Nintendo: Lucrative Cash Cow But Limited Upside For Now (OTCMKTS:NTDOF)

Kevin Frayer/Getty Images News

Investment thesis

Nintendo’s (OTCPK:NTDOY) competitive strengths as a videogame powerhouse remain untainted, but short-term supply-side issues will make festive season trading difficult. Operating as a steady cash cow has its attractions, but without a new product cycle, we believe there is a limited upside risk. We retain our neutral rating.

Quick primer

Nintendo is a leading franchise in electronic entertainment. We estimate its latest Switch game console will reach over 119 million hardware unit sales this festive season – the bestselling console for the company to date since the Wii which sold 103.51 million units.

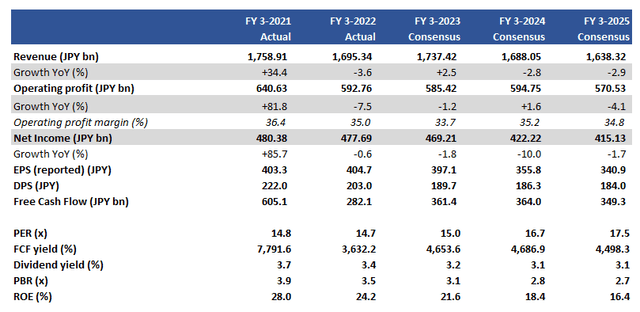

Key financials with consensus forecasts

Key financials with consensus forecasts (Company, Refinitiv)

Our objectives

China’s zero-tolerance policy over COVID-19 has hit Zhengzhou, where Foxconn’s (OTCPK:FXCOF) factories assemble the Apple (AAPL) iPhone, affecting shipment availability into the festive season. Nintendo’s key assembly partner Hosiden (OTCPK:HOIEF) revised down FY3/2023 guidance in November 2022, citing uncertain procurement conditions for semiconductors and other electronic components.

We want to assess the short-term impact of supply constraints into the key festive quarter, as well as the outlook for the next-generation hardware as the Switch enters its sixth Christmas season.

Not an ideal environment

Whilst the company has already telegraphed supply issues for the Switch hardware in Q1-2 FY3/2023 results (page 3) by decreasing shipment volume targets, we believe conditions have deteriorated further, underlined by Hosiden’s recent statement. Into the sixth festive holiday season, the hardware should be making a relatively healthy margin, and its comprehensive software library should still make it an ideal stocking filler.

The fall in hardware sales YoY will hurt software sales – both real and digital. Although the tie ratio (the proportion of software versus hardware units) is expected to rise slightly for FY3/2023 post-company revision, it nevertheless highlights that the key aim of growing the installed base is under some pressure. This is not helpful given the post-COVID normalization of demand, the relative lack of new blockbuster first-party software releases, and the cost-of-living crisis which is affecting key markets such as the U.K., Japan, and to some extent, in the U.S. We have already witnessed some evidence of a slowdown in the electronic entertainment market overall.

Whilst the game industry has exhibited signs of being ‘recession-proof’ in past cycles, we believe there is an element of truth to this as market growth is driven by products as opposed to economic cycles. However, when we take into account that the size of the global industry is approaching USD 200 billion, we feel that it is more susceptible to economic downturns due to its mass-market appeal – the industry is no longer primarily driven by a core audience thanks to smartphones and Nintendo.

Running a cash cow for the next two years

If you were running a platform where there are over 106 million playing users, with 36 million online account holders, would you switch (excuse the pun) it off? Nintendo has spent the last 6 years scaling the Switch franchise, and it has become a major cash cow operation despite becoming ex-growth and appears to be in no hurry for a next-generation machine. Management continually suggests that this platform will have a long shelf life (page 11), from which we infer two things. Firstly, there may be some hardware upgrades to come, but the company is unlikely to embark on a new product cycle in the next two years at least. This is fairly neutral to the shares in our view, but since new product cycles and expectations can drive the share price, the upside risk looks limited. Secondly, an ex-growth earnings profile will continue, meaning a share price appreciation will have to come from significant multiple expansions or a major increase in shareholder returns – neither of which we believe is likely.

We believe the company is in a position to allocate capital more towards shareholder returns, but as we saw in FY3/2022 when dividends were cut YoY, the company likes to have a major cash reserve given the difficult times experienced when product releases were unsuccessful (such as the GameCube and Wii U). This attitude to hoarding cash is unlikely to change.

Valuation

On consensus forecasts, the shares are trading on PER FY3/2024 16.7x on a flat to falling earnings profile YoY. With a dividend yield of around 3.0%, investors are not paid significantly to wait for the next big product release, and with FX market volatility coming down, a depreciating yen will become less of a tailwind for growth.

Risks

Upside risk comes from a major new product announcement in the next 6 months, which could reinvigorate interest in the franchise. In the shorter term, supply-side issues being addressed will be positive for sentiment as the key festive season will become operationally smoother to do business. Management could also consider increasing shareholder returns, although current priorities appear to be investing in capex (expanding office space in Kyoto) and JVs.

Downside risk comes from a poorer-than-expected performance in the key festive quarter, resulting in another revision for FY3/2023 company guidance. Weak guidance into FY3/2024 would be a negative, although we believe market expectations are not that high.

Conclusion

Investors like Nintendo shares given its sustainable free cash flow generation with the hit Switch platform giving it low downside risk. However, we believe the risk of making a current investment is opportunity cost, particularly from a product cycle point of view. The company’s competitiveness and its ability to continue creating stellar intellectual property with a global appeal remain steadfast – but we do not expect any major developments soon. We retain our neutral rating.