ON Semiconductor Q3 Preview: Risk-Reward Not Attractive (NASDAQ:ON)

24K-Production

Thesis

Leading power semiconductors and image sensors company ON Semiconductor Corporation (NASDAQ:ON), or onsemi, is slated to report its Q3 earnings release on October 31.

It has been a highly challenging period for semi players in general, particularly for companies with significant exposure to consumer electronics such as PC and smartphones. However, onsemi’s focus on automotive and industrial applications has largely shielded it from the mayhem in those segments.

Moreover, it appears to be unscathed by the recent US export restrictions, mainly focused on advanced chips designed for AI or high-performance-computing applications. As such, we don’t expect a material impact on its operating performance in the near term.

Furthermore, its silicon carbide (SiC) leadership has expanded its TAM, leveraging the rapidly growing EV market. Therefore, even though it has lost all its gains for the year, it still significantly outperformed its broad semi peers, as represented by the Semiconductor ETF (SOXX).

Still, we assess that onsemi’s growth should normalize moving ahead. We presented in our previous article that the company’s medium-term model suggests investors need to expect growth normalization. Also, IC Insights’ recent automotive and industrial revenue forecasts indicate that onsemi’s current growth rates are way above its 5Y CAGR estimates through 2026.

Coupled with the increasing risks of a global recession, onsemi’s CapEx expansion also carries significant risks, given the gross margins impact in the near term.

We also gleaned that ON’s price action remains dangerously perched near its August highs (which we believe was a significant medium-term price top). It has also not been able to regain sustained buying momentum from its October lows, indicating that selling pressure remains intense as it surged higher.

Therefore, we urge investors who are considering adding exposure and leveraging ON’s growth story to remain patient and wait for a much deeper pullback. We discuss the critical levels to watch and encourage investors sitting on solid gains to cut some exposure and rotate out.

Accordingly, we reiterate our Sell rating.

Don’t Ignore The Prospects Of Much Slower Growth

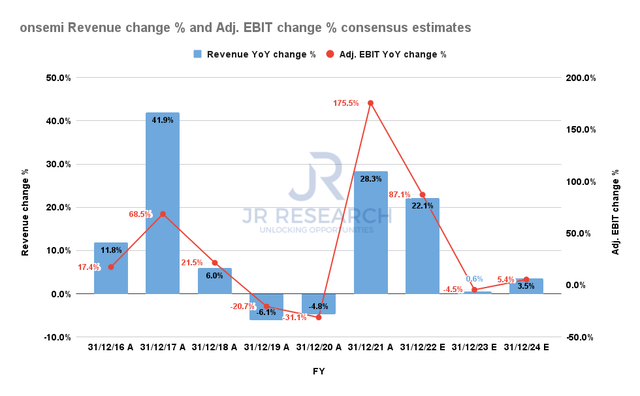

onsemi Revenue change % and Adjusted EBIT change % consensus estimates (S&P Cap IQ)

onsemi’s revised consensus estimates indicate that Street analysts still expect the company to deliver revenue growth of 22.1% in FY22 and an adjusted EBIT growth of 87.1%.

However, even the bullish analysts don’t expect onsemi to repeat such performances through FY24 anywhere close to what it is expected to post in 2022.

The normalization is also consistent with the broad semi industry’s revised estimates. For instance, industry analysts expect onsemi and its peers to post revenue growth of -0.1% in 2023, against an earnings growth of -4%. However, it’s nowhere close to the malaise in 2019, when earnings fell by 10.4%. Therefore, analysts still expect the broad industry to cope with the coming recession pretty well.

Furthermore, IC Insights indicated in a recent forward outlook commentary seeing automotive market to continue growing remarkably through 2026. It highlighted a revenue CAGR of 13.4% from FY21-26 for the auto vertical and a revenue CAGR of 8.4% for the industrial vertical. onsemi also expects automotive applications to lead industrial’s growth in the medium- to long-term.

