Q3 Outlook For Stocks: Bullish Into Peak Inflation Narrative (NYSEARCA:SPY)

utah778/iStock via Getty Images

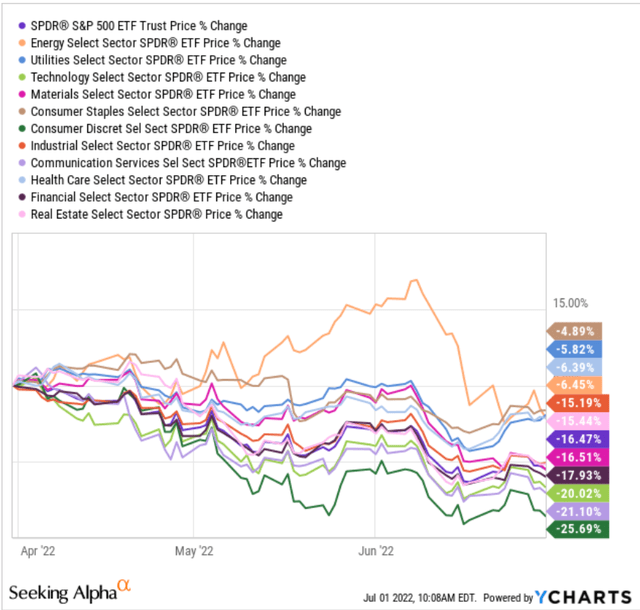

Good riddance to Q2. It was a terrible quarter for stocks with the S&P 500 (NYSEARCA:SPY) crashing by 16% representing the bulk of its 21% year-to-date decline. The big story was the persistently hot inflation with the CPI reaching 8.6%, forcing the Fed to turn hyper-hawkish. The combination of record gas prices, rising interest rates, and softer growth indicators have added to economic uncertainties. All eleven of the S&P sectors ended lower during the quarter, with the Consumer Discretionary Select Sector SPDR ETF (XLY) down 26% highlighting the pressures on consumer spending.

That being said, it’s important to take a look at the other side of the discussion. The macro-environment continues to evolve and there are some glimmers of hope suggesting the tide may already be turning. There’s a strong case to make that inflation has already peaked, with a trend lower going forward removing what has been the most challenging market headwind. Beaten-down stocks start looking attractive with compelling valuations and reset expectations. While it likely won’t be a straight line higher, we see room for the bulls to get an upper hand into the second half of the year.

Signs Inflation Has Peaked

The bullish case for stocks at this point revolves around the “soft landing” scenario where the economy at least avoids an apocalyptic collapse. In this case, even if a technical recession is confirmed pending Q2 GDP data, some measure of resiliency from the labor market and through key indicators can support confidence that the economy can emerge out of the current rough patch. Stocks should reprice higher on an improving outlook.

The data hasn’t all been bad. U.S. job openings still near record highs suggest the economy can absorb the slack from some headline-making layoffs in recent weeks which we view as being more company-specific. Some industries may indeed be slowing down on hiring, but we don’t see a case for across-the-board reductions in headcount. On the housing side, while sales of new and used residential homes are softer compared to a record 2021, current activity levels are simply back to 2019 levels which helps balance tight conditions.

More importantly, several signs are pointing to inflation turning the corner which will be critical to stabilizing the economic environment even as the Fed continues to hike rates.

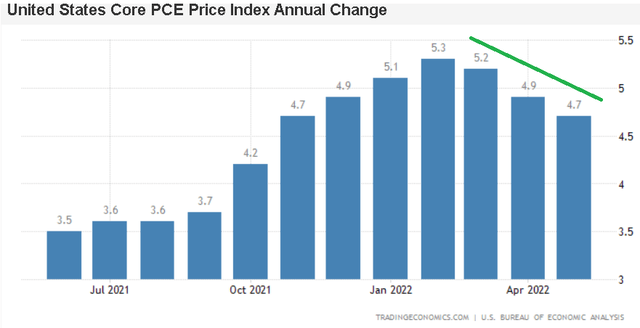

- The annual Core PCE Price Index is down for 3 consecutive months.

