Star Bulk Carriers Stock: High Rates Despite Decreased Iron Ore Demand

Alexey_Lesik/iStock via Getty Images

As Iron ore demand decreased in the past few months, Star Bulk Carriers (NASDAQ:SBLK) stock price dropped by 30% in the last months. The increased interest rates in the United States and European countries to combat inflation, combined with high temperatures and heavy rains in China, caused iron ore demand to decrease in the past few months. However, the slow fleet growth and the increased coal imports into the EU support the dry bulk market. My valuation shows that SBLK is worth $24 per share. I rate the stock is a hold.

Quarterly highlights

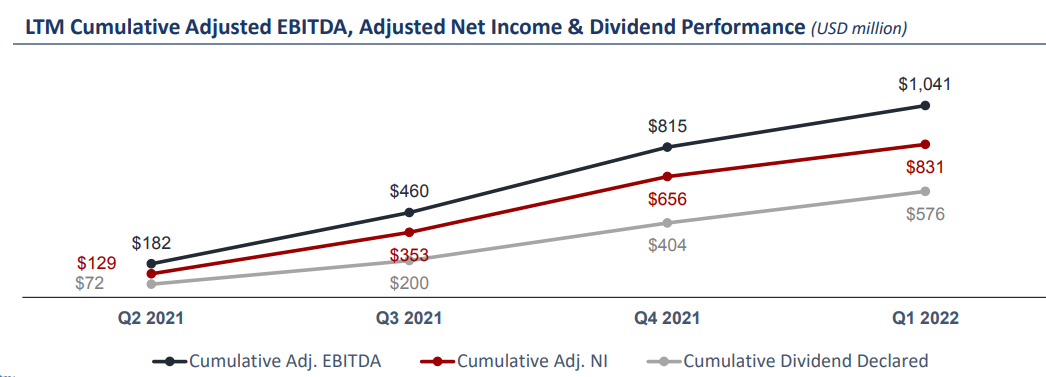

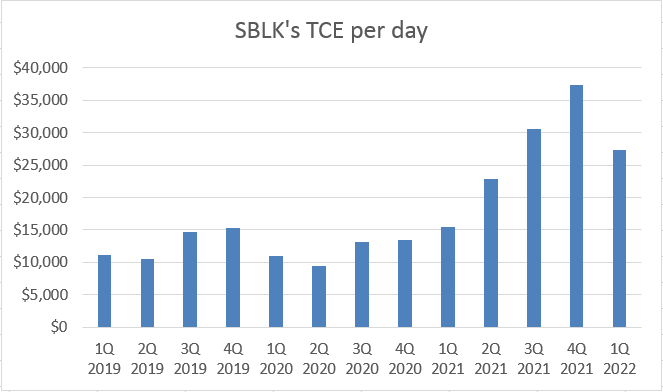

In its 1Q 2022 financial result, SBLK reported voyage revenues of $361 million, compared with 1Q 2021 voyage revenues of $200 million. SBLK’s TCE revenues increased from $156 million in 1Q 2021 to $305 million in 1Q 2022, up 96%. Star Bulk reported TCE per day of $27405 in the first quarter of 2022, compared with 1Q 2021 TCE per day of $156394. In 1Q 2022, SBLK’s net income and adjusted EBITDA increased by 376% (YoY) and 167% (YoY), respectively. Due to the performance of the company in recent quarters, driven by high dry bulk charter rates, Star Bulk’s cumulative adjusted EBITDA, adjusted net income, and dividend performance increased significantly. According to Figure 1, SBLK’s cumulative adjusted EBITDA increased from $72 million in 2Q 2021 to $576 million in 1Q 2022. During this period, the company’s cumulative adjusted net income increased from $129 million to $831 million. Moreover, from 31 March 2020 to 20 May 2022, Star Bulk’s cash and liquidity increased by 306% to $532.6 million. Also, the company’s adjusted net debt decreased from $1664.1 million on 31 March 2020 to $994.7 million on 20 May 2022, down 43%. However, it is worth mentioning that compared with the fourth quarter of 2021, SBLK’s TCE per day decreased by 27% in 1Q 2022. SBLK’s 2Q 2022 result will not be as strong as in 4Q 2021. However, I expect SBLK’s financial results to be stronger than in 2Q 2021 (as the company’s 2Q 2022 TCE per day will be higher than in 2Q 2021). “Looking to the next quarter, we have covered 74.3% of our available days for Q2 at a TCE of $29759 / day per vessel,” the CEO commented. SBLK’s TCE per day in 2Q 2021 was below $22927 (see Figure 2).

