Valvoline Sale May Unlock Value In 2 Ways (NYSE:VVV)

Amorn Suriyan/iStock via Getty Images

Valvoline (NYSE:VVV) today has two business units. First, its lubricants business (global products) which it’s selling to Saudi Aramco (ARMCO) for $2.65B pre-tax and roughly $2.25B after tax. Second, its retail service business which offers oil changes and similar car maintenance services.

The thesis has two main components:

- Without the global products business the remaining entity may re-rate as a fast-growing and relatively asset-light service business is highlighted as a standalone entity with the potential to grow locations.

- A significant portion of the cash proceeds may fuel stock buyback which could help returns depending on the price achieved relative to fair value.

We’ll discuss each in turn.

Potential re-rating

Without global products, which is a good business but more mature, the Valvoline service business may shine. It may also have more opportunity to grow services that are less lubricant-related. The remaining business does have an agreement to continue to use Valvoline products, but clearly the internal pressure to have the service business serve as basically a channel for Valvoline may reduce relative to offer a broader range of automotive services.

What Might The Remaining Business Be Worth?

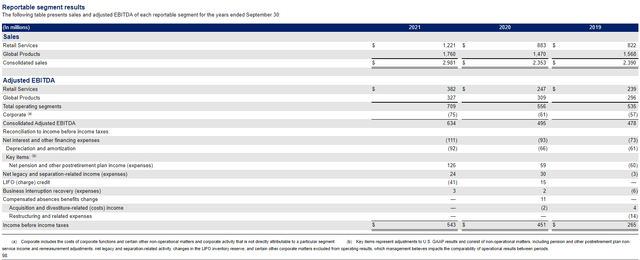

2021 was a strong year for Retail Services, but normalized EBITDA of around $350M appears reasonable. This includes an allocation of corporate costs ($50M) and is actually below management’s guidance for 2022 which is $365-$375M (net of $50M estimated corporate costs).

My estimate is slightly below 2022 guidance because of additional standalone costs and the supply agreement with Saudi Aramco and because the business has arguably been a slight post-Covid beneficiary in that it may have benefited from lots of people needing car services in 2021, having not used them much in 2020 due to the pandemic.

If that forecast holds it does show that retail services has shown strong growth in recent years and that may continue.

VVV 10-K

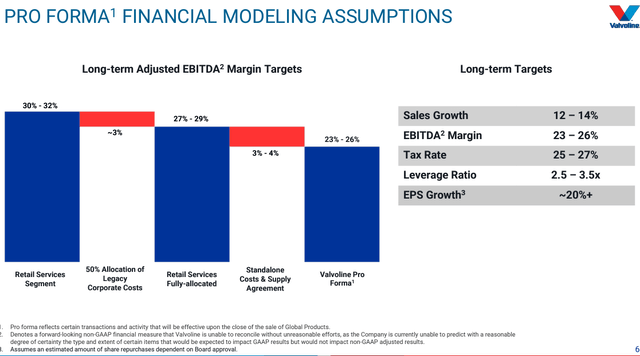

For reference here are management’s assumptions on what the separation will mean for EBITDA margins. This assessment may be conservative. They see higher standalone costs dragging on margins.

VVV Q3 2022 Presentation

An Appropriate Multiple

So with $350M of EBITDA (after corporate costs) what is an appropriate multiple? Looking at comps, we have the following:

| Business and consumer services | 16x EV/EBITDA |

| Computer services | 12x EV/EBITDA |

| Waste services | 16x EV/EBITDA |

| Healthcare support services | 13x EV/EBITDA |

| Office equipment and services | 12x EV/EBITDA |

| Retail (automotive) | 12x EV/EBITDA |

| Simple average of the above | 13.5x EV/EBITDA |

This 13.5x multiple (see sensitivities below for different multiples) suggests an EV of $4.725B. If we then add on expected after-tax sales proceeds from global products of $2.25B then that’s $6.975B of EV. Net debt stands at $1.4B, leaving $5.575B of equity value or $31.49/share (177M shares out).

That’s the intersection of a positive multiple re-rating for the standalone services business, and some conservatism on 2023 EBITDA based on higher costs of the standalone business.

Potential Buyback

Next let’s examine the potential for a buyback. Management has said the following about the proceeds (slide 4, Q3 2022 investor deck) “Expected use of proceeds: majority for shareholder returns, remainder for debt reduction, including 2030 bonds, and reinvestment” and “Pro forma leverage targeted at 2.5x –3.5x vs. current leverage of ~2.5x”.

Taking the mid-point of that leverage target implies debt of around $1B or $0.4B of debt paydown. Then we don’t know what will go on reinvestment, but assume 60% of proceeds are used for buybacks and that’s $1.35B on buybacks. Here’s how that could play out in different share price scenarios.

| Share price | Bought back shares (m) | Resulting fair value share price (13.5 x EV/EBITDA, $1B debt, $0.5B cash) |

| $20 | 67.5 | $38.5 |

| $25 | 54M | $34.4 |

| $30 | 45M | $32 |

| $35 | 38.6M | $30.5 |

Clearly, then the buyback could be very valuable if the shares are below my implied price target of around $31/share.

Risks

There is some risk the global products sale does not close or is delayed.

Automotive services are currently far more useful to internal combustion engine vehicles than electric vehicles. This could cause volume to decline over the medium term as electric vehicle adoption rises as expected, though Valvoline is exploring adapting their services for electric vehicles.

The separation costs and what they mean for EBITDA are hard to estimate with precision.

The business may have over-earned in 2021 and into early 2022 due to the economy’s emergence from Covid and a corresponding uptick in car usage.

Sensitivities

Here are several pre-buyback valuation sensitivities across a range of feasible EBITDA values and multiples with current net debt ($1.4B) and 177M shares out. It suggests a reasonable valuation range of $25-$41/share. That’s before the impact of any buyback.

| EV/EBITDA | EBITDA $300M | EBITDA $350M | EBITDA $400M |

| 16x | $32/share | $36 | $41 |

| 14x | $29 | $32 | $36 |

| 12x | $25 | $29 | $32 |

Conclusion

So on a fairly conservatives EBITDA estimate for the Valvoline separated services business we have a valuation of $31.50/share (range $25-41), for about 10% upside from the current price. If the company is able to conduct buybacks in the mid-$20s per share then the upside becomes more compelling.

Therefore, I don’t find Valvoline massively compelling today as the shares appear close to fair value with ~10% upside. However, if the shares do dip back into the mid-$20s as they were earlier this month, then Valvoline could become extremely interesting because of the potential for a large buyback to create value on top of the estimated discount to fair value.

It is an interesting situation, because some price softness over the coming months could make Valvoline a very attractive stock to hold if they can conduct buybacks in the mid-$20s or below. Equally if the stock rises into the $30s, then buyback activity may be counter-productive.