Spirit AeroSystems Stock: A Lot Of Upside For Buyers (NYSE:SPR)

Larry W. Smith

I previously have put a buy rating on Spirit AeroSystems Holdings, Inc. (NYSE:SPR) stock, but the reality has been that for Spirit AeroSystems stock, things got worse before they got better. That was driven by a multitude of reasons, including a delayed ramp-up profile for The Boeing Company (BA) 737 MAX deliveries, and we saw the combination of inflation and supply chain challenges pressured operations. In this report, I assess the stock price performance, the shipments, full year results, and outlook for Spirit AeroSystems.

Spirit AeroSystems Stock Climbs

Seeking Alpha

Since my last report covering Spirit AeroSystems stock, SPR outperformed the markets as it gained 18.1% compared to a 1.3% loss for the same period. It does show that despite the challenges in the supply chain, there is value to be rendered in the aerospace industry supply chain, with market-outperforming returns.

Spirit AeroSystems News: Improvement In Shipset Deliveries

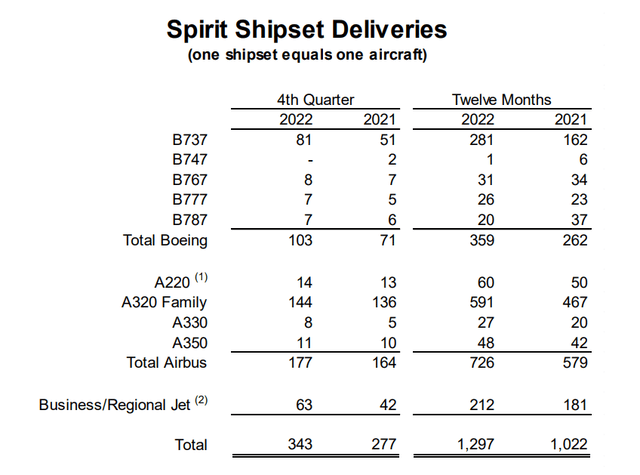

While Spirit AeroSystems stock has lost value since my first buy ratings, looking at the number of shipset deliveries there’s one thing that actually becomes clear: things are actually not bad. Boeing 737 shipset deliveries were up 119 units during the year, or nearly 75%, despite having 20 lower deliveries in the fourth quarter than anticipated. Boeing 747 deliveries were down, and that really is no surprise given that the program is winding down. For the Boeing 767, deliveries were down one unit but up a unit for the Boeing 777 program. For the Boeing 787 program, deliveries were up during the quarter but still lacking significantly compared to last year. For the year, Boeing shipset deliveries were up 37 percent.

Airbus SE (OTCPK:EADSF) A220 shipset deliveries were up 10 units, or 20 percent, and Airbus A320 ship set deliveries were up 124 units, or 27%. Furthermore, we saw improvement in Airbus A330 and Airbus A350 deliveries, resulting in a 25% increase in shipset deliveries for Airbus, and for all programs the shipset delivery volumes were up 27%.

During the year, Boeing 737 shipset deliveries fell 20 units short of expectations, but these will be delivered in 2023.

Spirit AeroSystems Books Profit As Revenues Increase

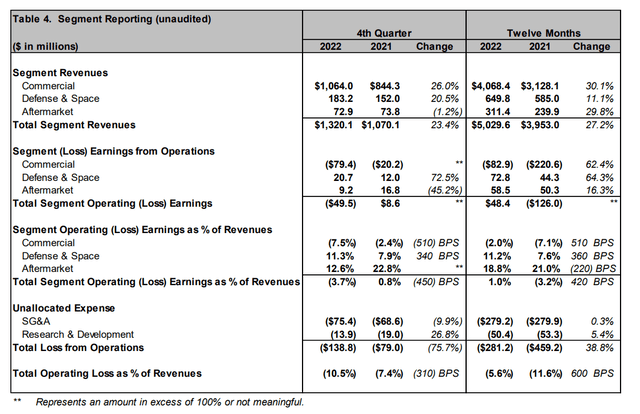

For the Commercial segment, revenues increased 26%, more or less in line with the improvement in the shipset delivery volume, but margins went from negative 2.4% to negative 7.5%. This was driven by absence of funds from the Aviation Manufacturing Jobs Program. Adjusting for this, the margin last year would have been -6.2%. Furthermore, there was a $111.3 million cost pressure as cost estimates went up, net forward losses were $58.3 million and excess capacity costs that Spirit AeroSystems were $29.7 million totaling nearly $200 million compared to $92.2 million in the comparable period last year.

Defense revenues climbed 20.5%, with profits increasing 72.5% on the back of lower cost adjustments and the absence of a charge that Spirit AeroSystems recognized last year, and for the Aftermarket segment we saw relative stability in the revenues but a deterioration in the margins due inventory adjustment charge in the fourth quarter of 2022.

