Rightmove Stock: Strong, Undervalued Business (OTCMKTS:RTMVF)

yujie chen

Introduction

We review our Rightmove PLC (OTCPK:RTMVY) investment case ahead of H1 2022 results scheduled for July 29. Rightmove’s share price is currently 26% below its peak last December and 10% lower than a year ago:

|

Rightmove Share Price (Last 1 Year)  Source: Google Finance (07-Jul-22). |

We upgraded our rating on Rightmove to Buy in October 2021. Since then shares have lost 10% (after dividends). (Our Buy ratings during parts of 2019 and 2020 were more successful, generating gains of 30% and 41%, respectively.)

We believe Rightmove to be one of the highest-quality businesses listed in the U.K. and capable of growing its earnings at 10%+ sustainably. Business trends have continued to be positive since our upgrade, but shares have de-rated to a 28x P/E in the past few months, likely on concerns about U.K. macro. We believe any downturn would have only a limited and short-term impact on Rightmove earnings. Our forecasts show a total return of 65% (15.8% annualized) by 2025 year-end, and the Dividend Yield is 1.3%. Buy.

Rightmove Buy Case Recap

Rightmove is the #1 residential property listings website in the U.K. Its revenues consist primarily of subscription fees from estate agents and developers, with different fees based on package tiers, products purchased, the number of branches and volumes.

|

Example Rightmove Products  Source: Rightmove estate agent membership guide (Apr-22). |

Our October 2021 upgrade assumed Rightmove earnings would continue to recover from COVID-19. Lockdown and other restrictions were significantly negative for the property market, and Rightmove supported estate agents with discounts of up to 75% for much of 2020, resulting in declines of 29% in revenues and 37% in EBIT that year.

Our investment case has assumed that, beyond the recovery:

- Rightmove will retain its dominance in U.K. residential property listings, helped by the network effect on its platform and the quality of its product features

- Revenues will grow at high-single-digit annually, driven by continuing Average Revenue Per Agent (“ARPA”) growth from both price and customer upgrades, as well as a small growth in the number of customers

- Rightmove has continued to enhance its value-add in the sale and letting processes by adding new features to its listing product and by expanding into adjacencies such as tenant referencing, landlord insurance and mortgages

- EBIT margin should recover to 75% and remain stable thereafter, as Rightmove is a platform business with low incremental unit costs and natural operational leverage

- Management to continue to return all earnings to shareholders in dividends and buybacks

- Shares to trade at a P/E multiple of 31x at exit, compared to the then 33.6x (relative to 2019 EPS)

Rightmove earnings have recovered strongly since our upgrade, but the stock has de-rated significantly from its peak in December 2021. Part of the de-rating can be attributed to concerns about worsening U.K. macro, but we believe any negative impact on Rightmove would be limited and short-term.

Earnings Growth Has Resumed After COVID-19

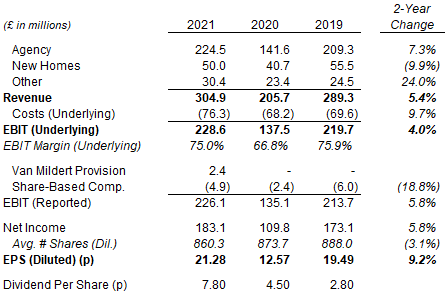

Rightmove ultimately finished 2021 with revenues that were 5.4% above 2019. Underlying EBIT margin returned to 75.0%, significantly above 2020’s 66.8%, and Underlying EBIT was 4.0% above 2019:

|

Rightmove Profit & Loss (2021 vs. Prior Years)  Source: Rightmove results releases. |

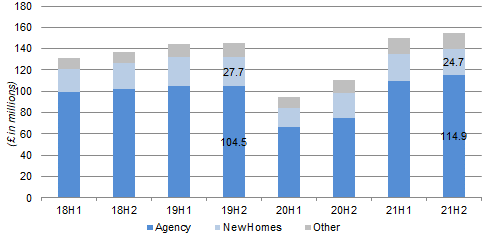

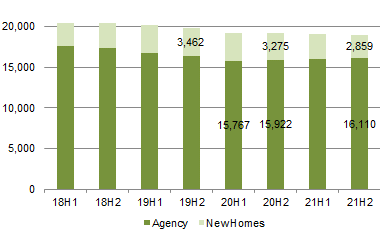

Rightmove revenues bounced back quickly from the trough in H1 2020. Revenues were 4.2% higher than the 2019 level in H1 2021, accelerating to 6.6% higher in H2 2021. Agency revenues were the strongest, being 9.9% higher than in 2019, offset by New Homes revenues still being 10.7% lower:

|

Rightmove Revenues by Half-year (Since 2018)  Source: Rightmove results releases. |

“Other” revenues in 2021 were £5.8m higher than in 2019, with over half of the increase from the newer Commercial Real Estate and Data Service businesses, each of which has grown by about 20% in two years.

