Radware: Best Near-Term InfoTech Stock Buy Now (NASDAQ:RDWR)

Pgiam/iStock via Getty Images

Investment Thesis

Careful comparisons urge a buy of Radware Ltd. (NASDAQ:RDWR).

21st Century paces of change in technology and rational behavior (not of emotional reactions) seriously disrupt accepted productive investment strategy of the 20th century.

One required change is the shortening of forecast horizons, with a shift from the multi-year passive approach of buy&hold to the active strategy of specific price-change target achievement or time-limit actions, with reinvestment set to new nearer-term targets.

That change avoids the irretrievable loss of invested time spent destructively by failure to recognize shifting evolutions like the cases of IBM, Kodak, GM, Xerox, GE, and many others.

It recognizes the evolutions in medical, communication, and information technologies and enjoys their operational benefits already present in extended lifetimes, trade-commission-free investments, and coming in transportation ownership and energy usage.

But it requires the ability to make valid direct comparisons of value between investment reward prospects and risk exposures in the uncertain future. Since uncertainty expands as the future dimension increases, shorter forecast horizons are a means of improving the reward-to-risk comparison.

That shortening is now best attended at the investment entry point with Market-Maker expectations for coming prices. When reached, they are then reintroduced at the exit/reinvestment point as the term of expectations for the required coming comparisons as decisions step in to move forward.

The MM’s constant presence, extensive global communications, and human resources dedicated to monitoring industry-focused competitive evolution sharpen MM price expectations, essential to their risk-avoidance roles.

Their roles requiring firm capital be only temporarily risk-exposed are hedged by derivative-securities deals to avoid undesired price changes. The deals’ prices and contracts provide a window of sorts to MM price expectations.

Information technology via the Internet makes investment monitoring and management time and attention efficient despite its increase in frequency.

Once an investment choice is made and buy transaction confirmation is received, the target-price GTC sell order for the confirmed number of shares at the target price or better should be placed. Keeping trade actions entered through the Internet on your lap/desk-top or cell phone should avoid trade commission charges. Your broker’s internal system should keep you informed of your account’s progress.

Your own private calendar record should be kept of the date 63 market days (or 91 calendar days) beyond the trade’s confirmation date as a time-limit alert to check if the GTC order has not been executed. If not, then start your exit and reinvestment decision process.

The 3 months’ time limit is what we find to be a good choice, but may be extended some if desired. Beyond 5-6 months, time investments start to work against the process and are not recommended.

For investments guided by this article or others by me target prices will always be found as the high price in the MM forecast range.

Description of Equity Subject Company

“Radware Ltd., together with its subsidiaries, develops, manufactures, and markets cyber security and application delivery solutions for applications in cloud, physical, and software-defined data centers worldwide. The company sells its products primarily to independent distributors, including value-added resellers, original equipment manufacturers, and system integrators. Radware Ltd. was founded in 1996 and is headquartered in Tel Aviv, Israel.”

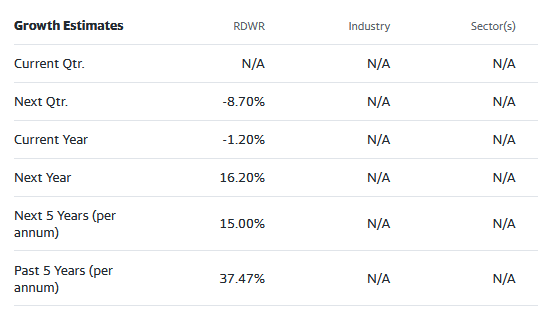

Source: Yahoo Finance

Yahoo Finance

These growth estimates have been made by and are collected from Wall Street analysts to suggest what conventional methodology currently produces. The typical variations across forecast horizons of different time periods illustrate the difficulty of making value comparisons when the forecast horizon is not clearly defined.

