Vodafone – Pan-European Telco Safety (NASDAQ:VOD)

David Ramos/Getty Images News

Author’s Note: This is the free version of a premium article posted on iREIT on Alpha in June of 2022.

Dear readers,

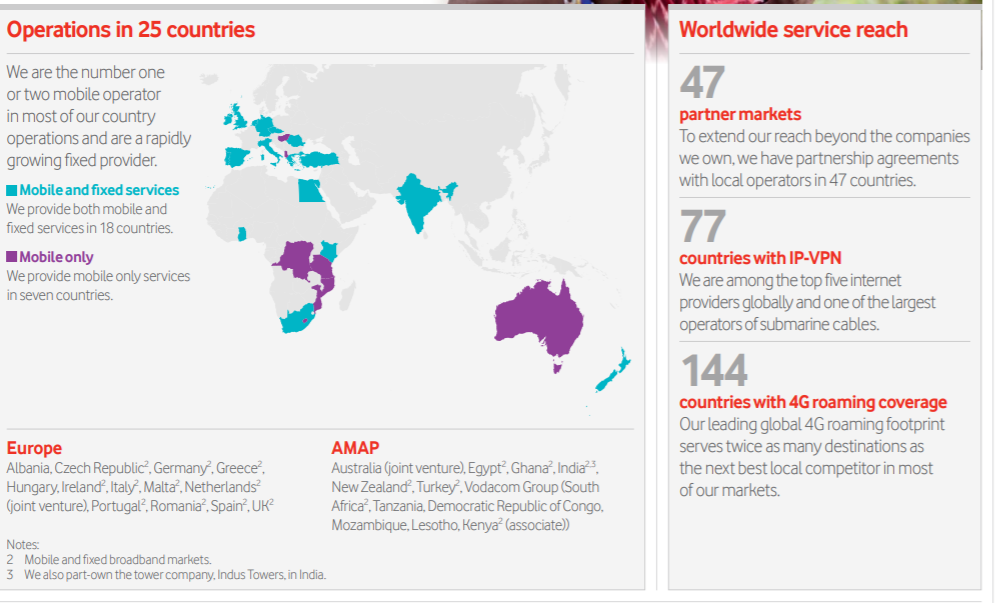

In this piece, we’re going to take a look at European telco giant Vodafone (NASDAQ:VOD). The company is a world-leading telco operator with one of the largest bases of customers on earth (close to 600 million combined in Europe, the Middle East, Africa, and Asia, with around 375 million in India).

We’re going to talk about the history and foundations of the company and look at where the company is going. Also, and most importantly, we’re going to see what we can make by investing in the company at this valuation – or at what valuation we should be starting to invest in Vodafone.

Vodafone – Looking at the company

When looking at Vodafone, we want to begin by understanding the company’s history – because it’s a relevant one. The company, along with its joint ventures, offers telephone, mobile, and broadband services to over 550 million customers worldwide.

Vodafone operations (VOD IR)

Some of Vodafone’s main markets include Germany, Italy, and the UK, which together account for roughly 50% of its group revenue. The company’s plans for this exposure are quite clear – they aim to diversify into further markets in India, Africa, and other nations/continents in order to decrease their dependency on Europe as a market, which is now in the middle of its execution. Vodafone as an entrant into the Indian market has seen some success, and they currently have over 375 million subscribers in India alone. These subscribers will double as a result of Vodafone’s merger with Idea Cellular, which was closed in mid-2018.

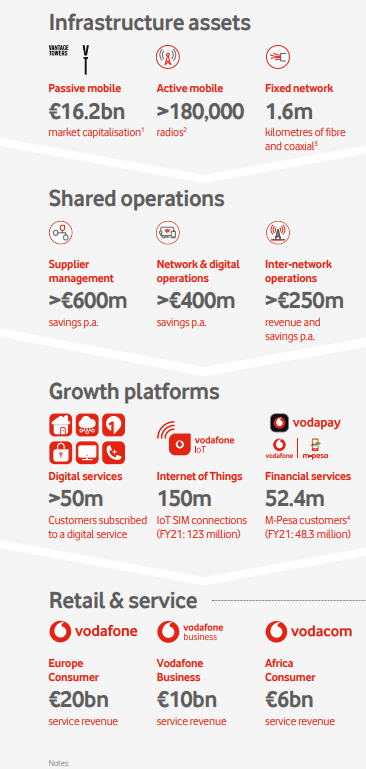

Vodafone Presentation (VOD IR)

Before 2014, Vodafone owned a large (45%) stake in the US telecommunications giant Verizon (VZ). This was sold as a part of the company’s restructuring plan. The stake was sold for $130B, and the asset sale that Vodafone has undergone as part of its plans to “cut the cord” in pay-TV and similar ventures is part of what’s depreciated the stock’s nominal value over the past few years.