2021 represented an incomplete recovery for Rightmove. While the U.K. residential property market was buoyant, helped by a temporary reduction in transaction Stamp Duty, this was actually a slight negative for Rightmove: Strong buyer demand made it harder for new estate agents to find enough properties to set up shop, but easier for property developers to sell their inventory without using property listings sites like Rightmove.

In any case, Rightmove’s market position remained strong, underlying ARPA and customer trends are healthy, and EPS is likely to grow by 10%+ in 2022.

Rightmove’s Continuing Market Dominance

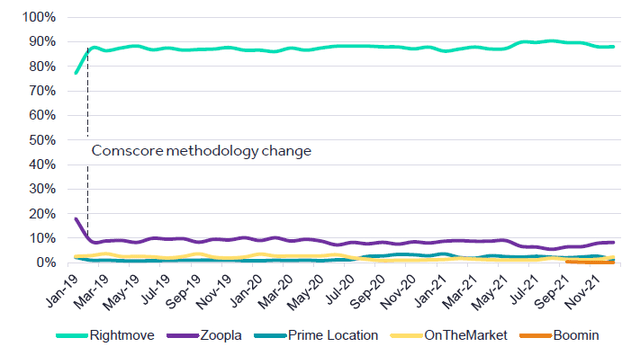

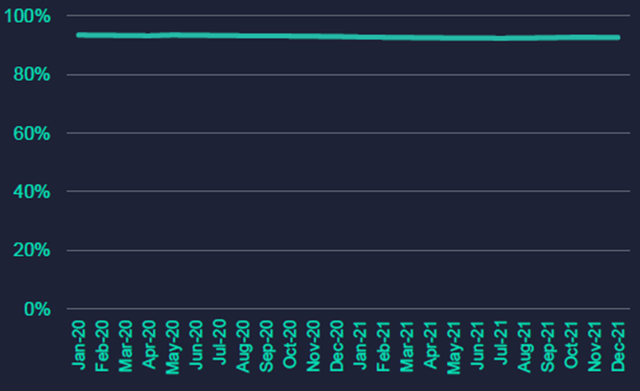

Rightmove’s market share among consumers, measured in terms of time spent, has remained dominant at near 90%:

|

Share of Consumer Time Spent by Platform (Since 2019)  Source: Rightmove results presentation (2021). NB. Data is based on comScore (time spent on all platforms). |

Similarly, Rightmove’s market share among estate agents, measured in terms of percentage of inventory listed on its site, has remained around the mid-90s percentage:

|

Rightmove Agency Stock Penetration (Since 2020)  Source: Rightmove results presentation (2021). |

We expect Rightmove to remain the dominant market leader in the future.

Positive Average Revenue Trends

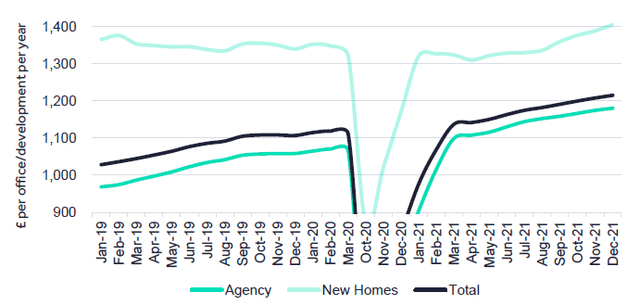

Rightmove’s ARPA has resumed growing in both segments in early 2021, with Agency ARPA growth accelerating from August 2021 onwards:

|

Rightmove 6-Month Trailing ARPA (Since 2019)  Source: Rightmove results presentation (2021). |

