Salesforce: Don’t Fear The Stock-Based Compensation, This Stock Is Cheap (NYSE:CRM)

Jemal Countess/Getty Images Entertainment

Salesforce (NYSE:CRM), like many tech stocks, has seen its stock thrashed over the past year. Yet, unlike many tech stocks, this is a company with a long track record of execution and strong free cash flow generation. Over the years, CRM has become a mature tech giant with a willingness to use its balance sheet for M&A. The company may be able to take advantage of the valuation reset in the tech sector through opportunistic M&A. Some investors have raised concerns regarding the stock-based compensation at the company – I discuss why it is an overblown fear. CRM is highly buyable here for long-term investors.

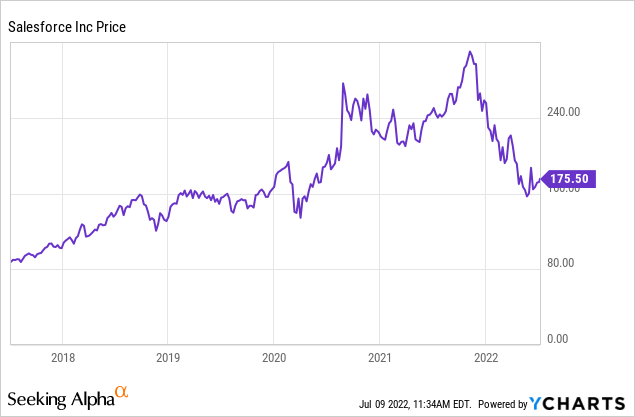

CRM Stock Price

After peaking above $311 per share in late 2021, CRM now finds itself trading around $175 per share.

I last covered CRM in April, where I rated the stock a buy on account of its strong foundation amidst the tech volatility. My stance remains the same – the longer this volatility persists, the greater the chances that CRM will make a move.

CRM Stock Key Metrics

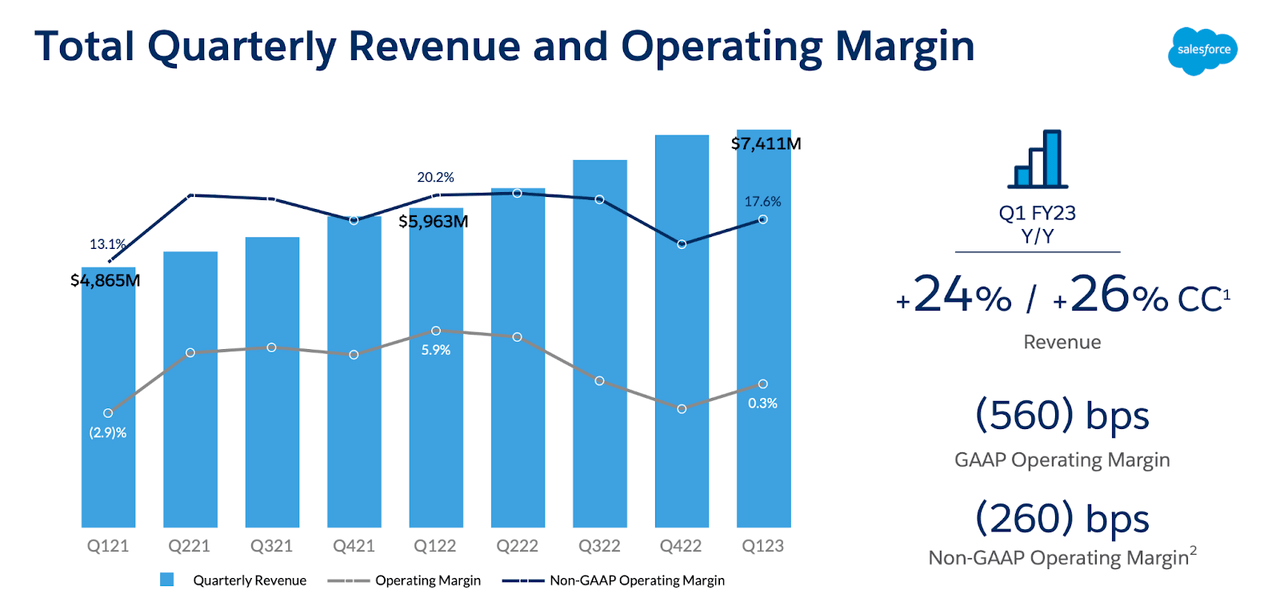

In the latest quarter, CRM continued its magic with 24% revenue growth and solid free cash flow generation.

