Qorvo And Skyworks Stock: Unfavorable Risk-Reward (QRVO, SWKS)

Sundry Photography/iStock Editorial via Getty Images

We are hold-rated on the wireless players Skyworks Solutions (NASDAQ:SWKS) and Qorvo (NASDAQ:QRVO). While many analysts pit the companies against one another, we group them because both are in the wireless industry and are highly exposed to the smartphone market. We believe the wireless industry faces demand headwinds in the smartphone market due to inflationary pressures. We also believe the industry will suffer as the pandemic-driven growth slows down and work-from-home environments disappear. QRVO is down 40% YTD, and SWKS has dipped 44% YTD. We believe SWKS and QRVO offer an unfavorable risk-reward situation. We expect the stock to fall lower still as demand headwinds materialize. In turn, we will reassess the stock when market demand becomes more apparent.

QRVO and SWKS are (too) vulnerable to smartphone markets

SWKS and QRVO’s businesses are heavily exposed to smartphone markets. Both companies operate within the wireless industry and work on connecting the world through Radio Frequency front-end businesses or RF front-end. We are bearish on QRVO and SWKS because we expect both stocks not to work in the near term. We credit the management of both SWKS and QRVO in their effort to diversify their businesses, but RF front-end sales remain stubbornly above 60% of total sales. We believe the pair are exposed to smartphone markets and will face demand declines as inflationary pressures persist.

