Tesla: The Energy Transition Technology Company (NASDAQ:TSLA)

Xiaolu Chu/Getty Images News

Investment Thesis

Tesla (NASDAQ:TSLA) develops, manufactures, and sells electric vehicles (EV), energy generation, and storage systems. Not only is it a leading EV manufacturer, but it is also developing bleeding edge technologies with the potential to change people’s lifestyle in the future. Some examples include self-driving vehicles, remote-controlled energy storage systems, and a real-time energy optimization platform. It turned profitable (net income positive) in 2020, and, since then, its revenue, operating cash flow, and net income have been rising at an impressive pace. I expect Tesla to continue its impressive performance well into the future. I believe it is a superb investment option because:

- Tesla is a clear leader in the EV space with technological superiority, brand recognition, and superb infrastructure.

- Tesla has a large pile of cash on its balance sheet to support its growth, and its profit margins are strong.

- Future growth trajectory is outstanding due to growing EV demand and the global push towards energy transition.

Clear Leader in EV Space with Technological Superiority

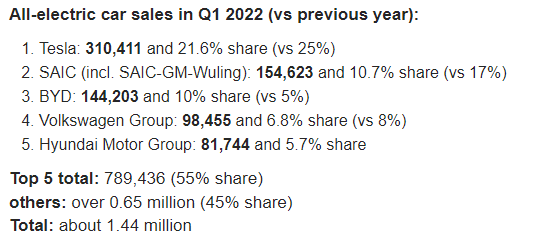

Although the space is getting crowded as many traditional car manufacturing powerhouses (e.g., Toyota (TM), Ford (F), and GM (GM)) bring new EV models to market, Tesla remains the clear leader. Looking at all-electric car sales in 1Q 2022, Tesla held 21.6% market share, which was more than double that of SAIC in the #2 spot. Also, Tesla’s YoY growth rate of 25% was well above the rest of the field, so the gap between Tesla and the rest of the group may increase in the future.

EV Market Share by Brand (InsideEVs)

The company also has lots of potential outside of EV manufacturing, because it possesses bleeding edge technology that could transform people’s lifestyle in the future. The most well known, and also the closest to commercialization, is the self-driving technology. Currently, Tesla’s Full Self Driving (FSD) computer runs neural networks in its vehicles (primarily based on vision sensors) to ensure driving safety. It is developing additional hardware to further train the neural networks and improve autopilot capacity. The autonomous car market size is expected to grow from $1.64 B in 2021 to $11 B in 2028 (CAGR of 31.3%). Capturing this market will boost revenue trajectory, and, also, it will increase the market share of Tesla cars in general.

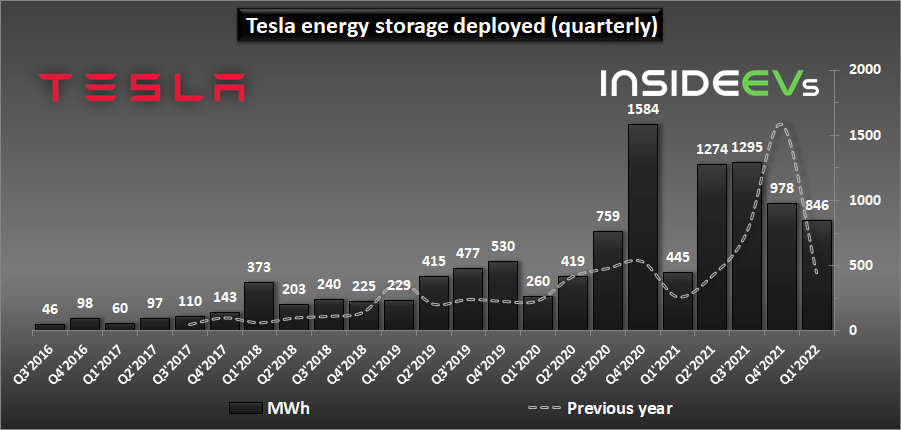

In a less visible area, Tesla’s influence in the energy storage market is increasing (current market share at 18.2%). So far, Tesla has developed software to remotely control and dispatch its energy storage systems. Also, it is developing software capacity to control and optimize energy usage in real time. This technology will improve the safety of cars, efficiency of the electric grid, and performance of solar energy storage. Currently, Tesla is aiming to deploy an annual energy storage capacity of 1,500 GWh by 2030, which implies 90% CAGR. That is a very ambitious plan and will require the company to piece together many different aspects (e.g., supply chain, factory capacity increase, and etc.). However, Tesla proved able to increase storage deployment by 90% in 1Q 2022 in the midst of supply chain constraints, so it is certainly capable of achieving the goal. Its increasing influence in energy storage will bring a large tailwind for Tesla’s revenue.

