Sizing Up Sight Sciences (NASDAQ:SGHT)

Ozgu Arslan/iStock via Getty Images

“The most pathetic person in the world is someone who has sight but no vision.”― Helen Keller

Today, we take a look at a small ocular concern. The company is seeing rapid revenue growth and over half of its market cap is net cash on the balance sheet. Analysts are sanguine on its prospects and the stock has seen some insider buying recently as well. A full analysis follows below.

Company Overview:

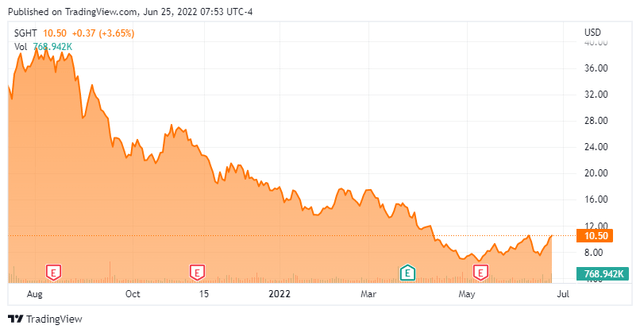

Sight Sciences, Inc. (NASDAQ:SGHT) is a Menlo Park, California based ophthalmic medical device concern focused on the development of surgical and nonsurgical solutions for the treatment of eye diseases. The company currently markets two devices: one for the treatment of primary open-angle glaucoma (POAG) and one for evaporative dry eye disease (DED) due to meibomian gland dysfunction (MGD). Sight Sciences was founded in 2011, launched its first product in 2018, and went public in July 2021, raising net proceeds of $252.2 million at $24 a share. The stock trades around $10.50 a share, translating to a market cap of $480 million.

May Company Presentation

Commercial Products

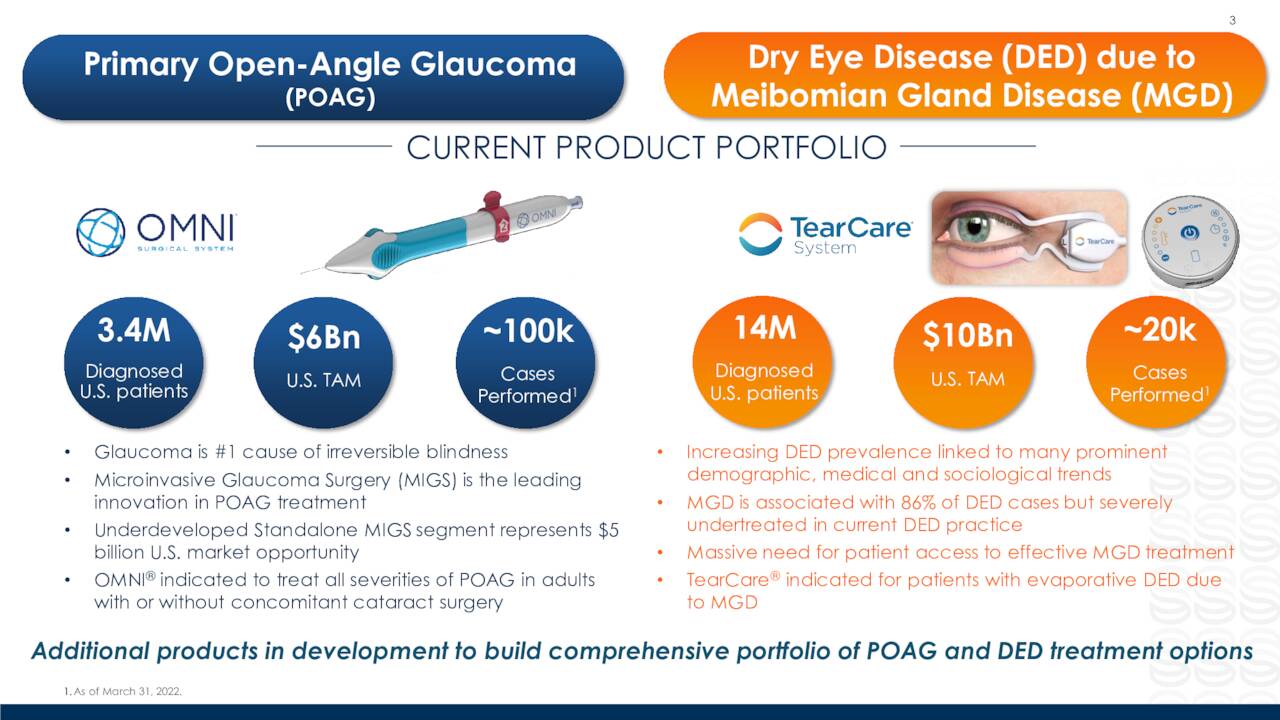

The company has two operating units that each currently house one product: Surgical Glaucoma, which includes its OMNI Surgical System; and Dry Eye, which includes Sight Sciences’ TearCare System.

