RLY ETF: Own This If Inflation Makes A Comeback

DNY59

A few months ago, I wrote a bullish article on the SPDR SSGA Multi-Asset Real Return ETF (NYSEARCA:RLY), suggesting investors own it while inflation expectations are rising. The RLY ETF gives investors a 1-stop exposure to commodities, natural resource equities, and infrastructure assets that should perform well in an inflationary environment.

Although headline inflation has eased in recent months, I believe there are signs that commodity-led inflation may make a comeback, driven by China’s re-opening and Russian energy embargoes. I believe investors should hold the RLY ETF to protect against such a scenario.

Headline Inflation Easing, Are We Out Of The Woods?

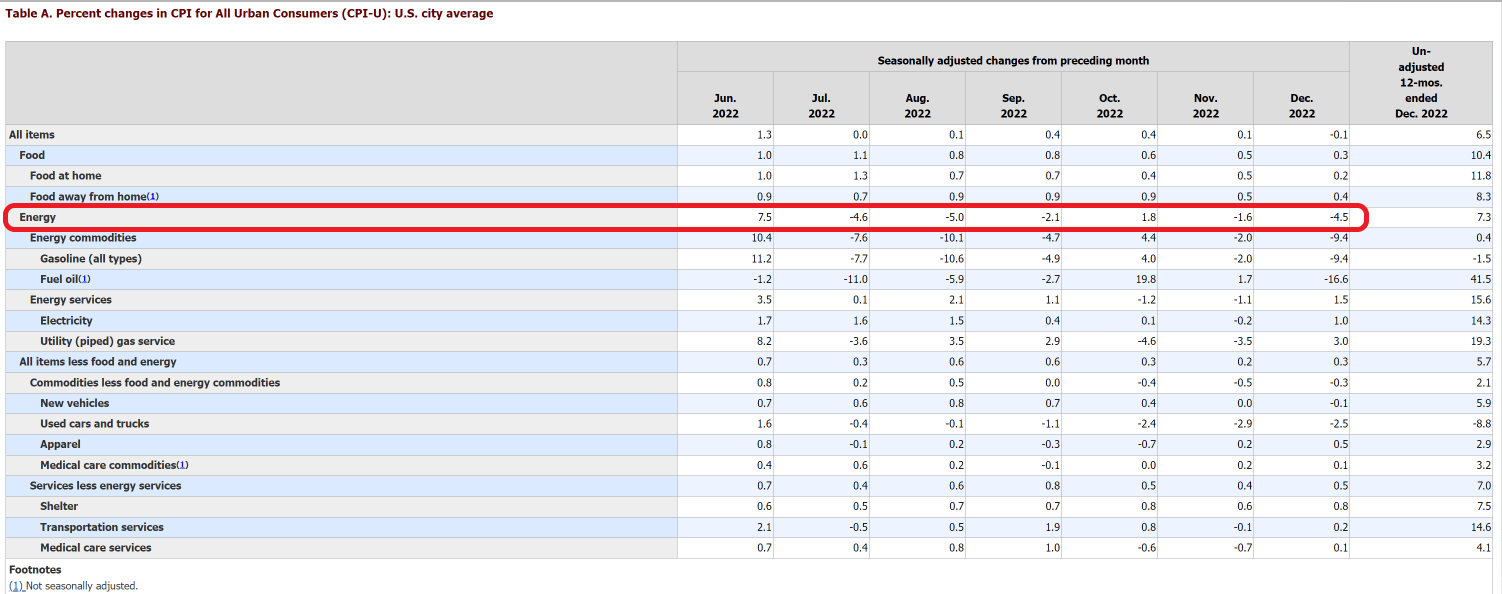

In recent months, we have seen a decline in headline inflation, mostly driven by a precipitous decline in energy prices. According to the BLS data, headline inflation declined sharply, with the December MoM reading coming in at -0.1% (Figure 1).

