Sunnova Energy Stock: A Bearish Setup Ahead Of Q3 Earnings (NYSE:NOVA)

ArtistGNDphotography

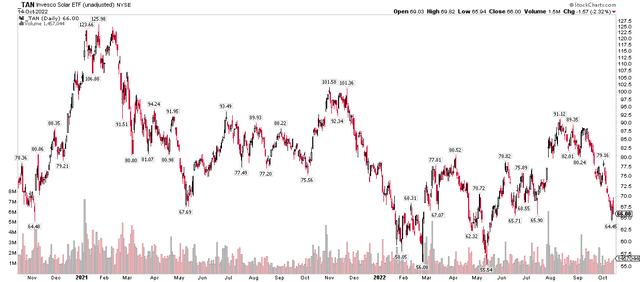

Solar stocks were a ray of sunshine in a bleak market earlier this year. The latest turn lower in the S&P 500 brought down companies engaged in the high-growth solar and renewable energy spaces. The Invesco Solar Portfolio ETF (TAN) lost nearly a third of its value from its high in August to last week’s low. One small independent renewable energy Utility sector stock has similar bearish price action.

TAN ETF: Solar Stocks Stumbling As Interest Rates Surge

Stockcharts.com

According to Bank of America Global Research, Sunnova (NYSE:NOVA) is a technology-agnostic residential solar service provider headquartered in Houston. Similar to residential solar service provider peer SunRun (RUN), NOVA principally finances, installs, services, and owns solar panel and battery storage systems on residential customer premises.

The Texas-based $1.9 billion Independent Power and Renewable Electricity Producers industry company within the Utilities sector does not have positive GAAP earnings over the last year and does not pay a dividend, according to The Wall Street Journal. There is an extremely high short interest of 24.3% ahead of its earnings date later this month and a key corporate event in mid-November.

Risks for the company include a difficult residential solar market, as well as uncertainty around California’s net metering court proceedings. Also hindering profits is the trend of rising interest rates for this firm dependent on debt financing in its capital structure. BofA believes there is limited exposure to potentially negative California court rulings, though.

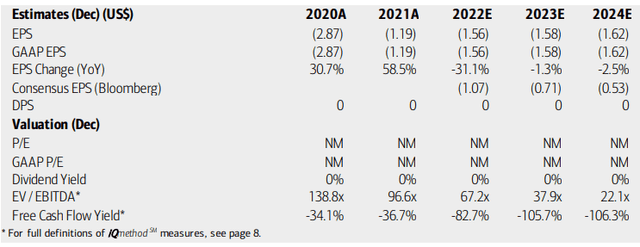

On valuation, BofA sees earnings solidly in the red through 2024 while the Bloomberg consensus estimate is not quite as bearish. The firm trades at a very high EV/EBITDA multiple, though it’s expected to become less egregiously valued by 2024. With such sharply negative free cash flow, the valuation and fundamental cases seem very poor right now. Much depends on its growth outlook, which Seeking Alpha rates as an A, but that is not born out in the earnings picture any time soon.

