Upstart Stock: Washed Out Levels, Undemanding Valuations (NASDAQ:UPST)

William_Potter/iStock via Getty Images

Price Action Thesis

We follow up on our previous post-FQ1 article on Upstart (NASDAQ:UPST), as we observed significant developments in its price action.

We discussed in our previous article in early May that UPST could be forming a consolidation zone predicated on its May lows. That thesis has played out as the market absorbed further selling in June. Moreover, UPST formed a higher high re-test of its June bottom, lending further credence to the resilience of its near-term support.

Notwithstanding, we have not observed a bear trap price action (significant rejection of selling momentum) that is a critical early signal to a potential reversal of its bearish bias. Therefore, we caution that a steeper sell-off before forming a potent bear trap cannot be ruled out.

Our reverse cash flow valuation model indicates that UPST seems attractive at the current levels. Therefore, we believe it offers investors an attractive entry point that could lead to market outperformance.

We reiterate our Buy rating on UPST.

UPST – Held Its May Bottom Firmly

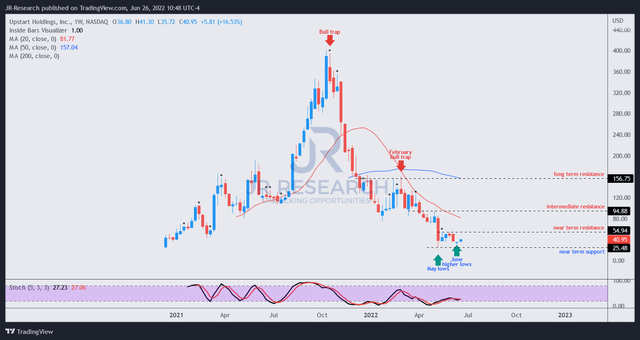

UPST price chart (TradingView)

After tumbling spectacularly to form its May lows ($25), it has consolidated impressively for close to two months. Therefore, we are pretty satisfied with the consolidation zone. Moreover, the recent June re-test did not break its May lows, as seen above. Consequently, it added another layer of buying momentum that further undergird its near-term support.

Notwithstanding, investors should note that UPST remains in a dominant bearish bias. Therefore, it could be stuck in an extended consolidation phase without a bear trap signal.

We also urge investors to pay attention to a re-test of its near-term resistance ($55). It’s vital for UPST not to form a bull trap (significant rejection of buying momentum) at that level, given its bearish momentum. Therefore, a lower high bull trap could indicate the market is likely leaning into a steeper sell-off in UPST stock.

Notably, its February bull trap was instrumental in forcing UPST into its bearish flow and prevented the retaking of its bullish bias. We missed the price action signal from its February price structure, leading to poorly executed calls previously. So, we have learned our lessons well.

The Market Remains Tentative Over Its Model

We highlighted that the sell-off post-FQ1 was justified as Upstart under-delivered. Furthermore, the company also took on unexpected loan risks on its balance sheet higher than the market had anticipated.

Given the macro uncertainty, we believe the market has justifiably pummeled UPST to deliver a wake-up call to management.

Therefore, it’s reassuring to hear from CFO Sanjay Datta that Upstart would refrain from similar undertakings moving forward. He articulated:

Obviously, the market reacted very unhappily to that. And so it’s not something I’ve ever carried strongly enough to sort of hold out on. I think the market really wants to view us as a marketplace that reacts to the vagaries of the market and accepts volume volatility as a result, which is how we largely view ourselves, then I think that the takeaway for us is that we’ll just keep our balance sheet out of it. (Bank of America 2022 Global Technology Conference)

Coupled with rising delinquency rates and higher hurdle rates required by its funding institutions, the market has turned negative over its near-term prospects.

Furthermore, less optimistic guidance proffered by management in its Q1 earnings card has validated the market’s concerns, as indicated by the prescience of its February bull trap (demonstrating that price action is forward-looking).

But Its Valuation Has Moderated Significantly

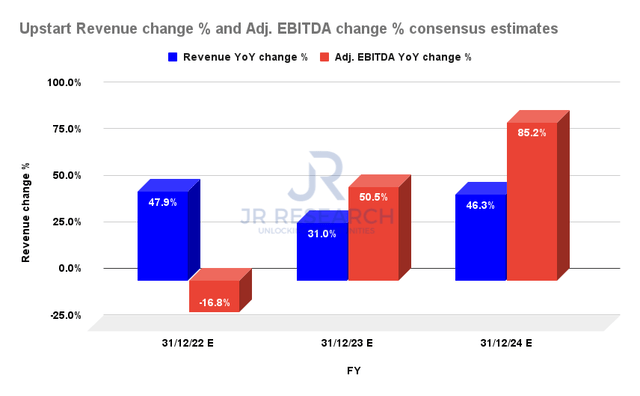

Upstart revenue change % and adjusted EBITDA change % consensus estimates (S&P Cap IQ)

The revised consensus estimates see a marked deceleration in its revenue growth in FY22. It’s also expected to impact its adjusted EBITDA growth, leading to a 16.8% YoY decline.

As a result, Upstart’s free cash flow (FCF) margins are estimated to fall into the red at -24.5%, compared to FY21’s 18.1%. Therefore, we believe the market has modeled for a substantial hit to its FCF profitability, even though it’s expected to be transitory.

The Street’s consensus suggests that the macro stresses are expected to normalize in FY23 before improving further through FY24. Therefore, Upstart’s inherent operating leverage should help deliver much higher adjusted EBITDA growth moving forward.

| Stock | UPST |

| Current market cap | $3.47B |

| Hurdle rate (CAGR) | 30% |

| Projection through | CQ4’26 |

| Required FCF yield in CQ4’26 | 2.5% |

| Assumed TTM FCF margin in CQ4’26 | 11% |

| Implied TTM revenue by CQ4’26 | $2.57B |

UPST reverse cash flow valuation model. Data source: S&P Cap IQ, author

We applied a hurdle rate of 30% in our valuation model to adjust for higher macro risks, which is appropriate for a high-growth play. But, we used an FCF yield of 2.5%, which gives allowance for Upstart’s growth focus.

However, we used relatively prudent parameters for its TTM FCF margin of 11%. In addition, we used a blended assumption predicated on a considerable discount of the Street’s consensus to model for a reasonable margin of safety, given the harsher macro conditions.

Consequently, we derived a TTM revenue target of $2.57B that Upstarts needs to deliver by CQ4’26. We believe if the economy doesn’t fall into a deep, extended recession (not modeled by the Street), Upstart should be able to achieve our revenue target.

Furthermore, the consensus estimates modeled for Upstart to post revenue of $2.4B in FY24. Therefore, we believe our model’s margin of safety is appropriate. As a result, UPST’s valuation seems undemanding at the current levels.

Is UPST Stock A Buy, Sell, Or Hold?

We reiterate our Buy rating on UPST. But, investors should note that we have not observed a bear trap price action. Therefore, we caution that a steeper sell-off to force a subsequent bear trap cannot be ruled out.

Furthermore, we used estimates that indicate any potential recession/slowdown is expected to be transitory and not extended. Therefore, investors should consider these two critical risks in their modeling.

Notwithstanding, our valuation analysis indicates that UPST can potentially outperform the market over the next four years, despite factoring in an appropriate margin of safety.