Signature Bank Stock: Baby With The Bathwater (NASDAQ:SBNY)

Sezeryadigar

The Company

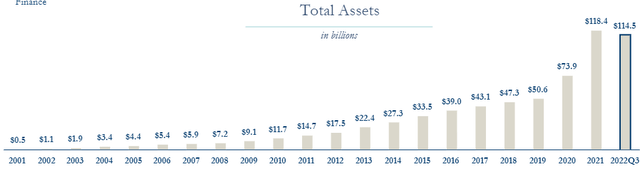

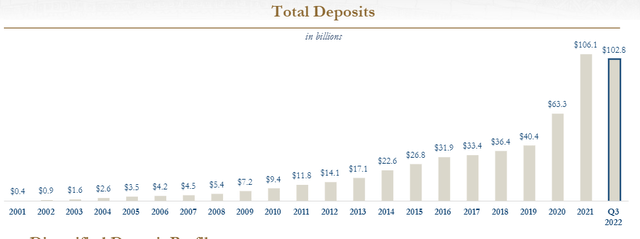

For those who are not familiar with the company, Signature Bank (NASDAQ:SBNY) is a New York based commercial bank that services primarily small and medium sized privately owned businesses, their owners and senior managers. The company calls its model branch-lite, and follows a private-client banking model. It was founded in 2001 and has grown entirely organically to become the 19th largest deposit bank with total deposits of $103 billion at the end of Q3 2022.

This organic growth has been incredibly impressive and steady with the exception of 2021 when assets and deposits jumped thanks largely to the growth of the company’s digital currency services, which I’ll get to in a moment.

SBNY Total Assets by Year (Q3 Earnings Presentation) SBNY Total Deposits by Year (Q3 Earnings Presentation)

The other impressive traits are how efficiently the bank is run and how good underwriting has been. By almost all relevant measures, this bank has been well run. As of Q3:

- ROACE was 18.42%

- Efficiency ratio was 31.41%

- Non-accrual loans were .25% and well reserved.

These are all market-leading metrics.

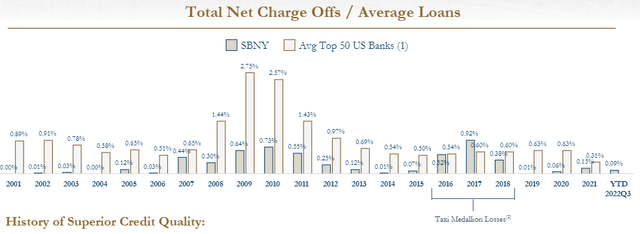

In terms of risk NCOs (net charge offs) are the fairest way to judge a bank’s underwriting and SBNY has been exceptional for two decades. It has led the industry every year except for 2017, when NYC taxi medallions were damaged by the growth of Uber (UBER) and Lyft (LYFT). Even then, NCOs were well below 1%. This success is due to the high-end nature of its client base, the quality of its lending teams, and the strict terms under which the bank lends.

SBNY NCOs as a % of Loans (Q3 Earnings Presentation)

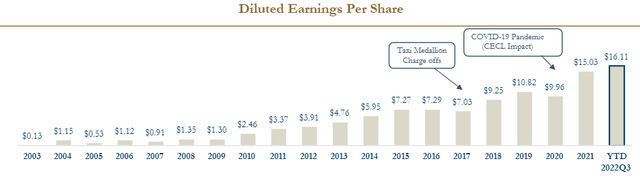

As a result of this underwriting discipline, SBNY made money in 2008 and 2009, years where many banks found themselves nursing severe losses. I view this earnings record (particularly in those two years) combined with the long-term low NCOs as the ultimate measures in a bank’s risk management.