Figure 1 – Star Bulk’s cumulative adjusted EBITDA, adjusted net income, and dividend performance

1Q 2022 presentation

Figure 2 – SBLK’s TCE per day

Author (based on SBKL’s quarterly financial reports)

Market outlook

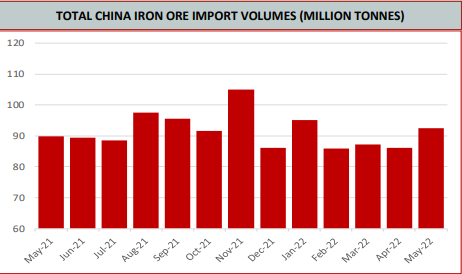

According to the MMI daily iron ore index report, published on 30 June 2022, total iron ore inventories at China ports decreased from more than 150 million tonnes in March 2022 to around 120 million tonnes in June 2022 (see Figure 3). On the other hand, total China iron ore import volumes increased from below 90 million tonnes in March 2022 to more than 90 million in May 2022 (see Figure 4)

Figure 3 – Total iron ore inventories at China ports

MMI

Figure 4 – Total China iron ore import volumes

MMI

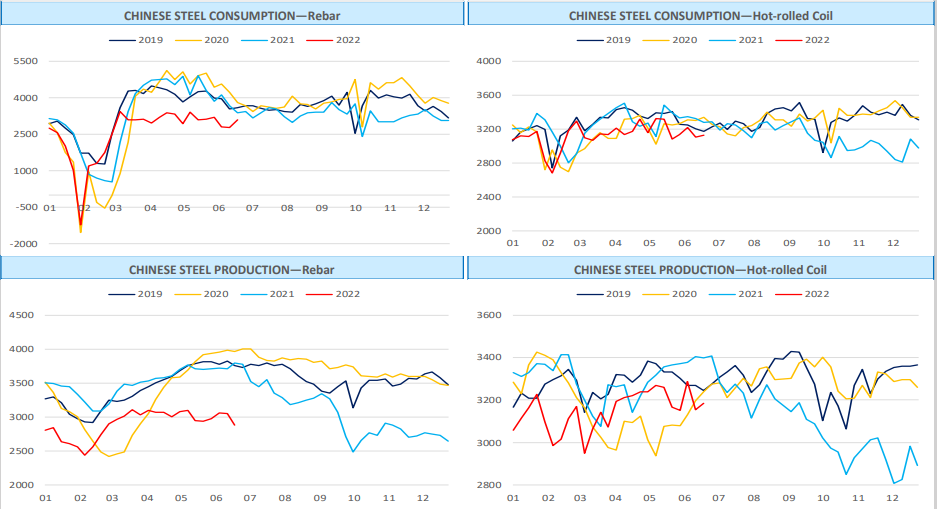

Moreover, Chinese rebar consumption and production in the last few months are below their levels in the same period in 2019, 2020, and 2021 (see Figure 5). Also, Chinese hot-rolled coil consumption and production in June 2022 are below their levels in June 2019, 2020, and 2021.

Figure 5 – Chinese steel consumption and production

MMI

“Iron ore futures contract has been rebounding for five days in a row with the support of terminal steel demand and improving market sentiment rebound,” SMM reported. On one hand, due to the recent relaxation of pandemic rules in China and falling finished products inventory, steel production in China may rebound (total China iron ore inventories at ports significantly dropped in recent months). On the other hand, high temperatures and heavy rains, harm China’s steel demand. According to SMM data, Yunnan steel enterprises expect their construction steel output to decrease from 1.2 million mt in June to 720000 mt in July, down 30%. Besides extreme weather conditions in China, increased interest rates in the United States & European countries caused the global steel demand to decrease in recent months. Figure 6 shows that from 7 March 2022 to 1 July 2022, the iron ore price decreased from $159 to $118 per tonne. However, it is worth mentioning that the iron ore price is still higher than its level before the COVID-19 pandemic started.

Overall, due to the extreme weather conditions, China’s iron ore imports will not increase in the next few months. Also, with normal weather conditions, the company’s internal steel production can satisfy the country’s needs in the short term. Increased interest rates in western countries caused their iron ore import to decrease, and with current fiscal and monetary policies to combat inflation, I do not expect the United States and European countries’ iron ore demand to increase in the following months. Thus, dry bulk charter rates cannot reach their record highs in the short term.

