PDC Energy: Continued Upside Based On Robust Results (NASDAQ:PDCE)

bymuratdeniz

Times have been rather interesting for investors in the oil and gas exploration and production space. One company that has demonstrated just how extreme financial results can be given the vast uncertainty that exists in the space is PDC Energy (NASDAQ:PDCE). Although the company missed on the bottom line when it reported financial results earlier this month, it easily topped expectations when it came to revenue. More importantly though, the company largely reaffirmed guidance for the year and looks set to generate a significant amount of cash flow both this year and next. Add on top of this the robustness of its balance sheet and how shares are currently priced, and I do believe that it warrants some upside potential from here.

A look at this year and next

Last month, I wrote an article about PDC Energy for my Marketplace service. That particular article served as a deep dive into the health and prospects of the business. But since then, management has reported financial results covering the third quarter of the company’s 2022 fiscal year. Focusing solely on the headline news, the company had rather mixed results. Revenue of $1.51 billion beat analysts’ expectations by $450 million. At the same time, however, non-GAAP earnings per share of $3.77 missed expectations by $0.28 per share.

Based only on these numbers, it can be rather difficult to know what to think about how the company is performing. But when you dig deeper, you find out that the picture for the firm is quite appealing. That might be why shares are up almost 16% since I performed my cash flow deep dive into the company on October 10th of this year. Using the most recent guidance provided by management and reflecting a change in energy prices, I decided to see what kind of cash flow the company should generate. These results can be seen in the table below.

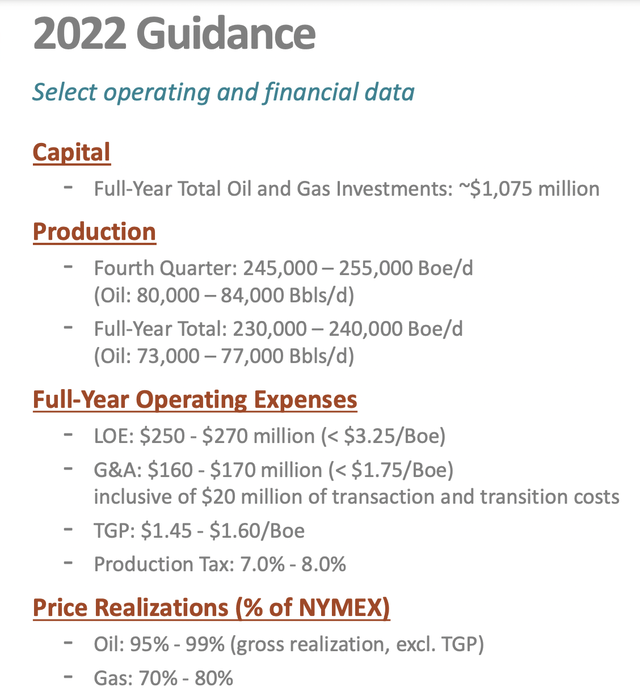

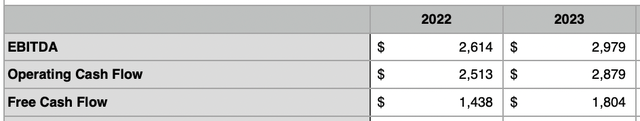

As you can see, PDC Energy should, based on current guidance for 2022, generate free cash flow of around $1.44 billion. This is very close to the $1.5 billion that management forecasted for the year. When it comes to the 2023 fiscal year, I am forecasting production levels that are 6.4% higher than what the company should generate this year. This is based on expectations for the final quarter of the 2022 fiscal year. If this comes to fruition, free cash flow for 2023 should skyrocket to $1.80 billion. This would also be aided by a change in hedging between this year and next. It is also worth mentioning that this increase comes even at a time when I’m forecasting a decline in the average price of oil from $95.55 per barrel this year to $80 per barrel next year, and for the average price of natural gas from $6.50 per Mcf to $6 per Mcf.

At the end of the day, there are other profitability metrics that are very important to look at. One of these would be operating cash flow, while the other would be EBITDA. This year, operating cash flow should be around $2.51 billion. Meanwhile, EBITDA should total $2.61 billion. For 2023, if current estimates are accurate, these numbers should climb to $2.88 billion and $2.98 billion, respectively. What this ultimately means for the company is a bit vague. After all, we don’t know how management will allocate any additional cash flows that the firm generates. But if the recent past is any indicator of the future, the company will likely do we next year of reducing debt and buying back shares. During the latest quarter alone, the company repurchased about 4.2 million shares of stock. At the same time, they managed to reduce net debt by $311.6 million. For the purpose of conservatism, I have decided that any additional cash flow generated would not be used toward net debt reduction. It’s highly probable that some will, but I prefer to be cautious in this regard.