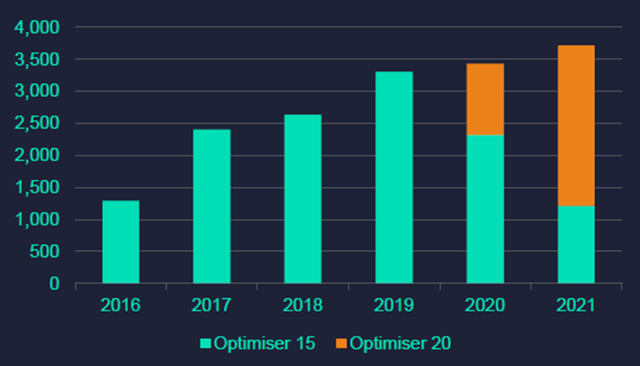

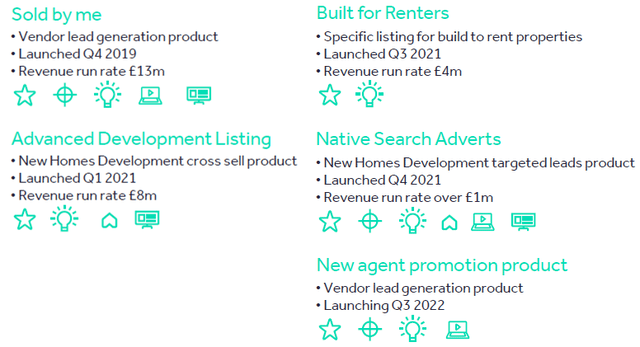

Package tier upgrades have continued to be a key driver of ARPA growth. A significant number of Agency customers have upgraded to Optimiser 2020 in the past two years (representing an average ARPA uplift of £300), and Rightmove has been in the process of retiring the older Optimiser 15 during 2022 (likely generating more upgrades).

|

Rightmove Optimiser Customer Numbers (2016-21)  Source: Rightmove results presentation (2021). |

The growth from new products has continued, with run-rate revenues continuing to grow for products launched before H1 2021 (like Sold By Me) while more new products are being launched (like Built for Renters):

|

Example Rightmove New Products  Source: Rightmove results presentation (2021). |

For 2022, management has guided to a £95-105 increase in APRA, representing a year-on-year growth of 8-9%, with approximately 40% of this to come from price increases, and the rest from upgrades and additional product purchases.

Positive Customer Number Trends

Rightmove customer number trends have started to turn positive.

The number of Agency customers troughed in H1 2020 (after declining since H2 2017) and has been rising since. However, the number New Homes customers fell again through 2021:

|

Rightmove Customer Count by Type (Since 2018)  Source: Rightmove results releases (2021). |

For 2022, management has guided to a “small growth” in the number of Agency customers, though the number of New Homes customers is expected to decline in H1 and “then flatten in H2”.

2022 Guidance & Long-Term Earnings

Rightmove’s guidance for 2022 guidance include:

- A “small growth” in Agency customers

- New Homes customers to decline in H1 then flatten in H2

- APRA to grow by £95-105 (8-9%)

- EBIT margin to be 74-75%

Including share buybacks, we believe EPS can grow at 10%+ in 2022.

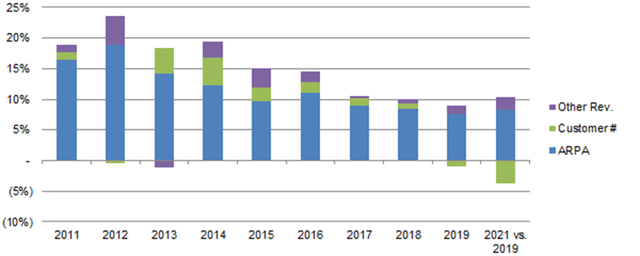

Beyond 2022, we expect APRA growth to continue to be near 10% and the total number of customers to resume positive growth, which on a stable EBIT margin should mean an EBIT growth of near 10% too:

|

Rightmove Revenue Growth by Component (2011-2019)  Source: Rightmove company filings. |

Including share buybacks, we believe EPS can grow at 10%+ annually beyond 2022 too.

Limited Impact from Worsening U.K. Macro

U.K. macroeconomics is worsening, as the U.K. faces a unique set of challenges in post-Brexit trade barriers, higher energy costs, a weak currency, political instability, etc.