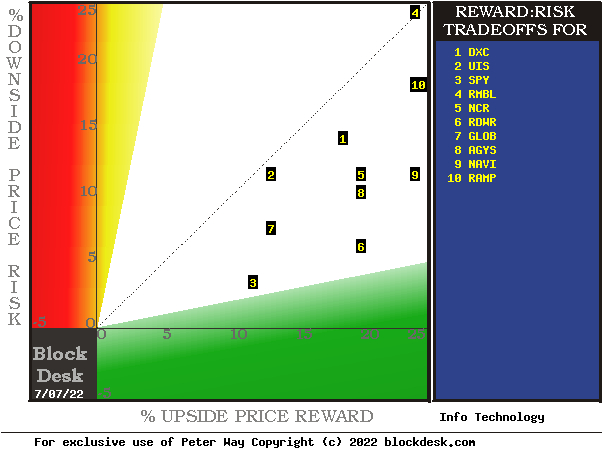

Risk and Reward Balances Among RDWR Competitors

Figure 1

blockdesk.com

(used with permission)

The risk dimension is of actual price drawdowns at their most extreme point while being held in previous pursuit of upside rewards similar to the ones currently being seen. They are measured on the red vertical scale. Reward expectations are measured on the green horizontal scale.

Both scales are of percent change from zero to 25%. Any stock or ETF whose present risk exposure exceeds its reward prospect will be above the dotted diagonal line. Capital-gain-attractive to-buy issues are in the directions down and to the right.

Our principal interest is in RDWR at location [6], just above the green area marking reward to risk trade-offs at a 5 to 1 ratio. A “market index” norm of reward~risk tradeoffs is offered by SPY at [3]. Most appealing by this Figure 1 view for wealth-building investors is RDWR.

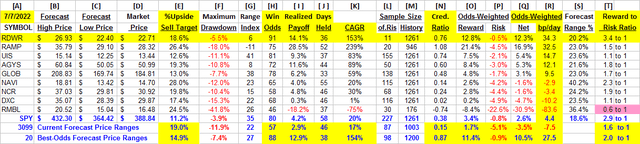

Comparing Competitive Features of Info-Technology Providers

The Figure 1 map provides a good visual comparison of the two most important aspects of every equity investment in the short term. There are other aspects of comparison which this map sometimes does not communicate well, particularly when general market perspectives like those of SPY are involved. Where questions of “how likely’ are present other comparative tables, like Figure 2, may be useful.

Yellow highlighting of the table’s cells emphasize factors important to securities valuations and the security RDWR of most promising of near capital gain as ranked in column [R].

Figure 2

(used with permission)

Why Do All This Math?

Figure 2’s purpose is to attempt universally comparable answers, stock by stock, of a) How BIG the prospective price gain payoff may be, b) how LIKELY the payoff will be a profitable experience, c) how SOON it may happen, and d) what price drawdown RISK may be encountered during its active holding period.

Readers familiar with our analysis methods after quick examination of Figure 2 may wish to skip to the next section viewing price range forecast trends for RDWR.

Column headers for Figure 2 define investment-choice preference elements for each row stock whose symbol appears at the left in column [A]. The elements are derived or calculated separately for each stock, based on the specifics of its situation and current-day MM price-range forecasts. Data in red numerals are negative, usually undesirable to “long” holding positions. Table cells with yellow fills are of data for the stocks of principal interest and of all issues at the ranking column, [R]. Fills of pink warn of conditions nor constructive to buys.

The price-range forecast limits of columns [B] and [C] get defined by MM hedging actions to protect firm capital required to be put at risk of price changes from volume trade orders placed by big-$ “institutional” clients.

[E] measures potential upside risks for MM short positions created to fill such orders, and reward potentials for the buy-side positions so created. Prior forecasts like the present provide a history of relevant price draw-down risks for buyers. The most severe ones actually encountered are in [F], during holding periods in effort to reach [E] gains. Those are where buyers are emotionally most likely to accept losses.

The Range Index [G] tells where today’s price lies relative to the MM community’s forecast of upper and lower limits of coming prices. Its numeric is the percentage proportion of the full low to high forecast seen below the current market price.

