Owl Rock Stock: Here’s Why I Bought The Dip (NYSE:ORCC)

Galeanu Mihai/iStock via Getty Images

Because of the recent market downturn, the stock of Owl Rock Capital Corporation (NYSE:ORCC) has begun to trade at a greater discount to book value, despite the fact that the business development company has a defensive investment portfolio, a low number of non-accrual investments, and covers its dividend pay-out with net investment income.

I believe the expanding book value discount makes Owl Rock even more intriguing than the BDC was previously.

Owl Rock: A 10% Yield Covered By Net Investment Income

Owl Rock’s portfolio is defensively structured, with a focus on highly secured debt investments. The BDC has a long history of loan origination, and management has guided the company through volatile markets with minimal credit losses.

Owl Rock primarily invests in senior secured debt, which has a very low default rate. The emphasis on secured debt is especially important for the business development company if the U.S. economy enters a recession.

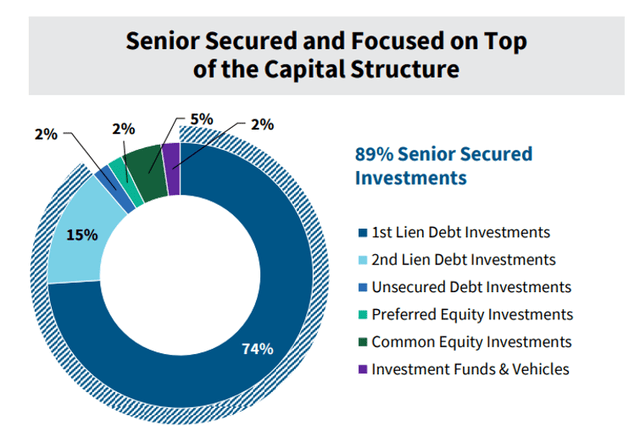

Owl Rock had a 74% allocation of investments to 1st liens as of March 31, 2022, which are the safest investments for BDC investors. 2nd lien debt received the second largest allocation (15%), bringing the total allocation of funds to senior secured investments to 89%. The remaining 11% of Owl Rock’s portfolio is made up of unsecured, common, and preferred equity investments.

Owl Rock had 157 portfolio companies with a total investment value of $12.8 billion as of March 31, 2022. To avoid earnings volatility, Owl Rock primarily invests in upper middle-market, recession-resistant businesses. The average portfolio company of the BDC has an EBITDA of $145 million and a loan-to-value ratio of 46%.

Portfolio Summary (Owl Rock Capital Corp)

Strict Credit Assessments, New Investments

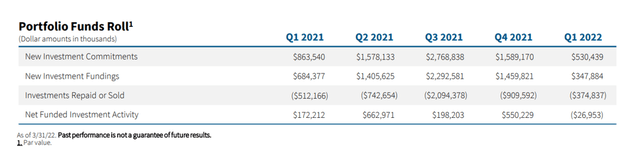

Owl Rock is very selective in its new investments, only investing in companies that have a high likelihood of making scheduled payments. Due to four portfolio companies making full pay-downs and three companies making partial pay-downs, Owl Rock’s net funded investment activity was negative in 1Q-22. Owl Rock has no shortage of investment opportunities, but it only closes about 5% of the deals presented to it.

Portfolio Funds Roll (Owl Rock Capital Corp)

Positive Net Investment Income Trend

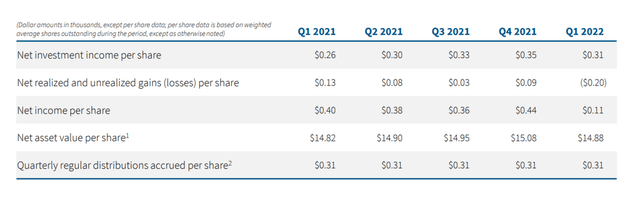

Owl Rock benefited from asset value recovery in 2021. The United States’ economy recovered from the pandemic, resulting in a modest increase in book value and strong growth in net investment income. Owl Rock’s investment portfolio generated $0.31 per share in net investment income in the first quarter, more than covering the BDC’s dividend payout of the same amount.

In the previous year, Owl Rock’s pay-out ratio was 96%. Owl Rock’s stock has a current dividend yield of 9.9% based on a quarterly dividend payment of $0.31 per share.

Net Investment Income (Owl Rock Capital Corp)

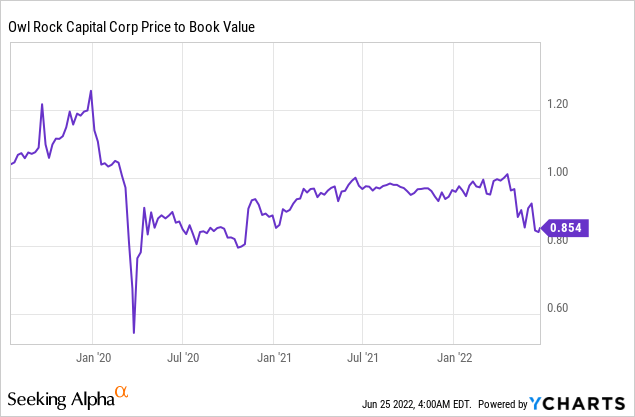

Now Trading At A 16% Discount To Book Value

When good business development companies suddenly become cheaper without any change in the core fundamentals, one should not hesitate to purchase them.

Owl Rock is one such BDC, with its book value being unfairly discounted by 16% despite the fact that the company has only one non-accrual.

At fair value, this non-accrual represents only 0.1% of Owl Rock’s total portfolio. Given Owl Rock’s debt portfolio’s excellent credit performance, I believe the discount to book value is exaggerated.

Why Owl Rock Capital Could See A Lower Valuation

Owl Rock currently has one portfolio company in non-accrual status, which means that one company (CIBT, 1st and 2nd lien) is not making scheduled payments.

A downturn in the U.S. economy could result in a greater number of portfolio companies being placed on non-accrual, which could have a negative impact on the BDC’s book value performance in the future. Book value losses would most likely deter investors, resulting in a lower book value multiple for the business development company.

My Conclusion

Owl Rock is appealing in this context because the stock has begun to trade at a greater discount to book value, despite the fact that credit performance has not deteriorated, and the loan portfolio is performing well.

Currently, investors receive a 16% discount on the BDC’s net assets, implying a reasonable margin of safety. The focus on very safe, secured debt investments makes major loan losses highly unlikely, which makes Owl Rock particularly appealing as a dividend investment. The yield has recently risen to 10% as a result of the increasing pressure on equity valuations.