Figure 6 – Iron ore price

tradingeconomics.com

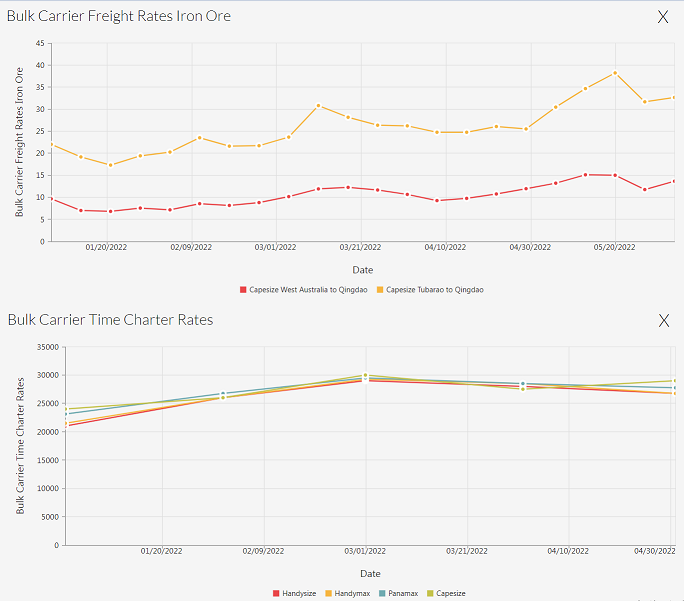

However, despite the weak outlook for iron ore demand in the short-term, bulk carrier charter rates and freight rates are still high. Figure 7 shows that bulk carrier freight rates for iron ore is now higher than in January 2022. Also, bulk carrier time charter rates are still higher than in January. Because of slow fleet growth, the decreased iron ore demand did not cause bulk carrier freight rates and charter rates to drop yet. Due to the increased financing costs, new environmental regulations, and uncertainties in the market, fleet growth is expected to slow to 2.6% (YoY) and 2.5 (YoY) in 2022 and 2023, respectively. Thus, the slow supply growth is supporting the dry bulk market, despite the decreased iron ore demand in recent months. However, if the global demand for iron ore continues to fall, the demand for existing dry bulk vessels will fall to the levels that make charter and freight rates plunge. Thus, keep an eye on COVID-19 regulations in China, the weather condition in China, and United States monetary policies to combat inflation.

Figure 7 – Bulk carrier rates

www.ssyonline.com

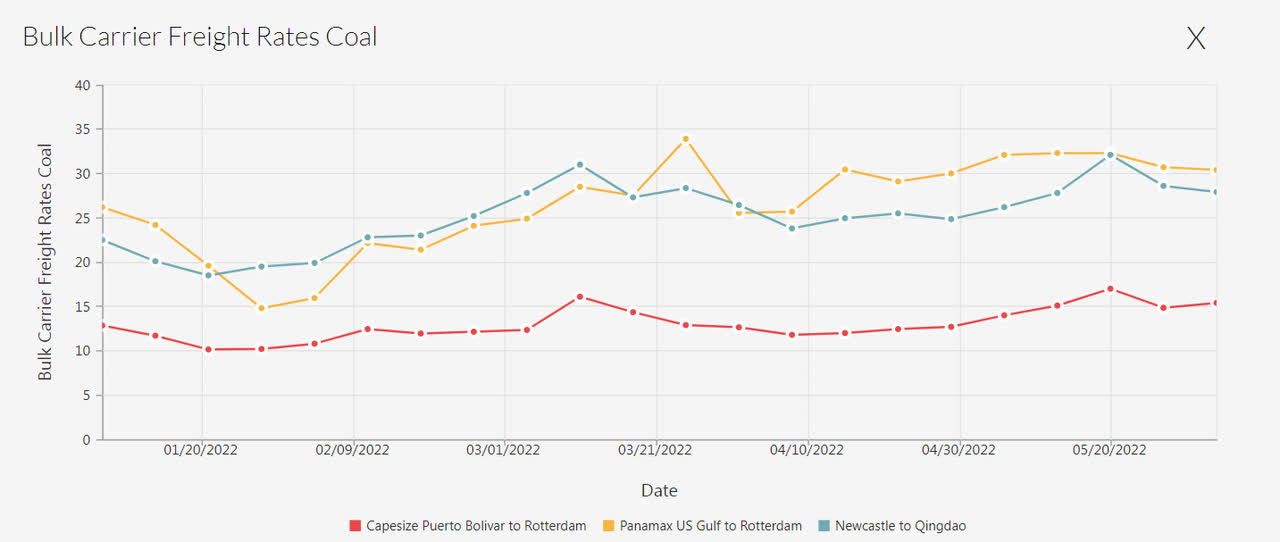

Moreover, due to the recent natural gas problems in Europe, coal imports into the EU have increased. As the war in Ukraine continues, European demand for coal increases. Thus, despite decreased iron ore demand, the increased demand for coal from the European countries supports the dry bulk market. Figure 8 shows that the bulk carrier freight rates for coal have increased significantly since January 2022.

