Trimble Stock: Don’t Average Down, Be Patient (NASDAQ:TRMB)

CreativaImages

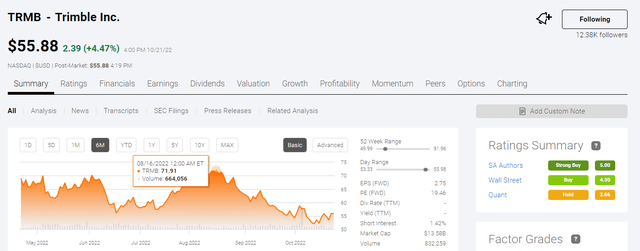

I agree with the Hold recommendation of Seeking Alpha Quant for Trimble Inc. (NASDAQ:TRMB). It is easy to ignore the Strong Buy and Buy recommendations of SA Authors and Wall Street. TRMB is a falling knife. It took less than 70 days for it to fall from $71 to $55. This big decline is in spite of the impressive Q3 earnings beat. I dug around and found no immediate threat to the profitable business of Trimble. Many people just dumped their shares for the past eight weeks.

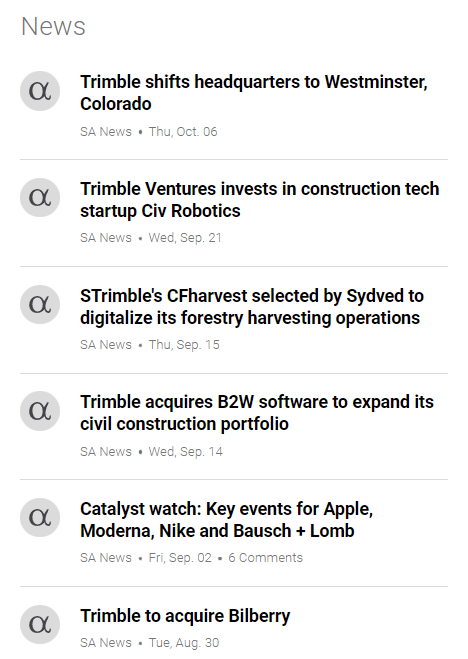

As per Seeking Alpha’s newsfeed machine, there is only good news for Trimble. The screenshot below illustrates that Trimble is acquiring new sources of revenue. A quick check on Trimble’s website told me its empire is already super-diversified. The stock price still went down after new acquisitions. It is investors expressing their disapproval.

Seeking Alpha

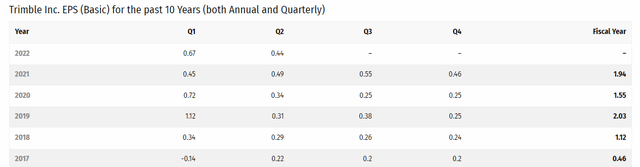

The prevailing pessimism on TRMB cannot be blamed on the lowered guidance for FY 2022. The management guided for $3.76 to $3.82 billion. That is not significantly lower from consensus expectation of $3.86 billion. That $100 million difference is not a dealbreaker. Trimble’s 2021 revenue was only $3.66 billion. A 2022 revenue of $3.76 billion is still an improvement.

The EPS guidance of $2.70-$2.80 would still be higher than 2021 and 2020 EPS.

Herd Negativity

It is not the shorts that should be blamed for TRMB’s falling knife status. The first screenshot in this article says the short interest is only 1.42%. Many traders started pushing TRMB up until it breached $71. After that, many others also dumped their shares.

It does not matter much that Trimble is a consistent profit-maker. Its stock will always endure a rollercoaster ride based on the emotion of stock buyers/sellers.

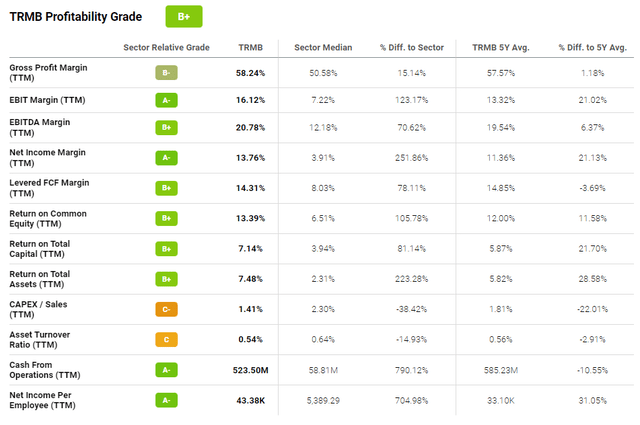

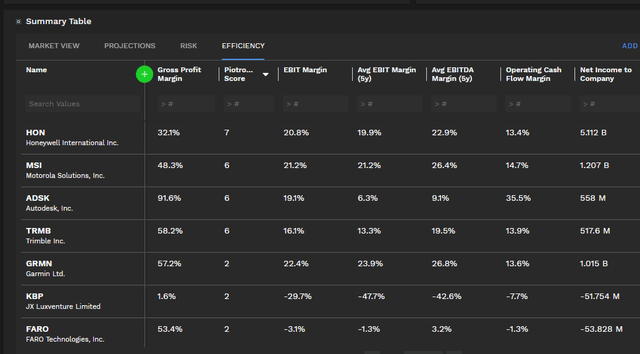

The depressing decline in TRMB’s price is an aberration when you consider that chart above. Trimble has improving profitability. Its TTM net margin of 13.76% is 11.36% higher than its 5-year average. This is also 251.86% higher than the sector average TTM net income of 3.91%. Better profitability is not enough to make bulls remain bulls forever.

