Skillz Stock: Why I’m Not Rolling The Dice (NYSE:SKLZ)

AsiaVision

Skillz (NYSE:SKLZ) is an online gaming company which was supposed to bridge the gap between video games and betting. The idea was that it would offer fun interactive ways to wager some money in a unique gaming environment.

Shares were initially hot, with SKLZ stock shooting up following its SPAC deal. Notable investors including Cathie Wood’s Ark Invest took positions in Skillz stock.

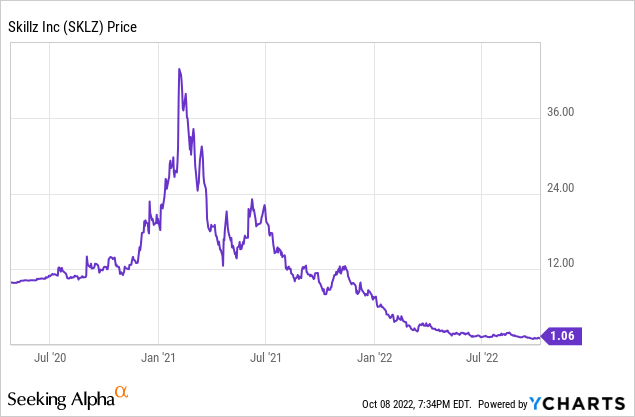

However, it has all come undone. SKLZ stock is now down more than 97% off its all-time high:

The reason why isn’t too hard to explain. Skillz’ marketing budget has been huge, but it hasn’t led to much in the way of player growth. And now that Skillz has cut marketing spend, revenues have started to implode. The company is now expected to generate just $270 million in revenues this year, which would be down 29% year-over-year, whereas investors had previously hoped for more than $400 million.

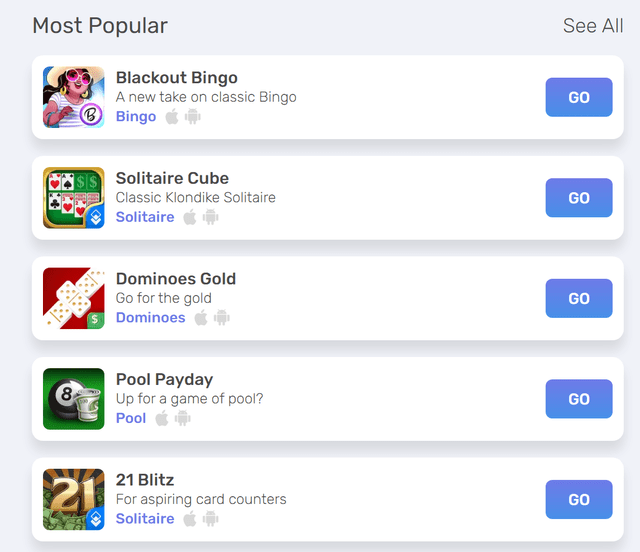

Why aren’t the games taking off? One reason might be that they’re not very engaging. According to Skillz’ own website, these are their most popular games:

Skillz’ most popular games (Games.skillz.com)

For all the excitement around potential NFL partnerships or whatnot, Skillz’ lineup looks pretty passe, and with fairly uninspiring graphics to boot. If you are thinking of Skillz as a leading esports company, that’s probably not the right perspective judging by this lineup of offerings.

All told, Skillz is generating tens of millions of dollars of adjusted EBITDA losses on a quarterly basis. And given its large debt load, the company doesn’t have much time to try to turn things around.

Bond Market Thinks Skillz Has A Losing Hand

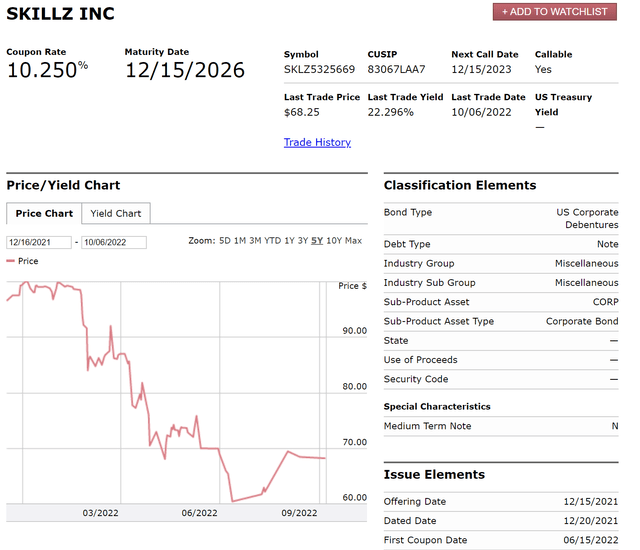

The bear case for Skillz is pretty simple, and, in fact, can be made largely with just the following graphic:

Skillz Corporate Bond Info (Finra by Morningstar)

This is Finra’s page showing Skillz’s December 15, 2026 maturity bond with a 10.25% coupon rate. Amazingly, the company just issued this bond in December. Already, it has fallen to 68 cents on the dollar.

With the last trade price of 68.25 cents, Skillz is now at a last trade yield of 22.3%. You read that correctly. If Skillz can merely stay in business through 2026 and repay its bonds at that time, a bondholder will earn a 22.3% annualized return.

For comparison’s sake, Carnival Cruise Line (CCL) currently has bonds trading in the 14% yield range. I’d note that Morgan Stanley slammed CCL stock this summer and suggested in a bear case scenario that CCL shares would be worth $0. So, with a stock where a prominent Wall Street firm says bankruptcy is potentially in play, those bonds yield 14%. Meanwhile, Skillz’ bonds are paying more than 22%. Needless to say, the bond market views Skillz as an exceptionally high-risk entity.

As a potential investor, you also have to ask yourself what will get better returns if Skillz is able to survive. If the company merely keeps the lights on through December 2026, an investor earns 22.3% per year. Is the common stock likely to deliver higher returns than that? It seems improbable. (Do note the bonds are under SEC Rule 144a and thus are not tradable for many investors)

Skillz Isn’t Cheap Simply Because The Stock Is At A Buck

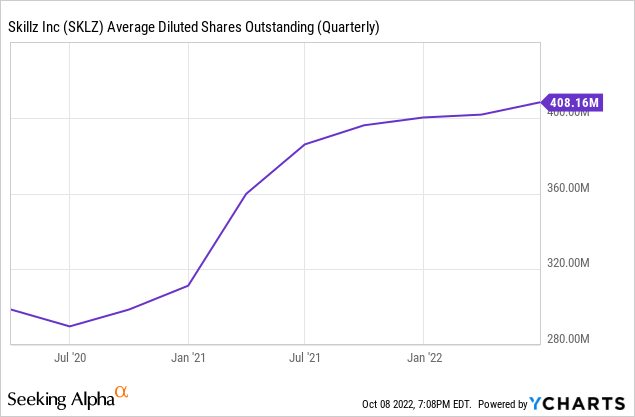

Investors might look at SKLZ stock at just over a buck, down 90% from its SPAC offering price, and think the thing is a steal. However, investors are actually paying a high valuation for the company, with the market cap remaining at greater than $400 million even today. That’s in part due to dilution.

Since the SPAC, Skillz’ shares outstanding has increased significantly, and investors should probably anticipate more share issuance in the future given the company’s large and persistent operating losses. Here’s shares outstanding since 2020:

If I had to guess, we’ll probably see a reverse split in SKLZ stock at some point to get the share count down to a more manageable level while getting the share price out of penny stock territory.

Right now, traders might be playing Skillz stock hoping for a short squeeze given the nominally low share price. If Skillz does, say, a 1:10 reverse stock split, however, suddenly this is a $10 stock and that low-priced equity appeal goes away. Meanwhile, the market cap would still be a bloated $400 million for a company that seemingly has no signs of profitability anytime soon and has woefully underperformed its initial business projections.

Skillz Was Supposed To Be Profitable By Now

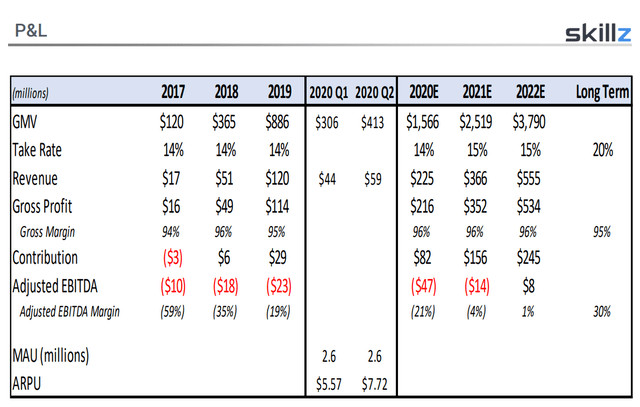

Here’s a slide from the Skillz SPAC merger presentation from September 2020:

Skillz’ initial outlook (SKLZ 2020 Presentation)

For 2022, according to the merger deck, Skillz was supposed to generate $555 million in revenues. Now, however, we’re looking at less than $300 million as of the latest guidance cut. And it gets worse.