Figure 8 – Bulk carrier freight rates for coal

www.ssyonline.com

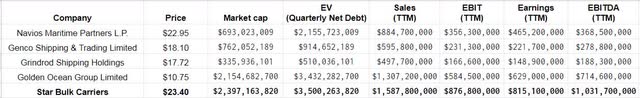

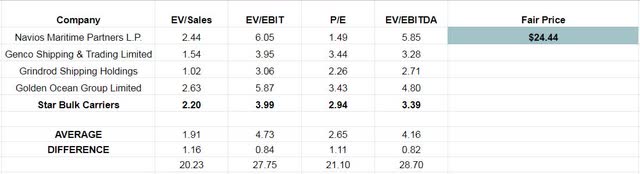

Valuation

Using the data provided in Table 1 and Competitive Companies Analysis (CCA), I evaluate SBLK. This method reflects the real-market data and is an appropriate way of analyzing SBLK due to the companies’ relative stability. Based on market cap and financial operations, I selected the dry bulk peers and used common key ratios in a CCA method to illustrate the value of similar companies. Data was gathered from the most recent quarterly and TTM data. Comparing Star Bulk multiples with its peers shows that SBLK has an EV/sales ratio of 2.26x, 16.5% more than the peers’ average of 1.94x. Also, SBLK’s P/E ratio is 11.3% more than the peers’ average of 2.74x. On the other hand, the company’s EV/EBIT and EV/EBITDA ratios are lower than the peer’s average EV/EBIT and EV/EBITDA ratios of 4.82x and 4.23x, respectively. According to these multiples, at its current price, SBLK is neither a better nor worse investment opportunity compared with its peers. I evaluate that the stock is worth $24 per share.

Table 1 – SBLK and its peers

Author (based on SA data)

Table 2 – SBLK stock valuation

Author (based on SA data)

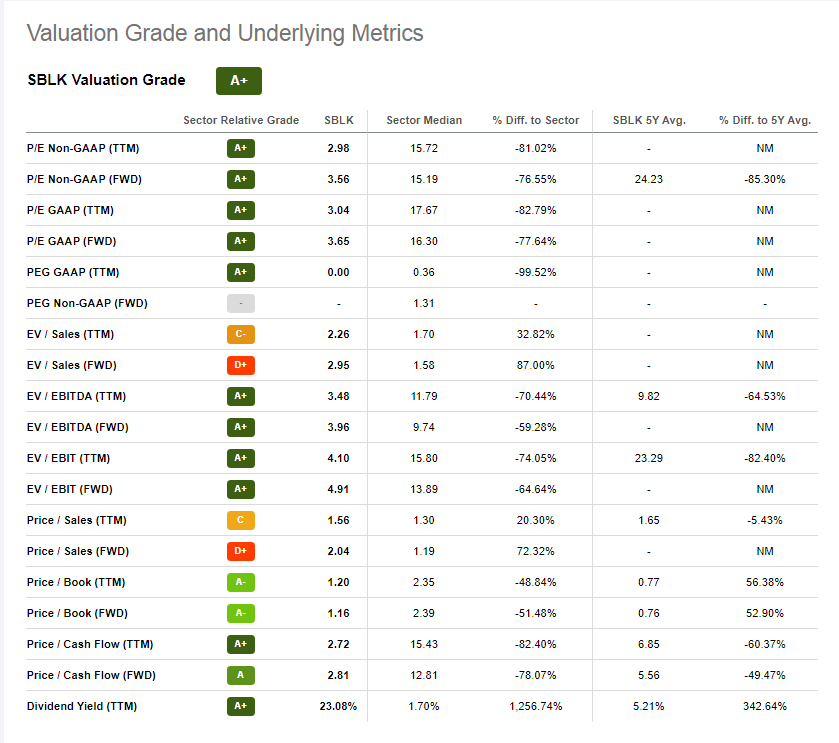

According to the Wall Street price target, SBLK has a low price target of $22, a median price target of $34, and a high price target of $41. Moreover, according to Seeking Alpha quant rating, SBLK has a valuation grade of A+ and is a strong buy (see Figure 9). The reason behind the strong buy rating suggested by Seeking Alpha is that bulk carriers’ multiples are significantly below the financial multiples of the industrial sector. However, as the market sentiments on dry bulk stocks are different compared to the rest of the market, with the current market condition, I do not expect the financial multiples of SBLK to increase to higher levels.

Figure 9 – SBLK valuation grade

Seeking Alpha

Summary

The decreased iron ore demand did not cause bulk carrier freight rates and charter rates to drop to levels that make investing in dry bulk companies too risky. Why? Because the slow fleet growth and increased imports into the European countries support the dry bulk market. Thus, I expect the company’s 1Q 2022 results to be stronger than in 1Q 2021. Moreover, in terms of valuation, the CCA method suggests that the stock is worth $24 per share. I rate SBLK a Hold.