Nicholas Ward’s Dividend Growth Portfolio: June 2022 Update

Sezeryadigar

Long-term followers of mine know how these things go…another month, another step towards financial freedom.

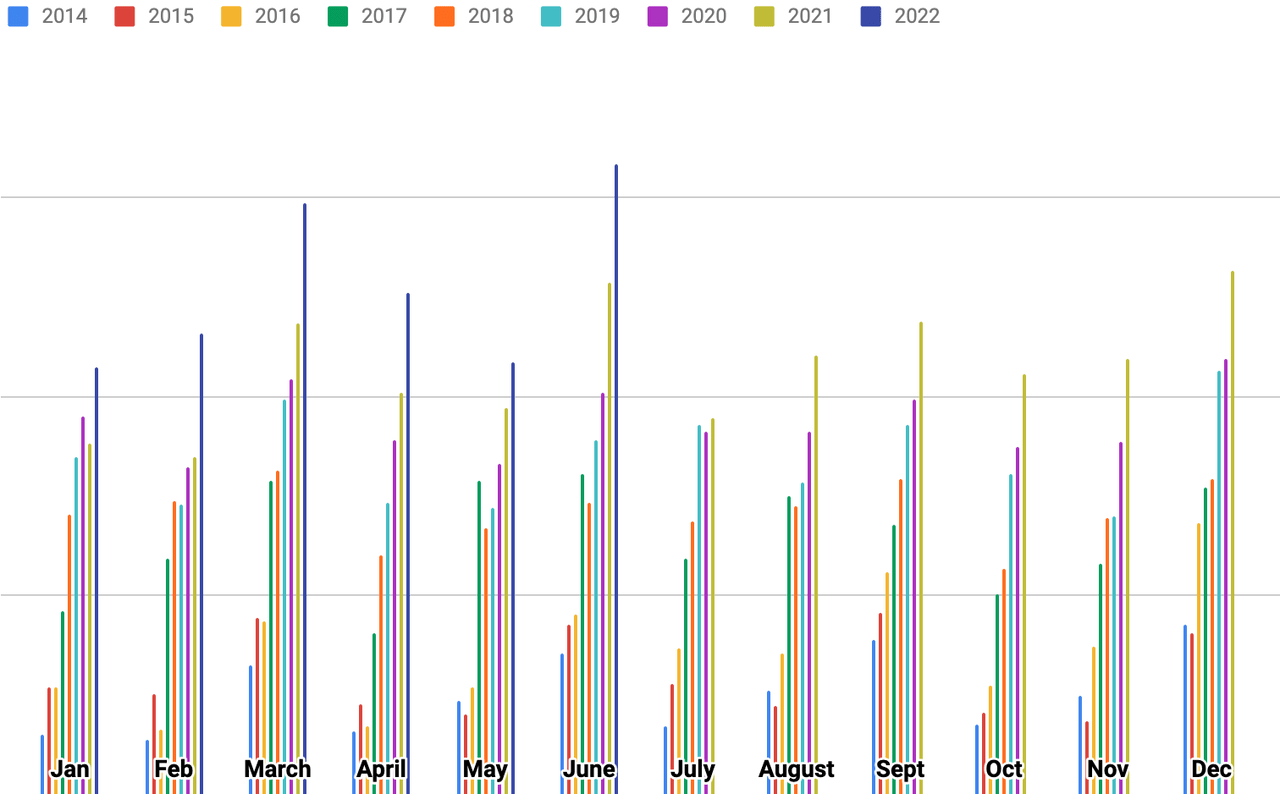

After a slightly smaller (yet, still totally acceptable) step during May (my passive income increased by 11.82% during that month), I was right back on the 20%+ pace that I’ve become used to throughout the last year or so (largely due to an increase in my family’s disposable income which has allowed me to allocate more new savings to the market on a monthly basis).

During June, my passive income increased by 23.32% on a year-over-year basis.

Nick’s Dividends (Nick’s data)

This meant that my passive income increased by at least 20% during 9 out of the last 12 months.

June of 2022 was an all-time record for me in terms of monthly dividend income.

For the very first time in June, my portfolio produced enough passive income to theoretically make my monthly mortgage payment. That was a mental milestone that I’ve been looking for. I don’t have any plans to exit the accumulation stage and enter into the distribution stage of my portfolio’s lifespan in the near term. I plan to continue to re-invest my dividends and use them to accelerate the compounding process that I’m cultivating here for the foreseeable future (due to a relatively low mortgage rate, I believe it makes more sense to allocate funds to the market – especially when it’s down ~20% – as opposed to paying off relatively low-interest rate debt). But, it feels really good knowing that if push came to shove, my portfolio could help support my family through a tough time, helping us to pay major bills like car payments and/or mortgage payments.