FY23 Q1 Presentation

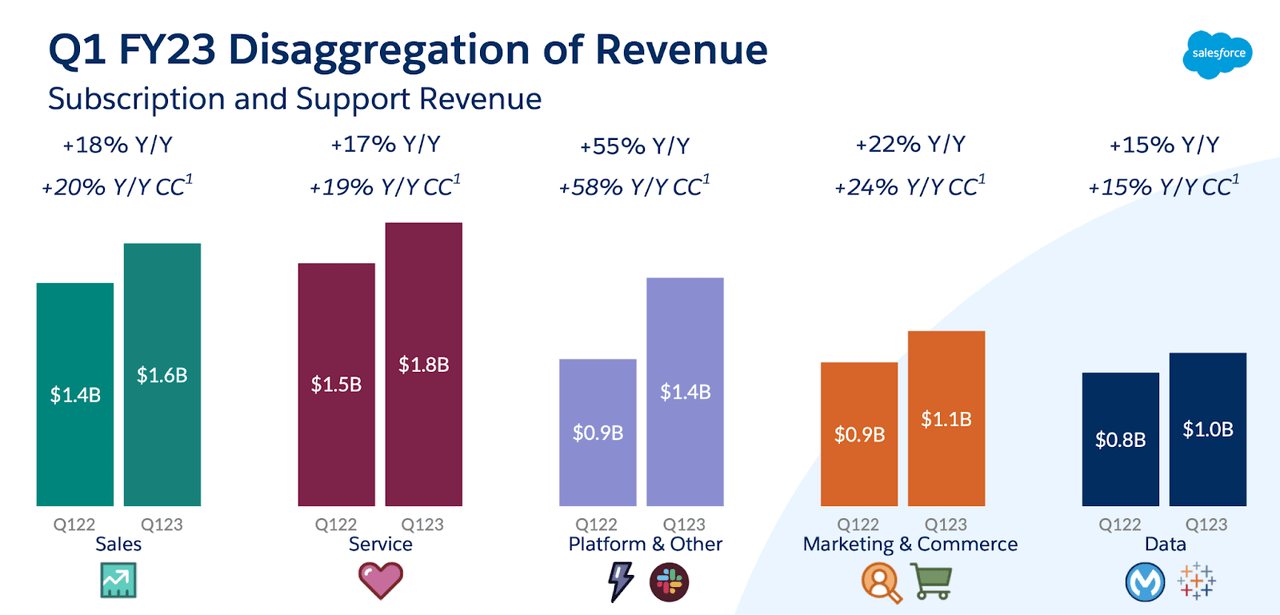

We can see below that it is still benefiting from its acquisition of Slack last year. Over the years, CRM has been able to sustain 20+% growth rates through opportunistic acquisitions of fast-growing companies.

