Palo Alto Networks: Recent Pullback Is Buying Opportunity

TU IS

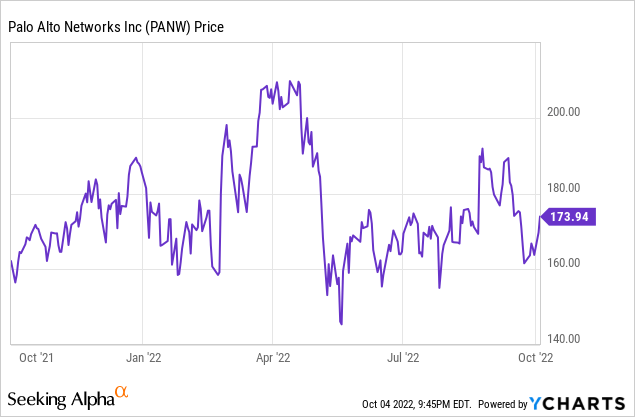

Palo Alto Networks (NASDAQ:PANW) recently reported a good end to their fiscal year and provided FY23 guidance above expectations. And while this initially sent the stock up over 10%, recent macro volatility and rising interest rates has caused the stock to pullback over recent weeks.

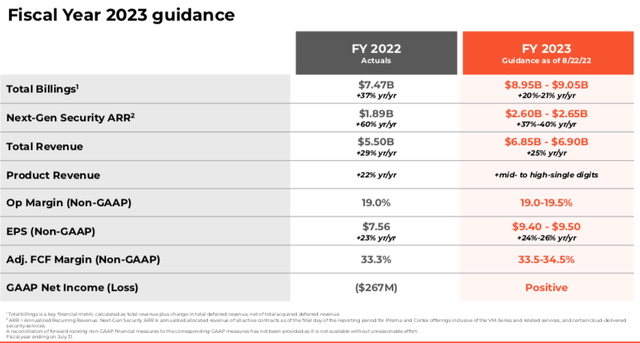

For FY23, the company is expecting revenue growth of 25% yoy, and this takes into consideration some longer sales cycles and some customers extending the life of existing hardware. While the macro environment remains complicated and uncertain, the company continues to believe the underlying trend of strong security spend is here to stay long-term.

So far this year, investors have favored stocks who have been able to demonstrate some sort of counter-cyclicality and demonstrate consistent profitability. With security spend likely to remain at the top of almost all company’s minds over the coming years, it’s no surprise to see PANW stock only down <5% so far this year, which is much better than the broader market performance.

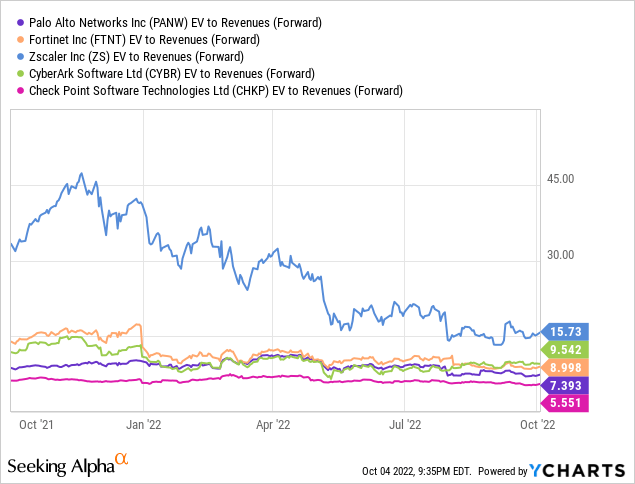

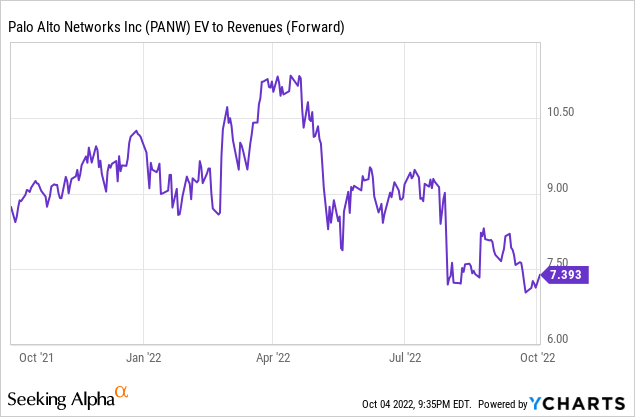

PANW currently trades at 7.4x forward revenue, which has pulled back from 11x forward revenue at the beginning of the year. Fears around a potential global recession combined with higher interest rates has made high-valuation stocks less attractive, and thus warrant low multiples.