- Commodity prices (metals/agriculture/energy) well off highs.

- Reports of retailers discounting merchandise amid an inventory glut.

- Used car prices trending lower.

- Improving supply chain conditions.

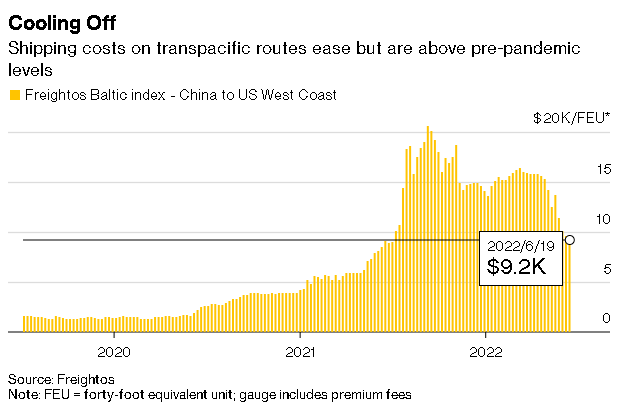

- Freight/ shipping rates cooling off.

- Early impact of recent Fed rate hikes.

- Annual inflation coming up against more difficult comps.

This week, we got the May Core PCE “Personal Consumption Expenditure” which favorably fell to 4.7% y/y compared to the consensus of a 4.8% increase. This was the third consecutive monthly decline and sets up an encouraging read for the more high-profile CPI in the upcoming June print.

Notably, the Core PCE is often referred to as the Fed’s preferred inflation metric, excluding food and energy prices, but there is also evidence those components can roll over. If you haven’t noticed, commodity prices across agriculture, metals and even energy are well off their highs. Copper prices currently trading at an 18-month low hardly screams runaway inflation and sets the tone for easing input costs for various industries.

Similarly, from fears of widespread shortages in grains during the early stages of the Russia-Ukraine conflict, a correction lower in everything from wheat, corn, and soybeans can provide some relief to food prices.

Part of the trends here reflect easing global supply chain disruptions. Compared to production stoppages due to the pandemic between 2020 and 2021, the gears in the global economy are beginning to run more smoothly. Freight and shipping costs that took many companies by surprise since last year are starting to cool off. Various shipping indexes are posting multi-month lows in published rates which can eventually translate into lower consumer and producer prices.

Bloomberg

One of the most positive developments on the inflation side is the messaging from major retailers that have built excess inventories of merchandise. From what was likely exuberance at the end of 2021, many companies ordered too many goods and now are having to clear shelf space. It’s expected that deep discounting through the rest of the year on items like apparel and electronics can flow into a lower CPI.

The other dynamic to consider is that the year-over-year price increases start to come up against what becomes a tough comparison period versus 2021. In this regard, the tendency is for the CPI to trend lower benefiting from the base effect. Month-over-month changes will be the key monitoring points, and the more volatile components can drag the index lower.

To conclude, there are many reasons to believe that inflationary conditions will improve from here. To balance the discussion, we’ll mention that oil prices remain the wildcard. It’s good to see benchmarks like WTI Crude (USO) trading rangebound in recent months but also breaking below a long-running uptrend from Q4 last year. This relative stability is positive. At the same time, a sharp breakout higher above $130 barrel would add a new layer of complexity to supply chain conditions and inflationary trends as a risk to watch.

Fed Flexibility Into 2023

The point we’re getting at here is that the ability of inflation to surprise the downside through the rest of the year can offer the Fed a new sense of flexibility. We’re not suggesting rate cuts anytime soon, but what ends up happening is that the trajectory and pace of hikes can get rolled back depending on how conditions evolve over the next few months.