Figure 1 – Headline CPI inflation declined due to energy prices (BLS)

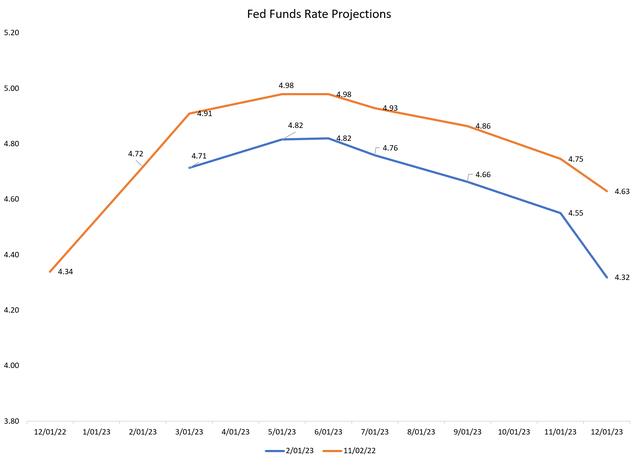

This has given investors a sense of comfort, as easing inflation supports the ‘soft landing’ narrative and gives the Fed flexibility to decrease the pace of its rate hikes to 50 bps in December and 25 bps at the recent February FOMC meeting. In fact, relative to expectations immediately following the November FOMC meeting, investors are now pricing in Fed Funds rate 18 bps lower in mid-2023 and 31 bps lower in late-2023. Incredibly, the market is calling the Fed’s bluff and is pricing in two full rate cuts between May and December.

Figure 2 – Terminal Fed Fund Rate expectations have shifted lower (Author created with data from CME)

Could Inflation Make A Comeback?

However, looking beneath the surface in headline inflation figures, I believe there are troubling signs that inflation could be entrenched and may make a comeback in the coming months.

