Palantir Q3 Earnings: What To Expect (NYSE:PLTR)

Michael Vi

Palantir (NYSE:PLTR) is estimated to submit its earnings card for the third quarter on November 10, 2022, and the company’s commercial results are likely going to attract a lot of attention. This is because Palantir’s financial results have been largely driven by the on-boarding of commercial clients in the last five quarters, especially in the firm’s domestic commercial business. I also expect Palantir to comment on its revenue growth potential going forward since the software analytics company cut its top line outlook in the second quarter. I believe that Palantir has a good chance of beating estimates, but given the disappointments delivered in recent months, investors may want to take a cautious approach!

A segment in focus: US commercial

The core highlight of Palantir’s third-quarter earnings sheet will be the commercial business which has been the software analytics company’s growth engine in the last few quarters. Palantir’s commercial top line growth slowed in Q2’22, however, due to macroeconomic headwinds that also resulted in Palantir ditching its annual 30% revenue growth target for FY 2022. In Q2’22, Palantir grew its commercial revenues 46% year over year which is a great rate of growth. However, revenue growth decelerated from 54% in Q1’22, indicating to investors that the company’s fastest-growing segment may be headed for a soft landing.

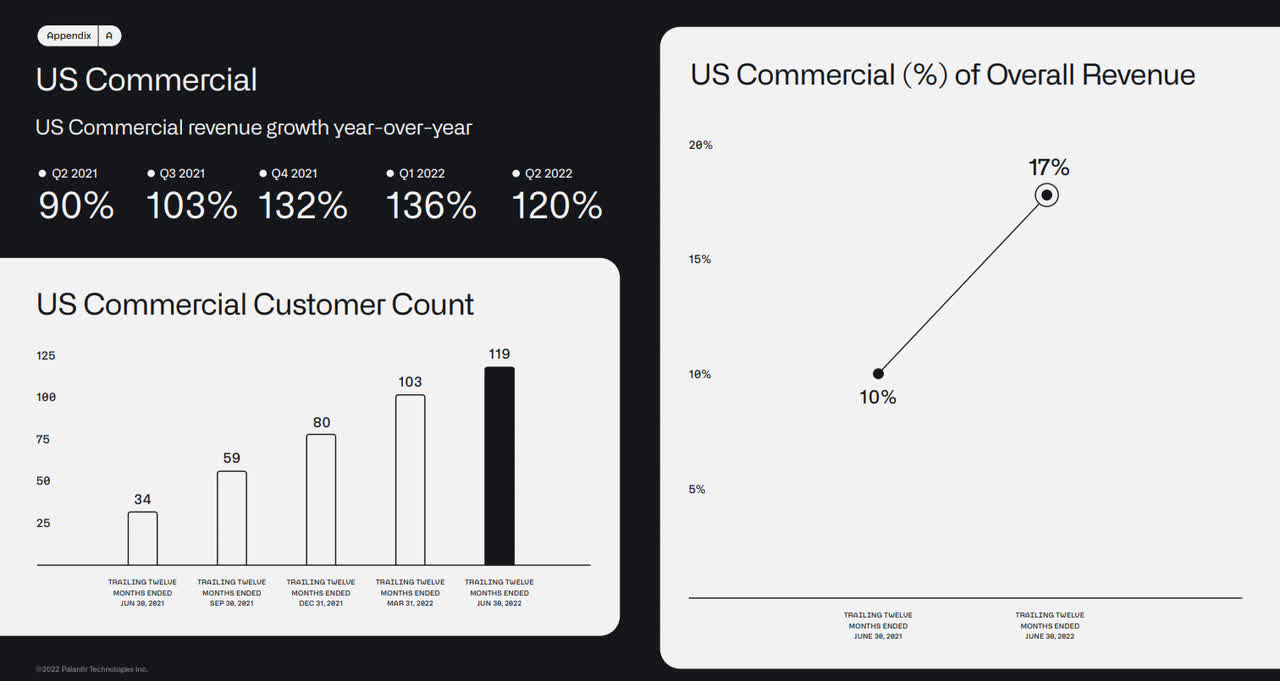

The commercial business is really important for Palantir because, like I said, it has been driving the company’s entire financial performance. Palantir’s commercial business grew 3.5 times faster in Q2’22 than its anchor government business. The firm’s US commercial business grew at a rate of 120% in Q2’22 and a deceleration in Q3’22, unfortunately, must be expected as economic conditions deteriorated and inflation continues to pressure companies to apply stricter cost discipline.

Palantir: Commercial Momentum

Palantir’s commercial service offering consists chiefly of its software platforms, called Foundries, which allow companies to centralize and analyze all of a firm’s data. For companies, the advantages are obvious: they can improve their decision-making by using data analytics, run more efficient organizations and save costs.

Palantir’s Foundry platforms — which are run as SaaS businesses — are being rolled out to more and more commercial clients through its acquire-expand-scale model. Foundry for builders, as an example, has been made available to early-stage and growth companies last year and the company has been able to on-board new clients rapidly.