Vodafone’s strategy over the past few years has included the M&A of smaller wireless and telecommunications companies and the development of its services into a full-range suite of communication plans for customers worldwide (with a core focus on Europe). The acquisition of Liberty Global is the latest feather in the company’s now-extensive cap of transactions.

Vodafone’s historical and current stance on India as a market is that it represents an important driver for future growth (hence the fight for almost a billion customers), and they continue to plan to grow in the country.

Vodafone also manages several 5G initiatives across Europe, among other things, in the complete company rollout of the new communication standards across the continent. This is much alike the plans of AT&T (T) and other global/American telecommunications giants, which are all currently facing the CapEx-intensive prospects of expanding already existing 4G networks into 5G.

Vodafone Presentation (VOD IR)

However, all is, of course, not well in the Indian market. Tough competition, which has heated up even more insistently since the launch of Jio back in -16. It’s also fair at this point to say that the promised windfall and “growth” story has turned into a ball-and-chain around Vodafone’s corporate ankle. In summer 2020, the Supreme Court ruled that Indian operators definitely have to pay the untold (zillions, not yet estimated) amount of rupees of the historical spectrum and license fees to the government that this same Court had decided to impose in the previous autumn. Who was the most affected by the ruling?

Vodafone. The winner of the ruling is Jio, which not only owes very little money but already is an Indian market leader. Vodafone’s degree of loss and issues here is hard to overstate, given that Vodafone chose to give out a 35.8% stake in its company to the government of India rather than paying out the interest owed to the government.

Thankfully, VOD is a primarily European player, despite its hundreds of millions of Indian customers. You may get the picture that Vodafone is not an especially well-managed company, but this is not entirely true. Management made extremely smart plays that have been overlooked by the broader market. What I am speaking about is the company’s Post-VZ cash-long state, where Vodafone took advantage of telco Europe to buy several EU cable operators.

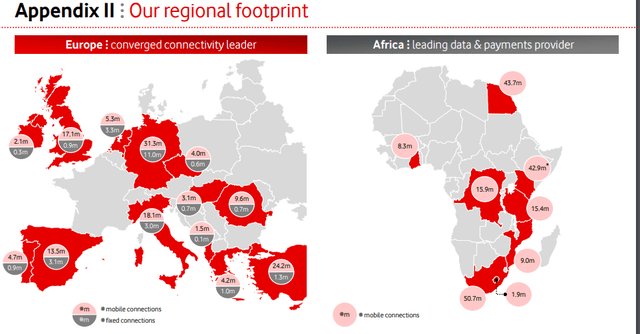

The Kabel-Deutschland bid in 2013 allowed Vodafone to enter the German quad-play communications market, while the strategic M&A of Ono allowed it to strengthen its position in Spain. Vodafone acquired Liberty Global’s operations in Germany, the Czech Republic, Hungary, and Romania for €18.4bn back in -18. From a fundamental viewpoint, this operation was excellent for Vodafone. In Germany, by buying the cable operator Unitymedia, Vodafone built a converged national challenger to Deutsche Telekom, bringing the fixed-side Gigabit connections to 25m German homes (62% of total German households) by 2022, and the company has been leveraging its capabilities since. The current share price and view on Vodafone often do not reflect this, and viewing many of the articles published on Seeking Alpha, it’s my view that this is an often little-known fact about the company.

In one of its main markets, Germany, Vodafone is now one of two giants, with the other one being Deutsche Telekom (OTCQX:DTEGY). By that, I mean operators that offer both fixed and mobile communications, which most peers do not. The group will be a key utility there, a cash machine that offers good visibility for at least 30 years.

In the Czech Republic, Hungary and Romania, Vodafone was primarily active in the mobile segment of these markets (with 15.8m mobile customers) and has no meaningful presence in each country’s fixed-line or TV segments. In these markets, it’s a tertiary operator with a quarter of market share or thereabouts, with the exception of Romania, where it has nearly a third.

Liberty Global is primarily a fixed-line and TV operator (with 1.8m broadband and 2.1m TV customers) with little or no mobile activities in these countries. So the key point that I’m trying to make in this article as to these operations is that this transaction allows and accelerates the availability of converged fixed, mobile, and TV services in the Czech Republic, Hungary, and Romania.