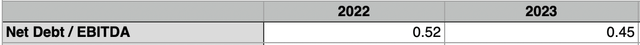

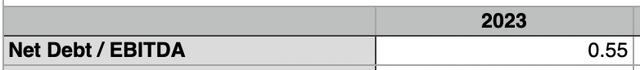

When it comes to valuing the company, the picture can be rather tricky. What I have done in this space before is to compare the firm’s cash flow metrics to its pricing metrics like its market capitalization and its enterprise value. On an EV to EBITDA basis for the 2022 fiscal year, the company is trading at a multiple of 3.2. This drops to 2.8 if we project out to the 2023 fiscal year. Meanwhile, the price to operating cash flow multiple of the company should be lower at 2.8, while for the 2023 fiscal year it should drop to 2.4. The numbers for the 2023 fiscal year make the company look cheap not only on an absolute basis, but also relative to other players that I have examined in the space and that is part of my Marketplace service coverage. As you can see in the table above, the net leverage ratio of the firm is also very low. Generally speaking, the market prefers a net leverage ratio of 2 or lower, and the level for PDC Energy is comfortably below 1.

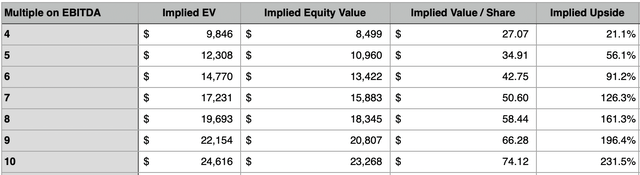

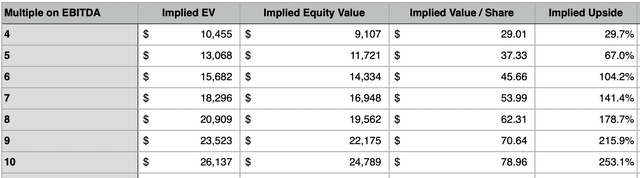

Finally, to see what kind of upside potential the company truly has, I did create the table below. In it, you can see a hypothetical range for the EV to EBITDA multiple, starting at 6 and ending at 10. At each point, you can see the implied share price and share upside for the company for the 2022 fiscal year. And in the table below that, you can see the same thing but for 2023. As you can see here, shares do have quite a bit of upside potential even if they stay near the lower end of the range.

Author – SEC EDGAR Data Author – SEC EDGAR Data

What if?

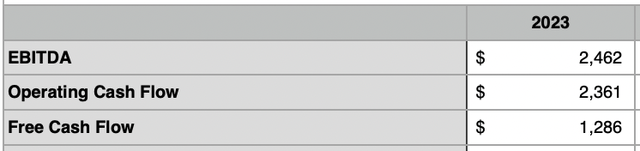

If there’s one thing that those who are familiar with the oil and gas exploration and production space know all too well, it’s that the industry is plagued with volatility. We don’t truly know, at the end of the day, what to expect from pricing. So to play it safe, I also looked at a scenario where the company would see average oil prices of $60 per barrel and average natural gas prices of $4 per Mcf. For oil, this is $20 per barrel lower than what my initial model suggested, while for natural gas it is lower to the tune of $2 per Mcf.

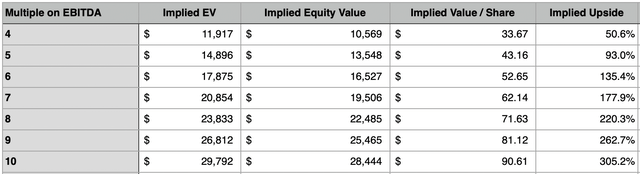

If this lower price situation comes to fruition, the company should still generate significant excess cash flow in 2023. Free cash flow next year should be $1.29 million. But as I have mentioned already, free cash flow is not the only metric that matters. When it comes to operating cash flow, we should expect a reading of $2.36 billion this year and EBITDA of $2.46 billion. The reason why I did not provide an analysis for this year is because 2022 is nearly over and the probability of a substantial decline in pricing to move the average that much lower for the year as a whole is very small.

Naturally, leverage and pricing for the company in this more bearish scenario does look less appealing. But on the whole, the company still seems quite healthy. Using the data for 2023 under the conservative scenario, the net leverage ratio would still be well under 1 at 0.55. Add on top of this all of the other aspects of my analysis and upside potential for shareholders moving forward looks promising. Even in some of the more moderate scenarios, upside potential could reach above 100%, though I do think less upside than that is more probable given the amount of pessimism in the broader market and in this space following its collapse years ago.

Takeaway

The data that we have at our disposal today is definitely promising. Management did keep guidance largely unchanged during the recent quarter, really only increasing some of its cash outflow items such as capital expenditures. But everything else looks strong and debt is falling nicely. Add in how shares are priced right now and the amount of cash flow the company can generate even during difficult times, and I would make the case that the company warrants a ‘buy’ rating at this time.