Tesla Energy Storage (InsideEVs)

Strong Fundamentals and Cash Generation

Tesla used to be a company for dreamers. The company was full of futuristic ideas, but failed to generate any money “now.” This is no longer the case. It turned operating cash flow positive in 2018 and net income positive in 2020. Since then, revenue (53% per year, 5-year average), EBITDA (179% YoY), and EPS (641% YoY) have been growing at an impressive pace. Tesla generated $13 B operating cash flow in the past 12 months. So, now it is a company with profitability to go along with the futuristic technology.

Not surprisingly, its financial fundamentals are very strong. As mentioned above, Tesla generated operating cash flow of $13 B in the past 12 months and $7 B of free cash flow. It also has $18 B of cash on its balance sheet against $7.0 B of total debt, which gives the negative net debt position of $11 B. This strong cash position will allow it to keep expanding its manufacturing capacity, supporting R&D, and acquiring key technologies.

Bright Growth Trajectory and Improving Margin

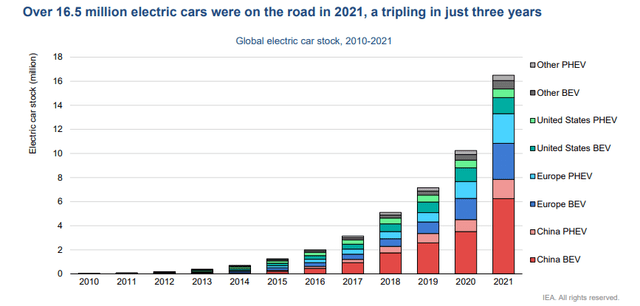

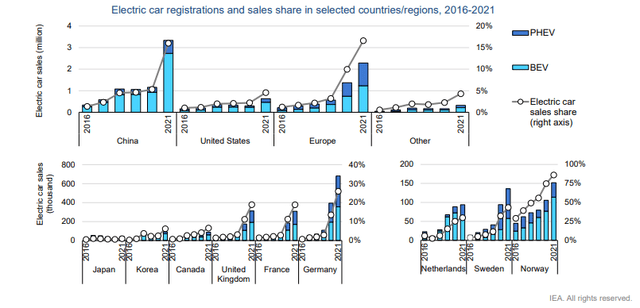

The energy transition is well underway, and EV sales are picking up all over the world. The EV fleet on the road tripled over three years, and the pace will likely accelerate as major companies (e.g. Toyota, GM, and Ford) continue to release more and more EV models. Sustained high gasoline/diesel prices will contribute positively to the trend as well. As a clear leader in this EV transition, Tesla will enjoy a large tailwind.

Global EV Trend (IEA) EV Sales by Region (IEA)

As of 2021, the market share of EV is only 5% in the U.S. (~15% in China and Europe). Therefore, there still is plenty of room for EV sales growth in general, and for Tesla in particular. It will see a nice long upward runway for years coming.

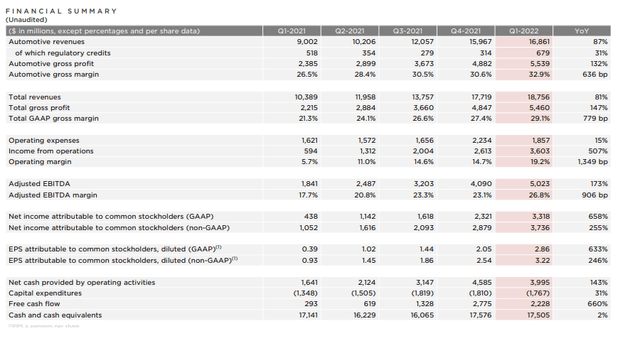

Looking over the financial statements, a noticeable trend is that automotive revenue increased by 87% while operating expenses increased by only 15%, which contributes to the margin expansion. EBITDA margin increased from 12% in 2021 to 20% in 2022. As more and more Gigafactory constructions finish, and the more expensive early ramping up phases complete, the margin will continue to improve.