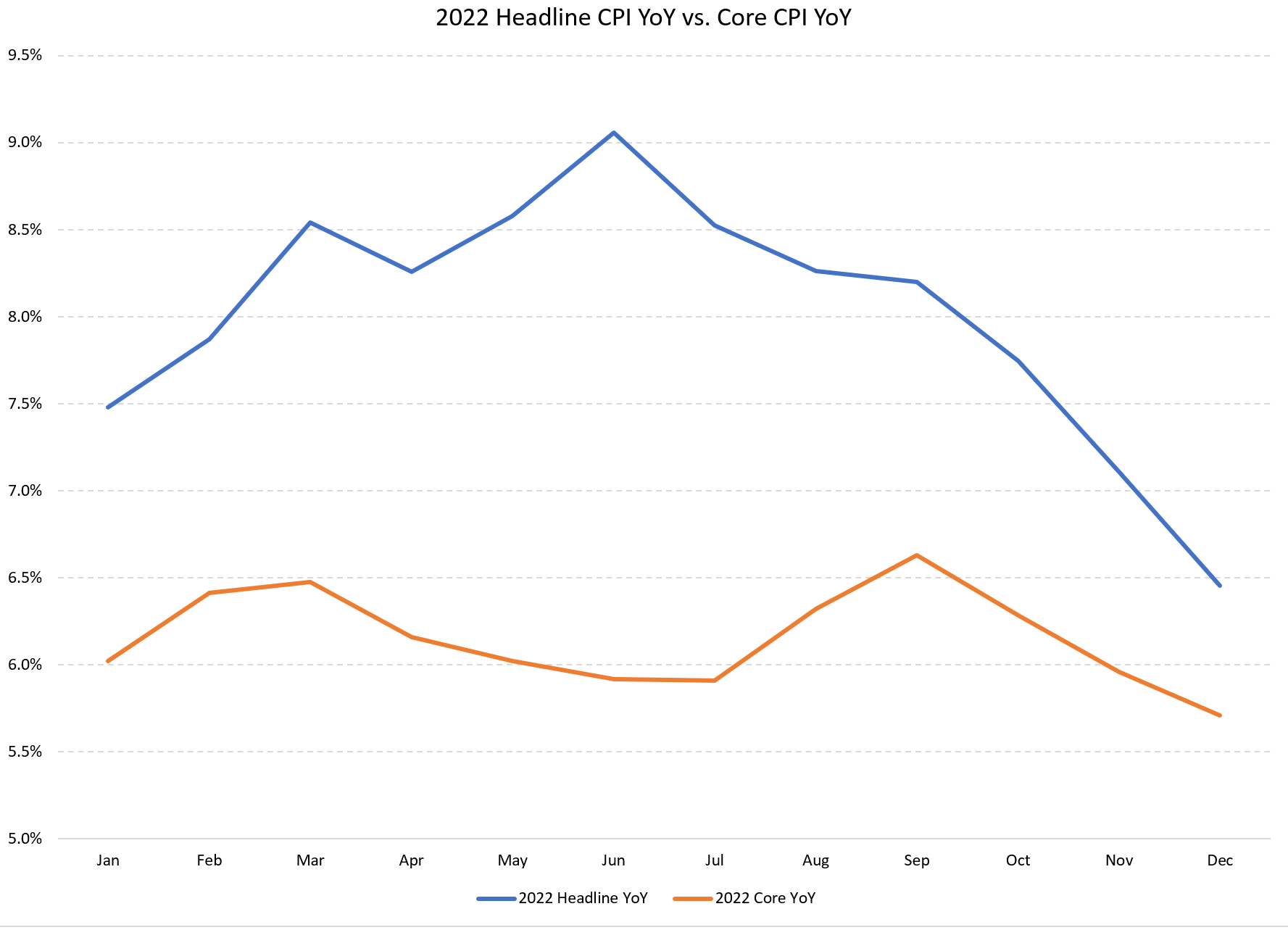

First, if we look at the CPI inflation figures, we can see that while headline has declined rapidly from 9.1% YoY in June to 6.5% YoY in December, the core inflation figure excluding food and energy prices have been much stickier, hovering between 5.5% to 6.5% for the whole year (Figure 3).

Figure 3 – Headline vs. Core CPI Inflation (Author created with data from bls)

Furthermore, as I noted above, headline inflation was driven lower by energy prices. But in recent weeks, we have seen energy commodities like gasoline make a strong rebound, climbing 50 cents in a matter of weeks (Figure 4).

Figure 4 – Wholesale gasoline prices (tradingeconomics.com)

China And Russia Driving Energy Rebound

There are two main reasons for the rally in energy prices. First, investors should recall that the Chinese economy was closed for most of 2022 due to its Zero-COVID policies. This caused Chinese oil demand to fall by 390k bopd in 2022, the first decline since 1990. However, since early November, China has been quickly rolling back its Zero-COVID policies, with a goal of fully re-opening its economy in the coming months. As I wrote in a recent article on the United States Brent Oil Fund (BNO), one of the largest consequences of a Chinese re-opening is going to be a surge in demand for energy commodities like crude oil and gasoline:

China’s re-opening has lifted the prospects for crude oil, with the International Energy Agency (“IEA”) recently forecasting in its January outlook report that China’s re-opening could lift oil demand by 1.9 million barrels per day to a record 101.7 mmbpd, with more than half of the growth coming from China. Similarly, OPEC is expecting Chinese demand to grow by more than 500,000 bpd in 2023.

On the supply side, an ongoing embargo on Russian crude oil and oil products recently went into effect and is tightening energy markets, especially for fuels like diesel and gasoline. Importantly, fuel from Russia that was destined for Europe would need to be diverted or curtailed, requiring replacements to be imported from countries like the U.S. This will drive up American fuel prices.

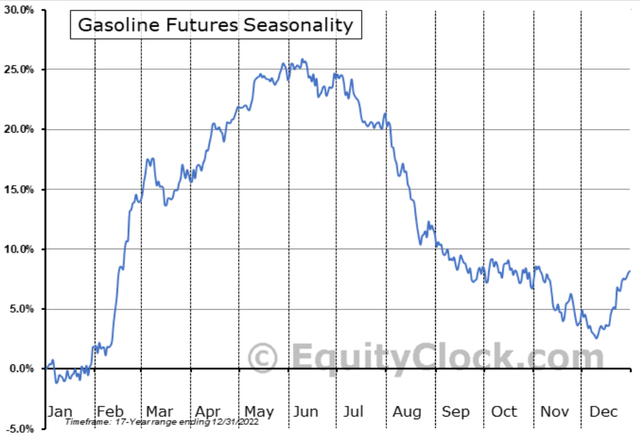

The net effect of increased Chinese demand and reduced Russian supply is a going to be a tightening of global energy markets, forcing up fuel prices at the pump for American consumers. This tightening will coincide with seasonality in gasoline prices as traders start to anticipate the summer driving season (Figure 5).

Figure 5 – Gasoline seasonality (equityclock.com)

Therefore, we are likely to see a resumption of energy inflation within CPI in the coming months.

