Novavax (NVAX): Don’t Buy This Surge, Sell (Technical Analysis)

-slav-

Price Action Thesis

We present a timely update to our previous post-FQ1 earnings article on Novavax (NASDAQ:NVAX), as there were substantial developments in its price structure.

We urged investors to take the opportunity to sell in May, which initially saw NVAX fall more than 30% to its June bottom. However, a sharp revival in the biotech space has recently lifted many pure-play biotech players. Therefore, we have decided to revisit our thesis and would include price action in the broad biotech space to corroborate our thesis on NVAX.

Despite the massive surge from its June bottom, we believe that the run-up is unsustainable, given its rapid flush-up price structures. Also, NVAX remains entrenched in a bearish bias. Our observation of the Nasdaq Biotechnology ETF (IBB) also indicates a dominant bearish bias, with a rapid flush-up from June’s oversold zones.

As a result, it has reinforced our conviction that investors should use the surge in NVAX as an even better exit point to layer out/cut exposure further if they have not.

NVAX – Sell Thesis Played Out In May But Overturned By Oversold Zones In June

NVAX price chart (TradingView)

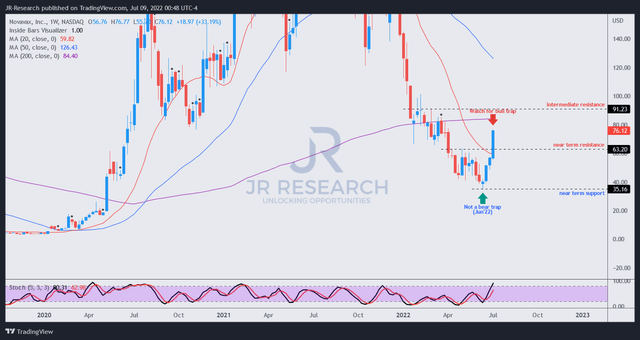

As mentioned, our Sell thesis played out well in May, as it fell more than 30% before reaching oversold zones in June. In addition, there was a bullish divergence on the stochastics in its mid-June bottom, which highlighted buying momentum has built up despite its steep collapse.

Consequently, NVAX has surged rapidly over the past three weeks, as seen above. It also broke through its near-term resistance ($63) with an eye toward its intermediate resistance ($90). However, we urge investors not to buy into such flush-up price action, as the price structures could precede a possible bull trap (no indication yet). As a result, we posit a possible bull trap (significant rejection of buying momentum) to either form close to its near-term or intermediate resistance.

Notwithstanding, investors can consider using the recent price action to cut exposure prematurely, with further cuts if a bull trap forms subsequently.

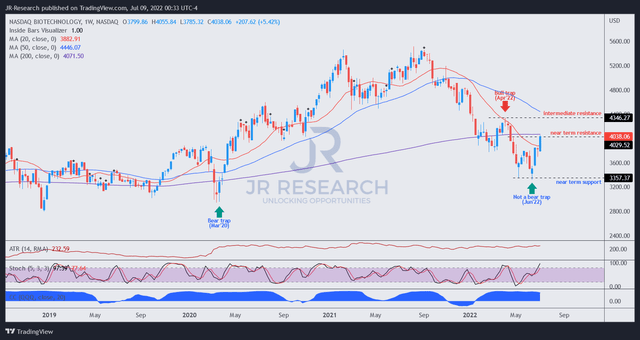

As seen above, the market lifted the general biotech space in June/July over the past three weeks. Investors can use one of the leading biotech ETFs as a proxy (we used the IBB, which represents the NBI above).

As seen above, the NBI also staged a remarkable surge over the last three weeks, testing its near-term resistance (4,040). However, we postulate that the surge is unsustainable, coupled with the dominant bearish flow seen in NBI. However, we also have not observed any signs of a bull trap yet. So, investors are encouraged to watch its price action closely.

Is NVAX Stock A Buy, Sell, Or Hold?

We reiterate our Sell rating on NVAX. However, we urge investors/traders considering directionally bearish set-ups to wait for a bull trap price action first.

We believe the recent spikes have proffered investors another opportunity to cut exposure at a much better price. We posit that its rapid surges are unsustainable.

Furthermore, we also highlighted in our previous article that the company is very late to the COVID vaccines game, with markedly falling revenue and profitability estimates moving forward.

In addition, the WSJ reported recently that “amid declining demand, tens of millions of COVID-19 vaccines are being discarded by drugmakers, governments, and vaccination sites.”

Notwithstanding, Novavax’s commitment to delivering an Omicron-specific vaccine in Q4 could have also lifted investors’ sentiments. But, the Street remains unconvinced, given its declining revenue estimates.

As a result, we urge investors to maintain a speculative posture on NVAX, using opportunities to layer out if it makes sense. Also, we will be on the lookout for future opportunities to execute directionally bullish set-ups, if appropriate.