FY23 Q1 Presentation

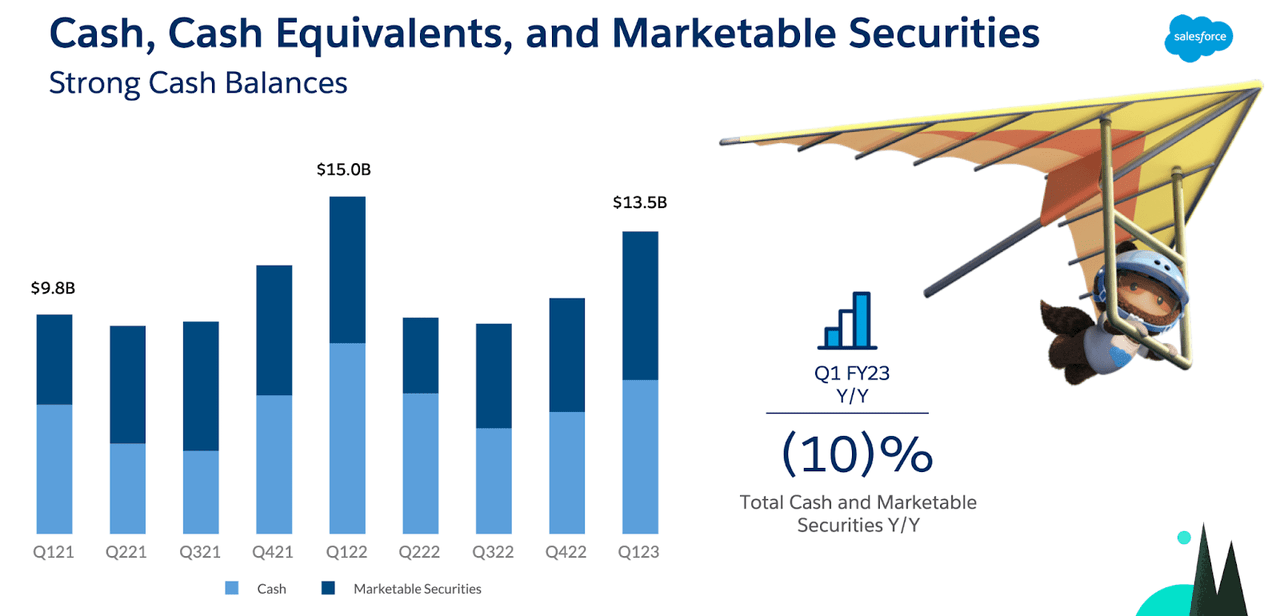

CRM ended the quarter with $13.5 billion of cash and marketable securities versus $10.6 billion of debt.

FY23 Q1 Presentation

Net cash makes up 1.7% of the market cap. Some readers might scoff at that number, as many tech stocks now see net cash making up 20% or even 30% of their market caps. For CRM, however, one should look at the glass half full. This company has shown a willingness to lever its balance sheet for M&A. Oracle (ORCL) has debt to EBITDA in the 3x range. If CRM allowed leverage to rise that high, then it could theoretically raise over $20 billion in debt capital – which coupled with some stock should be more than enough to fund M&A in the sector.

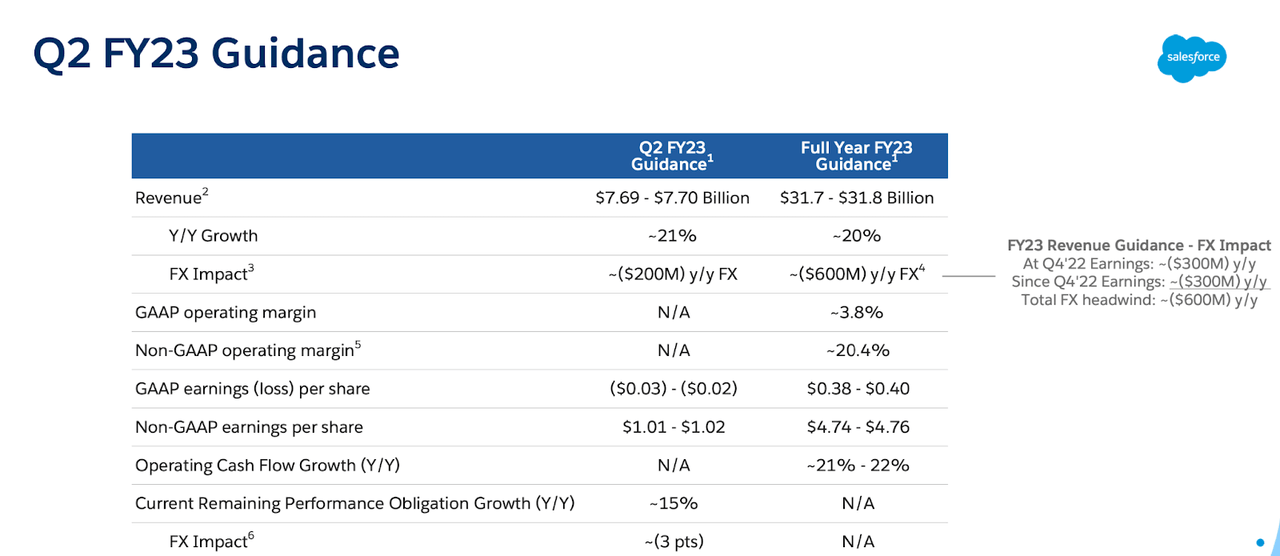

Looking forward, CRM has guided for 21% revenue growth this coming quarter and 20% revenue growth for the full year.

FY23 Q1 Presentation

Salesforce Stock Compensation

Amidst the tech crash, I have noticed an increasing disdain for the stock-based compensation seen at tech companies. Fellow Seeking Alpha author Ranjit Thomas recently wrote an article stating that CRM was a sell based on elevated stock-based compensation.