Chinese Demand For Commodities May Surge In Coming Months

In addition to energy, I believe the Chinese re-opening story will have large impacts on many other commodities like iron ore and copper. Already, we have seen iron ore prices rally by more than 60% since the China re-opening story broke, as many investors expect a massive round of fiscal stimulus to jump start the moribund Chinese economy (Figure 6).

Figure 6 – Iron ore has rebounded 60% since November (tradingeconomics.com)

In the coming months, we may see the return of commodity-driven inflation as we lap the basing effects of 2022 (i.e. while iron ore prices are down YoY currently, if prices stay constant, YoY figures will begin to turn positive by July).

RLY Poised To Benefit From Commodity-Led Inflation

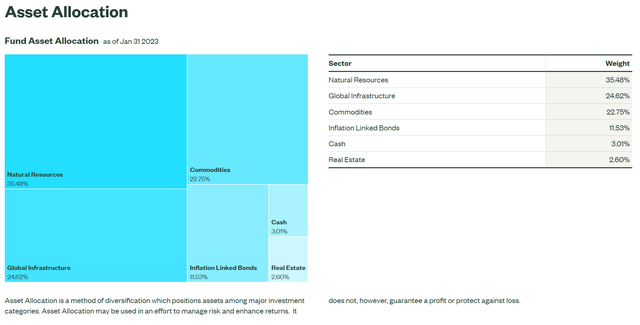

If commodity-led inflation makes a comeback in the next few quarters, the RLY ETF could be poised to benefit as its portfolio has 35% allocated to natural resource equities and 23% allocated to commodities, in addition to a 12% allocation to inflation linked bonds. Note, inflation linked bonds may not benefit in a rising inflation environment if central banks continue to raise interest rates to combat inflation. For more details on why this may be the case, please refer to some of my prior articles on the subject. Figure 7 shows RLY’s asset allocation.

Figure 7 – RLY asset allocation (ssga.com)

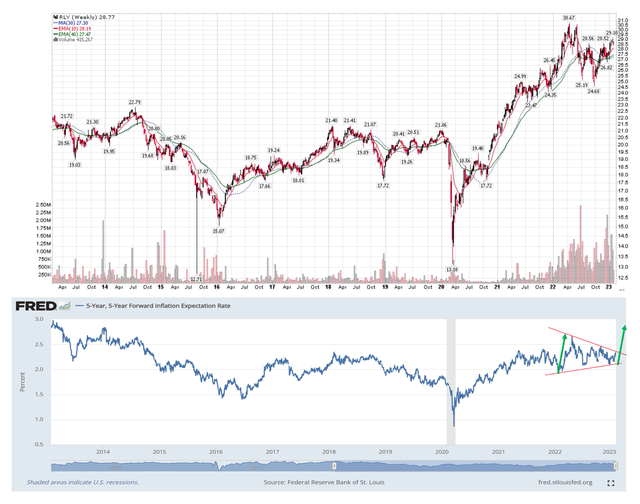

Technicals Suggest A Resumption Of Inflation

In my prior article, I suggested investors monitor the 5-Year, 5-Year Forward Inflation Expectation Rate (“5Yr Breakeven”) to see whether they should own the RLY ETF. When 5Yr Breakevens are rising, that means inflation expectations are rising, and commodities and natural resource equities should do well (Figure 8). Looking at the breakeven rate, it appears to be forming a bullish symmetrical triangle that is resolving to the upside. This suggests further upside is to be expected from the RLY ETF.

Figure 8 – RLY vs. 5Yr Breakeven rates (Author created with price chart from stockcharts.com and breakeven rates from St. Louis Fed)

Risk To RLY

While I have presented a bullish case in inflation and RLY, there is also a bear case. If the Fed is successful in taming inflation and core inflation figures return to the Fed’s 2% target, then we should expect declines in the RLY ETF.

Conclusion

The RLY ETF gives investors 1-stop exposure to commodities, natural resource equities and infrastructure assets that should perform well in an inflationary environment. Although headline inflation has eased in recent months, I believe a case can be made that commodity-led inflation may make a comeback, driven by China’s re-opening and Russian energy embargoes. I believe investors should hold the RLY ETF to protect against such a scenario.