Tellurian: Revised Driftwood Funding Plan (NYSE:TELL)

MsLightBox/E+ via Getty Images

Shares of Tellurian Inc. (NYSE:TELL) declined nearly 50% since August 24 due to the cancellation of its $1 billion note offering and the subsequent cancellation of two SPAs (Sales Purchase Agreements). We believe the declines were overreactions. The debt (with warrants) and SPAs cancellations led to high volume drops, creating an attractive opportunity for Driftwood LNG’s optionality. It is not unusual for a company trying to accomplish something innovative and consequential to have fervent groups of bulls and bears actively promoting their side and high share price volatility to ensue. This is the case with Tellurian Inc. a potential leader in the dynamic LNG production and export industry.

September was a Tough Month

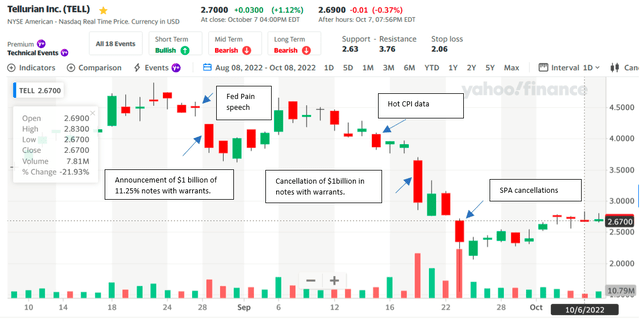

Commencing with Powell’s “pain” speech following the Fed’s Jackson Hole meeting, September was a tough month to float a large debt deal for a developing business. The chart below shows the problematic timing of Tellurian’s debt offering, due to restrictive monetary commentary, Fed tightening, and hot inflation data. The high yield market’s stressed condition was seen in the cancellation of Brightspeed’s $3 billion high yield offering and the CITRIX buyout closing only after investment banks had to absorb a $500 million loss.

On September 19th, when Tellurian withdrew its offering, the deal terms were 11.25% notes priced at an original issue discount of $95, resulting in a yield of 12.5% before equity warrants. The deal had $600 million of firm interest, but, with the warrants, its cost of capital was nearly 20% to attract the remaining interest to complete the deal, according to Matt Phillips, Tellurian Investor Relations Vice President.

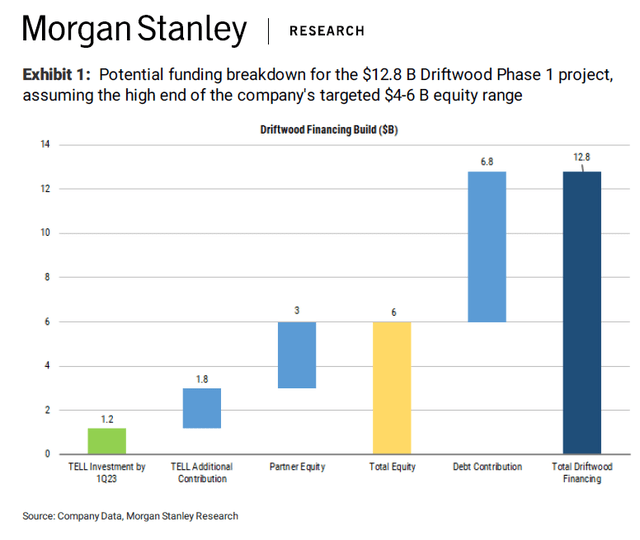

Following the cancellations, Morgan Stanley and Tellurian met with investors in Boston and New York to update them on their plans to finance the Driftwood facility leveraging its now open capacity due to the Shell and Vitol contract cancellations. Morgan Stanley published a research update on October 3, 2022, with a $5 price target, net asset value of $1.4-1.7 billion, and a $6 billion equity commitment to be divided between strategic investors and Tellurian.

The chart below shows September was a tough month for raising capital. Below the chart is a list of the relevant news items with their hyperlinks.

Tellurian chart (Yahoo.Finance Chart of Tellurian Stock)

- Powell’s Jackson Hole “pain speech” 8.26.2022

- Announcement of deal 8.29.2022

- Hot CPI data and Dow 1000 point plunge 9.13.2022

- Cancellation of debt deal 9.19.2022

- Fed hike another 75 bps 9.21.2022

- Cancellation of SPAs 9.23.2022

- Shares traded intraday to $1.53/share on 77 million in volume.

- Brightspeed debt cancellation 9.29.2022

What’s the Big Deal?