You’ll note that adjusted EBITDA was supposed to be close to breakeven in 2021 and move into positive territory this year. Instead, the company hit an adjusted EBITDA margin of -47% last year, which was 43% worse than modeled. Worryingly, the company only had a -19% adjusted EBITDA margin in 2019 prior to the SPAC deal. So, despite everyone being stuck at home and having tons of time to play Skillz’ games in 2020 and 2021, the company’s revenue fell far short of expectations and its profitability actually got much worse than it was prior to the pandemic.

Now, the company is telling investors that it is aiming for breakeven on an EBITDA basis by the end of 2024. That’s quite a shift from how it was supposed to be profitable already in 2022. And the credit market in particular seems uncertain that Skillz will ever achieve profitability, at least to the extent necessary to service its 2026 maturity bonds.

The company’s marketing spend has been a big part of the problem, as Skillz has spent heavily and not earned a high return on that investment. Why might that be?

From the company’s Q2 conference call in August, we got this amazing bit about why the company’s marketing spend has failed to deliver expected results:

The main drivers of this are a mix of instances of users cheating us on our platform and past product modifications that shouldn’t have rolled from our test phase to full rollout. So when I speak of cheating, let me give you an example. We’ve seen instances of users cheating on the platform, including abusing system discounts and incentives in other countries such as in the Philippines, where users are abusing our friend referral program to get financial incentives without delivering real user referrals.

It’s worth asking how sophisticated Skillz’ platform is if its systems can be so easily fooled by users. If a company wants to be the future of online gaming, its information technology needs to be rock solid. This is not an encouraging sign.

This is also of interest, since Skillz has previously called out anti-fraud and cheating prevention as one of its eight key features:

Skillz Platform Features (May 2022 Corporate Presentation)

We’re getting late in Skillz’ timeline for the company to still be figuring out basic pieces of its marketing and monetization models. Given the company’s high interest payments and 2026 debt maturity, it would seem that Skillz needs to right the ship immediately if it is going to survive.

SKLZ Stock Verdict

The takeaway here is easy: Skillz is a strong sell. Simply put, I’m not convinced that this company has a viable business model.

So, what are shares worth?

As of last quarter, Skillz had $470 million of cash and current marketable securities. Against that, the company had $354 million of total liabilities, so there’s theoretically around $116 million of cash available to shareholders. That would be the absolute ceiling I’d assign the stock’s valuation at the present time given the massive cash burn rate, shrinking revenues, and the pressing questions around whether the company’s core business model is functional. Unfortunately, $116 million works out to under 30 cents per share of value for SKLZ stock.

That’s right, the stock seemingly still has at least 70% more downside from here. And that’s assuming the company can figure out some way to stem the operating losses and not burn what’s left of its remaining cash. This will be complicated since the company has a large debt to address in 2026, and thus needs to figure out some way to generate cash flows to meet its obligations.

As the company’s 22%-yielding debt shows, there is significant doubt about Skillz’ ability to remain an operating business for too much longer. The company lost $61 million last quarter alone. That’s an annualized pace of more than $240 million. With that in mind, the clock is ticking down quickly for Skillz’ match. I believe there’s a good chance the company won’t be able to survive. Even if it does, there is little reason to pay any premium to the company’s cash on hand, as the operating business seems to have negative value given its large and persistent losses.

To change my opinion, we’d see need to see Skillz slash its marketing budget while still keeping revenues closer to steady. I believe this will be difficult, given that we saw an 18% decline in revenues this past quarter in response to the company’s last round of cost-cutting. If there is a core user base that will stick around even without heavy engagement marketing, however, that could change the equation. Getting to adjusted EBITDA neutral would be the first step on the road to a comeback for Skillz.

Barring evidence of a turnaround, however, shares are still dramatically overvalued at today’s levels. Don’t be fooled by the $1 stock price. This is the sort of situation where we’ll probably see a reverse split and then shares will tank once again, as is common with loss-making penny stocks.