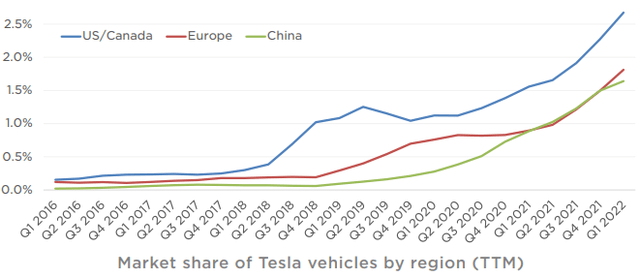

Market Share of Tesla Vehicle (Tesla Investor Relations)

Tesla Financial Statement 1Q 2022 (Tesla Investor Relations)

Intrinsic Value Estimation

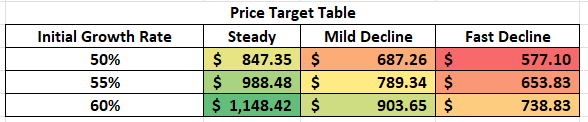

I used a DCF model to estimate the intrinsic value of Tesla. For the estimation, I utilized EBITDA ($12.7 B) as cash flow proxy and current WACC of 8.0% as the discount rate. For the base case, I assumed EBITDA growth of 50% (average revenue growth of the past 5 years) for the next 5 years and zero growth afterwards (zero terminal growth). For the bullish and very bullish cases, I assumed EBITDA growth of 55% and 60%, respectively, for the next 5 years and zero growth afterwards. Also, I ran a scenario with declining growth rate. For the mild-decline scenario, the growth rate was reduced by 5% each year, and for the fast-decline scenario, the growth rate was reduced by 10% each year.

The estimation revealed that the current stock price represents 20-40% upside in the bull cases, and 15-20% downside in the bear case scenario. Given its leadership position, superior technology, and strong financials, I expect Tesla to excel in the future and achieve the upside.

Price Target Table (Author Generated)

The assumptions and data used for the price target estimation are summarized below:

- WACC: 8.0%

- EBITDA Growth Rate: 50% (Base Case), 55% (Bullish Case), 60% (Very Bullish Case)

- EBITDA Growth Rate Decline Rate: 0% (Steady), 5% (Mild Decline), 10% (Fast Decline)

- Current EBITDA: $12.7 B

- Current Stock Price: $737.12 (06/24/2022)

- Tax rate: 20%

Cappuccino Stock Rating

The metric details can be found in this article.

| Weighting | TSLA | |

| Economic Moat Strength | 30% | 4 |

| Financial Strength | 30% | 5 |

| Growth Rate vs. Sector | 15% | 5 |

| Margin of Safety | 15% | 3 |

| Sector Outlook | 10% | 5 |

| Overall | 4.4 |

Economic Moat Strength (4/5)

Currently, Tesla is the clear leader in EV space with a technological edge, and I expect it to maintain this position for a while. However, major car manufacturers are only now really entering the market, and their manufacturing experience will start to erode Tesla’s advantage. Also, there are a lot of competing start-ups, so the EV space is getting more crowded.

Financial Strength (5/5)

Easy 5 in this category. Large pile of cash and strong operating cash flow will support its growth. Also, its profit margins are improving, and as revenue ramps up, I expect its cash position to become even stronger.

Growth Rate (5/5)

Tesla has been an outstanding growth company. Revenue growth of 53% per year in the past 5 years and 73% YoY indicates that their revenue growth is accelerating. As more and more Gigafactories reach completion, I expect its revenue growth to remain exceptional for a while.

Margin of Safety (3/5)

I am very comfortable saying that Tesla’s stock price will go higher in the long run. However, Tesla stock does tend to swing wildly with news headlines (government regulation change, interest rate change, and CEO’s antics). Also, due to its high valuation, any miss in earnings will result in a large price drop. Therefore 3 out of 5 is appropriate here.

Sector Outlook (5/5)

Energy transition is well on the way, and EV sales growth will continue in the future. Looking at the data and what I see on the road (EV and EV stations), I think the trend is real. Also, EV only holds 5% market share in the U.S. at this point, so I expect the EV segment still has a long runway ahead.

Risk

Even with the recent price drop, the valuation of Tesla is still very steep. P/E (FWD) of 61.47x and EV/Sales (FWD) of 12.5x are much higher than the sector median. Any disappointment in revenue growth or a delivery hiccup will result in a large price drop. Also, a negative macro outlook (e.g., increasing interest rate or slowing economy) can have a larger impact on a high valuation stock like Tesla.