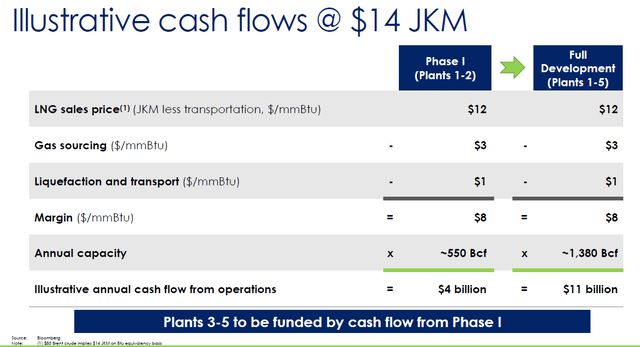

The investment opportunity for Tellurian Inc. lies in its ability to generate $11 billion in cash flow per year from its Driftwood LNG facility in Louisiana. While the actual amount of dilution for funding TELL has not been determined. We believe it will be in the $3 billion range at the Driftwood level for 35% of the project. Assuming completion of all five trains in 2027, Tellurian’s market cap could trade at 4 x cash flow (65% of $11 billion) or $28.6 billion assuming an $8/mmBTU LNG price. Assuming 1 billion in shares outstanding, Tellurian shares could trade at $28.6/share in 2027. From today’s price of $2.70, that would be 10.5 x return through 2027.

We have been publicly positive on TELL for the following reasons — Charif Souki, the Executive Chairman of Tellurian Inc., has great experience as the former Co-Founder and Co-CEO of Cheniere Energy (LNG). Souki helped finance both of Cheniere’s first two major projects. The first Cheniere project was a gasification facility and the second was a liquefaction facility. Once it was discovered that the US shale fracking revolution unleashed massive amounts of natural gas, Tellurian had to reverse its business model from LNG importing and gasification to LNG liquefaction and exporting. This created a huge boom bust cycle around its first gasification facility but demonstrated Souki’s ability to adapt and reverse directions successfully. Having financed two facilities for Cheniere, Souki has a track record of delivering. Additionally, as a former investment banker, he understands how to leverage multiple investment instruments to finance a large project like Driftwood LNG.

The chart below of Cheniere Energy Inc. shows the 2003-2006 surge when Souki helped Cheniere finance its first gasification facility. Furthermore, from 2010-2014, Cheniere shares appreciated in lockstep with the financing and construction of the Sabine Pass liquefaction facility. Consequently, we believe that, as TELL secures financing of its Driftwood LNG facility, sizeable and rapid appreciation should ensue. In an earlier note, we quantified the speed of Cheniere’s share price appreciation during project one and project two being 421% annualized between April 2003 to October 2005 and for Sabine Pass 126% annualized between January 2012 to August 2014. During the period of financing and construction Cheniere saw outsized returns as the risk of completing the financing and construction declined to zero. We believe that investors in TELL could enjoy similar high returns like those experienced by Cheniere’s shares with successful financing and construction.

Just as Souki is considered a leader in the US LNG space, Tellurian’s team has great experience as well. Tellurian’s team “originated and executed c. 79% of U.S. LNG capacity development and c. 36% of global LNG capacity development across four continents.” Tellurian’s model is transformative; its integrated model seeks to capture the US versus international natural gas price spread rather than operate as a toll road process provider. Tellurian has “all FERC and DOE permits secured for Driftwood LNG terminal and pipelines.”

The chart below of Cheniere stock shows its price performance during both facilities’ financing and construction phases and, since 2020, the international LNG price run up.

Cheniere Energy [LNG] Chart since 2000 (Yahoo.finance and IGA research)

Tellurian’s Strategic Investor Focus:

Perhaps the greatest misconception is how Tellurian will finance the project. Contrary to some misguided commentary, Tellurian does not need to rely primarily on selling stock to raise capital. Tellurian can issue debt, convertible debt and convertible shares. Furthermore, it is currently generating cashflow from its Haynesville natural gas business (expected to generate $400mm in cash flow in 2023) and will be using this cash flow to fund Driftwood’s construction.

Most importantly, Tellurian can sell access to the Driftwood facility in exchange for capital to build the facility. For example, Tellurian could offer 35% of the Driftwood facility for about $3-3.5 billion and the strategic partner could generate $3-3.5 billion in annual cash flow for its project investment. While this would lead to dilution at the TELL stock level, it will not cause a dilution death spiral as bears have suggested.