However, given the underlying solid demand trends of IT security spend, PANW’s focus on moving up market to larger enterprises, and the stock’s recent pullback over the past few weeks, I believe the stock remains an attractive opportunity for long-term investors.

Financial Review

PANW has seen their financial success accelerate over the past few years as underlying demand trends remain very strong. While the global pandemic caused many businesses to shift their operating models, one of the most important investments enterprises continue to make is around security solutions. And that trend does not appear to be going away anytime soon.

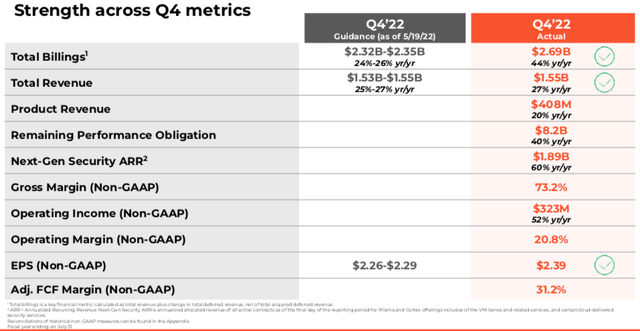

PANW reported Q4 results on August 22, which saw revenue grow 27% yoy to $1.55 billion and came in above consensus estimates of $1.54 billion. While the revenue beat was not as big as in previous quarters, the company reported an impressive 44% yoy growth in billings, ending the quarter at $2.7 billion.

Not surprisingly, non-GAAP gross margin remained strong at 73.2% and operating margin improved to 20.8%. The better than expected revenue combined with ongoing margin expansion led to non-GAAP EPS of $2.39 during the quarter, above expectations for $2.28.

The underlying trends of strong security spend is clearly driving the narrative at PANW and given the constant news flow of security breaches, heightened focus on security spend is unlikely to disappear any time soon. But PANW has also been a benefactor of moving further up the market and better competing for enterprise deals. I believe this growth driver further insulates them from the broader macro sensitivity, as enterprises are less likely to reduce security spend during more challenging macro periods.

PANW

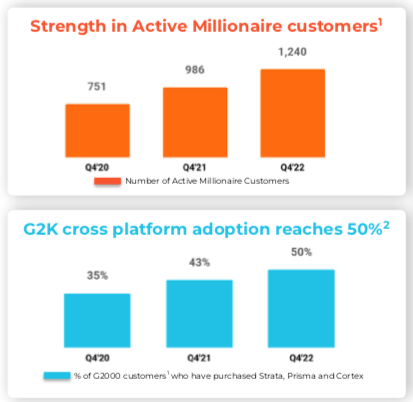

During Q4, the company reported 1,240 customers with >$1 million in TTM bookings, growing an impressive 26% yoy. On top of that, PANW now has 50% of the Global 2000 customers who has purchased the company’s Strata, Prisma, and Cortex solutions.

By moving further up the market towards larger enterprises, PANW has been able to demonstrate consistently strong growth with high customer retention.

When asked about the recent enterprise strength on the company’s earnings call, management pointed at the fact they have become much more competitive against other vendors and are winning more deals.

What has happened in the last year-and-a-half or two, we’ve become a force to reckon with. I’d say in the most, the largest enterprise deal is head-to-head with two vendors. Very rarely do we see a third. It doesn’t take a lot to guess who the second vendor is. And three years ago we’re not showing up at a party. Two years ago we’re getting 1 or 2 deals out of 10. Now we think we’re in 5 to 6 out of 10 deals. And our aspiration is next year to be in 10 out of 10 deals. You know what, hopefully if we can win half the deals that we’re in, we’ll be growing at big numbers like we did this year.