Vodafone Presentation (VOD IR)

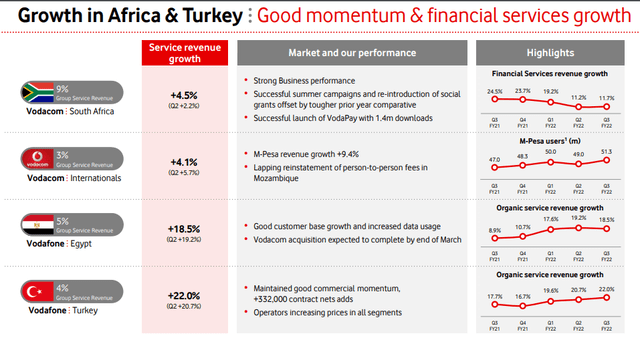

The company’s non-EU operations in Egypt, South Africa, and other things are of significant interest as well, having turned into an African powerhouse. I’m of the camp that believes Africa to be a very significant future player in global economics, so I’m always looking for new ways to gain exposure to the continent.

COVID-19 wasn’t good for Vodafone. The company suffered from lower roaming revenues, especially as travel trended down, but has been returning to growth since then. In particular, Vodafone can focus on its fixed activities as part of its resurgence of profitability. In the company’s main revenue generator Germany, the growth is actually solid in terms of trends, even though VOD is still mostly struggling in geographies like Italy.

The company reported FY22 not that long ago, which included annual revenue growth of 4%, which was more or less according to overall expectations. EBITDAaL was up 5% as long, in line with expectations as well.

The good news was that FCF actually beat expectations, and Vodafone showcased just what a quality telco can do in terms of free cash flow generation when things are working – the negative news was a dividend stuck at 9 cents (though it wasn’t really expected to grow here) per share, as well as a relatively modest FY23 guidance, which is likely to overhang the company’s compressed/pressured share price here.

Still, the company has very conservative leverage, at around 2.7X net debt/adj. EBITDAaL, and intends to continue to push CapEx in order to improve its overall assets – good news, all things considered. We look at Vodafone like we look at most telcos – EBITDA less CapEx cash flow generation.

The problem is that the market does not see Vodafone growing enough considering its impressive assets, which is why the market is punishing the company. This doesn’t reflect the conservative safety Vodafone actually seems to be offering and the integration that seems to be ongoing. Vodafone is indeed continuing to make good progress on integrating Unitymedia, with the rebranding and TV portfolio harmonization now complete, and the organizational integration completed. The broadband customer base has reached nearly 11M, with 23.8M households now able to access Gigabit speeds.

Elsewhere in Europe, the UK sees good momentum (EBITDA up by 3.3% YOY), competitive Spain experiences a return to very slight revenue growth and Italy, the toughest market of the group with continued price competition, is declining less, and EBITDA is stabilizing. In short, everything Vodafone is seeing is growth, with the one exception of Vodafone India.

Risks to Vodafone

As you might expect, India is one of the biggest risks that bear mentioning here – though I will say that with Vodafone leaving a significant stake to the Indian government, the issue here should be all but over. Aside from its Indian issues, there are a few things that will weigh on Vodafone in the near future, as I see the risks.

First is the CEO. Nick Read probably has done some good things – but the list of utter catastrophes under his watch is long. From missing opportunities in Italy with Iliad, Spain with the Orange-Masmovil Merger, and with the Vantage story where Brookfield and Global Infrastructure Partners made a €14.5B unsolicited offer for a majority stake in the unit, but Vodafone would prefer to make a deal with a telco (likely Orange) rather than financial investors. A mistake, as I see it – and he continues to make them. Management, specifically Mr. Read, and the way he governs VOD is one of the risks I see here – and this might be a dealbreaker for some of you.

The company, being a telco, is in the unenviable position of pushing massive amounts of CapEx to market in order to keep track of its 5G investments, and this will likely continue until at the very least 2025E.

The company’s failure to use its position really comes to the forefront also, when we consider that it missed the opportunity to M&A with Virgin, which will now merge with O2. Why would this have been such a great deal? Because with Virgin, VOD would have had in the UK what it has in Germany – a market co-leader with assets second to virtually none.

Good telcos exist – and Vodafone isn’t the most qualitative – but it sure as heck is one of the largest and one of the more interesting ones.

Let’s look at what sort of picture the valuation presents us with.

Vodafone – The valuation

Here is where things get very positive indeed. Like many telcos, Vodafone is actually significantly undervalued to what I view to be a conservative estimate of its earnings potential. While the post-Liberty deal leverage is up significantly compared to prior to the deal, the dividend is now very much in harmony with the company’s balance sheet and is easily covered – while still being one of the absolute best on the entire market.

