The Truth About Blackstone (NYSE:BX)

ALLVISIONN/iStock via Getty Images

Earlier this week, we posted an article that explained our thoughts regarding Blackstone Inc.’s (NYSE:BX) move to limit the redemptions of its public non-listed REIT, Blackstone Real Estate Income Trust (“BREIT”).

In short, we think that the market overreacted to the news, and this is largely due to all the scary headlines put out by various media outlets.

Its REIT is doing just fine and so is Blackstone itself. Both have strong balance sheets, enjoy rapidly growing cash flow, and aren’t facing any kind of distress, despite this becoming an increasingly popular narrative.

Just look at some of these recent headlines: the first one makes it seem as if Blackstone was suffering a “bank run,” which is a severe exaggeration of what’s really happening, and the second one makes it seem as if BREIT was facing a “slump in performance” when in reality, its net operating income is up by 13% over the past year:

Google Google

Today, I am writing this follow-up because Blackstone’s co-founder, Steve Schwarzman, just spoke on this topic at a conference and it merits your attention.

Talking at The Goldman Sachs (GS) conference, Schwarzman noted that he is “baffled” by all the worries about BREIT:

“I watch on television sometime and people are concerned about it, I find it a bit baffling… The idea that there is something going wrong with this product because some people are redeeming, is conflating completely incorrect assumptions, completely incorrect assumptions.”

Blackstone

He goes on to explain that the fundamentals of BREIT are actually very strong and that the future is bright even despite the challenging environment:

“What we did with BREIT is we concentrated it in warehouses and apartments and we avoided almost all the other asset classes. We have 80% of the fund in those terrific performing asset classes…. Another thing that’s important is where is this real estate? Those 70% in BREIT is in the Sunbelt… it’s 5x the population growth in the rest of the country… So we’ve got perfect locations with terrific assets.

Our NOI went up this year at 13%. The average REIT went up 8%. So we’re out-earning that by like 65%. BREIT, because it was so successful, its returns have averaged 13% a year for the last 6 years. That’s 3x the return of the REIT index.

… We own real estate that is at least 20% below market prices. So the market for warehouses and multifamily is still going up. Green Street, which is a big adviser, said that they think those two asset classes will be up somewhere in the 8% to 9% zone this year. And we have this large portfolio that rolls off its leases. Leases terminate pretty quickly in this area in the 3 to 4-year zone. And if you just mark that up to current market without the appreciation, you can see this will be a very positive experience for investors.”

So clearly, BREIT is doing very well from a fundamental perspective. It owns highly desirable assets that have a strong track record and are expected to keep growing rents at a rapid pace. This is largely because they are located in growing markets, but also because their current rents are below market.

So why are there so many investors trying to get out of BREIT?

Schwartzman provides an interesting explanation. It has little to do with fundamentals and a lot more with the liquidity of certain specific Asian investors:

“We set it up originally 6 years ago so that we would not permit redemptions beyond 5% a quarter… and what happened is we went over that 5% last month. So what happened? We started asking ourselves, what’s going on? And we found how to fasten anything that these redemptions were preponderantly coming from Asia. The same product is in the United States. It’s U.S. real estate. What was going on in Asia? And it didn’t take long to figure out that the Hang Seng Index went down 40% and the Asians tend to use more leverage, more margin debt. So if you are an investor who has got margin debt and your market goes down 40%, you can imagine what it was like to be one of those into the pools. You’re under excruciating financial pressure, and so they were just looking for liquidity.”

I think that many Blackstone shareholders will stop here and feel reassured that the redemptions are limited to Asian investors, which likely aren’t even a big part of the REIT. If that’s the case, then the redemptions would likely be more limited than what some might have predicted. After a few months of negative growth, the inflows could soon surpass the outflows again, leading to a rapid recovery in Blackstone’s share price.

But I fear that this theory is wrong.

Yes, Asian investors might have been the first ones to ask for redemptions, but they are not alone.

Asian investors were first in-line because their stock market has dropped the most and it caused many to reconsider their allocation to BREIT.

