Recession Is Priced In; Stagflation Is Not

SERSOL

A paradigm has emerged in the finance world that bad news for the economy, even an impending recession, means good news for markets. The rationale being that, after sufficient pain, the Federal Reserve will revert back to easing monetary policy.

I agree with the above prognosis. However, the market appears to be betting that recession will quash inflation. On this issue, I’m not so sure.

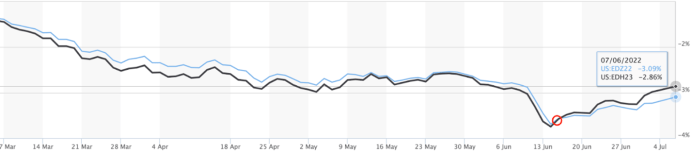

To see this, first take a look at the Dec 22 and Mar 23 Eurodollar futures:

MarketWatch

They inverted in June. In layman’s terms, the market is predicting the Fed will cut rates in Q1 of 2023, in contradiction with FOMC estimates.

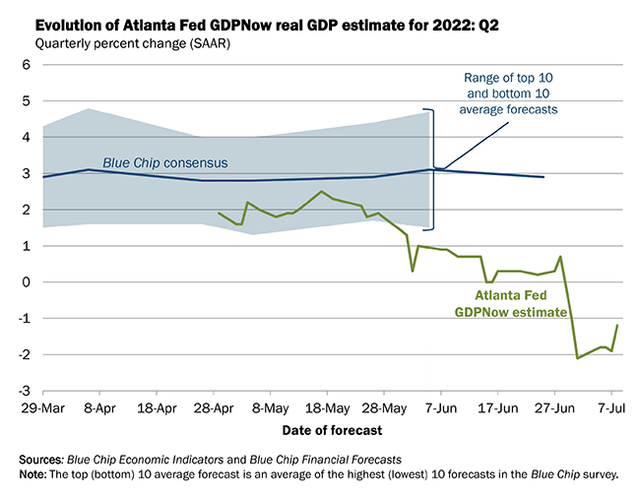

So why is the marketing disagreeing with those who actually control interest rates? The shift coincides with a cascade of increasingly negative economic data, summarily expressed in the Atlanta Fed’s GDPNow estimate:

Atlanta Fed’s GDP estimate turned negative in mid-June. (Atlanta Fed)

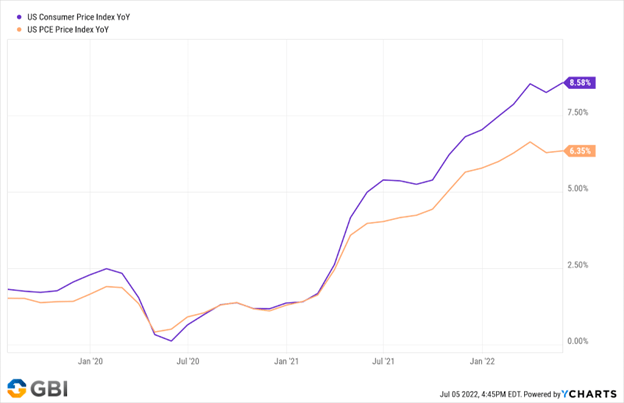

Their estimate is now comfortably in negative territory. If this pans out, the US economy will officially be in recession. Yet neither CPI nor PCE have declined to any meaningful degree:

Ycharts

Past Fed Chair Paul Volcker set the precedent that recession can cure inflation, and since that time economist take this recession-inflation relationship for granted. But we forgot how long it took. Under Volcker, the Fed Funds Rate sustained a 10-handle for roughly three years! And now, the market is already expecting Powell to cave with an FFR that has yet to reach 2%? Perhaps even more crucial, Volcker had the added tailwind of the fiscally conservative Reagan Administration at his side. While I can’t predict what the Biden Admin will do, I look at CA Governor Gavin Newsom handing out $1050 checks as a ‘solution’ to rising gas costs, and I struggle to see how inflation remains tame in that environment.

Placing importance on fiscal policy is something that champions of the controversial Modern Monetary Theory have been warning about for years. According to them, fiscal policy is arguably more important than monetary policy when it comes to inflation. So if a pivot back to quantitative easing does occur in such a short time frame and is exacerbated by a fiscally loose Biden Admin, stagflation is a very real possibility.