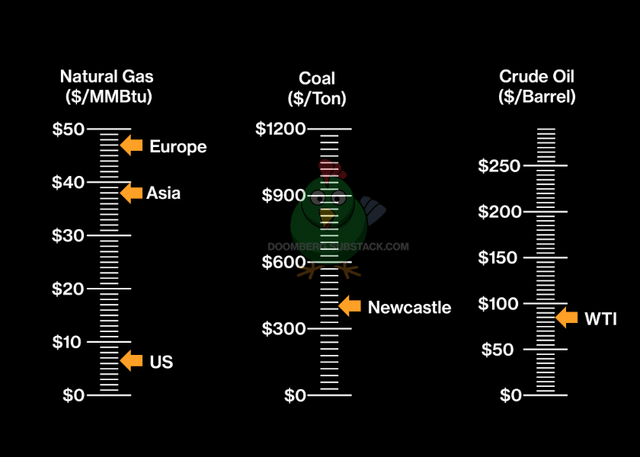

Furthermore, the risk profile of funding a processing business where you know the input costs, the output prices, operating expenses, and capital costs, is compelling because the business risk is quantifiable. Once a processing facility secures its risk capital and models future income streams, bank debt financing and corporate debt can then be utilized to finance the remainder of the project. While Driftwood is not a tolling model where there is a fixed fee, Driftwood will provide funders with the spread between US and international gas prices. This spread should lead to a higher, though variable, margin for strategic funders. The market currently suggests this can be highly remunerative because today’s prices for international natural gas are about six times US Henry Hub prices. As of October 20th, the price for US benchmark HH is $5.358/mmBTU and European benchmark TTF is $36.765/mmBTU creating a current margin of $31.40/mmBTU for Europe. For the Asian spread, US HH is $5.358/mmBTU and JKM is $32.35/mmBTU creating a current margin of $26.992/mmBTU in Asia.

Based on Tellurian’s July 2022 Investor Presentation, the Driftwood project was to be financed with $4bn in equity and $8bn in debt. From that model, the Driftwood LNG facility would generate $11bn in cash flow on all five trains. Under the summer strategy, TELL sought $3bn from private equity or a strategic investor, and $1bn would come from Tellurian’s cash and operating cash flow. Unfortunately, that financing was not completed.

The prospective cash flow illustration below shows how a $14 JKM can lead to a $11 billion in cash flows when all five trains are constructed.

cash flow projections from Driftwood LNG (Tellurian July 2022 Investor Presentation)

According to Morgan Stanley’s October 3, 2022 report, Tellurian will invest $4bn to $6bn in equity with the balance covered by debt. The lower debt to equity ratio should make floating debt easier. Furthermore, with this scenario, Tellurian appears to be willing to commit more equity capital to funding Driftwood. How much equity Tellurian will invest and how much additional dilution will occur is to be finalized. Based on Tellurian’s July investor presentation estimating $11bn in cash flow an LNG margin of $8/mmBTU and Souki’s May 17 YouTube, we estimate that 35% of Driftwood capacity costing $3-3.5 billion can generate $3-3.5 billion/year in cash flow once Driftwood is exporting LNG. Tellurian will self-fund up to $3 billion through 2027. In the Morgan Stanley diagram below shows Tellurian will have committed $1.2 billion in capital through early 2023 and another $1.8 billion into 2027 – for a total of $3 billion in equity.

From the perspective of a strategic funder like a Haynesville natural gas producer such as Southwest Energy Company or Chesapeake Energy Corporation, the funder(s) stand to benefit from a sales price of $15/mmBTU for JKM in 2026 less $4mmBTU feed stock, $2/mmBTU for liquefaction, and $2/mmBTU for transportation. $15/mmBTU – $8/mmBTU (costs) time 500mmBTUs/year = $3.5 billion is potential Driftwood annual income for strategic investors.

financing sources for Driftwood (Morgan Stanley October 3, 2022 report)

Source: Morgan Stanley Research

LNG Pricing Prospects:

The war in Ukraine has removed Russia as a credible global producer for the next few years, so the lost production will not return meaningfully even with the war ending. Furthermore, the energy shortages being felt globally suggest that countries are reevaluating the draconian commitment to renewables and abandonment of fossil fuels and nuclear. Consequently, LNG is gaining momentum as a transition fuel that produces lower carbon emissions than coal and oil. Most importantly, it produces significant power generation, and the world is suffering from energy poverty.