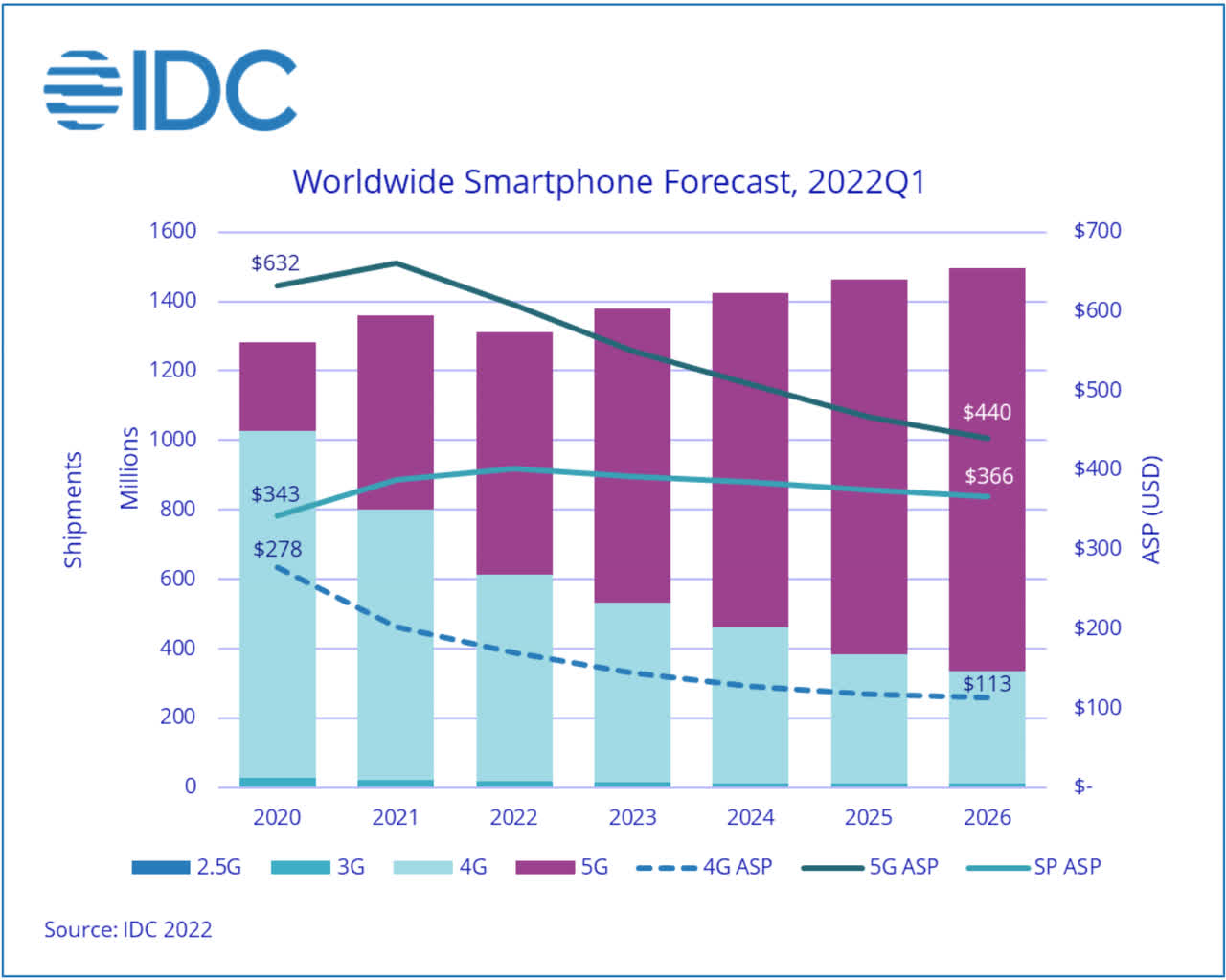

SWKS’s exposure to its mobile segment is estimated at around 73%, with a 51% reliance on Apple (AAPL). QRVO derives 71% of its revenue from mobile products and has a 32% reliance on Apple. We are concerned about SWKS and QRVO’s exposure to mobile segments in the coming quarters as smartphone markets face demand headwinds. The smartphone industry is facing its third consecutive quarter of decline. The following IDC graph shows the decline in smartphone forecasts. We believe SWKS and QRVO are not immune to the repercussions of this decline. IDC’s worldwide quarterly mobile phone tracker forecast reported that shipments of smartphones would decline 3.5% to 1.31 billion units in 2022.

IDC

The smartphone industry faces headwinds due to “weakening demand, inflation, continued geopolitical tensions, and ongoing supply chain constraints.” None of the factors causing the demand headwinds are expected to ease in 2022. In turn, we believe more heartache is ahead for SWKS and QRVO. US smartphone markets are forecasted to settle on a flat growth line with a mere 2% increase in smartphone demand for 2022. Global smartphone companies are adjusting to weakened demand. It is a matter of time until QRVO and SWKS feel the materializing declines in smartphone demand.

SWKS and QRVO are losing their pandemic growth catalyst

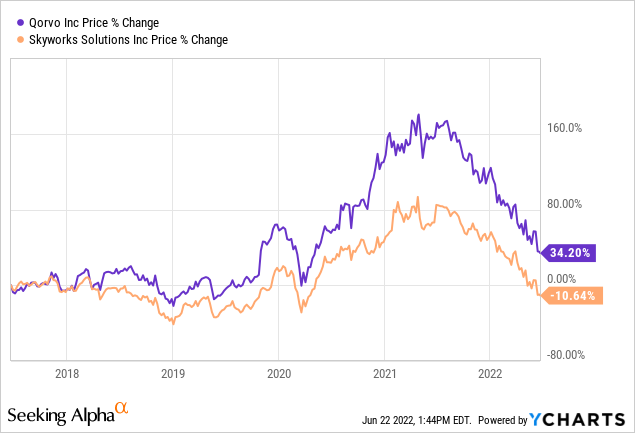

We also believe the semi-peer group, including SWKS and QRVO, will feel demand slowdown as the pandemic ends. The wireless industry peaked during COVID because of the work-from-home environment and intensified need to connect people across the globe. QRVO surged between March 2020 and March 2021 by around 123%. SWKS grew about 139% during the same period. The following chart shows both stocks’ growth over the past five years.