For the full year, we saw significant improvement in the revenues as well as the margins, and Spirit AeroSystems saw its operating margin being positive. To me, that clearly shows they are on the way back. Growing back to the 16.5% margins for the commercial segment is going to be challenging, but the positive is that Spirit AeroSystems is anticipating two rate breaks next year as it anticipates higher production rates, and the company is already bringing the headcount up to support those higher rates.

A Challenging Path Ahead For Spirit AeroSystems

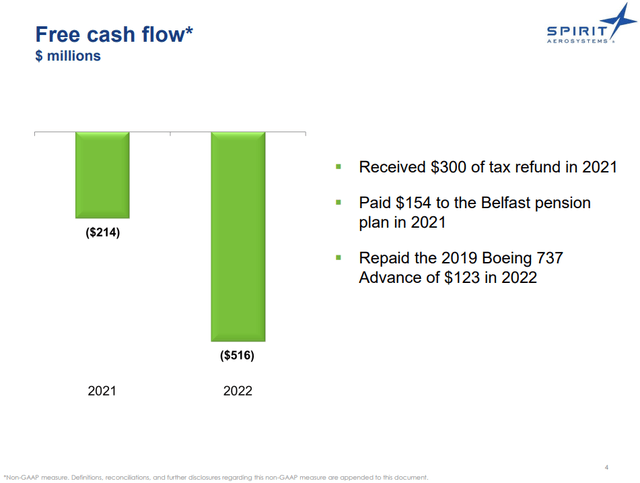

Free cash flow (“FCF”) was way year-over-year, but that was driven by positive cash flow events in 2021. If we adjust for one-off items, then the free cash flow would be negative $360 million in 2021 and negative $393 million in 2022. So, that was not too far off from last year, and given that the company is doing additional hiring for future hire production rates on the Boeing 737 program, I do think the 2022 free cash flow number are quite ok, and even more so when considering that the company delivered 90 fewer 737 shipsets than earlier anticipated and 20 shipsets fewer compared to its last guidance.

The positive, of course, is that with higher shipset deliveries this year, which are more firm than last year, we should see a significant improvement in free cash flow. That is despite the cash burned on the Boeing 787 plus a payment Spirit makes on each Dreamliner shipset to Boeing.

Cash Flow Should Improve Significantly

For 2023, 420 Boeing 737 shipset deliveries are expected including 20 deliveries that slipped from last year into 2023. This 50% increase in shipset deliveries provides a significant increase in Spirit’s cash cow shipset program and allows for better cost amortization, increasing margins driven by two rate breaks in the second half of the year which will be in full effect in 2024.

Furthermore, with the higher rates, the excess capacity costs that the company carries should come down as well. So, there will be a more efficient use of resources. What has remained significantly underexposed by the investing community and the investment research community is the fact that a fourth production line in Everett for the MAX should be big for Spirit AeroSystems. That will unlock further growth at Spirit AeroSystems, while the company has also diversified its commercial airplane portfolio and focuses more on Defense and Aftermarket sales.

For 2023, including pension cash gains, positive free cash flow is expected, but beyond that we should see significant improvement in margins and free cash flow as production increases further. Due to the higher production costs, the return to the same cash flow levels lies at a higher production rate, but Spirit AeroSystems can support Boeing in rates that have never been seen before. The same holds for the Airbus single aisle programs, so there is a lot to be positive about beyond 2023.

Conclusion: Spirit AeroSystems Remains A Long-Term Buy

Last year, my main concern was that the guidance on cash flow provided was largely inconsistent due to changes at the production planning of Boeing. However, those production planning challenges are fading, and the additional complexity regarding supply chain issues and cost inflations should at some point moderate as well. This leaves Spirit AeroSystems with a lot of room to grow towards profit and cash flow levels that it has not seen before.

Despite the challenges and the rather slow snapback to previous rates which layer on top of deliveries shifting into 2023, I do believe that Spirit AeroSystems is showing significant improvement in its results. This year will be a full year of supporting a production rate of more than 31 aircraft per month, meaning that, compared to this year, Boeing 737 shipsets should increase by 50% whereas 20 to 25 percent could previously be modelled on an annualized scale for the 31 aircraft per month.

Other positives are the company’s attempt to diversify on commercial program and extract more value from aftermarket sales and Defense while running a cost reduction initiative on the Boeing 737 program and having more exposure to Airbus programs. So, there are positives, and with continued strength in the narrowbody market, Spirit AeroSystems should see its results improve in the same way they are showing significant improvements even though delivery numbers are still falling a bit short. Overall, I do believe that the current Spirit AeroSystems Holdings, Inc. share price mostly reflects the pressured deliveries, without appreciating the actual improvement in performance and future performance.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.