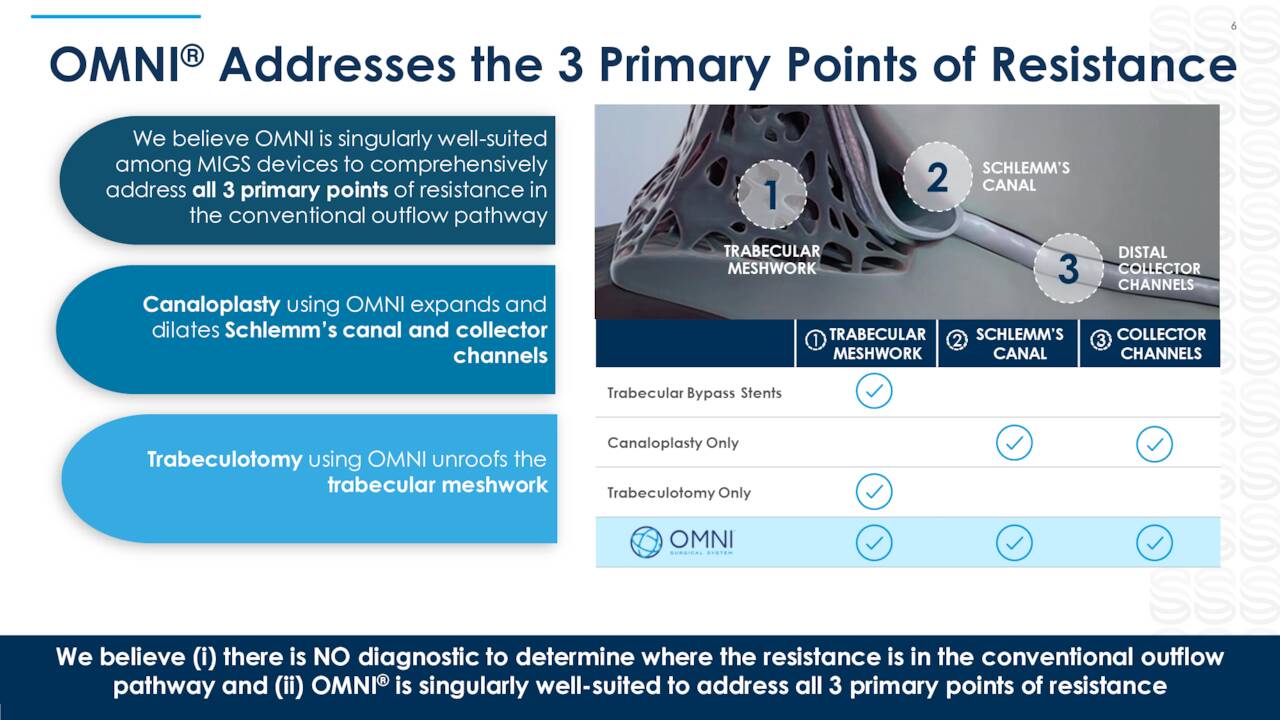

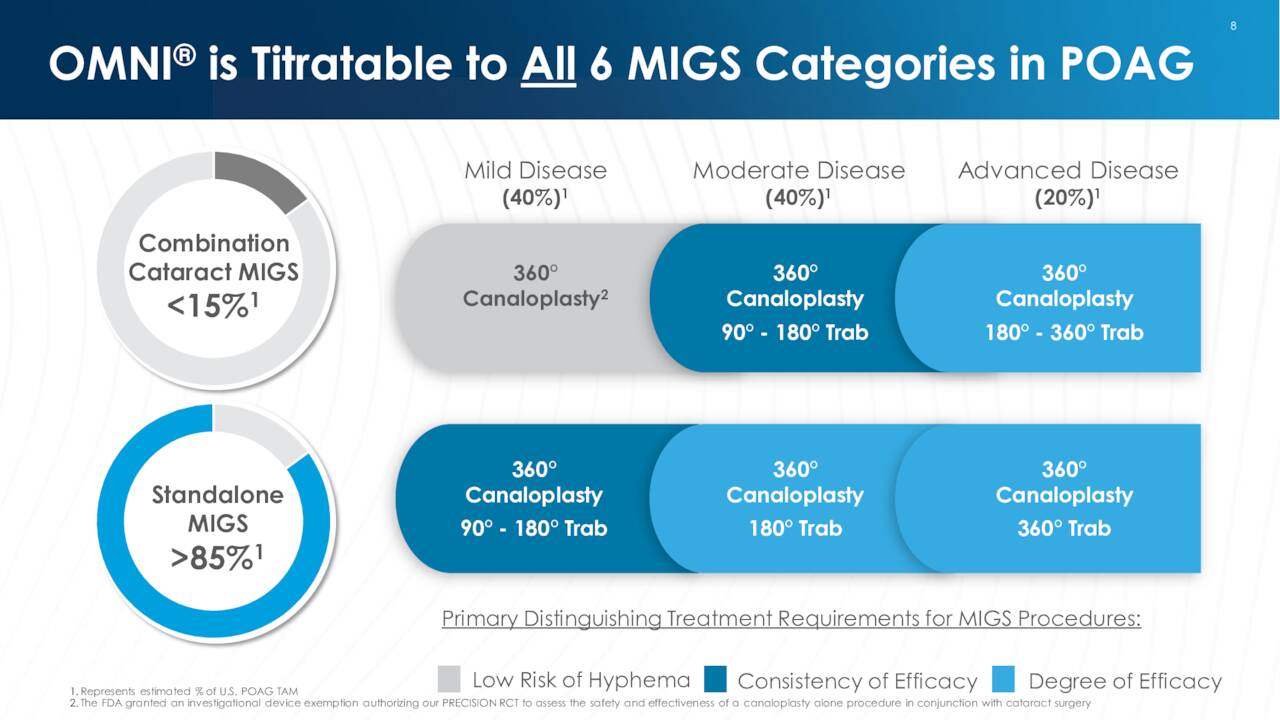

OMNI. OMNI Surgical System is a handheld, single use device that allows ophthalmic surgeons to reduce intraocular pressure in adult glaucoma patients, which allows them to sequentially complete two surgical procedures known as canaloplasty (micro catheterization and transluminal viscodilation of Schlemm’s canal) and trabeculotomy (cutting of trabecular meshwork), transforming procedures that required deep scleral incisions into minimally invasive glaucoma surgery (MIGS). This result is accomplished through the use of a single, bloodless, and suture-less clear corneal microincision and is effective across all severities of POAG.

May Company Presentation

POAG is the most common form of glaucoma, which is a group of chronic diseases that damage the optic nerve and is the world’s leading cause of irreversible blindness. This progressive, often asymptomatic disease afflicts ~102 million worldwide, with POAG accounting for ~60 million, including ~4.1 million Americans. Management estimates the market opportunity for its OMNI device at ~$6 billion, yet FY20 U.S. revenues from approved MIGS products was only $350 million, reflecting the large (until now) untapped opportunity – more on this dynamic shortly. Competing MIGS devices include Glaukos’ (GKOS) iStent inject, Alcon (ALC)/Ivantis’ Hydrus Microstent, and AbbVie’s (ABBV) Durysta implant, although Sight Sciences is confident that OMNI is the superior product.