The market hasn’t gotten the memo.

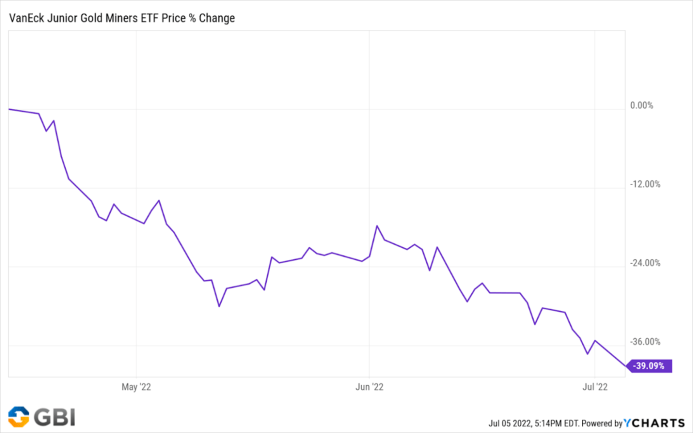

Gold, which ought to be a preferred stagflation asset as its demand is less tethered to real economic activity than virtually all other commodities, has taken quite the beating. Look at the 3-month chart for VanEck’s Junior Gold Miners ETF (GDXJ):

Ycharts

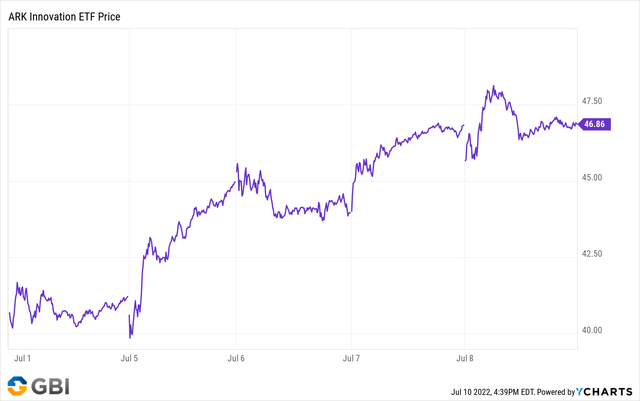

The GDXJ made new 52-week lows last week, ending 3.85% down. Meanwhile, Cathie Wood’s ARK Innovation ETF (ARKK) rallies 16.32% on the week! A clear sign that traders anticipate a “return to normal” when it comes to both monetary policy and inflation:

Ycharts

Last week’s ARKK action may be partially attributed to profit taking by the shorts. That said, I’ve spoken to fund managers who are predicting strongest rallies to be in unprofitable tech names given they took the biggest beatings. Maybe in the short run, but this prediction will not pan out in the long run.

Let’s discuss why growth performs poorly in a stagflation environment.

When the Fed does pivot, if inflation has not yet been reigned in, while the drop in Treasury yields will elevate all asset prices, consumers will not have the disposable income to spend on services offered by most big growth names – They will not be purchasing the $121k Tesla (an ARKK holding) Model X and instead opt for the comparable Mercedes GLC at $54k. They will trim down entertainment subscriptions like Netflix, Hulu, Roku (an ARKK holding), Disney+, etc. They will spend less shopping online, reducing the need for services like Square (an ARKK holding) – Rising food, gas, shelter, and clothing costs will absorb too much working class cash.

In such an atmosphere, demand for a true inflation hedge will manifest. Crypto is superior to gold at subverting authority, but it’s no safe haven. Folks struggling financially will not be able to stomach the volatility. Crypto outflows may be another boon for gold.

I’m not sure when the market will come to this realization. It may take a few more CPI prints to set in. Wednesday’s print will be important to watch.

I took out some call options on GDXJ. Historically, July is a good month for stocks so the timing was hard to pass up. Then again, the Fed may “break something” in the meantime so I’m maintaining majority cash (for now).

Long term, I’m looking at gold, oil, and agricultural commodities. Commodities like silver, copper, and lumber could be hit hard in the recessionary elements of stagflation. Gold, being largely a monetary asset, has some protection against this. As for oil and agriculture, well, people have to eat and travel. This is just a fact of life.