Look at the global economic appeal of US natural gas across multiple energy alternatives shown below — US natural gas is far cheaper than foreign natural gas benchmarks. US natural gas is cheaper than coal and oil, and generates half the carbon emissions of coal and oil. US natural gas is the logical choice to reduce energy poverty with the least emissions, even with the rebirth of nuclear and promise of hydrogen.

global value of US natural gas vs competition (Doonberg@substack)

Source: Doomberg@substack.com A Lump of Coal

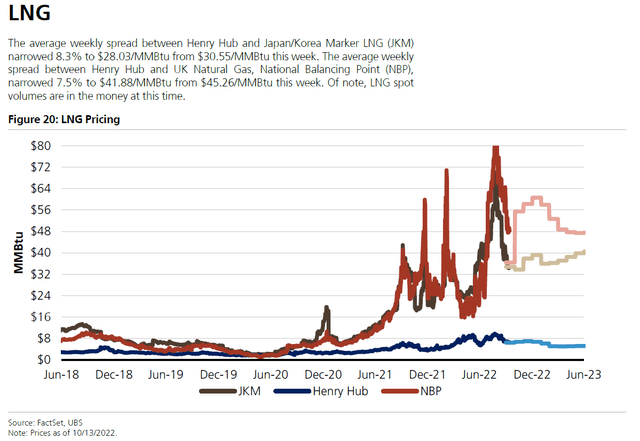

The chart below shows the parabolic run in LNG prices since 2020. While new supply will undoubtedly meet some new demand, the significant reduction of Russian gas from the world market and its protracted prospect for an antebellum production return, will keep gas prices elevated for years. Further, LNG is experiencing increased demand as the renewable for fossil fuel transition is proving to be problematic. The consequences of fuel poverty and food shortages playing out today are powerful arguments for LNG as an immediate lower carbon emitting replacement for coal fired electric generation globally.

LNG price chart (UBS Research)

How to Close Driftwood:

There is a benefit with the cancellation of the Shell and Vitol’s SPAs in that strategic funders can control who their LNG is sold to. For example, a potential funder, such as a Haynesville E&P, may want to sell to their own preferred buyers of LNG, not Shell or Vitol’s customers. The market reacted to the SPA cancellations as if the cancellation of their SPAs was because Shell and Vitol believed TELL could not secure funding. Furthermore, the lack of gasification capacity in Europe and extraordinary gas price volatility due to the Russian invasion, made the SPA terms problematic for Shell and Vitol. Both Shell and Vitol could return with revised SPAs which are priced to the market and accordant to their capacity to ship. [The 77 million share volume and price plunge to $1.58 intraday price for TELL on September 23, appears unjustified if not suspicious.]

Beyond investment return, demand for LNG can be driven by environmental concerns and energy security arguments. Following the Russian natural gas debacle, countries are increasingly interested in diversifying their supply sources. Certain European countries may want US LNG due to the absence of Russian LNG. India is a country struggling with terrible air pollution and it has indicated that it wants LNG to replace its massive coal fired electric generation plants. Worse still is the adverse health impact of people cooking in huts with wood and dried dung, which would be vastly improved by natural gas cooking common in North America.

Ideal investors in the Driftwood facility are strategic investors. That is, an entity which would enjoy a material benefit from the LNG Liquefaction facility itself. This most logical strategic investors are natural gas E&Ps in the Haynesville shale who would economically benefit from partnering with Driftwood to sell domestic natural gas at elevated international prices. Both Southwest Energy and Chesapeake Energy Corporation stated clearly in their q2 earnings calls that they are interested in selling into the international markets. Southwest Energy is 150 miles north of Driftwood and its CEO, Bill Way on its August 5th quarterly call said “We are evaluating on a risk adjusted basis, potential opportunities to benefit from global pricing by leveraging our approximate reliable long-term supply capability to help enable liquefaction projects to achieve FID.” Likewise, Chesapeake President and CEO Nick Dell’Osso said on his August 3rd conference call “we think we are a preferred seller of gas into the LNG world. We’re right there on the doorstep of the facilities, we have a tremendous amount of gas, we have good connectivity to market. There’s a lot of projects that are in the works….” Chesapeake Energy and Southwest Energy are representative and logical strategic funders of Driftwood. Charif Souki explains on May 17th how advantageous it would be to an E&P to sell its natural gas at the much higher international rates.

