Short Peloton, Buy Nautilus: More Reasonably Valued For Recovery

home gym room in the attic Nautilus Bowflex velocore vicnt/iStock via Getty Images

For the “Long/Short Pair Trade” contest, I’d like to offer for your reading pleasure two stocks that benefitted from the COVID trade, then suffered during the re-opening: Nautilus (NYSE:NLS) and Peloton (NASDAQ:PTON). While the “easy and quick money” shorting both stocks has already been made, I hope to present a cogent argument that there is value in Nautilus, especially at its current depressed price, while Peloton still has much more risk due to still being over-valued after falling nearly 90%. I am long Nautilus-not expecting a quick profit, but buying a company with multiple recognizable brands, a growing online streaming service, and a decent financial position at 1/3 book value is an opportunity I will take.

Both sides of this trade have been crushed this year

As stated above, the easy short money has been made in both Nautilus and Peloton. The below charts taken from SA earlier today show both stocks’ one-year return.

Peloton One-Year Return (Seeking Alpha quotes page) Nautilus One-Year Return (Seeking Alpha quotes page)

Both stocks began a gradual decline as the economy re-opened, with Peloton falling off a cliff last fall, then continuing to decline. Going short, selling bear call spreads or buying puts in either ticker would have been a profitable trade-very profitable. Why do I think Nautilus is worth purchasing/going long, and even after losing over 90% a short position in Peloton could be profitable?

First, the Bull Case for Nautilus

I am bullish on Nautilus for three reasons:

1) More diversified business lines

2) Strong brand names with inherent market value

3) Tremendous discount to book value (OK, this is related to #2!)

Nautilus dates back to the famous cam workout machines from nearly 60 years ago. For many of us, the image that springs to mind when hearing “Nautilus” and fitness equipment together is of large early weightlifting machines with unique cams designed after the shells of the nautilus aquatic animal. Designed by eccentric inventor Arthur Jones, also famous for often saying his life goals were “younger women, faster airplanes and larger crocodiles”, these machines invented in the late 1960s, rapidly caught on in fitness centers and gyms.

Arthur Jones, Inventor of the Nautilus Weightlifting Machine (Google Images)

But the modern Nautilus company is much more than these unique fitness machines. The company now produces a much wider range of brands and equipment than most realize including Schwinn indoor fitness bicycles and the Bowflex line of fitness equipment. Nautilus also is rapidly moving into the streaming and connected fitness space with their own streaming library of courses and workouts with over 1200 titles via the JRNY service. Information on these brands can be found here: Brands – Nautilus, Inc.

Interestingly as someone who primarily rides road bicycles and recently tried a Peloton bike for the first time, the Bowflex VeloCore bicycle actually can lean-a feature more advanced than the Peloton bikes I have seen and ridden.

Related to this point is each of these lines appeal to different market segments from home fitness users, connected fitness and fitness centers. While Peloton is addressing the fitness center market, Nautilus has been in this sector throughout its history, and expanded by accretive purchases. While admittedly having some growing pains, the JRNY system now has a robust library and continues to receive developmental and program funding to grow. These brands have recognizable names in fitness.

And the third reason I am bullish is the valuation NLS is trading at presently. I will show more valuation information later, but my preference is value investing, and Nautilus is a screaming value right now trading at 1/3 book value. ShadowStock wrote a good article in late April discussing Nautilus’ liquidation value, and the share price has declined 40% since then. In my mind, this makes Nautilus a potential takeover target-while not a “slam dunk”, an interesting option on future profit. A few months ago news articles popped rumoring Peloton (PTON) was about to be acquired. These caused a rapid spike in PTONs stock price. Almost immediately these articles were discounted and PTONs price continued to drop. Nautilus instead would be an accretive purchase by many firms at this large discount to book value. While just as much conjecture as the earlier articles regarding purchasers of Peloton, for the sake of this article Lululemon (LULU), one of the rumored suitors for PTON, could easily purchase Nautilus due to recent reduction in NLS share price with their cash on hand and not affect their liquidity materially.

The Bear Case for Peloton

To me, the entire bear case for Peloton boils down to two inter-related factors: The still relatively high valuation for Peloton, and the likelihood they pulled much of their total addressable market (T.A.M.) forward during COVID.

I will show a few tables showing relative valuation between Peloton and Nautilus. While some of the multiples and ratios shown are also not favorable for Nautilus, in aggregate Peloton’s are still inflated, leading me to posit that Peloton could fall an additional 2/3s or so to have an equivalent valuation.

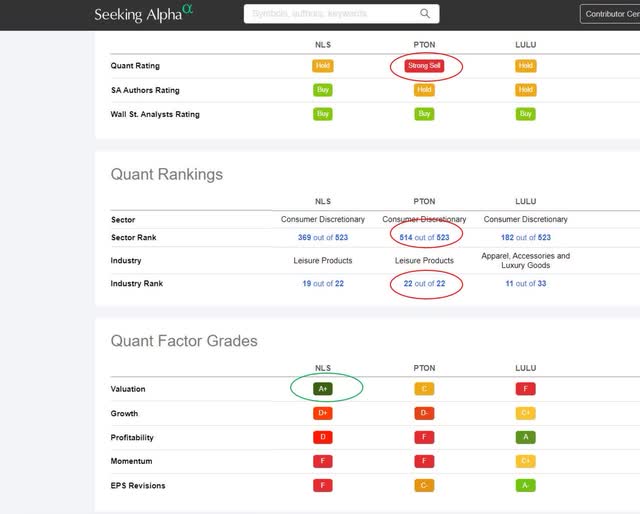

Nautilus, Peloton and Lulumon Quant Factor Grades (Seeking Alpha Peers Page)

While difficult to read due to compression, Peloton ranks at or near the bottom in their category, and the company’s highest quant factor grade is a C+. In an industry where “sell” ratings are not very common, Peloton earns a “strong sell” even after falling over 90%! Of note, Nautilus earns an “A+” rating for valuation as noted above.

