Olaplex: An Undervalued Cash Machine (NASDAQ:OLPX)

PeopleImages/iStock via Getty Images

Introduction

Olaplex (NASDAQ:OLPX) is an expanding cash machine that is undervalued at its current price. Its stock is down 80.74% YTD, like most growth stocks. Short interest is currently reported at 12.35%. But Olaplex reports an industry leading 36% net income margin ($280 million) on $707.5 million (expected FY 2022) revenues. The company is expected to grow (only) 18% this year, compared to a CAGR of 70% between 2019 – 2021.

Management had to decrease the guidance for 2022 (18 pct. points – $ 100+ million) after Q2-2022, and the markets punished Olaplex’s stock severely. It currently trades at a TTM P/E multiple of 13.63x and a TTM EV/EBIT multiple of 9.5, both representing discounts of 36% compared to the sector average (21.46x PE and 18.11 EV/EBIT). Revenues for Q4-2022 are expected to decline by 20% YoY, but total sales growth in 2022 is still expected to be around 18% compared to 2021.

In my opinion, the current valuation is excessively low because the market prices the uncertainty regarding management guidance accuracy as well as the general slowdown of sales growth YoY since both topics were major analyst concerns during the Q3 earnings call.

I believe that a growing money printer such as Olaplex should be worth more, especially in an environment where investors seek profitability over sales growth – and luckily, Olaplex even manages to combine both.

Based on different EV/ EBIT valuation scenarios, the stock price should rise to $9.63, $12.87, or $17.25 until 2025 in a bear, base, and bull case, respectively. This implies a potential ROI between 70% and 204% over a three-year period.

Reasons to Believe

Giant untapped markets both in the US and internationally

The global market for haircare products was estimated close to $40 bn p.a. in 2020, and it continues to grow. Olaplex has existed since 2014, and it is still in a full expansion phase. Penetrating new markets is one of management’s strategic pillars. In 2021, only 42% of sales were outside the United States, and the company’s products were distributed across 60+ countries, compared to 100+ countries for its main competitors (L’Oréal (OTCPK:LRLCY), Coty (COTY), Estée Lauder (EL), Henkel AG & Co. KGaA (OTCPK:HELKF)).

Excellent customer feedback at scale

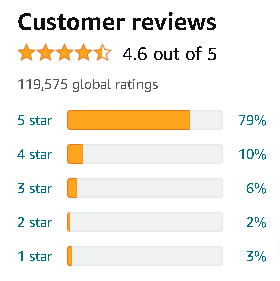

Olaplex was mentioned more often on Instagram than its far larger competitor L’Oréal (OTCPK:LRLCY) (14.2 million hashtags vs. 8.4 million, respectively). On Amazon, 100k+ customer reviews were submitted, and an overwhelming 89% are either 4 or 5 stars. On Reddit, entire beauty threads earned Olaplex critical praise. All in all, customers seem to be happy about the promised results of Olaplex’s products, which fosters brand reputation and suggests a loyal customer base.

Olaplex customer reviews (Amazon.com)

Industry leading Margins

Although EBIT margins are expected to be pressurized slightly (Earnings Call, Nov 9th), they will remain industry leading. With little debt, nearly abundant capital is available to fuel promotions, CAPEX, or return money to investors. Each decision would appreciate the stock price.

Mispricing because of uncertainty

The sales growth decline in Q4 might be technical and not organic, since management acknowledged that improvements in demand forecasting were necessary (Earnings Call, Nov 9th). As a result, Olaplex’s inventories increased significantly in Q3-2022. Both factors raised questions about the underlying reasons, and these are reflected in today’s valuation. Nevertheless, the company remains on a fundamental growth trajectory, and I consider the slowdown in Q3 more comparable to a speed bump than to a dead end.

