SS&C Technologies Stock: Overvalued Serial Acquirer (NASDAQ:SSNC)

metamorworks/iStock via Getty Images

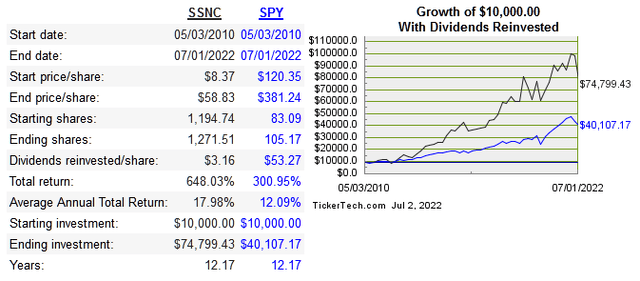

SS&C Technologies Holdings Inc. (NASDAQ:SSNC) is a serial acquirer of software businesses in the fintech industry. Founded in 1986 and IPO-ing in 1996, the founder took the company private in 2005 as a consequence of the tech bubble popping, only to later IPO again in 2010. They have acquired 59 businesses along the way. In their second act as a public company, they have soundly beaten the market so far.

dividend channel

The companies being acquired clearly boost both the top and bottom line. The margins are great, FCF and EPS are growing impressively.

|

Gross Margin |

47.7% |

|

Operating Margin |

24.8% |

|

Net Margin |

15.6% |

|

16-Year Revenue CAGR |

22.1% |

|

16-Year EPS CAGR |

43.5% |

|

16-Year FCF |

27.6% |

Capital Allocation

The company relies heavily on acquiring companies to drive growth. Their biggest acquisition so far was $5.4 billion deal for DST Systems in 2018.

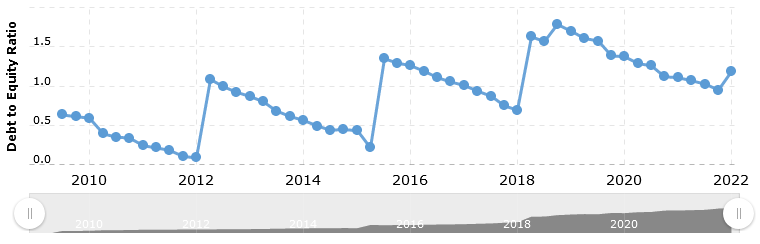

They use an interesting mix of capital allocation. The acquirer strategy has worked well so far, but they also use a lot of debt and dilution to raise money for acquisitions. They’ve paid a dividend since 2014, but also pay down debt each year. This debt repayment is expressed in the debt/equity ratio over time.

macrotrends

At first glance, the levels of long term debt were troubling to me, but with aggressive repayment of debt, it seems like they have a formula that works.

I’m often critical of companies paying a dividend where I think it’s not necessary at the time. This is also the case with SSNC, but the payout ratio of dividends to free cash flow has never been above 36%. This isn’t a serious issue for me in this case because acquisitions are clearly the main driver for returns in this company. Up to $1 billion in buybacks was approved last summer, and again I would rather see more go towards debt repayment in spite of consistent deleveraging periods.

Risk

My biggest concern is the relatively low return on capital in relation to capital intensity.

|

10-Year CAGR Revenue |

29.8% |

|

10-Year CAGR Assets |

30.5% |

|

10-Year Median ROIC |

4.2% |

|

9% |

On top of this is the return on capital. While margins and growth of EPS and FCF have been very high, the returns on capital aren’t very impressive. Business theory would say that any company that can’t consistently generate returns on invested capital above their cost of capital is destroying value. This isn’t how it played out for SSNC, as the stock returns earlier showed that the market has valued their performance highly in spite of current WACC of around 9% being higher than the median.

The biggest tech companies are money printing machines, and can self fund virtually any project. Cost of capital means very little to them. This certainly isn’t the case for SSNC, so cost of capital matters.

Even though the leverage strategy has worked so far, an era of higher interest rates might change the success in the future. It raises the cost of debt, which could slow down the rate of acquiring new companies. The amount of leverage routinely used is still too much for my liking because there could still be excess debt used in the future, especially if a bigger acquisition doesn’t pan out as expected.

Valuation

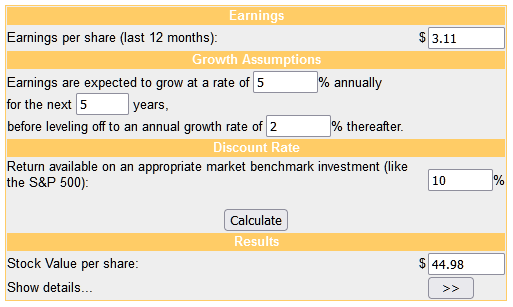

There aren’t too many exact peers who use the roll up strategy in the specific industries as SSNC. Using an extremely conservative DCF, I see the company as slightly overvalued right now.

moneychimp

The current dividend yield is 1.3%, not enough to entice me to want to take part in the total return over the long haul.

Conclusion

Companies that can successfully employ the serial acquirer strategy aren’t very common. So far SSNC has used a combination of debt and equity raises to acquire 59 companies, and has had aggressive periods of debt repayment. Despite very impressive growth of EPS and free cash flow, the company achieves relatively low returns on invested capital compared to capital intensity.

I don’t anticipate returns on capital climbing higher in the future, and the routine use of debt does worry me with interest rates now rising again. I rate the business quality and M&A abilities as above average, but at this price not a buy.