T. Rowe Price: Short-Term Headwinds, But Potential Long-Term Upside (NASDAQ:TROW)

Marina_Skoropadskaya

Owning high-quality dividend growth stocks is a great strategy for long-term minded investors with a long time horizon. The ability to put your money to work and allow compounding to take place is an underutilized and underappreciated strategy.

As a dividend investor, you often take note of the latest dividend increase you see from a stock you own, rightfully so because it is rather exciting to know you will be getting paid more in the next 12 months essentially for doing nothing but investing in the stock.

Dividend increases are one thing, but continuous and consistent dividend growth is entirely different. This is where Dividend Aristocrats come into play. A Dividend Aristocrat is a company that has increased its dividend for 25 or more CONSECUTIVE years.

However, a consistent dividend increase is just part of the story, as past performance does not guarantee anything in the future. As such, we still need to perform our due diligence.

Dividend Aristocrats as a whole have been treading water in this downturn we have seen in the greater indexes. The ProShares S&P 500 Dividend Aristocrats ETF (NOBL) is down 10% on the year while the S&P 500 (SPY) is down over 20%.

In today’s article, we will take a closer look at a Dividend Aristocrat with a fast growing dividend.

A Beaten Down Dividend Growth Stock

T. Rowe Price (NASDAQ:TROW) is the Dividend Aristocrat we will be looking at today. TROW is a US Investment Management company that has an array of different financial offerings. Think of things like 401(k) offerings, investor management, as well as advisory services.

At the completion of the company’s Q1, TROW had $1.55 trillion in assets under management, or AUM. TROW earns a management fee or advisory fee based on their AUM, so as you can imagine, as the account values of their investors fall with the market, so does the company’s management fee revenue.

The fall in the markets has been a major part of the story, as TROW shares have fallen 40% on the year. When the pandemic hit and the government was printing money left and right, the influx of new retail investors was huge, which greatly benefitted a company like TROW.

That has all changed now as the Federal Reserve has gone from a near zero rate environment and adding money to the supply to a monetary tightening policy where they are reducing the money supply while increasing interest rates. The latest hike of 75 basis points was the largest one in 28 years.

This has in turn put pressure on equities, but this is not the intent nor the concern of the Federal Reserve. The Fed is doing this in order to fight the record high inflation we have been seeing, in which these policies will fight to combat that, which will involve slowing the economy.

With equities falling, many of these new investors have not experienced a bull market or real recession in their lifetime. The 2020 “recession” was the quickest on record and fueled by a global pandemic, but we are pointing towards a regular recession in the months ahead, assuming it has not already begun.

This has led to massive withdrawals from investors out of their investing accounts, negatively impacting a company like T Rowe Price.

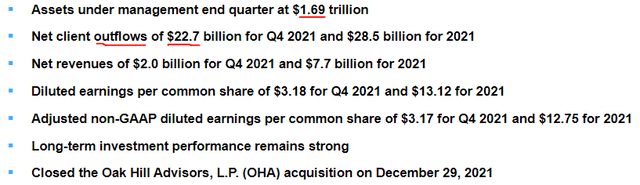

Here is a look at the company’s Q4 results in which we see AUM of $1.69 trillion. However, this is really when the pain began for the company. As you can see on the slide below, the company saw net client outflows (money being taken off their platform) of $22.7 billion in Q4 alone, nearly 80% of the entire outflows for the year came in that quarter alone.

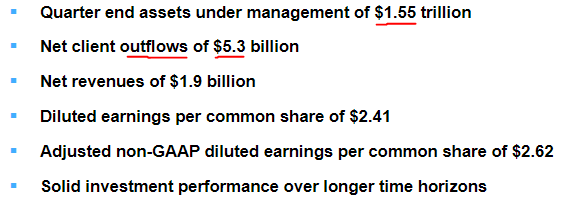

Remember, lower AUM means less money they can collect on management fees. Fast forward to Q1 2022, and we see AUM has fallen $140 billion and the outflows continued, albeit at a slower pace, with $5.3 billion in cash outflows.

TROW Q1 2022

More Pain Likely Ahead

So where does the company go from here? Well, much of that will be predicated on the economy and the greater stock market.

Many economists are predicting a recession beginning in the early parts of 2023, but some believe it may have already begun. The moves in the stock market indicate that investors are beginning to price this in, but this next earnings season we are about to embark on will be very telling.

We are likely to see companies begin to report the pain they are seeing and revise their earnings estimates lower, which will then lead to analyst price cuts that could add fuel to the fire, sending the greater market lower.

More pain in the market means more trouble for a company like TROW, which makes me believe the stock could go lower. However, I am looking to layer into my position of TROW because things could change on a whim. You could get a Fed that reverses course (unlikely anytime soon), or a cease fire in the Russia/Ukraine War, or a slew of other things that could send this market higher on a dime.

Trying to time the market is a difficult thing to do.

Investor Takeaway

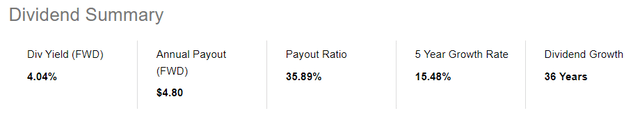

TROW is a great company that will return with a vengeance. They have a great dividend track record that will reward you while you wait. The company has increased their dividend for 36 years and counting. Over the past five years, the company has a dividend growth rate of 15.48%.

In addition to a strong dividend growth track record, you can obtain shares today and earn a tremendous dividend yield over 4%. This is the highest yield you have seen from the company.

You are getting a high-yield, strong dividend growth, and consistent dividend growth. Lastly, you are getting a dividend that is well covered and prime for future dividend growth. The company currently has a payout ratio of only 35%.

Definitely take a look at T. Rowe Price to add on any pullbacks in the market.