PNM Resources Stock: Avangrid Merger Is Likely To Close

imaginima/iStock via Getty Images

In Oct ’20, New Mexico’s largest electricity provider PNM Resources (NYSE:PNM) entered into a definitive agreement to be acquired by Avangrid (AGR). AGR is the US subsidiary of the Spanish multinational electric utility Iberdrola (OTCPK:IBDSF) (OTCPK:IBDRY) and operates primarily in Northeastern states. Consideration stands at $50.30 in cash for each PNM share and $8.3bn EV in total. The deal has received all the needed approvals other than New Mexico Public Regulation Commission (NMPRC) consent. In Dec ’21, the regulator rejected the merger citing concerns over Avangrid’s track-record, legal investigation in Spain and potentially rising electricity prices. PNM-AGR followed by filing an appeal to the Supreme Court. Currently, the litigation is ongoing, and the Supreme Court ruling should come in 12-18 months.

Strategic rationale here seems straightforward, and the valuation looks fair from the perspective of similar utility mergers in New Mexico. The investment thesis boils down to the regulatory approval. While the whole process can turn out to be lengthy, I believe that eventually this merger has a good chance of going through:

-

Sticking points previously highlighted by NMPRC have largely been resolved. Recently, a Spanish judge dropped charges against Iberdrola’s CEO in a corporate espionage case. Apparently, this was one of the main concerns and is now settled. Another concern – the commission appealed that Iberdrola hired an attorney with close ties to the Attorney General. This, however, has been refuted by the Supreme Court Disciplinary Board. Overall, the merger has by now received support from 23 out of 24 intervening parties, such as the Attorney General as well as customer and clean energy representatives. Santa Fe-based New Energy Economy is the only one in opposition.

-

NMPRC has argued that AGR provides low-quality service in Northeastern States and, as a result, has already received penalties. However, the company has attributed customer service and reliability issues to extreme weather conditions in the Northeast – not a concern in New Mexico. Moreover, AGR argues that in those same locations other utilities were fined in much higher amounts. For example, in New York, Consolidated Edison’s (ED) penalty was 8x greater ($80m versus $10m) while, in Connecticut, AGR was fined only $2m compared to a $28m penalty for its peer Eversource (ES). Apparently, most, if not all, customer service issues have been resolved. In 2018, AGR unveiled a 10-year program that will invest $2.5bn into an extreme event resiliency program in Northeastern states. By the way, the current proposal also includes penalties for reliability violations.

-

A key point is that due to a 2020 constitutional amendment next January, NMPRC will shift from a five-member to a three-member body. Members will be appointed by the governor. The sitting New Mexico governor has openly supported the merger – a very strong plus for the merger given that she will make NMPRC appointments. Recently, rumours appeared that the companies would withdraw their appeal and simply refile their NMPRC application. Another application would be reviewed by a new commission. In January, companies extended their merger deadline to April 2023. This suggests that a new application is pretty much in the cards.

I am not an expert in the field but, in my view, PNM-AGR has a strong case here. Very importantly, the governor seems to be in support – this suggests that the new commission could very well approve the merger. A couple of additional points:

-

Customers and officials in Maine have said that electricity rates have increased following AGR’s entry. However, if the merger is approved, the company would require NMPRC’s approval for any rate increase.

-

AGR has argued that, in the evaluation process, the commission did not follow its procedures, i.e., it used media and hearsay as evidence. Another example – a Maine legislator, known to be a long-time Avangrid opponent, phoned into a commission meeting and urged to reject the merger. This is prohibited under PRC rules but, reportedly, it even influenced one commissioner to vote against the merger.

-

Other recent electric utility mergers in NM (see below) suggest that NMPRC historically approved deals where local utilities were acquired by out-of-state companies. Moreover, concessions offered by AGR exceed those done by previous buyers. AGR has pledged more than $300m for direct rate relief and investments into NM jobs and various green initiatives. Customer rate credits, for instance, are at $67m compared to $8m, $11m and $8.7m in other mergers (Emera, TECO and El Paso Electric, see below). Companies have agreed on having a majority of independent directors, if required – this has not been done previously.

Extended timeline is the main risk. The merger is already ongoing for 1.5 years and another 12-18 months are expected. If, on the other hand, the appeal is withdrawn, a new NMPRC application would be considered in around a year – the previous filing was rejected after 14 months. In any case, the timeline here will exceed at least 1 year.