May Company Presentation

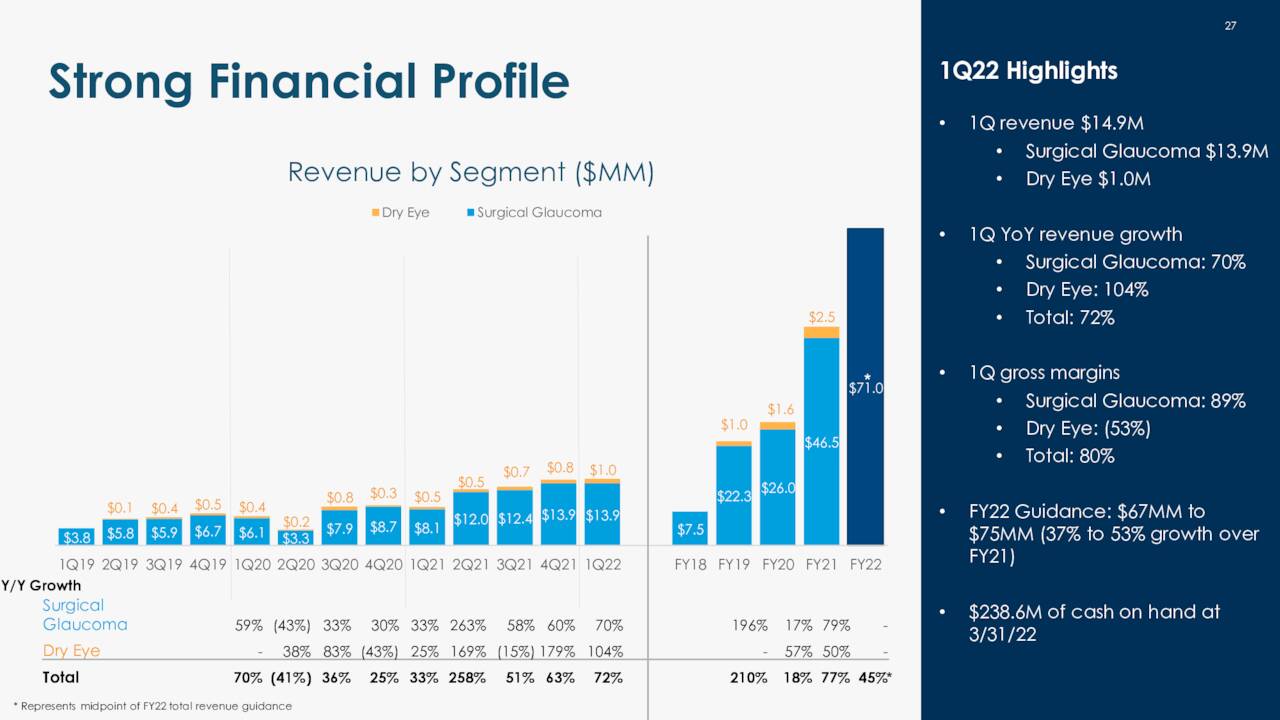

Surgical Glaucoma generated FY21 revenue of $46.5 million, up 79% from FY20, and 95% of the company’s total. Gross margin from this unit was 86%, up from 73% in FY20. Since launch, OMNI has been employed ~100,000 times in ~1,200 hospitals and walk-in clinics in the U.S. and the EU. Nearly 1,600 of the 5,600+ American surgeons licensed to perform MIGS procedures have received OMNI training.

Returning to the market opportunity, the current paradigm for a POAG patient who does not require cataract surgery (~85% of cases) is to increase use of topical eye drops. Owing to OMNI’s effectiveness and relative non-invasiveness, management’s research indicates that 85% of glaucoma patients would choose a stand-alone procedure (i.e., not in combination with cataract surgery) using OMNI if recommended by their doctor. Currently, OMNI in stand-alone interventions comprises not much more than 10% of its usage versus nearly 90% in combo with cataract surgery (the smaller market). To further pioneer this $5 billion standalone opportunity, Sight Sciences is focused on educating the glaucoma community on the benefits of an OMNI intervention versus prescribing a second or third eye drop.

This unit expects to launch a next-gen version of OMNI and a goniotomy (eye pressure reduction surgery) device in 2H22. Further down the road, it is designing an implantable canalicular scaffold and an implantable solution for advance/refractory glaucoma patients, but its focus is on building out the stand-alone POAG market.

TearCare. Sight Sciences’ TearCare System is a wearable open-eye heating and expression device that melts meibomian gland obstructions, which are the primary cause of evaporative DED. Meibomian glands are located in the upper and lower eyelids and produce an olive oil-like substance (meibum) that forms the outer layer of healthy tears. Sometimes, meibum hardens in the glands, blocking the glands’ ability to produce more. When this occurs, tears are created without meibum and rapidly evaporate leading to DED. TearCare heats and liquifies meibomian gland obstructions, allowing eyecare professionals to clear them out with a separate instrument. Consisting of a razor-razorblade model, TearCare consists of a SmartHub hardware controller (razor) that is sold to eyecare professionals along with single-use higher-margin SmartLids (razor blade), which are adhesively applied to a patient’s outer eyelid[S], delivering a therapeutic amount of heat, allowing patients to blink while the procedure is conducted.