Since Gas Tech, we have noticed increased indications of a deal with India, where the strategic buyer, India, is an off taker of LNG. Having feedstock providers and an off takers, significantly de-risks funding Driftwood LNG. India is the fourth largest importer of oil in the world and “liquefied natural gas (LNG) imports are expected to quadruple to 124 billion cubic meters (BCM)” said Minister of Petroleum and Natural Gas. Secretary Pankaj Jain.

“India has resumed talks with Tellurian LNG as the world’s fourth-largest LNG buyer wants to strike new term deals to secure supplies” according to Energy Intelligence.

“India’s Federal Oil Minister Hardeep Puri, along with the chairmen of state-owned refiners Indian Oil Corp. (IOC), Bharat Petroleum Corp. Ltd. (BPCL) and gas pipeline utility Gail India met with Tellurian Chief Executive Officer Octavio Simoes in Houston.

Another Try

“We exchanged notes on the evolving gas markets and opportunities for Indian oil marketing companies to invest in Tellurian’s project in US,” Puri, who has been in the US since Oct. 6, said in a Twitter post Tuesday.

Petronet LNG, India’s largest LNG buyer, signed an initial pact with Tellurian in September 2019 to negotiate the purchase of up to 5 million tons per year of LNG from the 27 million ton/yr Driftwood project” according to Energy Intelligence.

Tellurian CEO and President Octavio Simoes affirmed these Indian business development prospects in this Twitter release last week following the Houston Conference.

With entities whose own financial, business, and/or proprietary environmental and energy security interests driving this large transaction, we believe that Tellurian is well positioned to close these key strategic investors in the coming months.

Tellurian must close this Driftwood LNG financing. We believe it will now be willing to commit up to $3 billion of its own capital up from $1 billion this summer. That $3 billion is $1.2 billion committed through q1 2023, and another $1.8 billion from future cash flows from its upstream activities from 2023-2027. The company may have targeted those additional cash flows to expand its upstream activities, but funding Driftwood is essential. Since the company, in this scenario implied by the Morgan Stanley report diagram above, is not seeking more equity capital from the $3-3.5 billion range, investors should be pleased to see the liquefaction facility get financed without meaningful additional dilution or delay. Consequently, we believe that TELL shares could exceed its spring time high of $6.2/share in the first half of 2023, and upon securing the “Full Notice To Proceed” from Bechtel, shares could top $10/share.

Conclusion:

While the bond offering and SPA cancellations were a disappointment, we view this decline as excessive. And it is not the first time Tellurian has disappointed shareholders. Approximately one year ago, the company sought to sell $50mm in baby bonds on the NASDAQ, and then found out that they had to cancel the deal due to a NASDAQ “rules” issue. Tellurian then relisted on the New York Stock Exchange and sold the same bonds three months later on the New York Stock Exchange which did not have the same requirement. Further, the company has changed strategies from securing a bond finance syndicate in late 2021 to raising $3 billion in risk capital in the first half of 2022. Now its focus is squarely on securing strategic investors to raise $3-3.5 billion.

Now are unprecedented times with interest rates soaring, energy policy disasters, and LNG prices rising parabolically with Russia’s invasion of Ukraine. Furthermore, Tellurian is using an innovative strategy that is not a fee-based long term contract. All of these factors make securing large commitments of risk capital difficult and Tellurian should not be discredited for not succeeding. These funding efforts have doubtless educated the Tellurian’s team as to what their strategic partners are looking for in a transaction; however, some Souki overconfidence may have hurt the company’s credibility, emboldened the short sellers, and punished retail shareholders’ returns [including the author’s].

Tellurian has 10x upside and the best time to buy a stock is when everyone is selling. In Tellurian’s case, this September’s decline, in response to the cancellation of the bond offering and SPAs, may have created an excellent entry point for investors looking for an energy transition play with asymmetric upside.

Investing in Tellurian Inc is a high risk high return proposition. The upside story is based upon the Driftwood LNG facility getting financed. Tellurian shares swing wildly based on Driftwood’s prospects of being financed. The stock often triples when funding looks credible and loses two thirds when those plans are dashed, as was the reaction in September. These moves are logical as the market discounts future cash flows at approximately 40%, when the project is not close to being financed, and about 15% when financing appears more likely. Consequently, securing enough strategic investors in the first half of 2023, should lead to a healthy rally in the next two or three quarters. The aftermath of the funding and contract cancellations may be an excellent time to buy an LNG liquefaction and production company for the value of its upstream business with little value attributed to its experienced management team. That is why Tellurian Inc is a textbook example of high optionality.