STAG Industrial: Sidelines Until I See Dividend Growth (STAG)

gremlin

2022 has been a bumpy ride in markets and it has created buying opportunities in various different sectors, including industrial REITs. It has been a sector characterized by high FFO multiples and impressive dividend growth, but this year has led to multiple compression. It’s been a couple months since I have written up STAG Industrial (NYSE:STAG), and my last article in August was the last hold article written on the company. Today’s article will be another hold, for the same primary reason, which is the lack of dividend growth.

Investment Thesis

STAG is an industrial REIT that gets a lot of coverage on Seeking Alpha. It’s a draw for many income investors due to its monthly dividend and yield of 4.5% that is higher than competitors like Prologis (PLD), Rexford Industrial Realty (REXR), and Terreno Realty (TRNO). However, the biggest red flag for me is the slow dividend growth. In a sector that has had some of the best dividend growth among all REITs, STAG sticks out like a sore thumb. Some have argued that STAG has room for multiple expansion, but I don’t see any reason why STAG should trade higher than a 15x price/FFO multiple, which is where shares currently are today.

The company does have a well-diversified portfolio by geography as well as their top tenants and industries, so concentration risk is limited. Shares outstanding has continued to increase fairly quickly while FFO/share growth has been stuck in the mid-single digits and isn’t projected to accelerate in the next couple years. My thesis could change if we start to see evidence of dividend growth, but for now, I’m sticking with other industrial REITs despite higher valuations.

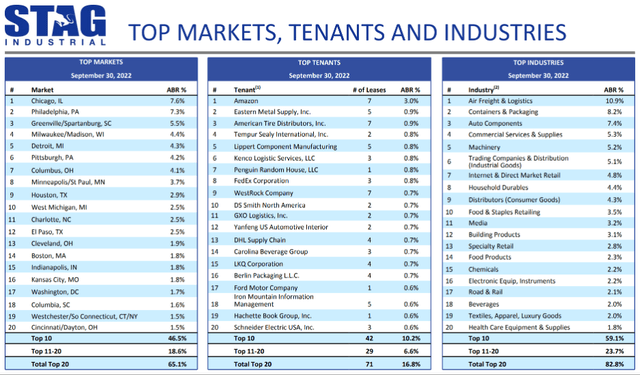

STAG Top 20 (stagindustrial.com)

One of the things that STAG does a little differently than other industrial REITs is that they focus on secondary markets instead of large coastal markets like New York, Miami, Los Angeles, or Seattle. Chicago and Philadelphia are major markets for STAG, but the top 10 makes up about half of their rent. Their top industries are diversified as well.

Their tenant list doesn’t have much concentration, but Amazon at 3% of ABR sticks out like a sore thumb. I have seen multiple headlines about Amazon and their layoffs on the ecommerce side. I don’t think that will lead to issues for Amazon paying STAG for those properties, but the future prospects for adding new properties for Amazon might not be as attractive. While the valuation has bounced around over the last couple years, shares are trading right around fair value.

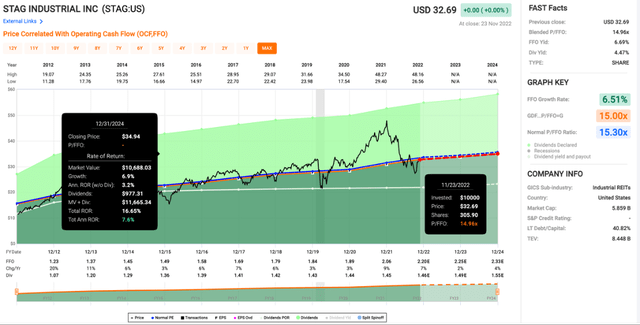

Valuation

Over the last decade, shares have had an average price/FFO multiple of 15.3x. Right now, shares are slightly below that at 15x. I don’t think we will see any multiple expansion because there isn’t any reason for it. The fact that STAG is an industrial REIT so it should trade at a higher multiple isn’t enough in my mind. If STAG was an industrial REIT consistently posting double digit FFO/share growth and double-digit dividend growth, then I would be arguing for multiple expansion.

Like I said earlier, if management can get things moving in a direction over the next couple years where the dividend growth speeds up and FFO/share starts to grow faster as well, I will reevaluate my opinion on STAG. Right now, the thing that draws in most investors is the 4.5% monthly dividend.

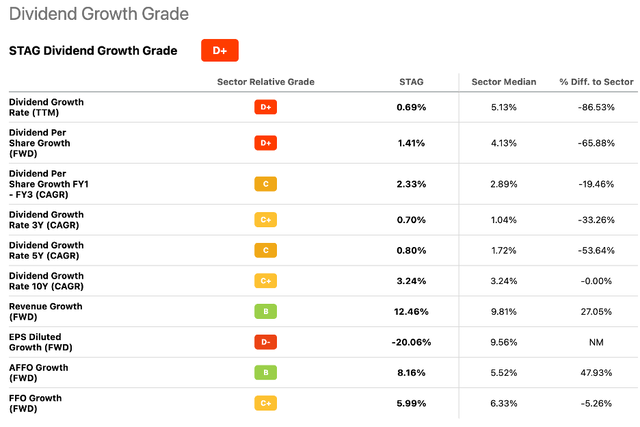

Dividend Growth?

If you have read my past articles on STAG, you will probably remember a similar section complaining about the lack of dividend growth. I do like monthly dividends, but I don’t like to sacrifice dividend growth to get them. Below is Seeking Alpha’s dividend growth page for STAG. They have helpful metrics, but all of the growth metrics, from one year all the way to ten year, are very slow.

Dividend Growth Page (seekingalpha.com)

The other thing that investors will want to keep an eye is the outstanding share count. While the FFO/share has grown slowly, share count has expanded significantly in recent years. I’m fine with REITs using equity issuances to grow, but it should result in FFO/share growth instead of just new property acquisitions.

Conclusion

I do like the industrial REIT sector, and I think it will be a sector that continues to do well. I recently added Terreno Realty to my Roth IRA, and I plan to write an update on them soon. I will be looking for opportunities to add to my exposure to the sector if I see other attractive opportunities. However, I think investors can find better options than STAG. I’m not against their strategy for targeting tier 2 markets, even if competitors have emphasized markets with high barriers to entry on the coast.

The primary thing that keeps me away from STAG is the lack of dividend growth. In a sector of REITs that have had impressive and consistent dividend growth, STAG has lagged significantly. Despite the lack of dividend growth, I think the valuation is near fair value today at a price/FFO of 15x. Without meaningful dividend increases, I don’t think we will see any meaningful multiple expansion. For REIT investors looking at the industrial sector, I would recommend looking at the alternatives if you prioritize dividend growth.