For the DCF, I use very conservative estimates and estimate a Sales growth of 0%, and actually, a negative EBITDA of around 0.5% to account for the increase in CapEx spend, as well as considering overall macro. You might argue as to why I’m doing this, but you’ll realize in just a moment. Even with these negative EBITDA assumptions, a WACC of 5.3%, and a risk-free rate of about 3.5%, adjusted for the current market, you still get a price per share for the native UK-based VOD ticker at 212p for one share – which is more than 50% higher than the current company share price. This accounts for and presents just how undervalued the company currently is – that you can assume such growth rates and still come out on top.

This theme continues for the most part across the valuation spectrum. I look at things like peers, where P/E averages are currently between 10-12X P/E. Many great telcos are currently on sale, including companies like DT, Orange (ORAN), Telefonica (TEF), and Telenor (OTCPK:TELNY). I’m long most of the ones mentioned in this article. Vodafone’s lack of EPS is pressuring its P/E, which is currently above 10X, but when looking at EV/EBITDA, book multiples, and yield comparisons, Vodafone always comes out on top.

It yields significantly more, is valued at significantly less, and has a significantly higher upside than most of its peers. From a peer comparison, Vodafone suffers from significant undervaluation, which presents investors with an opportunity here.

Moving to compare the company’s NAV, we use EBITDA multiples to value the company at peer averages of 4-6X, which together with the listed value of the towers and other assets, comes to around €55B on a net basis, which comes to an implied NAV/Share based on the current share count of 150p/share. Given that the current price is 126p, or £1.26/share, this is still a significant discount to a relatively conservative NAV.

No matter which way you slice it, apart from the conservative P/E rating due to the company’s recently pressured earnings, this company has a significant upside for us to consider. S&P Global analysts give the company average targets of £1.88 or 188p, which comes to an undervaluation of 26.4%, which is on par with some of the telcos I buy – but also lower than some others.

Still – averaging out realistic assumptions, forecasts and what the company should be valued at based on NAV, peers and the like, we come to a valuation of no less than £1.65/share, or 165p, which still leaves us with a very decent upside from today’s valuation.

Thesis

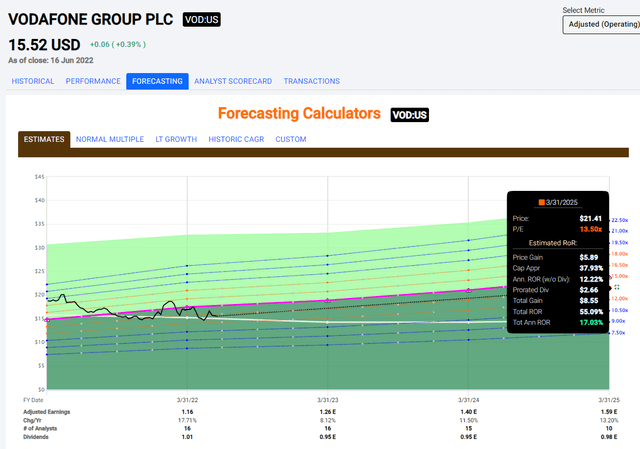

Vodafone, of course, has an attractive ADR – the symbol is the same as for the native, which is VOD. VOD is a 10X ADR, which means that every share you buy on the NYSE actually is worth 10 ordinary shares. The ADR reflects a very real upside that I see for the company and that I consider accurate. VOD is forecasted to grow its earnings on the base of strength in Germany as well as the other geographies, much as it has been doing in 2021. Even based on a conservative 12-14X P/E multiple, the upside we can get from this BBB-rated telco is 17% annually.

Vodafone Upside (F.A.S.T graphs)

Now, I’ve been pushing telcos for a long time. Some have gone up significantly – others have been absent with their sudden rises. But the common denominator for every single telco I’ve been buying is the very real fact that they’ve been delivering dividends.

Without fail. Year in and year out.

In this coming market environment, I consider the safety of dividends and the safety of investing at low valuations of paramount importance to us investors – and that’s why I consider these businesses such great investments, even if you might experience some pressure in the short term.

Because you’re locking capital into very much necessary/wanted assets and services, many of which have incomes that, through steady price increases (like the ones we’ve seen from US companies), are essentially indexed to inflation. I don’t mind sacrificing in the form of short-term negatives or downturns, if I get my returns in the form of dividends, followed by the eventual returns of capital appreciation, protected. That is what I view getting with companies like Vodafone and other telcos.

Not everyone’s a fan. I get that. But I view telcos as materially safer than Energy companies, lacking some of their volatility (in pricing), and on par with utilities and grocers. This makes the companies interesting investments to me, and I consider VOD to be a superb “BUY” with an upside here.

Here are my targets for the business.