StoneCo Q3 Results: The Turnaround Is Gaining Steam (NASDAQ:STNE)

ArtistGNDphotography/E+ via Getty Images

In the recent past StoneCo (NASDAQ:STNE) had some issues with its credit products and had to pause and redesign them, and its growth had somewhat sputtered. This brought down the share price very significantly, and forced the company to come up with a turnaround plan. Recent results are showing that its turnaround is gaining steam, and the company is back to posting strong profitable growth. During the quarter the company delivered growth with market share gains and doubled its profit sequentially.

For the quarter revenue grew 71% y/y and the company reached 2.3 million clients. The company also doubled its profit versus last quarter, with strong margin improvement and an adjusted EBT of R$211 million in the quarter. The software business exceeded 20% y/y growth, and the adjusted EBITDA margin in this segment increased significantly y/y and was stable quarter-over-quarter. Importantly the business is generating cash.

StoneCo remains very cautious with the re-launch of its credit products, taking a conservative approach given the credit cycle the market is facing. It expects to ramp up this business in 2023. Other positives include the company being more disciplined with operating expenses, and the company believes operational leverage will take place in 2023. In general the company expects the trend of improving overall results and margins to continue next year.

Q3 2022 Results

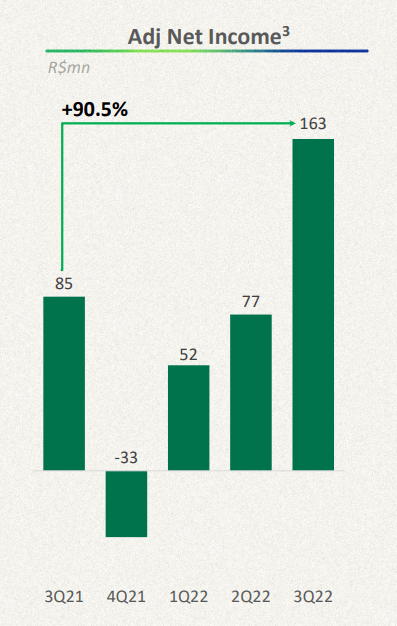

The most important takeaway from StoneCo’s Q3 2022 results is that the company had a strong recovery in its profitability. Revenue grew 71% y/y to R$2.5 billion and its adjusted net income more than doubled sequentially to R$163 million.

StoneCo Investor Presentation

Its adjusted EBT reached R$211 million, 69% above previous guidance. The outperformance relative to previous guidance was mainly the result of better than expected revenue net of funding costs in financial services, including a successful repricing strategy.

Software

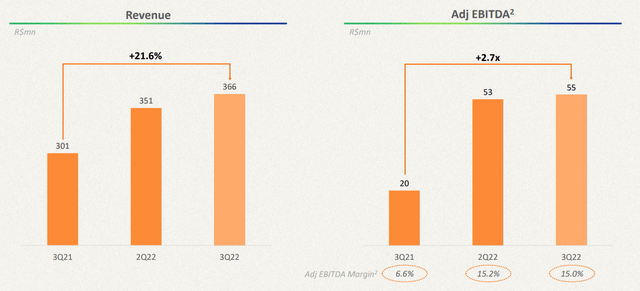

The software segment is becoming an important part of the business too. Software revenues increased 22% y/y, reaching R$366 million.

StoneCo Investor Presentation

Adjusted EBITDA more than doubled y/y, to R$55 million, with a margin of 15%. This quarter software margin was affected by non-recurring cloud costs, which are expected to normalize in the fourth quarter, the company therefore expects EBITDA margins to improve in the short-term.

Balance Sheet

StoneCo reduced debt levels from R$6.8 billion in the second quarter to R$6 billion in the third quarter. Its adjusted net cash balance improved by around R$350 million in the quarter to R$3.1 billion. It is comforting to see the balance sheet get stronger, but we believe there is still room for improvement.

Growth

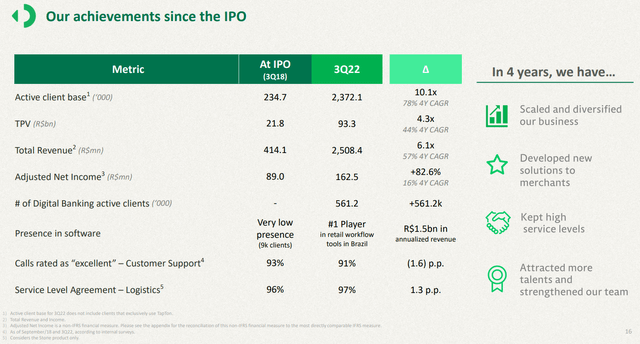

One of the big attraction of StoneCo as an investment has been its impressive growth. The company made a nice slide summarizing the growth it has delivered since its IPO roughly four years ago. Surprisingly, the client base and revenue growth have far outpaced earnings growth. Going forward it seems the company will be more disciplined with expenses, and hopefully that will mean earnings join the impressive growth in the other key performance metrics. The company emphasized that despite the active client base increasing ten-fold, it still has only ~11% market share in payment in Brazil, it therefore believes it still has plenty of room to grow.