Building and operating a manufacturing site is a complex task. It requires experience, engineering expertise, and supply chain management. As Tesla expands its footprint and ramps up manufacturing capacity, unexpected problems are sure to arise. For example, recently the Shanghai plant had to severely reduce manufacturing capacity, due to COVID lockdown and supply chain issues. Therefore, investors should monitor its progress on manufacturing capacity.

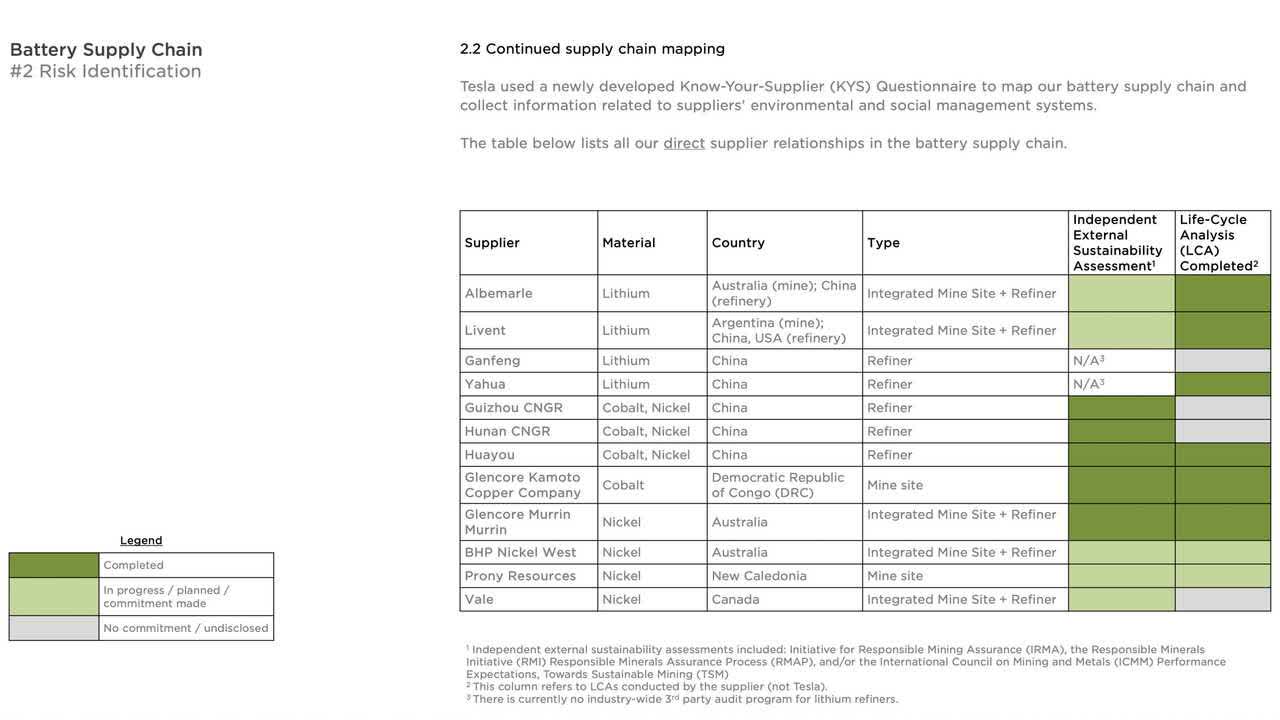

Supply chain has been presenting issues, and it’s affecting profitability and production capacity. Recently, CEO Elon Musk mentioned that Berlin and Austin factories are “gigantic money furnaces” and bankruptcy is a possibility. Given its financial position and substantial increase in operating cash flow in the past 2 years ($5.9 B in 2020 to $13.9 B in TTM), I don’t think bankruptcy is a possibility. Also, Tesla is scouting sites in India and Indonesia (top producer of Nickel) to simplify the supply chain. Therefore, while the supply chain is clearly constraining Tesla’s profitability and production capacity, it won’t affect Tesla’s long-term growth trajectory.

Supply Chain Mapping (InsideEVs)

Conclusion

Tesla has been a great investment for the past several years. Given its leadership position, growth rate, and strong financials, I expect that to continue into the future. High valuation and manufacturing challenges may negatively affect the stock price, but I expect the company to handle this well. I expect 20-30% upside from here.

Marketplace In Preparation

Thank you all for reading my article. I’m in preparation for a Marketplace launch soon. Please get excited! Also, let me know the types of analysis or information you would like to see more of in my articles. I will take that into consideration for the marketplace. Thank you all for your support!