Again, PANW’s ability to not only put themselves in a more competitive position, but actually win these large enterprise deals has better insulated the company’s revenue from any extreme volatility. Just a few years ago, PANW was usually in the running for large enterprise contracts, but only sparingly won those deals. With management remaining confident in their strategy to continue to win these larger, more recurring, and stickier enterprise deals, I believe their revenue may be less susceptible to macro volatility compared to other vendors who focus on small and middle-sized companies.

For Q1, the company is expecting revenue of $1.54-1.56 billion (23-25% yoy growth), compared to consensus estimates of $1.54 billion. Billings are also expected to be $1.68-1.7billion, compared to expectations for $1.74 billion.

For the full-year, revenue is expected to be $6.85-6.9 billion, representing 25% yoy growth at the midpoint and came in above expectations for $6.76 billion. Importantly, non-GAAP operating margins are expected to be 19-19.5%, which would represent some mild expansion from the 19% margin seen in FY22. This led to non-GAAP EPS guidance of $9.40-9.50 coming in above expectations for $9.30.

Overall, the stronger than expected guidance metrics has helped push the stock higher immediately after reporting earnings. Management commented on a few near-term headwinds and areas of concerns regarding the macro environment, however, almost every company is experiencing similar impacts as these are not PANW-specific.

First, we saw more longer-duration deals as customers increasingly had the confidence to make large, long-term commitments with us. This is important as a transformation objective we set out for Palo Alto Networks. It confirms and validates our view that customers will consolidate if we give them constant best-of-breed products and then show that they are integrated to deliver better security outcomes. Second, we saw some isolated instances of customers extending the life of hardware, potentially driven by macro forces. We expect that on the margin, this could continue into FY 2023. It is counter-balanced by some customers refreshing their state and our continued share gains in the hardware form factor.

Third, in transformational projects, the vast majority of our customers continue on their investments here, despite the expected short-term macro impacts. Security spending is tied into our customers’ desires to move to the cloud, drive more direct relationship with their customers, modernize their IT infrastructure, as well as drive efficiencies while adapting to a new way of working. Those efforts continue. Coupled with the heightened awareness and need to do something on cybersecurity, we expect secular tailwinds to persist in cybersecurity, and we are best positioned to deliver against our customer needs

While the macro environment has caused some longer-duration deals and some customers extending the life of hardware, their customers continue to invest in transformational projects, with a focus on security spend. Granted the macro environment continues to be pressured due to several factors, such as high interest rates, high inflation, and geo-political challenges, the underlying trend of increased security spend has remained solid.

Valuation

Despite the company providing very strong guidance for their upcoming fiscal year, the continued macro volatility and rising interest rates has caused ongoing pressure on PANW’s stock. In fact, after the stock popped 10% post-earnings, recent market volatility has pushed down the stock back to pre-earning’s levels, erasing all gains post Q4.

In addition to the company recently splitting their stock in a three-for-one deal, they also announced their intent to repurchase up to $915 million of stock. PANW is expected to generate around 33.5-34.5% FCF margin, which gives the company sufficient cash flow to advance their capital allocation strategy.

While the security industry remains highly competitive, investors have typically placed a premium multiple on these companies given the long-term secular trend of increased IT security spend over the coming years. Additionally, the global concerns around privacy and security breaches has caused a heightened awareness of how essential security spend is.

PANW currently trades at 7.4x forward revenue, which has pulled back quite significantly from their 11x forward multiple just a few months ago. Yes, we are in a much different macro environment now that at the beginning of the year, especially with interest rates moving significantly higher.

However, the company’s FY23 revenue guidance of 25% yoy combined with ongoing margin expansion puts the company clearly above the Rule of 40 score, and thus deserving of an ongoing multiple premium.

Even if the stock’s multiple takes a few quarters of execution before improving, I believe the recent post-Q4 pullback of around 10% in recent weeks provides for a great entry point for long-term investors.