[H] tells what proportion of the [L] sample of prior like-balance forecasts have earned gains by either having price reach its [B] target or be above its [D] entry cost at the end of a 3-month max-patience holding period limit. [ I ] gives the net gains-losses of those [L] experiences.

What makes RDWR most attractive in the group at this point in time is its ability to produce capital gains most consistently at its present operating balance between share price risk and reward at the Range Index [G]. At a RI of 1, today’s price is at the bottom of its forecast range, with all price expectations only to the upside. Not our expectations, but those of Market-Makers acting in support of Institutional Investment organizations build the values of their typical multi-billion-$ portfolios. Credibility of the [E] upside prospect as evidenced in the [I] payoff at +18% is shown in [N].

Further Reward~Risk tradeoffs involve using the [H] odds for gains with the 100 – H loss odds as weights for N-conditioned [E] and for [F], for a combined-return score [Q]. The typical position holding period [J] on [Q] provides a figure of merit [fom] ranking measure [R] useful in portfolio position preferencing. Figure 2 is row-ranked on [R] among alternative candidate securities, with PPG in top rank.

Along with the candidate-specific stocks, these selection considerations are provided for the averages of some 3,000 stocks for which MM price-range forecasts are available today, and 20 of the best-ranked (by fom) of those forecasts, as well as the forecast for S&P500 Index ETF (SPY) as an equity-market proxy.

Current-market index SPY is not competitive as an investment alternative. Its Range Index of 26 indicates 3/4ths of its forecast range is to the upside, but little more than half of previous SPY forecasts at this range index produced profitable outcomes.

As shown in column [T] of figure 2, those levels vary significantly between stocks. What matters is the net gain between investment gains and losses actually achieved following the forecasts, shown in column [I]. The Win Odds of [H] tells what proportion of the Sample RIs of each stock were profitable. Odds below 80% often have proven to lack reliability.

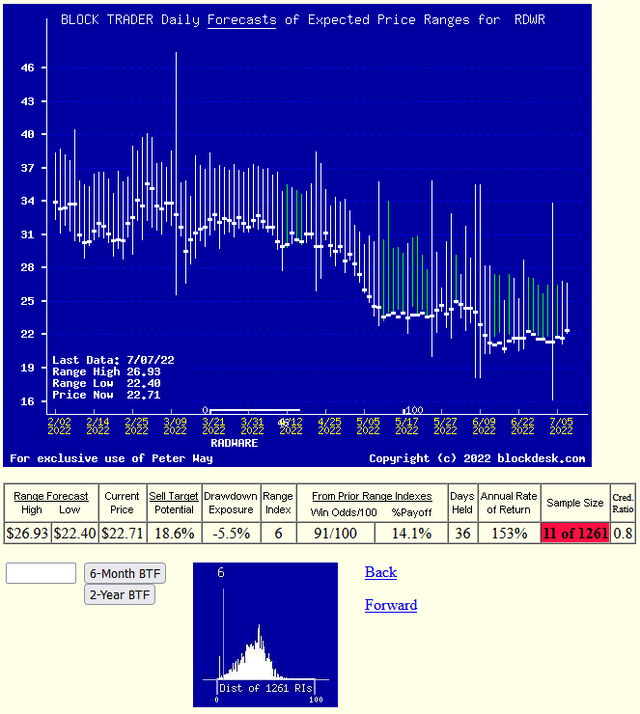

Recent Forecast Trends of the Primary Subject

Figure 3

RDWR has declined in price to a point where hedging actions show that coming-price expectations resist further declines, with Range Index value of only 6% above the MM community’s low and 94% of the range to the upside.

Past experiences at this level have produced profitable position outcomes in 10 out of every 11 opportunities, winners 91% of the time. The small image showing the frequency of RIs makes it clear that the bulk of the past 5 years of daily forecasts have been at higher price and price expectation levels.

Current comparison with other Leveraged ETFs ranks RDWR at the top of the list of such alternative investment prospect candidates.

Conclusion

Radware Ltd. Currently appears the best Information Technology competitor choice of investors desiring near-term capital gain wealth-builders.