May Company Presentation

Approximately 739 million people worldwide suffer from DED, of which ~38 million are American. If left untreated – and only ~17 million Americans have actually been diagnosed with DED – it can lead to permanent cornea damage and impaired vision. DED due to MGD comprises ~86% of all DED cases. Sight Sciences’ estimates the market opportunity for DED at ~$10 billion, although – like glaucoma – the market is underserved with instruments for treating DED only reaching $2.4 billion in FY20. Prescription eyedrops dominate with instruments such as Johnson & Johnson’s LipiFlow Thermal Pulsation System and Alcon’s Systane iLux (amongst others) providing competition for TearCare.

May Company Presentation

Launched in 2019, TearCare received FDA clearance for DED due to MGD in December 2021 after demonstrating non-inferiority to LipiFlow on most measures and superiority on the balance (e.g., Ocular Surface Disease Index scoring). It accounted for FY21 revenue of $2.5 million, up 50% from FY20, and 5% of Sight Sciences’ total. With an emphasis on rapidly expanding its SmartHub installed base, gross margin is not currently emphasized and as such was small at 13% in FY21.

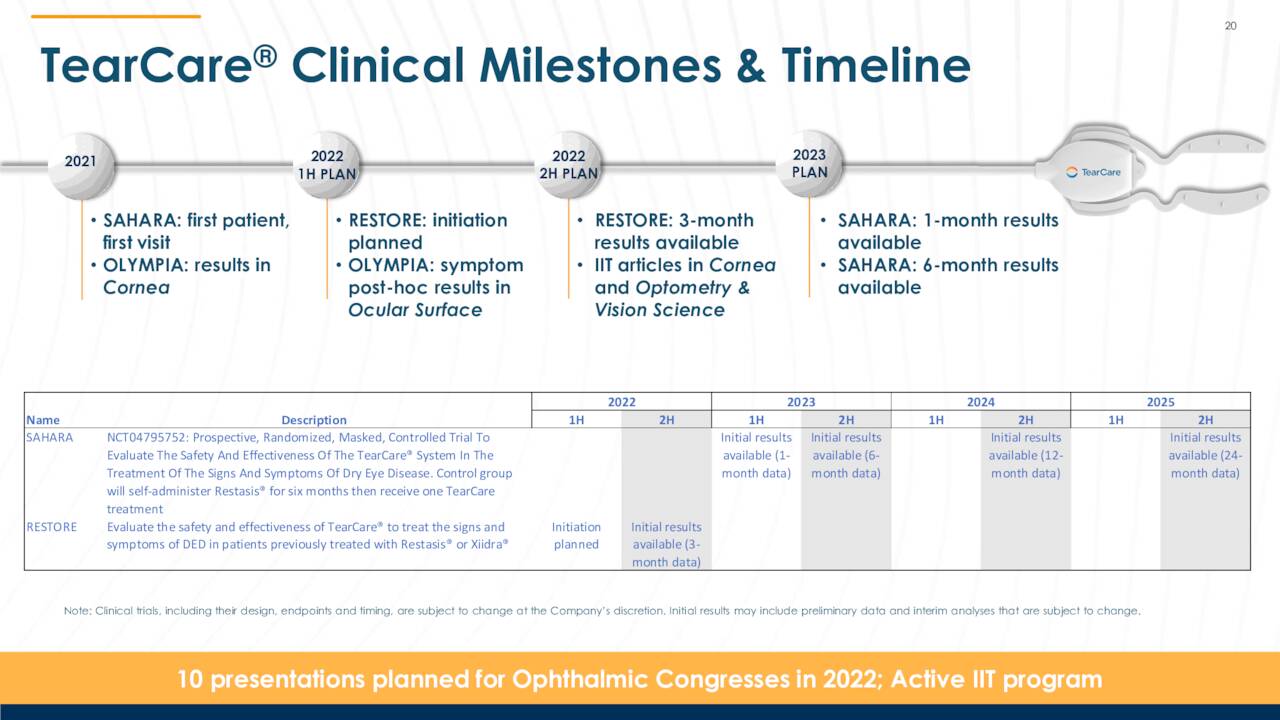

As of March 31, 2022, there had been an estimated 20,000 use cases of TearCare in over 600 eyecare facilities in the U.S. Adoption and use of SmartLids is likely to increase with the recent FDA clearance. However, patients still typically pay for this MGD therapy procedures out-of-pocket. To drive payer adoption, Sight Sciences is conducting a randomized, 300-patient clinical trial (SAHARA) that is pitting TearCare against the number one selling prescription DED eye drop (AbbVie’s Restasis (cyclosporin)) in a 24-month study. Initiated in 2021, one-month results are anticipated in 1H23 and six-month data in 2H23. Another study (RESTORE) is set to initiate in 1H22 and is designed to evaluate TearCare in patients already treated with Restasis or Novartis’ (NVS) Xiidra. Three-months results are anticipated in 2H22. If they can demonstrate superiority and effectiveness, TearCare has the opportunity to muscle in on the prescription eyedrops’ market share.

Stock Price Performance

With a small but differentiated product suite, a significant addressable opportunity, and an expectation of pent-up demand from the eschewing of elective surgery during the height of the pandemic, Sight Sciences became a market favorite shortly after its public debut, with its stock quickly bid to $42.57 a share on August 2, 2021. However, that valuation represented nosebleed territory, trading at ~36x FY21 revenue net of cash. Within a month, shares of SGHT were below $30 and with the market’s U-turn away from high-growth, profitless concerns stoked by inflation fears near YE21, they fell below $20 – even with FY21 revenues increasing 77% over FY20. As inflation became a reality in 1H22, its stock continued to crater despite a lack of company-specific negative catalysts, bottoming at $6.25 a share in late April 2022, down 85% from its all-time high of nine months prior. The stock has been clawing its way back up over the past month or so.