Nautilus, Peloton and Lulumon Valuation Ratios (Seeking Alpha Peers Page)

I won’t go exhaustively into every multiple, instead have highlighted key metrics in green for Nautilus and red for Peloton. Peloton’s ratios for price/sales, EV/sales-forward, EV/Sales-trailing twelve months, and price to book value are all 5x Nautilus’ ratios or more. Even giving Peloton the benefit of a better, more mature streaming service, this is an eye-popping difference in multiples. Presuming further multiple compression-especially with my next point of concern-Peloton’s share price is vulnerable.

Peloton quite honestly caught lightening in a bottle during COVID-19. With the economy shutting down due to a communicable disease even experts were unsure how it spread, both workplaces and fitness centers shut down totally nearly overnight in March 2020. Peloton went from a niche, expensive piece of home fitness equipment for hard core aficionados to a popular, actually faddish purchase for many people with both time and cash on their hands. Their order book, and share price, exploded. From an IPO in 2019 around $25 and level share pricing through March 2020, the share price rockets to over $160 a share by December. Production also ramped up, spending massive amounts of capital to produce more bikes, more online content and develop additional products. While the share price dropped some during 2021, Peloton remained “hot” but the writing was on the wall. Even before the economy fully re-opened, Peloton equipment and accessories started showing up on online sites, and Peloton began reducing prices. Now overstocked inventory plagues the company. Like many exercise fads before it is likely Peloton, while a quality product and workout system, has a finite market. While a sustainable business model could have been built around a quality upscale exercise bike and other equipment and an ongoing connected community, COVID “spiked” this market. Peloton’s management was caught in a difficult situation-a nearly vertical growth in orders with likely a drastically smaller “tail”. I’m not sure any management team could have navigated this expertly, and the challenge of balancing a rapidly growing and likely unsustainable hardware side of the business then transitioning to a mostly subscription service may have been impossible for any team. I don’t think Peloton will go bankrupt. I just don’t see their subscription service and smaller hardware sales of what is basically a commodity product justifying their outsized valuation.

How I have played this trade

I have traded this trade and currently am long Nautilus (full disclosure below).

I have not naked shorted Peloton, as my securities trading is done in an IRA account to save on capital gains taxes. I have sold out of the money bear call spreads on Peloton to gather premium while the share price drops further from the call prices. There is still a limited opportunity here however the spreads between call prices limits it. Of course, Peloton could be sold short, especially after up days. For the more aggressive reader, other strategies using options, such as buying out of the money puts or selling naked calls could also be used, and, at least on a percentage basis, could create greater profits. Any of these could be profitable if Peloton continues to lose value over time. Obviously, options strategies create a time or “theta” dimension, while selling short creates margin loan costs.

I established my long position in Nautilus by selling cash secured puts instead of buying the shares outright. I first sold cash secured puts and had the shares “put” to me. While I currently have a small capital loss, I have turned around and sold covered calls on the position, further reducing my cost basis. I intend to continue this until one of two things happen. The first, most likely outcome is I reduce my cost basis to nearly zero of calls can still be written at this low price point. The unlikely but potential acquisition of Nautilus could result in a quick 100% or better gain on my cost basis as well if the book value calculations are remotely accurate. I see this as a longshot, but not impossible outcome.

Risks

The first risk to discuss was seen Tuesday July 5th when Peloton’s share price jumped 14%. Although my opinion of Peloton is that the shares are still over-valued in comparison to peers and in a difficult economic environment, bounces could occur and prices go up and stabilize at a higher level. If short, the investor would not only be paying a carrying cost in margin loans but also have to close the position at a loss. While I think this is unlikely due to how battered the share price is, a little good news might cause another large spike, especially at this depressed price.

The risk in Nautilus is similar in the opposite direction. With the share price so low, continued downward movement could cause one of two negative outcomes: Delisting if below $1 for too long, or a reverse split. While on paper stock splits don’t change anything for the company, investor sentiment views splits positively and reverse splits negatively. A reverse stock split would be a negative event for Nautilus.

Generally I don’t believe Nautilus is at risk of going bankrupt. While they have negative cash flow currently, the long-term trend is positive cash flow. Their debt is manageable at least over the near term.

Any strategy using options also introduces timing risk. Short-term moves can have outsized effects on option pricing-good for the timely premium seller, but could make a position turn against the trader in a short period of time. Before using any of the options strategies discussed, the reader is encouraged to understand options, “the greeks” and how much capital is at risk, whether undefined or defined risk, as these are more exotic trades than simply owning shares.

Best wishes for investment success!