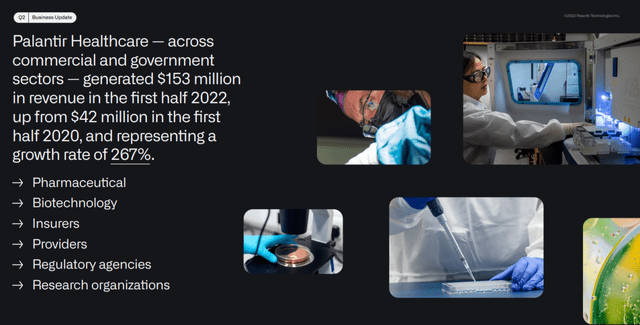

One segment that I believe is very promising is Palantir Healthcare which is seeing strong product adoption and revenue growth. Palantir Healthcare helps companies in the industry deal with large amounts of data and model different project outcomes to limit costs and operational risks. Palantir Healthcare has applications in both government and private sectors and it is one of the fastest-growing businesses for the company with 267% revenue growth in the first six months of FY 2022.

Palantir’s commercial operations have potential during a recession

Palantir may see slowing growth in its commercial practice in the short term, but I believe the business will continue to grow… even in a recession. This is because companies look for cost-effective ways to grow their businesses and seek out cost savings during recessions. Adopting Palantir’s Foundry platforms could be a preferred way for commercial clients to secure efficiency gains and invest in IT infrastructure.

Free cash flow expectations for Q3’22

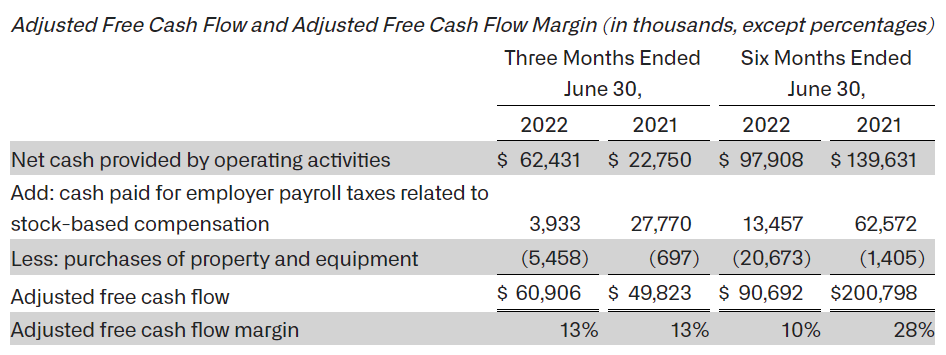

Palantir has disappointed my expectations for free cash flow growth in the last two quarters because the company has not on-boarded as many commercial clients as I thought it could. Palantir’s year-to-date free cash flow calculates to just $90.7M, down from $200.8M in the year-earlier period.

Palantir: YTD 2022 Free Cash Flow

For the third quarter, I expect Palantir to report free cash flow between $60-65M which would mark an up to 7% improvement over the second quarter as a higher number of commercial clients improve Palantir’s monetization.

Palantir has guided for $474 – $475M in revenues for Q3’22 and if the company can maintain its second-quarter free cash flow margin of 13%, Palantir would report free cash flow of $62M… which would fall into my estimated guidance range.

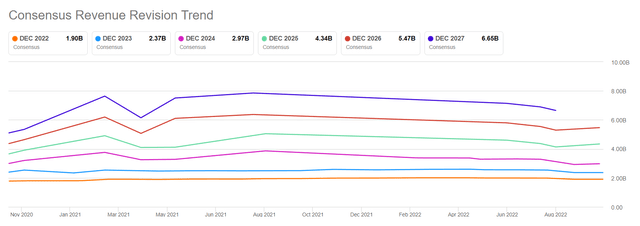

Palantir is seeing down-ward pressure on estimates

After the software analytics company reduced its revenue growth target to just 23% for FY 2022, revenue estimates have started to trend down. Analysts have down-graded their forward annual revenue estimates for Palantir more than just a few times in the last 90-days and all of the revisions were made to the down-side. In the last three months, there were 12 down-ward revenue revisions compared to 0 up-ward revisions. The trend is profoundly negative and unless Palantir reignites revenue growth through its commercial practice, the trend is likely going to remain negative.

Palantir: Forward Annual Revenue Estimates

Risks with Palantir

I see three risks for Palantir heading into the earnings report next month:

- Palantir’s revenue guidance is still shaky and investors look for reaffirmation. The company has said that it expects revenues of $1.90-1.902B in FY 2022 which calculates to an implied growth rate of 23%. Just two quarters ago, Palantir guided for 30% annual revenue growth. If Palantir further cuts back its top line growth expectations, shares could go into a free-fall after the third-quarter earnings report.

- Palantir’s free cash flow is the most important figure, I believe. If Palantir disappoints again with its Q3’22 free cash flow performance, the market may respond in an unforgiving manner.

- The software analytics company has the potential to turn things around by reporting stronger (US) commercial revenue growth for Q3’22. If this happens, shares of Palantir could revalue higher. If the company yet again sees a deceleration of its top line growth in the third quarter — which would be the second consecutive quarter of revenue deceleration in its fastest-growing business — shares are also likely going to get pushed into another down-leg.

Final thoughts

Expectations for Palantir are not very high heading into earnings because the software analytics company already cut its top line growth target for FY 2022 in the second quarter. If the firm, however, can convince investors with strong client acquisition in the commercial business and strong monetization, especially in the US, and avoid reporting a second consecutive quarter of revenue deceleration, the market may actually respond positively to Palantir’s earnings results. Risks have clearly grown in the last two quarters, and I believe the best strategy is to wait for Palantir to provide clarification about its commercial business momentum before buying into PLTR!