Take A Quick Look At QuickLogic

PonyWang/E+ via Getty Images

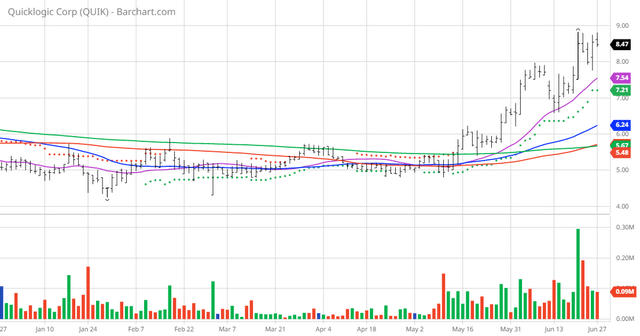

The Chart of the Day belongs to the semiconductor company QuickLogic (QUIK). I found the stock by sorting Barchart’s Top Stocks to Own list first by the most frequent number of new highs in the last month, then used the Flipchart feature to review the charts for consistent price appreciation. Since the Trend Spotter signaled a buy on 5/12 the stock gained 56.27%.

QUIK vs Daily Moving Averages (Barchart)

QuickLogic Corporation, a semiconductor company, develops semiconductor platforms and intellectual property solutions for smartphones, wearable, hearable, tablets, and the Internet-of-Things devices. It also provides flexible sensor processing solutions, ultra-low power display bridges, ultra-low power field programmable gate arrays (FPGAs); and analytics toolkit, an end-to-end software suite that offers processes for developing pattern matching sensor algorithms using machine learning technology, as well as programming hardware and design software solutions.

The company’s products include pASIC 3, QuickRAM, QuickPCI, EOS, QuickAI, SensiML Analytics Studio, ArcticLink III, PolarPro 3, PolarPro II, PolarPro, and Eclipse II, as well as silicon platforms, IP cores, software drivers, firmware, and application software. It delivers its solutions through ultra-low power customer programmable System on Chip (SoC) semiconductor solutions, embedded software, and algorithm solutions for always-on voice and sensor processing, and enhanced visual experiences.

In addition, the company licenses FPGA technology for use in other semiconductor companies SoCs. It markets and sells its products to original equipment manufacturers and original design manufacturers through a network of sales managers and distributors in North America, Europe, and the Asia Pacific. QuickLogic Corporation was founded in 1988 and is headquartered in San Jose, California.

Barchart’s Opinion Trading systems are listed below. Please note that the Barchart Opinion indicators are updated live during the session every 20 minutes and can therefore change during the day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart.com website when you read this report.

Barchart Technical Indicators:

- 100% technical buy signals but increasing

- 55.30+ Weighted Alpha

- 21.87% gain in the last year

- Trend Spotter buy signal

- Above its 20, 50 and 100-day moving averages

- 7 new highs and up 27.18% in the last month

- Relative Strength Index 67.57%

- Technical support level at 7.95

- Recently traded at $8.47 with 50-day moving average of $6.24

Fundamental factors:

- Market Cap $106 million

- Revenue expected to grow 51.10% this year and another 25.00% next year

- Earnings estimated to increase 77.10% this year, an additional 300.00% next year and continue to compound at an annual rate of 20.00% for the next 5 years

Analysts and Investor Sentiment — I don’t buy stocks because everyone else is buying but I do realize that if major firms and investors are dumping a stock it’s hard to make money swimming against the tide:

- Wall Street analysts give 3 strong buy opinions on the stock

- Analysts have price targets as high as $12.00

- The individual investors following the stock on Seeking Alpha voted 58 to 22 for the stock to beat the market with the more experienced investors voting 7 to 5 for the same result

- 6,250 investors are monitoring the stock on Seeking Alpha