Sentiment Can’t Get Worse, Which Is Good News

designer491/iStock via Getty Images

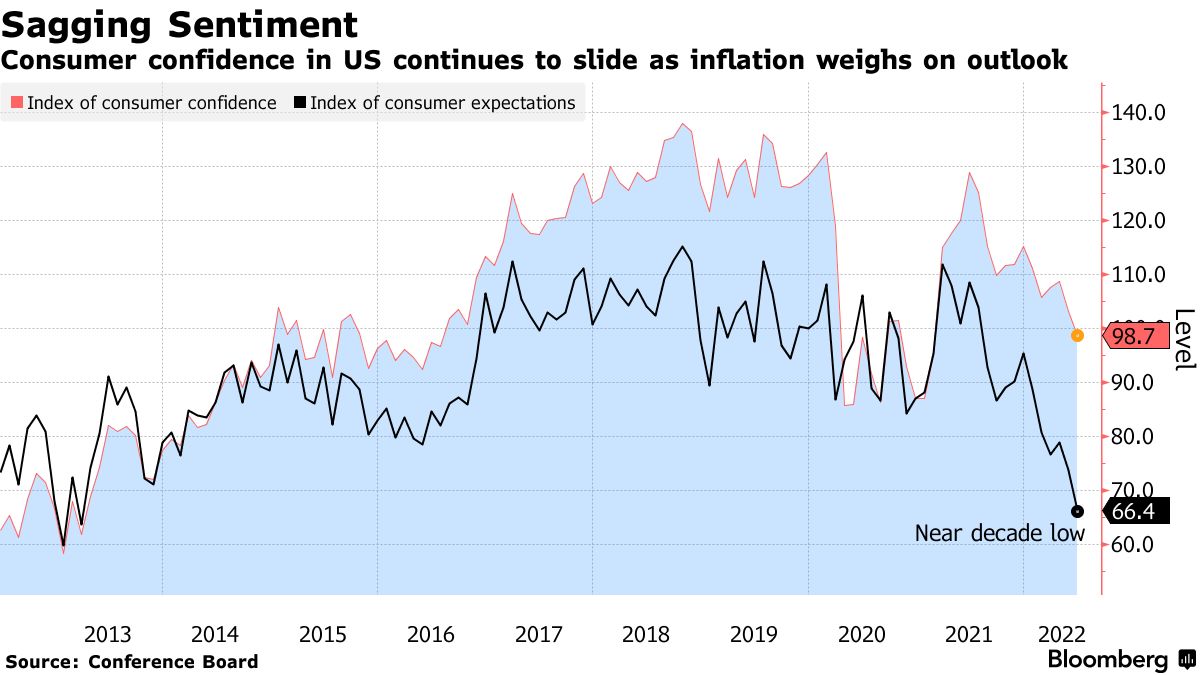

Stocks had a strong start with the Dow Jones Industrial Average surging 450 points at yesterday’s open on news that China was cutting back on its quarantine requirements for travelers and that Beijing and Shanghai reported no new coronavirus infections for the first time since February. The enthusiasm was short lived when the Conference Board reported that confidence fell to a 16-month low in June, as consumers stressed about the increase in food and energy costs and the possibility of another recession. I would put a lot more emphasis on the reopening of China’s economy than a consumer sentiment report from an investment standpoint, but the consensus continues to view every glass as half empty right now.

Finviz

Consumer and investor confidence levels are coincident indicators. They don’t tell us a whole lot about where we are headed or where we have been. Instead, they are stark reminders about what conditions are like today. Those feelings, depending on how extreme, are then extrapolated into the future to shape our outlooks. Given the historically low levels of sentiment we have seen in recent months, it is not surprising that future expectations have declined to the lowest level in nearly a decade. Although at historical extremes in either direction, those outlooks are rarely accurate. I think today is no different.

Bloomberg

This is why confidence surveys are reliable contrarian indicators when they fall to levels we saw during the pandemic or rise to levels they did at the end of last year. Traders were alarmed in yesterday’s report by consumers’ six-month outlook, which is why stocks were broadly sold. Selling stocks during the fall of 2020 or buying them at the end of 2021 on the tailcoats of similar extremes would have produced some horrible returns.