Another aspect – the current merger agreement requires PNM to sell its Four Corners coal plant. PNM’s most recent application to do so was rejected by NMPRC. Given a new commission, however, I expect this to be resolved.

The downside to unaffected price is at 6% but is likely irrelevant given the time that has passed. Nevertheless, most peers have traded up since the announcement date:

|

XEL |

ES |

AGR |

SWX |

NEE |

EXC |

AEP |

CNP |

CMS |

SRE |

PNW |

|

|

Market Cap ($bn) |

40 |

30 |

19 |

6 |

158 |

45 |

50 |

19 |

20 |

48 |

8 |

|

% Change Since October 21, 2020 |

2% |

-5% |

-12% |

31% |

8% |

53% |

8% |

42% |

6% |

19% |

-11% |

New Mexico Utility Mergers

NM has three recent cases of mergers where a local utility was acquired by an out-of-state company:

-

In 2019, El Paso Electric was acquired by an Infrastructure Investments Fund (IIF) in an all-cash transaction which valued El Paso Electric at 15x 2019 EBITDA. Total consideration stood at $4.3bn EV. The merger was approved by NMPRC in a ~9-month timeline. Commitments were minimal – primarily, ~$20m for NM economic development. Admittedly, the buyer was financial rather than strategic. However, the merger managed to overcome regulatory pressure coming from its ties with J.P. Morgan. Here is a quote from a still-serving NMPRC commissioner:

“Whatever our thinking about J.P. Morgan as a corporate entity and other activities that they’re involved in, as I’m looking at this issue it’s not going to be relevant to the operation of El Paso Electric.”

-

In 2014, New Mexico Gas Company (NMGC) was acquired by electric and gas utility TECO Energy for $950m or 11x 2013 EBITDA. NMPRC approval was received ~15 months after the merger announcement. Settlement with NMPRC included frozen customer rates, 10-year ownership and already-mentioned customer rate credits – definitely nothing beyond what PNM-AGR have promised.

-

Just two years later, in 2016, Emera acquired the same TECO Energy for ~$10.4bn in EV or 11x 2015 EBITDA. NMPRC approval for the NMGC subsidiary was received 9 months later. Reportedly, concessions were not that significant – a total of ~$15m of investments into pipelines and commitments to underserved communities. The Emera-TECO merger is perhaps the most accurate analogy to the AGR-PNM – both transaction and buyer sizes were somewhat similar. At the time, Emera had assets of $11.5bn. In 2021, they were ~$34bn. AGR’s size is very roughly comparable – assets of $31.3bn in 2016 and $39.5bn in 2021. Moreover, customer bases were of the same scale – NMGC served 515k customers compared to 540k PNM serves via its NM subsidiary.

Background

PNM is an electric utility operating in NM ($3.1bn base rate) and West Texas ($1.5bn) via two subsidiaries. The NM subsidiary has a 3.1 GW resource portfolio, 41% of which are renewables (compared to 31% last year). For the company, access to AGR’s resources and equipment is a clear strategic benefit. PNM also has $3.5bn in net debt or 5.8x 2021 EBITDA – similar to peers:

|

Peer |

XEL |

NEE |

CMS |

SWX |

CNP |

|

Net Debt/2021 EBITDA |

5.4 |

8.5 |

5.3 |

7.7 |

5.2 |

Source: Company Financial Statements

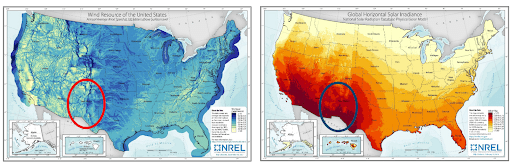

Meanwhile, for AGR and Iberdrola, the goal is to expand both its regulated business and green energy portfolio in the US. Speaking of the latter, NM has some of the highest wind and solar resources in the US. As of 2020, AGR already had 1.9 GW of renewable energy in NM and Texas with a further 1.4 GW in plans.

PNM Resources Investor Presentation, June 2022

AGR’s offer values PNM at 14x 2021 EBITDA – generally in line with previous utility acquisitions in NM. This, along with strategic rationale, suggests virtually no deal termination risk from either AGR or PNM.

Conclusion

The setup is likely priced efficiently – the spread of 4% reflects the odds that the commission approval is eventually going to happen. I also expect a significant amount of time to pass before the merger materialises. For these reasons, I will not open a position for the time being. I could become interested, though, if PNM share price retraces to more attractive levels.