Those who bought shares in mid-July made big money when they sold at $70 in August. After those early profit-takers, the other holders also dumped their TRMB.

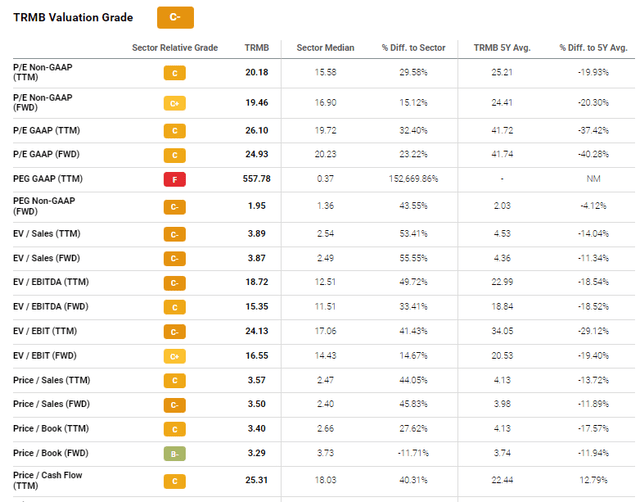

Aside from this depressed market state, my hold rating for TRMB is also because the $16 drop is not yet enough to reduce its high valuation ratios. Do not average down. The chart below illustrates that TRMB’s valuation ratios are notably higher than its sector peers.

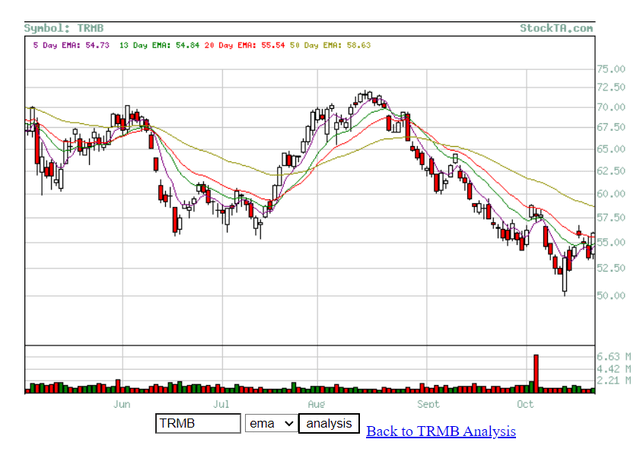

This relative overvaluation should incentivize investors not to make big purchases of TRMB. Be patient and let others’ pessimism bring down TRMB to 20x TTM P/E valuation. There’s no guarantee that TRMB will drop to $45 before 2022 ends. On the other hand, the EMA chart below illustrates bearish averages. There’s no bullish reversal in sight.

At the moment, be neutral on TRMB because its declining RSI score is only 48.58. It has not reached the oversold RSI score of 30.

Conclusion

Trimble is a reliable company that still has high valuation ratios after its recent beating. Hold on to your shares. It could whiplash back up within the next two months. There will be other deep-stacked investors who might like this articles’ thesis. Once the stock is down to their ideal buy-in price level, they could repeat that July bull run.

It might be better if management starts paying dividends. This is better than acquiring more companies. Dividends are tangible rewards for shareholders. Buying other companies do not immediately become accretive.

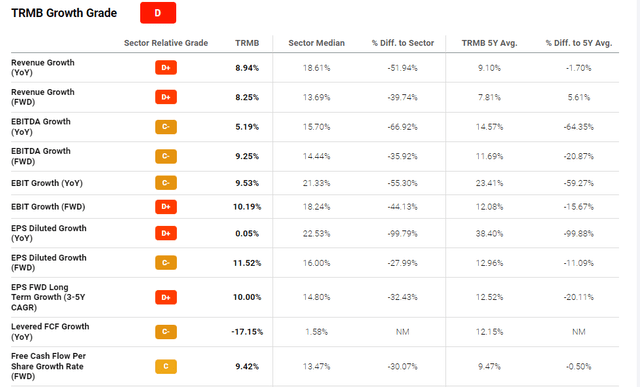

Diversification is good, but dipping in too many pies is not going to improve its low revenue CAGR. It is hard to justify TRMB’s forward P/E of 24.93x. Its forward revenue CAGR is only 8.25%. Growth should always be our top qualifying factor when evaluating stocks.

Like it or not, Trimble is overvalued and is a slow-growth company. It does not pay dividends. These aggravating circumstances are why you should not average down on TRMB.

Stability-wise, Trimble has a total debt of $1.41 billion, but its levered free cash flow is $538.23 million. Its total cash position is $350.10 million. This company has no difficulty meeting its debt repayments. The Altman Z score of TRMB is 5.14. There is almost no chance that this super-diversified company is going to go bankrupt.

The Finbox comparative chart also explains why you should hold on your TRMB position. Trimble is an efficient company. Its Piotroski F-score is 6. Going forward, improved efficiency in marketing its products/solutions might also improve its low revenue CAGR.