StoneCo Investor Presentation

Credit Product

One of the things that got the company in trouble were the losses from its credit product, it is therefore being very conservative with the credit relaunch. The company remains in ‘test mode’, and is expecting to relaunch towards the first half of next year. This is what Lia Matos, Chief Strategy Officer, had to say about the credit product during the Q&A session of the most recent earnings call:

So first, regarding credit, I think no big update other than what I just said in the call and what we also highlighted last quarter. We’re still in test mode, and we’ll keep you posted as we have more updates. Our plan looking ahead is really to be ready to relaunch towards the first half of next year. But we really want to take a conservative approach to be able to test the full credit cycle with clients before making the decision to scale further, which will probably happen more towards the second half of next year. Now, we have Gregor on Board, which is really great and the team is in place and working really hard towards this plan.

So I think that’s the update that we can give regarding credit. We still think that that’s a big opportunity ahead like Thiago said. And we’re really focused on implementing this plan. I think regarding interchange cap, the impact is really going to be very dependent on competitive dynamics. We do believe that players will be more rational and it will take some more time until the full effect this past due to merchants. With that said, we believe that this benefit could be somewhere between a 100 million and 200 million in our EBT for 2023.

Guidance

It wasn’t really explained why, but StoneCo expects a negative impact from the World Cup next quarter. Still, the company continues to expect strong core growth and improving profitability in the business. It is guiding for total revenue and income above R$2.6 billion, representing y/y growth above 38.8%. and it expects adjusted EBT of more than R$250 million compared with R$211 million for the third quarter.

Valuation

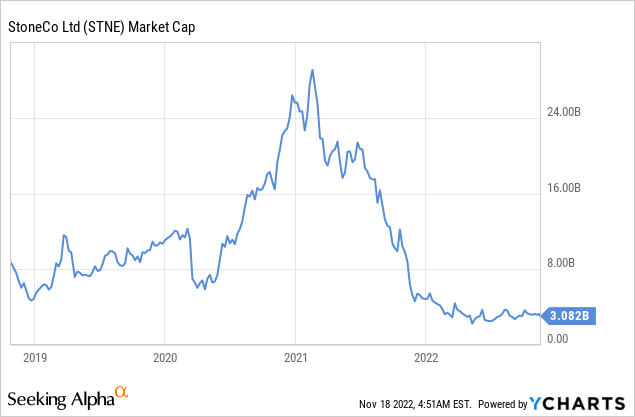

The valuation has come down significantly, in part due to some of the issues mentioned above, including problems with its credit products. At the current market cap of ~$3 billion, we believe the credit product is not really needed to justify the valuation, and just the payments and software businesses can be enough for the company to do well. If we annualize the most recent adjusted net income of R$163 million, we get R$652 million, or roughly $120 million. That means the company is trading at about 25x annualized adjusted net income. We believe this is a very reasonable multiple for a company that is still growing at an impressive rate, it could be argued it is even relatively cheap.

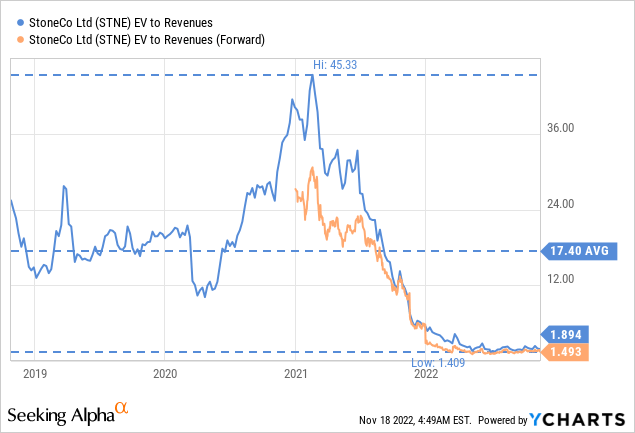

The valuation compression can be seen in the EV/Revenues multiple, which has come down significantly as the share price declined and revenues continued to grow.

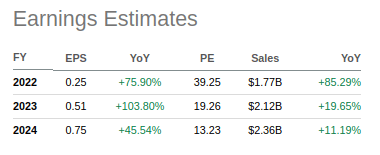

Based on analyst’s earnings estimates, as compiled by Seeking Alpha, shares are trading with a forward p/e ratio based on 2024 estimates of only ~13x. Given that we are seeing signs of the turnaround gaining steam, and the valuation being quite reasonable, we believe shares are very attractive at current prices.

Seeking Alpha

Risks

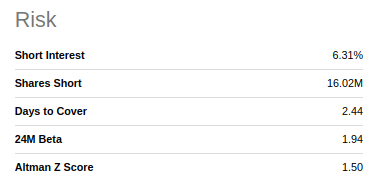

We believe a big risk for the company is the macroeconomic environment in Brazil. Fortunately, the company is being very careful with the relaunch of its credit product. The balance sheet could use some further strengthening, as the Altman Z-score remains quite low. In general we consider StoneCo to be an above average risk, but high potential reward type of investment.

Seeking Alpha

Conclusion

Our main takeaway from the recent quarterly results from StoneCo is that their turnaround is gaining steam. Profitability is quickly improving, and the company is delivering good growth and gaining market share. The software business is performing well too, and the credit products relaunch is being done in a very conservative way. While we see some risks, including a balance sheet that could use some further strengthening and complicated macro-economic conditions in Brazil, we believe shares are attractively priced and offer a lot of potential. We believe StoneCo is an above average risk, but very high potential reward type of investment, especially if the turnaround continues to go well.