Sunnova Energy: Earnings, Valuation, Free Cash Flow Forecasts

BofA Global Research

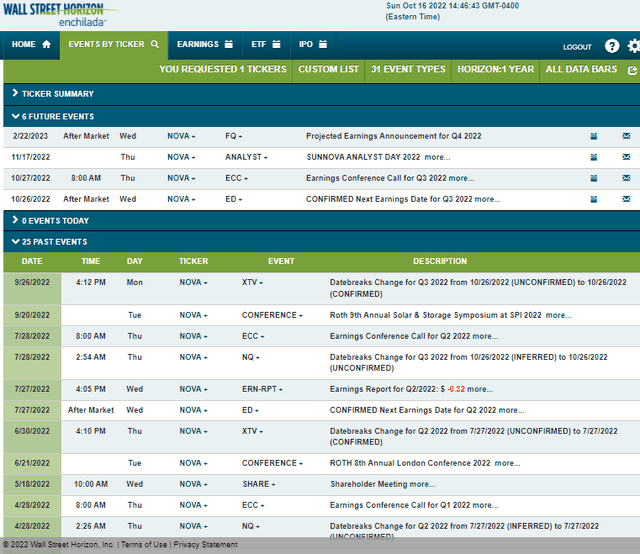

Looking ahead, corporate event data provided by Wall Street Horizon shows a confirmed Q3 earnings date of Wednesday, Oct. 26 AMC with a conference call the following morning. You can listen live here. The potential for volatility does not end there. Sunnova has an analyst day on November 17.

Corporate Event Calendar

Wall Street Horizon

The Options Angle

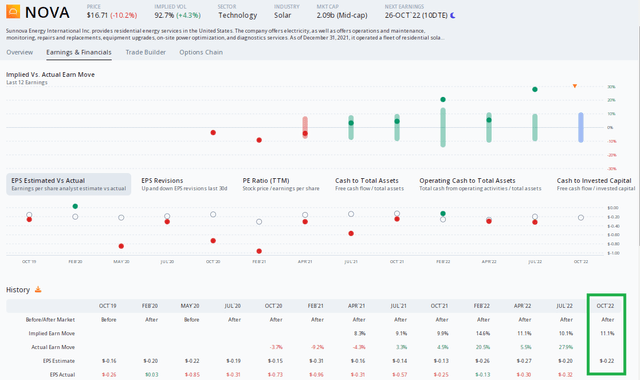

Data from Option Research & Technology Services (ORATS) show a consensus EPS forecast of $-0.22 with an implied stock price move of 11.1% post earnings later this month using the nearest-expiring at-the-money straddle. The company has actually traded higher in each of the previous five quarterly reports, despite several bottom-line misses. ORATS reports that there have been two analyst upgrades since its Q2 report.

NOVA: A Large Stock Price Swing Post-Earnings Implied

ORATS

The Technical Take

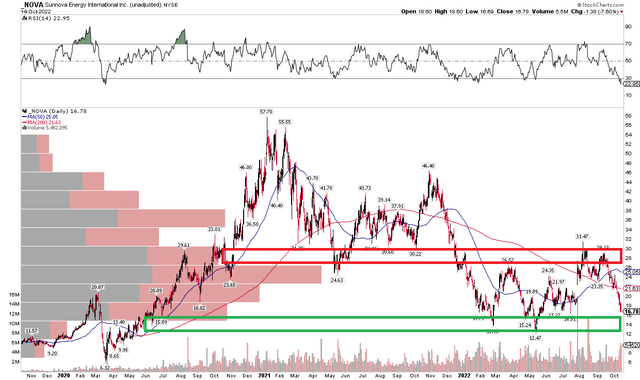

It has been a tough slog for the bulls since early 2021 when NOVA peaked near $60. A 70% decline through last week brings the stock to a fresh three-month low. Shares still hang above the 2022 low of $12.47 notched in May. With a big volume jump on its latest drop, the trend appears firmly bearish. Notice how sellers quickly pounced when the stock encroached into resistance in the low $30s during its summer rally. A retest of the lows looks likely. That decline is confirmed by a new low on the RSI indicator, too.

I think buying in the $12 to $13 area can make sense, but there is not a large volume of stock traded there to provide much cushion, so I suspect that NOVA will fall further. I would avoid the stock from a technical perspective. A move above $32 on a weekly closing basis would be bullish.

NOVA: Shares Dipping To Soft Support, A Bearish Trend Persists

Stockcharts.com

The Bottom Line

There’s demand for cash flow and profits now as rates rise. With a bearish chart and no forecast earnings in the coming years, I’d avoid this speculative renewable energy utility. Traders can have their way with this one, as volatility should be high from its earnings date through next month’s key analyst day.