SL Green Preferreds Are A Better Option (NYSE:SLG.PI) (NYSE:SLG)

Ultima_Gaina

I’m not a particular lover of NYC, and Manhattan in particular is very exposed to office vacancies for its real estate market. With WFH being a better option for the employee who’ve had a taste of it, hybrid in our models is here to stay. SL Green Realty (NYSE:SLG) and its preferred shares (NYSE:SLG.PI) are exposed to WFH and the Manhattan markets with the vast majority of its portfolio focused on office REITs. But because of long lease terms they aren’t really at any risk for some years in terms of fundamental impact, but markets will and have looked beyond that with quite a dismal view. Even in very adverse scenarios for the office market, we believe the preferred can still be paid. Moreover, the adverse scenarios are much less likely to apply to a premier portfolio like SLG’s compared to others’. Value may not hold, but the preferreds are unlikely to see capital impairment. Indeed, offering the same yield as the common stock, which can be treated a bit like a cap rate, the preferreds are the superior investment given the real risk of WFH. The problem is getting more than a payback could be trouble in our adverse scenario, where we think the future is more likely than not to be WFH. Best avoided just because there is a binary element here and a high level of uncertainty.

SLG: What You Need to Know

Let’s just give some key data on SLG for the thesis.

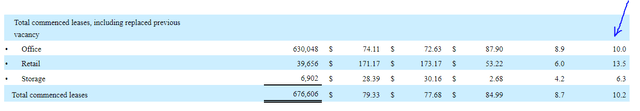

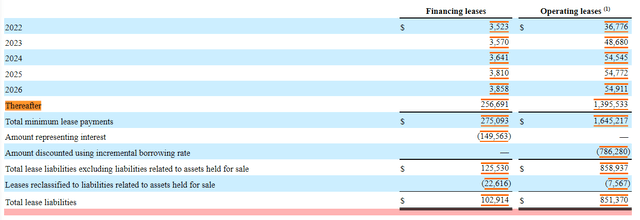

First is the lease terms. On average for office, and indeed office is most of the SLG portfolio, the lease terms are 10 years. The profile is that most of the leases are long-term around that 10 year mark. 10% of lease payments come 2026 or before.

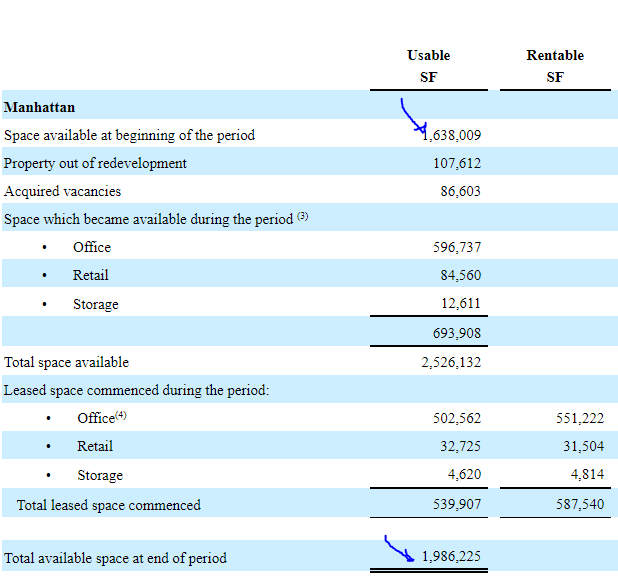

However, office real estate markets are already under pressure with SLG being no exception. While available space hasn’t grown too much, it’s still grown a fair bit. Considering acquired vacancies in the last 6 months, less at 10% growth in space in the previous quarter. In the current quarter occupancy rates have risen, so the situation has sequentially improved with less new space opened than open space leased. Better than the overall market but still tough.

Space (sec.gov)

Occupancy rates are not too bad though, and things are somewhat recovering to pre-pandemic levels at 92.1% including all signed leases. This is up from the 92% previous quarter, so a very slight sequential improvement and notably it’s happening at sequentially much shorter lease terms of 6 years compared to 11 years last quarter, so not the strongest sign.

Outcomes

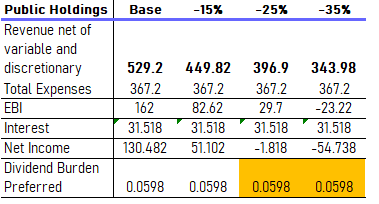

There’s a decent horizon for debt repayment, and the debt is mostly fixed rate at decently long maturities, with little need to refinance. It is going to be insensitive to the broader interest picture from a cash flow point of view for the next decade, and the interest burden will fall. WFH is a major issue for the real estate market however. There are hundreds of millions of square feet of office space in Manhattan. Whether these spaces can be repurposed is irrelevant in the face of WFH risks. WFH would mean less interest to live in Manhattan at the same time as lots of space hits the market. People need less space to work at home than in the office, presuming that spaces at home can be used for both purposes. There is only a hybrid offset here if a portion of the space is still required for a rotating workforce. According to NYU Stern, the effects on valuations could be severe, with 28% declines in 2028 expected by their models. Assuming that valuations and lease terms are going to move proportionately, and that discount rates are broadly fixed, we can equate this to the declines that may happen in lease rates. Presuming debt repayment continues and separating properly between variable and fixed costs, we can see which scenarios put explicit pressure on the dividend burden of the preferred shares.

Sensitivity (VTS)

The burden is very small, but negative incomes can be reached in principle if declines are 25% or more severe. The issue is that the debt has covenants that could affect the company’s ability to pay the dividend at all. Even with a relatively small debt load, these covenants could be breached and therefore dividends no longer possible to pay if margins thin into negative territory.

If the dividend were to become impaired the investment would deserve low values. Indeed, the equity component of the preferred would already decline in line with the common stock given that cash flows would be impaired and the entitlement to the properties lessened in value.

Bottom Line

There’s still a lot going on in New York, and demographics are generally strong in the US. If recovery values remain non-catastrophic, the company could have little debt issue even if margins start to thin, and in turn would have no dividend issue for the preferred shares even in a pretty adverse scenario for Manhattan real estate. Also, the shares trade at a 23% discount to the part value, at which SLG could redeem the shares at their option. It’s a small class of securities but they may do that at some point although we see no incentive.

Still, investors are looking ahead with the possibility of more pressured payments in an adverse leasing scenario. The risks are there. But relative to the SLG shares which give the same yield but without the downside protection of preferred equity, the preferreds look like a solid option.

Lease signings have in general slowed a lot, as has transaction velocity in Manhattan markets. Prices have recovered partially for now but many are on the sidelines and may not get back in if the secular picture continues to decline. While not directly a concern for lease rates, the skittishness of markets could be proven right if ultimately the employee puts their foot down on the WFH issue. Then things will go empty without renewing at nearly the same rates as today with the dramatic changes in S/D that we could see. We think that WFH makes life better, and that it is quite likely to be the future.

The final thing to consider is duration. Preferreds are sometimes valued as high duration bonds due to their perpetual nature. If the current declines are just reflecting a change in prevailing rates without considering longer-term dividend risks and the possibility of a fair return, then there’s more reason to be concerned here.