Canyon Education

Grand Canyon Education (LOPE) is an incredibly profitable enterprise serving colleges and universities in the U.S. Everything from administrative support, marketing help, faculty training, admissions and financial aid sourcing, and communications/brand development to back-office accounting, audit and procurement services are offered. A major stock repurchase program is underway. Valuations look to be fair, assuming slow growth in the business.

StockCharts.com

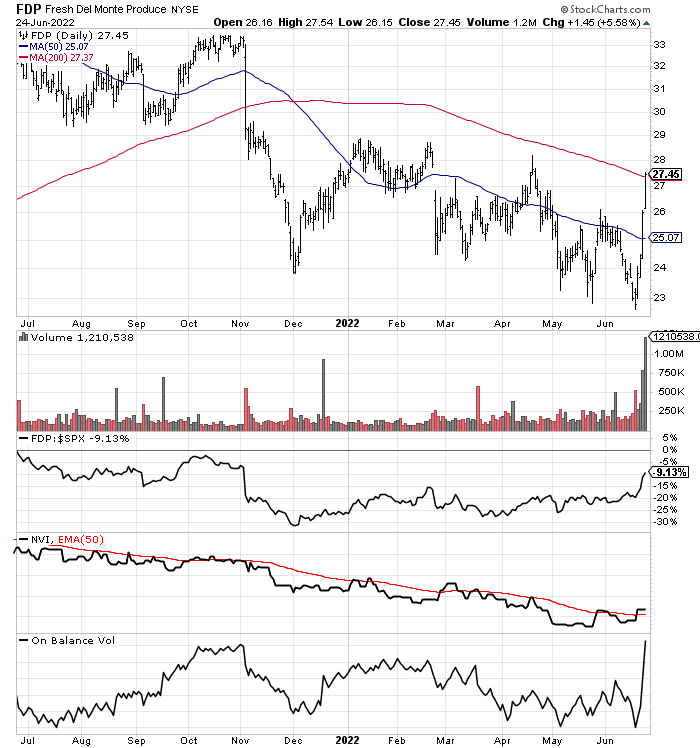

Fresh Del Monte Produce

A large Central America land and farming concern, Fresh Del Monte Produce (FDP) has tremendous real estate, marine vessel, and warehouse value underpinning shares. Fresh fruits and vegetables are grown by the company and shipped around the world to grocery store chains. Great food inflation hedge, paying a small 2% dividend. Earnings are on the low end with room to expand. Selling around tangible accounting book value.

StockCharts.com

Final Thoughts

This is a basic quant-sort generated list of companies, exhibiting strong buying interest last week. Will bullish action continue is open to question and debate? The goal of the Volume Breakout Report is to give readers access to technical trading data usually reserved for Wall Street firms, hedge funds and well-heeled individual investors.

I suggest readers take deeper dives into any of the selections that appeal to you, and your risk tolerances or sector exposure needs in portfolio construction. Understand small-cap picks should be a limited portion of portfolio design, and a diversified number of stocks is the only rational way to play them. Wild price swings both up and down are integral aspects of the companies mentioned. Please consider using stop-loss mechanical sell orders to reduce downside potential in each name. Depending on your risk tolerance, 10% to 30% stop levels are recommended. Letting your winners run for a while has proven a smart strategy from my trading and research into these computer-generated “formula” choices.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.