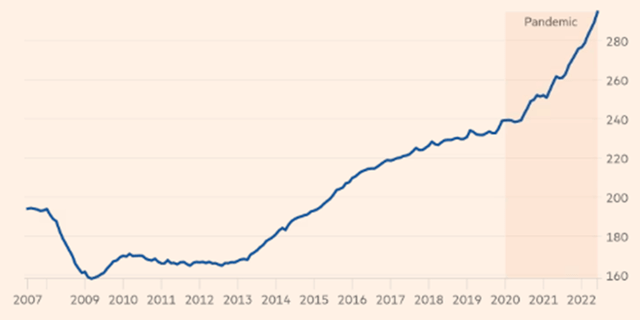

However, U.K. residential property prices have remained strong, with June 2022 recording a 13% year-on-year increase (the fastest since 2004) and an 1.8% increase month-on-month (the fastest since early 2007):

|

Average U.K. House Price (£ thousands)  Source: Financial Times (07-Jul-22). |

In the event of an economic downturn, we expect any impact on Rightmove to be limited, as its products are mission-critical to estate agents and a relatively limited portion of their revenues (estimated at 6% on average). The sharp decline in 2020 was an exception, created by the unprecedented nature of COVID lockdowns, but the rapid recovery in 2021 demonstrated that even sharp declines would be short-term in nature.

Rightmove Valuation

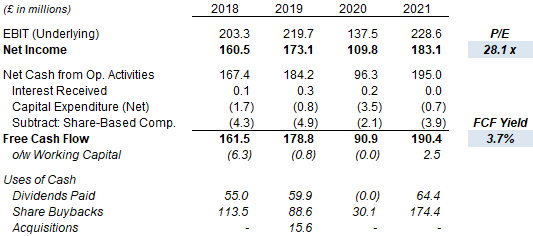

At 597.8p, Rightmove stock is trading at a 28.1x P/E and a 3.7% Free Cash Flow Yield:

|

Rightmove Earnings, Cashflows & Valuation (Since 2015)  Source: Rightmove company filings. |

Rightmove paid a dividend of 7.8p for 2021, representing a Dividend Yield of 1.3%. The Payout Ratio was 37%, and management expects to grow dividends in line with EPS.

Management has a policy to return all earnings to shareholders, with approximately one third to be done in dividends and two thirds in buybacks.

Rightmove Return Forecasts

Actual 2021 EPS was 2% above our forecasts.

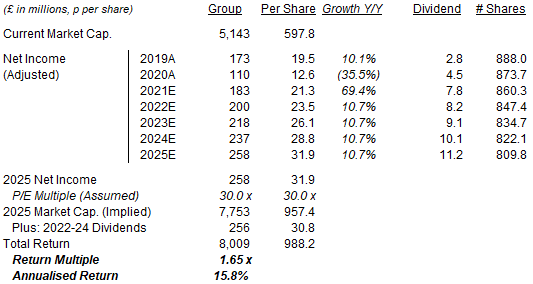

We extended our forecasts to 2025 and keep most of our assumptions unchanged:

- 2022 Net Income of £200m (was £198m)

- Thereafter, Net Income to grow at 9% annually (unchanged)

- Share count to fall by 1.5% annually (unchanged)

- Dividends to be based on a 35% Payout Ratio (unchanged)

- 2025 year-end P/E of 30.0x (was 31.0x)

We are not explicitly modelling a downturn in the U.K., as we believe the negative impact on Rightmove earnings would likely be quickly offset by stronger growth in subsequent years.

Our 2024 EPS forecast of 28.8p is virtually unchanged from before (28.9p). Our 2025 EPS forecast of 31.9p implies a 2019-25 EPS CAGR of 8.6%:

|

Illustrative Rightmove Returns  Source: Librarian Capital estimates. |

With shares at 597.8p, we expect a total return of 65% (15.8% annualized) by 2025 year-end, in just under 3.5 years.

Is Rightmove A Buy? Conclusion

Rightmove shares have fallen 26% from their December 2021 peak, de-rating to a 28x P/E, likely due to concerns about U.K. macro. It is one of the highest-quality listed businesses in the U.K., and earnings have quickly recovered from the disruption by lockdowns in 2020.

Rightmove remains dominant in U.K. residential property listings, and trends are positive in average revenue and customer numbers. We believe EPS can grow at 10%+ sustainably, the stock’s P/E should re-rate from 28x to 30x and, and the Dividend Yield is 1.3%.

With shares at 597.8p, we expect a total return of 65% (15.8% annualized) by 2025 year-end. We reiterate our Buy rating on Rightmove PLC stock.