SBNY EPS by Year (Q3 Earnings Presentation)

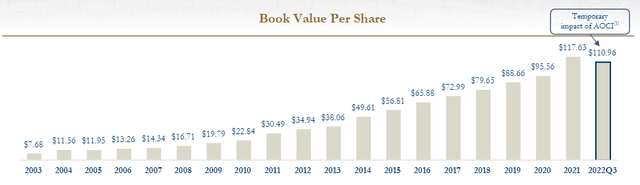

Because SBNY has had nary an earnings hiccup, it has steadily grown book value/share every year of its existence, except for this year which has a temporary impact of AOCI stemming from mark-to-market losses on its hold to maturity investment portfolio.

SBNY Book Value by Year (Q3 Earnings Presentation)

The AOCI loss stems from the $25 billion investment portfolio primarily comprised of RMBS (residential mortgage backed securities) and CMOs (collateralized mortgage obligations) that started the year at a 3.55 year duration and this currently stands at 4.55 years. Said simply, despite the relatively short duration, interest rate increases have led to a little over $3 billion in mark to market losses in this investment portfolio.

SBNY stock has traded terribly this year, down 64% as of this writing (December 20th). This loss compares to the S&P Regional Bank ETF (KRE) that’s down 19%. However, there is more to that 64% than meets the eye.

In my opinion, the bulk of this loss stems from Signet, the company’s digital currency services business… in more ways than one. For starters, everything attached to crypto is getting destroyed. Moreover, I believe people are conflating Signet with Silvergate (SI). Yet, the two could not be more different. Digital currency deposits are only about 20% of SBNY’s deposit base (and shrinking) versus digital representing virtually all of Silvergate’s. SBNY also has only $100 million of loans backed by crypto (~0.1% of total loans ~1% of equity) versus SI’s billions of crypto backed loans that far exceed its equity.

People are also concerned that a decline in the digital deposits (most of which are non-interest bearing) will severely dent SBNY’s NIM and therefore its earnings. I have seen estimates from $3 to $8 drag on earnings. The company is on pace to earn about $21/share this year. Assuming a worst-case scenario where all crypto deposits exit immediately while no traditional deposits replace them and there is no organic growth anywhere else in the business, SBNY would still earn around $13 next year. At $115/share on the stock, it is only trading at 8.8x that draconian scenario.

In terms of the stock’s performance versus the KRE, it has also not lagged as badly as that 64% versus 19% year-to-date decline. The Signet business drove SBNY to outperform KRE by over 3x from the beginning of 2021 to the stock’s peak in early January of this year, when SBNY gained ~170% vs KRE’s 53% gain. Therefore, SBNY’s underperformance versus KRE since the beginning is of 2021 is much less dramatic. Moreover, the company took advantage of that 2021 pop aggressively. It issued 2.88 million shares at $232/share in July 2021 and $2.1 million shares at $352/share in January 2022. Those moves look brilliant today.

The last issue that has people concerned is that a liquidation of the crypto deposits would strain the company’s cash balances and create a forced crystallization of the losses in the mortgage portfolio which would dent regulatory tier 1 capital enough to force an equity issuance. Tom Lott offered an excellent rebuttal of this thesis in his May article on the company. Tom might have been early on the stock but ultimately, I do not think he was wrong. I think there is a very low likelihood of the company having to issue equity and even in a worst-case scenario, I have a hard time seeing how it would have to do so at dilutive levels to book value.

Risks

I laid out the main risks above. They are:

- NIM declines from losing crypto (mainly non-interest bearing) deposits.

- Declining (but still nowhere near negative) earnings.

- Crystallization of mortgage losses denting tier 1 capital and forcing an equity raise.

Obviously, as a bank SBNY could also suffer losses in its loan portfolio. However, I believe I laid out the company’s history of extremely good underwriting above.

Conclusion

At a valuation close to book value, less than 9x a draconian earnings picture and less than 6x a much more likely $20+ eps, despite ROACE and efficiency ratios that are the envy of most banks in the country and a history of very strong underwriting even in terrible economic climates, I think SBNY offers a very intriguing long opportunity for patient money. These guys have built a high-quality franchise that is a long-term earnings compounder. It is an excellent pair against SVB Financial (SIVB), which I pitched as a short yesterday.