If your stocks are down 40% over the past year, but BREIT is up 10%, then it becomes very tempting to get out of BREIT to reinvest in stocks at much better valuations. Relatively speaking, BREIT has become a lot less attractive relative to the stocks because the performance disparity has been so exceptionally large.

This applied first to Asian investors, but it also applies to U.S. and European investors, and many of them will want out as well.

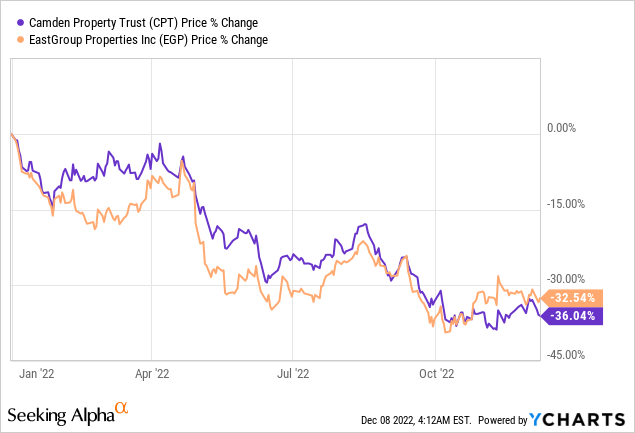

The listed REIT (VNQ) market is down 25% year-to-date in the U.S., even as BREIT is up 10%. That’s a huge disparity! There are many high-quality listed REITs like Camden Properties (CPT) and EastGroup Properties, Inc. (EGP) that own similar assets as BREIT, but they are down 35%:

YCHARTS

These listed REITs are now priced at a 20-30% discount to their net asset value, but BREIT allows you to redeem at par with its net asset value.

And naturally, investors are now cashing out of non-listed REITs to invest in listed REITs instead. I recently posted the following tweet about this:

Twitter Jussi Askola

Listed REITs have a lot less to lose and a lot more to gain because they are priced at a steep discount to NAV even as BREIT is priced at an all-time high.

That’s for the same assets!

And so there is a significant arbitrage in selling the illiquid asset to buy the liquid one, and this is what’s driving all these redemptions. As long as this remains true, I expect to see more outflows than inflows into not just BREIT, but also other non-listed REITs.

In fact, Starwood, another major asset manager, also just limited the redemptions of its non-listed REIT.

It shows you that this is not about Blackstone. It is simply that listed real estate offers a better deal, and so it is natural for BREIT investors to want out.

Takeaway #1:

The main takeaway here is that the headwind of redemptions could last for a lot longer than many of the bullish shareholders might have wished for.

BREIT is an important fee generator and growth driver for Blackstone’s business, so this is significant news, and Blackstone deserves to trade at a somewhat lower valuation.

Did it drop too much?

Perhaps, but you cannot deny that this is a negative development in its business.

I actually think that Blackstone is a Buy at today’s valuation, but I also think that there are better opportunities out there, and this is why I am not investing in it. There are other asset managers that are less exposed to such risks because they have more permanent capital (no redemption risk), and yet, they are priced at lower valuations in many cases. Examples that I prefer include KKR & Co. Inc. (KKR), Blue Owl Capital Inc. (OWL), and Patria Investments Limited (PAX).

Twitter Jussi Askola

Takeaway #2:

Listed REITs are today deeply undervalued, and I think that it is a great time to be investing in them.

They are down so heavily because of fears of interest rates, but what the market appears to have missed is that REIT balance sheets are the strongest ever, with just 35% debt and long maturities at nearly 10 years. So the impact won’t be significant on the cost side, but the inflation has pushed rents a lot lower.

BREIT has grown its same property NOI by 13% this year, and this is nothing uncommon. Earlier, we mentioned CPT and EGP, and both have also grown their same-property NOI this year by 10%+ – and yet, they are down 35%.

This essentially means that their valuation has been cut in half and they now trade at large discounts to fair value. If I was invested in BREIT, I would try to exit to buy such undervalued REITs instead.