Valuation

To value Olaplex, the following calculation is applied:

- I take management guidance FY 2022 as the baseline revenue for all cases

- I apply a bear, base, and bull sales growth CAGR (10%, 15%, 20%) to estimate sales in 2025

- I assume that EBIT margins will slightly contract as the business expands, but remain close to the historical value (56.2%)

- I will discount the vulnerabiity of Olaplex, namely that it only operates one product line, and estimate EBIT multiples between 15x and 18x (industry average 21x)

- I keep net debt constant at $405 million

- I expect no further shareholder dilution, so same amount of shares outstanding as in 2022 (691 million)

- I calculate the estimated value per share for each scenario

| Scenario | |||

| Valuation (All numbers in $m) | Bear | Base | Bull |

| Baseline revenue (guidance 2022) | 707.5 | 707.5 | 707.5 |

| Revenue Growth (CAGR 2023 – 2025) | 10% | 15% | 20% |

| Revenue 2025 | 941.7 | 1076.0 | 1222.6 |

| EBIT margin 2025 (historically 56%) | 50% | 54% | 56% |

| EBIT 2025 | 470.8 | 581.1 | 684.6 |

| EV/EBIT 2025 | 15x | 16x | 18x |

| EV 2025 | 7062.6 | 9296.8 | 12323.4 |

| Net Debt | 405 | ||

| Equity value 2025 | 6657.6 | 8891.8 | 11918.4 |

| Shares Outstading (million) | 691 | ||

| Implied Share Price | 9.63 | 12.87 | 17.25 |

| Implied Upside | 70% | 127% | 204% |

Potential Catalysts for Share Price Appreciation

Better Guidance on revenue projections in 2023

Management asserted it worked on a plan to improve sales and earnings forecasting for analyst guidance. Should that plan be executed successfully, uncertainty would be reduced and the share price should return closer to its intrinsic value.

Positive surprises on Q4-2022 results

The last guidance suggests a 20% YoY sales decline in Q4-2022. Should the results be positively surprising, i.e. less worse than expected, Olaplex’s share price could appreciate.

Return to Sales growth in the US and sustained growth internationally

Overall sales growth is driven by international expansion. Sustaining that momentum and while returning to growth in the US could be a sign that the company grows intrinsically and would cause the share price to rise.

Clearing of high inventories from the balance sheet

Olaplex piled up inventory during Q3-2022 and the inventory turnover declined. Management claims this was done in anticipation of high demand during the holiday season and to avoid a repetition of supply chain issues faced in 2021. A reduction in those inventory levels in Q4-2022 can be interpreted as a sign of more efficient operational management, which could increase the share price.

Risks &Limitations

Brand Reputation

Olaplex was subject to allegations that claimed certain ingredients in their products cause infertility. With a sensitive target audience, it is paramount for Olaplex to protect its brand reputation since failure to do so could threaten its business critically.

Ability to retain customers & customer churn, customer acquisition

A major concern for Olaplex’s products is customer churn since it is a treatment that is intended for application over prolonged periods of time. High churn would mean low loyalty, which would indicate dissatisfaction with the results yielded by the product. Fortunately, customer reviews on Reddit and on Amazon seem to point into the opposite direction.

Single Product Portfolio

Olaplex only manufactures haircare products. Failing to diversify product categories could be harmful for the company in the long run, especially when the company’s patents expire in 2034 – which will increase vulnerability to competition.

Equity Ownership Structure

While renown investors such as Two Sigma, Millenium, or Exodus Point bought Olaplex shares in Q3-2022, 76.94% of the equity remains with Advent International. This requires monitoring, since such substantial ownership could create negative price pressure should Advent decide to liquidate its position after price increases.

Conclusion

Olaplex is a cash machine, undervalued, and has strong growth potential. Its financial position is healthy, and it currently faces little to no competition in its niche. Its customers are happy with the results of the product. Yet, it only has one major product line which makes it vulnerable. Consequently, I factor in a discount compared to sector average multiples to value Olaplex. As a result, the valuation yields a 70% to 204% upside until 2025.

Nevertheless, I want to verify my suspicion that the 20% YoY sales decline in the US was technical and not organic. Also, a market capitalization of $3+ billion still leaves room for a lot of downside. Hence, I will wait for Q4-2022 results before deciding whether to invest or not. Nevertheless, the stock remains a buy in my opinion.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.