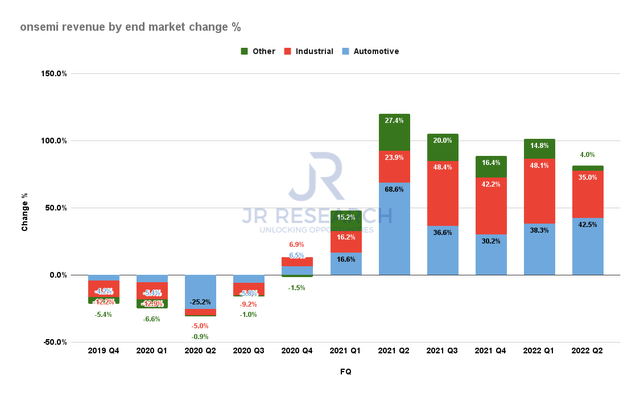

onsemi Revenue by end market change % (Company filings)

Therefore, we urge investors to consider whether onsemi’s automotive and industrial revenue could continue posting the gangbusters growth rates we saw over the past five quarters. Hence, we believe it’s critical for investors to be extremely cautious here.

Is ON Stock A Buy, Sell, Or Hold?

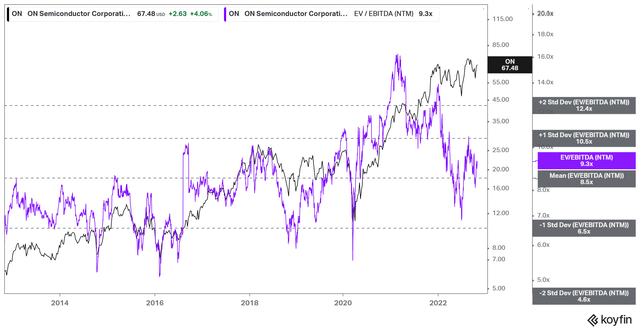

ON NTM EBITDA multiples valuation trend (koyfin)

ON last traded at an NTM EBITDA multiple of 9.3x, just ahead of its 10Y mean of 8.5x.

We believe the market has already de-rated ON, even though onsemi bulls are inclined to think that onsemi could be re-rated with markedly higher valuation multiples, given its TAM expansion to the fast-growing automotive vertical. However, we have not seen that re-rating by the market.

Therefore, we assess that the market has likely factored the material slowdown in onsemi’s forward operating performance, as it needs to lap highly challenging growth rates.

Also, ON is trading at a slight premium against its SOXX peers, as its NTM normalized P/E of 13.7x is ahead of SOXX’s 12.9x. Notwithstanding, it’s slightly below the semi industry’s forward P/E of 14.4x (according to Refinitiv data).

However, ON has generally traded at lower earnings multiples against the broad semi industry over time. Therefore, unless the market decides to re-rate ON, we don’t observe a strong bullish thesis from the relative valuation perspective.

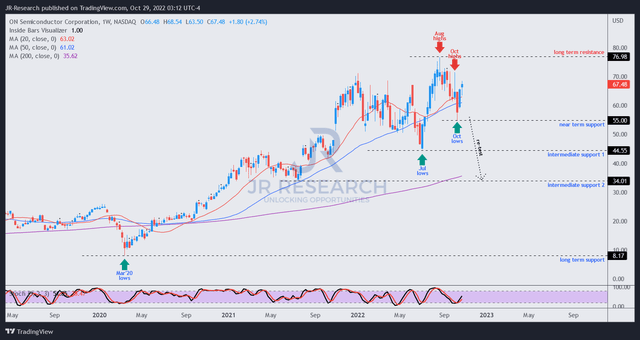

ON price chart (weekly) (TradingView)

As seen above, ON could not regain control of its August highs, a significant price top, and a bull trap.

Despite the recent recovery from its October lows, we postulate that a failure for buyers to grind higher and maintain control of its 50-week moving average (blue line) would not be constructive for ON’s medium-term bullish bias.

Therefore, we urge investors to be patient here. We suggest investors consider assessing ON’s price action if it re-tests its near-term or intermediate support levels moving ahead.

A deeper fall to its “intermediate support 2” should be viewed constructively, as it would improve ON’s EBITDA multiples markedly toward the two standard deviation zone under its 10Y mean.

For now, we believe investors sitting on solid gains should consider layering out and cutting some exposure.

We reiterate our Sell rating.