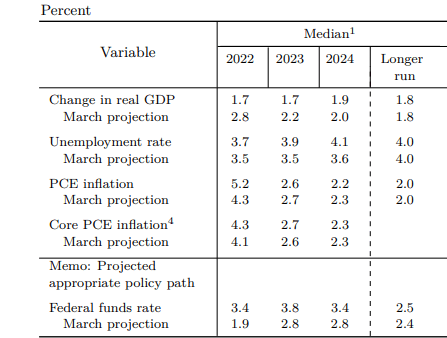

Compared to the current Fed funds rate at 1.75%, the Fed is projecting that the level will trend towards 3.4% by year-end. This would include another 75 or 50 basis point hike at the next meeting and smaller moves into Q4. That said, if it becomes clear that inflation is firmly trending lower, the Fed would have room to not be as aggressive with tightening monetary policy. Into 2023, the Fed could move to boost growth with rate cuts if it’s not seen contributing to further inflation. At the end of the day, inflation may very well end up being “transitory” even if the timing and peak were way off.

FOMC

Q3 S&P 500 Forecast

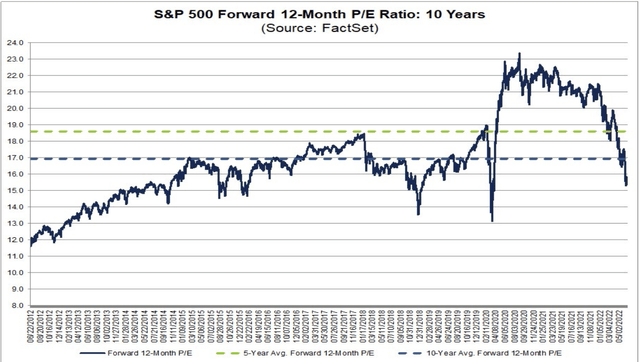

We believe it’s a good spot to add exposure to equities as an asset class. The silver lining of the deep selloff this year is that valuations have been pulled down to what we believe are attractive levels. The forward P/E on the S&P 500 is currently at 15.8x, which is now below the 5-year average of 18.6x and below the 10-year average of 16.8x.

This assumes that earnings for the group on a bottom-up basis aggregating the EPS of all constituents is set to climb 10% this year which is already considering some revisions lower to earnings in some sectors but a more positive setup in others. Our takeaway from the chart above is that stocks are cheap.

The upcoming Q2 earnings season will be important not only to get an updated assessment of operating conditions from companies across all sectors but to confirm the earnings trends. The low bar of expectations coupled with stocks that have already been beaten down could set up a “buy the news” type of scenario.

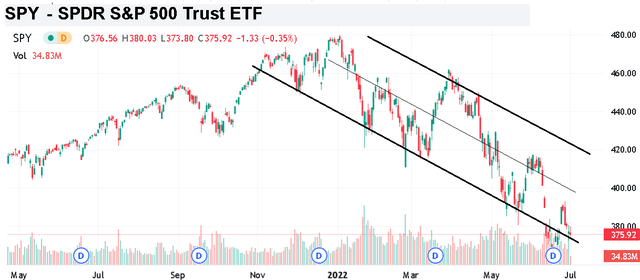

As it relates to SPY, the cycle low around $362.17 or 3,639 on the index, about 4% lower, is now the critical level of support to watch. To the upside, we’ll need a move above $400 or 4,000 to regain more positive momentum. While the all-time high near $480 is likely off the table for the foreseeable future, a rally towards $440 looks like a good upside target in the year ahead.

Final Thoughts

It’s ugly out there but things do come around, and our take is that risks are tilted to the upside. All it takes is a few big green candles to shift the market narrative. Ultimately, this combination of lower-than-expected inflation with resilient economic growth could be very bullish for stocks compared to the current pessimism.

In terms of risks, the white elephant in the room remains the ongoing Russia-Ukraine crisis with a potential for a regional escalation that forces a reassessment of the macro outlook. A deeper deterioration in economic conditions in the U.S. and globally could also open the door for another leg lower in the market.

The June CPI data set to be released on July 13th will be critical to get the headlines on board of slowing inflation. We won’t be surprised if a lower-than-expected number works as a major market pivot for stocks to get the bulls back in control.