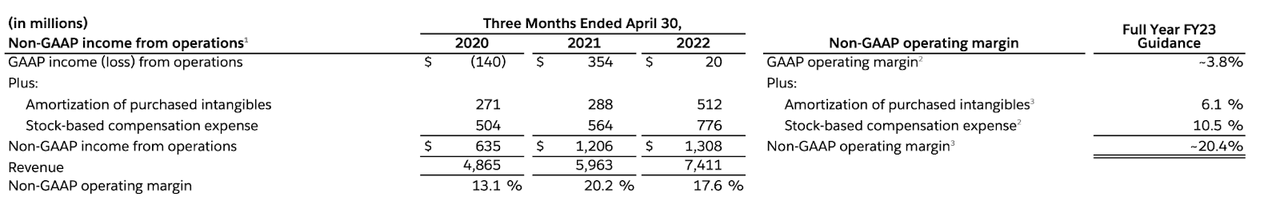

Stock-based compensation indeed makes up a large part of non-GAAP operating margins – as we can see below, it made up 59% of last quarter’s non-GAAP profits.

FY23 Q1 Presentation

Is stock-based compensation bad? Not necessarily. Yes, stock-based compensation inherently leads to dilution, but that is not necessarily bad. Consider the alternative – CRM could instead be compensating its employees solely with cash, but that would place a greater strain on cash flow metrics than issuing stock. From the perspective of the company, stock-based compensation is preferable as compared to all-cash compensation. Thus, when one argues that stock-based compensation is bad, the main issue is actually due with operating expenses itself, not stock-based compensation.

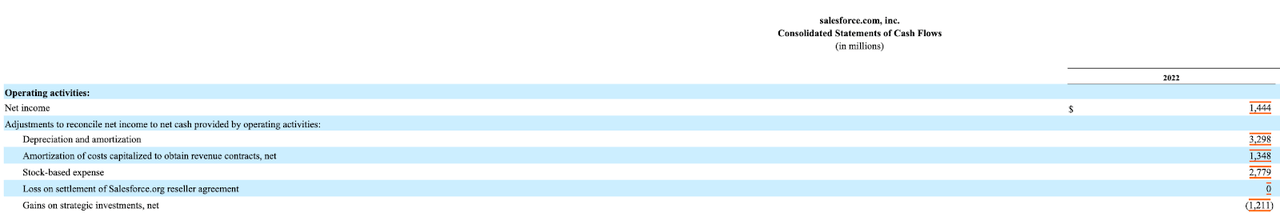

Let’s return back to CRM. As we can see below, CRM is generating cash flow even without including stock-based compensation.

2021 10-K

Capital expenditures were $717 million for the full 2021 year – far lower than depreciation and amortization expenses. Stock-based compensation is helping CRM generate greater positive cash flows, but even excluding it, CRM is still cash flow positive. The only reason why its net cash position is not growing over the years is because the company has been using excess cash on the M&A front. The takeaway is that investors should view stock-based compensation and “normal” cash compensation in the same vein because the negative impact from dilution is offset by the positive impact to cash flow generation.

Is CRM Stock A Buy, Sell, Or Hold?

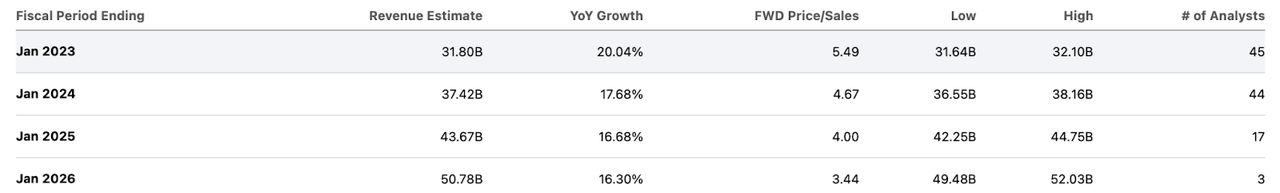

Consensus estimates call for CRM to grow at a 16+% rate over the coming years.

Seeking Alpha

CRM is not generating large margins right now, but it generates an outsized 78% gross margin as its software product can be shared across incremental customers at minimal cost. CRM has not realized strong net margins historically, but that is arguably due to its heavy investment in future growth. I can see CRM sustaining at least a 30% net margin over the long term. Applying a 1.5x price to earnings growth ratio (‘PEG ratio’), I could see CRM trading at 7.2x sales in 2025. That represents a stock price of $270 per share, or 54% potential upside over the next 12 months. The near term risks to this thesis mainly revolve around volatility. Wall Street might not have the same outlook for long term margins nor appetite to pay up for tech stocks. The long term risk is that of competition – growth may stall over the long term if the market becomes saturated with competing products. CRM has worked hard to bolster its portfolio offerings, which should help stave off competition. I rate CRM a buy, though note that there may be more compelling opportunities elsewhere in the tech sector.