1Q21 Revenue & Outlook

When Sight Sciences reported its 4Q21 earnings in March, it provided a FY22 revenue target of $71 million – based on a range midpoint – representing a 45% increase from FY21. That outlook did not change, even when the company reported 1Q22 revenue of $14.9 million on May 10, 2022, up 72% from the prior year period and $1.3 million better than Street expectations, as the number of facilities ordering OMNI in the quarter improved sequentially to 811 (105 new) from 760 (98) in 4Q21. Management cited a conservative approach and doctors trialing other devices in 2Q22 for not raising its outlook. Furthermore, total gross margin improved to 80% (89% in Surgical Glaucoma) from 73% (77%) in 1Q21 despite the installed base for lower-margin SmartHub increasing from 562 at YE21 to 635 on March 31, 2022.

May Company Presentation

Balance Sheet & Analyst Commentary:

Sight Sciences is in good financial condition, holding cash and equivalents of $238.6 million and debt of $32.8 million as of March 31, 2022. Cash used in operations during 1Q22 was $22 million, but increases in clinical and commercial spends should be somewhat offset by product revenue growth going forward.

The Street is unanimously constructive on Sight Sciences, featuring two buy and three outperform ratings and a median twelve-month price target of $27, which is down from over $40 a share at the beginning of 2022 as analysts deal with the new valuation paradigm.

Board member Staffan Encrantz, who represents the beneficial owner interests of Allegro Investment Fund, found the sub-$10 a share price so enticing that he purchased 551,802 shares at an average price of $8.33 a share for his and his wife’s trust account over the course of three days in mid-May.

Verdict:

Net of net cash, Sight Sciences currently trades at approximately four times FY22E sales, which are projected to grow 45% over FY21. With an opportunity to create a $5 billion market for its OMNI device and take share from eyedrops in DED, the company has potential to grow its top line above 30% for the foreseeable future. Factor in nearly 90% gross margin for OMNI combined with a palatable cash outflow and a case can be made that shares of SGHT are forming a bottom. Currently down 70% from their all-time high, shares of SGHT represent an asymmetrical risk-reward profile in the low $10s.

If the market wasn’t so negative on growth concerns that are not yet profitable and if the ocular space not such a wasteland since the pandemic, we would consider Sight Sciences for a decent sized holding. That said, it merits a small ‘watch item‘ position for now and we probably will revisit this name as the company gets closer to break even status.

“The visionary lies to himself, the liar only to others.”― Friedrich Nietzsche