YCharts

We believe the pandemic is almost over and, in turn, expect QRVO and SWKS’s pandemic-driven growth to slow down. We believe pandemic-incited demand is already moderating, and investors will continue to see a downward draft in the wireless industry.

SWKS and QRVO provided weaker-than-expected guidance for 2Q22

SWKS and QRVO both lowered their 5G TAM outlook for 2Q22. QRVO lowered 5G TAM to 650-675M units compared to the previous estimate of 700-750M. SWKS’s management also lowered expectations without mentioning specific numbers. Both companies lowered guidance for their general financial results in the coming quarter. SWKS management has blamed lowered outlooks on China lockdowns. According to Chief Financial Officer Kris Sennesael, management believes China lockdowns would create a $50M headwind for June Quarter. QRVO management expects EPS of $2.00 to $2.50 versus the prior consensus estimate of $2.73.

Stock Performance

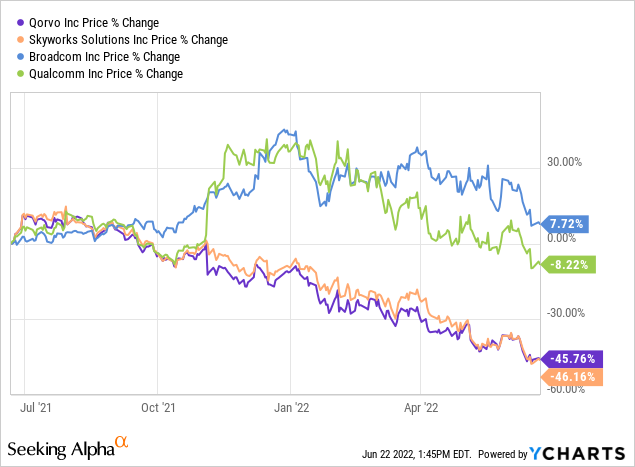

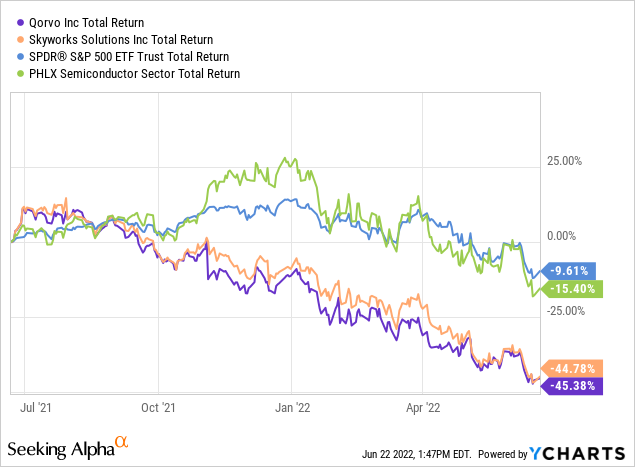

SWKS and QRVO both had unique runs. Both stocks surged in the pandemic starting in 2020 but are dipping as the pandemic ends. SWKS dropped 14% over the past five years, while QRVO grew around 36% during the same period. SWKS dropped 47% over the past year. QRVO also dipped about 46% during the same year. On the YTD, SWKS declined 44% and QRVO 40%. Even at their 52-week high, both stocks could not surpass the $202 level. We believe both stocks have yet to reflect their downside fully. We recommend investors stray clear of the wireless industry at the moment. We expect the downward draft to continue and would not be surprised if stocks dip beyond 52-week lows of $92 for QRVO and $89 for SWKS. The following graphs outline QRVO and SWKS stock performance.