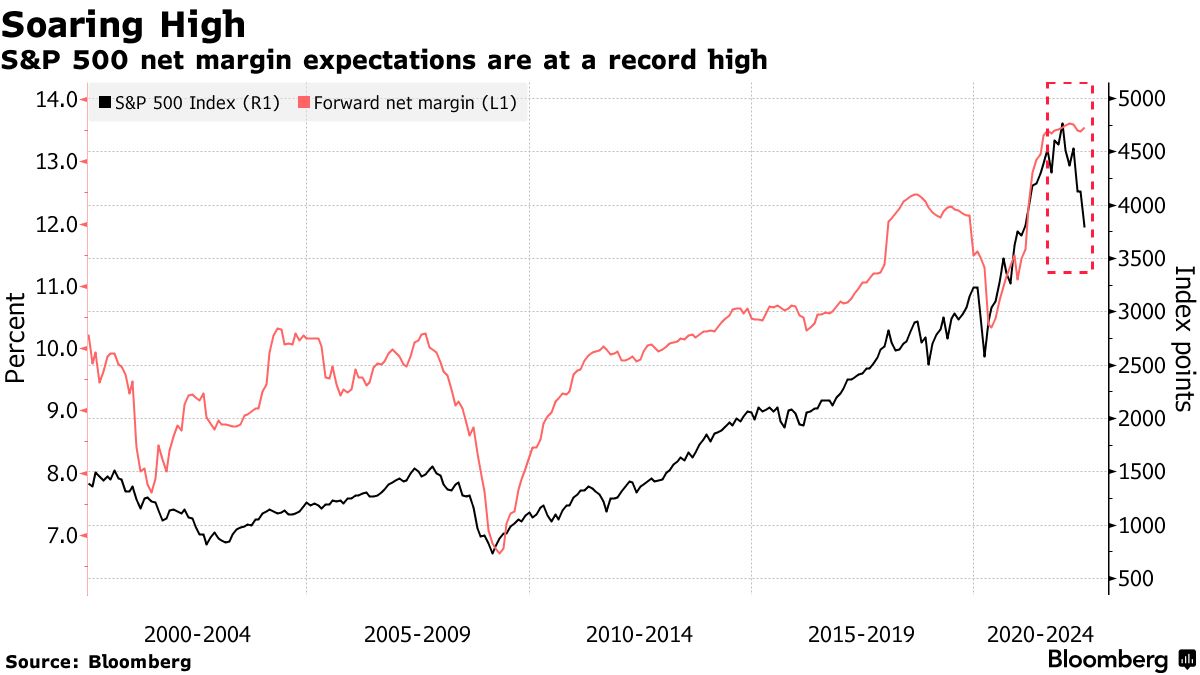

There is a lot of consternation about earnings reports for the second quarter, because the consensus believes that margins will fall short, as will profits, which will result in lower guidance for the back half of the year. That very well might happen, but the fact that there is so much anxiety about it tells me that it is largely priced into the market. Unlike consumer and investor sentiment, market prices lead real-world developments. I think the mid-June lows for the major market averages were an indication of what is to come and not a reflection of what has already happened.

Bloomberg

After market prices discount future events, consumers and investors then react to the price changes in confidence and sentiment surveys. This is why the market is a leading indicator, while confidence and sentiment are more coincident. If we do see companies lower guidance for the second half of the year, due to margin pressures from inflation, that may mark the bottom in their respective stock prices. In fact, resetting the bar at a level that a management team feels confident they can beat is an intelligent move, especially with stock prices down 20% or more from this year’s highs. That sets the path for outperformance moving forward, which stock prices should start to discount later this summer.

There are legitimate concerns that dismal sentiment and fears about a recession could be a self-fulfilling prophecy if consumers retrench. Yet consumers continue to spend and the latest confidence report showed that the percentage of respondents planning to buy a car or major appliance rose in June. There are fewer consumers planning to travel, due to higher gas prices and airfares, but overall spending levels are holding up. I will continue to focus on what consumers are doing rather than what they are saying. On that front, it looks to me like this expansion will continue.

Lots of services offer investment ideas, but few offer a comprehensive top-down investment strategy that helps you tactically shift your asset allocation between offense and defense. That is how The Portfolio Architect compliments other services that focus on the bottom-ups security analysis of REITs, CEFs, ETFs, dividend-paying stocks and other securities.