YCharts

YCharts

Valuation

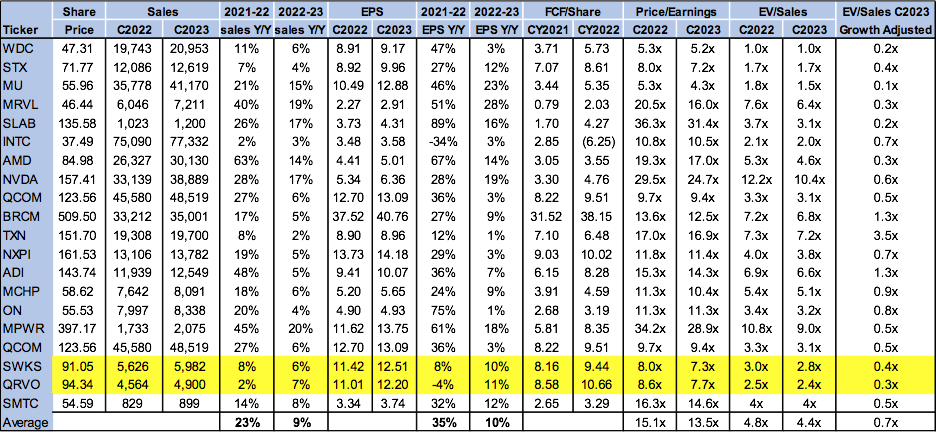

SWKS and QRVO share the same price range. SWKS is trading around $91, and QRVO is trading around $94. Both stocks are relatively cheap. On the P/E basis, SWKS is trading at 7.3X C2023, and QRVO is trading at 7.7x C2023 compared to the 13.5x average peer group. SWKS’s EPS stands at $12.51, and QRVO’s at $12.50. On EV/sales C2023, SWKS is trading at 2.8x and QRVO at 2.4x versus the peer group average of 4.4x. Adjusted growth, SWKS is 0.4x, and QRVO is trading at 0.3x. The following chart illustrates the semiconductor peer group valuation.

Refinitiv & Techstockpros

Word on Wall Street

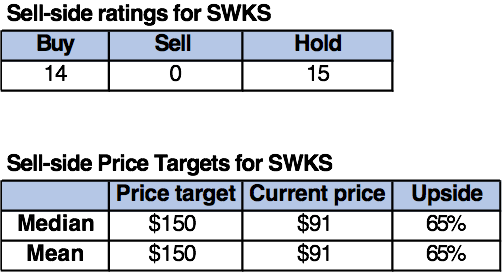

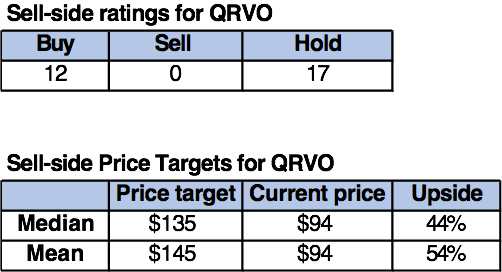

On both SWKS and QRVO, a majority of the analysts are hold-rated. Out of SWKS’s 29 analysts, 14 are buy-rated, 15 hold-rated, and zero sell-rated. QRVO reflects more of the same hold sentiment. Out of the 29 analysts on QRVO, 12 are buy-rated, 17 hold-rated, and zero sell-rated.

SWKS is currently trading at $91. The sell-side median price target is $150, and the mean is $150 for an upside of 65%. QRVO’s price targets tell a similar story. QRVO is currently trading at $94. The sell-side median price target is a bit lower at $135, and the mean is $145, for an upside of 44-54%. The following chart indicates QRVO and SWKS sell-side ratings and price targets:

Refinitiv & Techstockpros

Refinitiv & Techstockpros

What to do with the stock

We still believe SWKS and QRVO do not present a favorable risk-reward scenario. SWKS and QRVO stocks have declined 28% and 38% in the past two quarters respectively. We believe the industry will continue to face demand headwinds in the smartphone market due to inflationary pressures. We also believe RF front business will slow down with weakened work-from-home-driven demand. We will revisit the stock when inflationary pressures and demand headwinds ease.