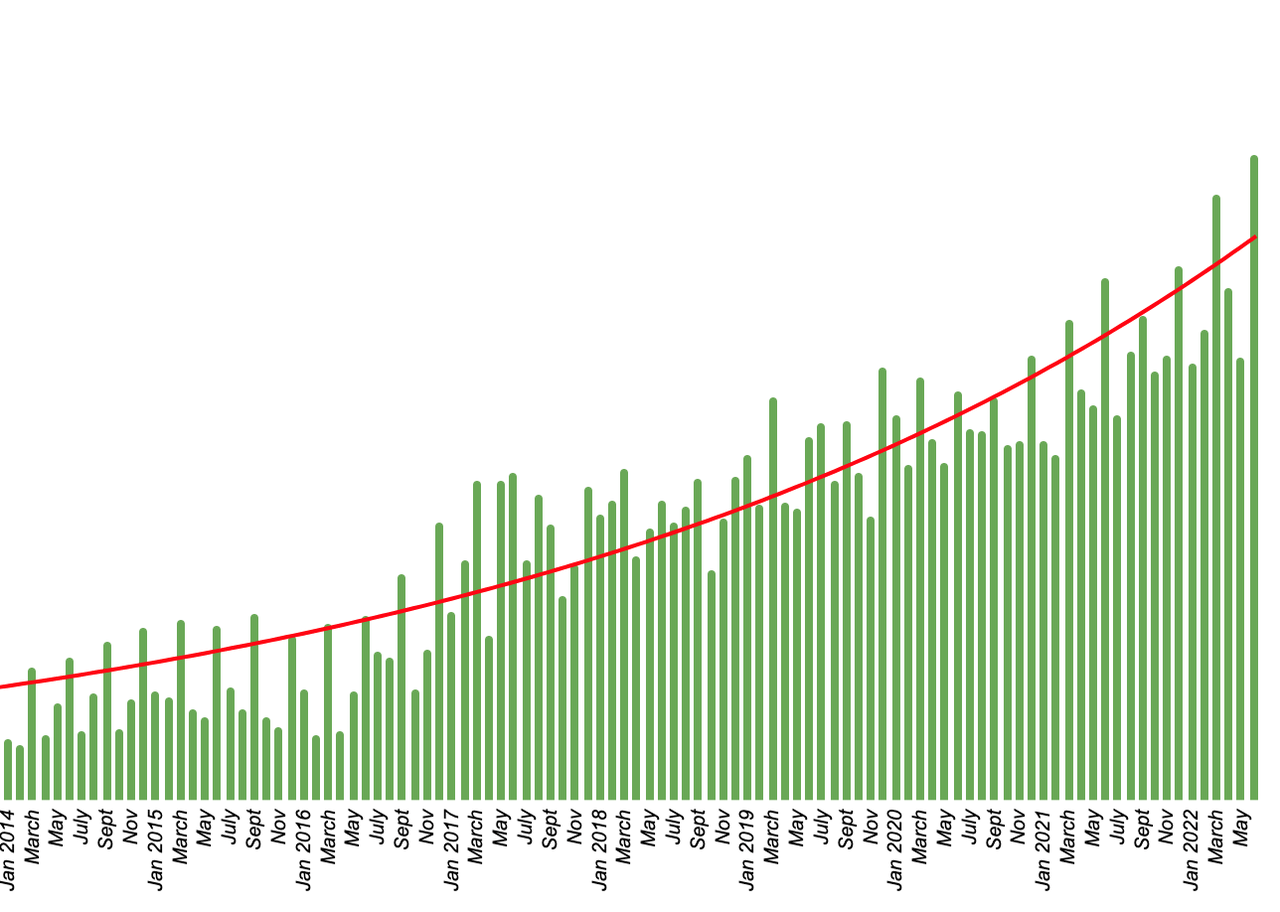

June’s passive income performance pushed my year-to-date dividend growth up to 23.77% compared to the performance that my portfolio posted during the first 6 months of 2021.

Nick’s Monthly Dividends (Nick’s data)

There has recently been slight change in my household’s financial situation which is likely going to reduce amount of money that I allocate towards the brokerage accounts by approximately 20%-25% on a monthly basis; however, even with that in mind, I still believe that 2022 can be a 20%+ dividend growth year, overall.

And thankfully, our overall savings rate isn’t declining…moving forward, we’ll just be allocating a larger portion of our monthly income towards a 401(k) account due to a generous employer match (although I’d love to manage this money myself, I’m not going to turn down a quick 100% return…an employer 401(k) matching program is about the only “free” money that exists in this world).

So all in all, despite numerous macro headwinds (inflation concerns, talk of recession, geopolitical issues…you name it) I remain very happy with the dividend growth path that I’ve embarked upon. As I always say, short-term share price movement is unpredictable. Volatility in the markets is largely based upon irrational speculation driven by fear and/or greed. But, for the most part, dividends are based upon fundamental performance which makes them much easier to model. I sleep well at night knowing that I’m making – reliably increasing – money while I sleep.

It doesn’t get much better than that and I look forward to watching the compounding process continue to play itself out with regard to organic increases, monthly selective re-investments, and the ongoing additions of wonderful companies with generous dividend growth policies to my portfolio.

Total Returns

As I just stated, short-term market volatility/share price movement is unpredictable and therefore, I focus the vast majority of my attention on the quality, safety, and growth prospects of my passive income stream.

Overtime, I’m confident that the same rising fundamentals that dictate dividend safety/growth prospects will also result in higher share prices. But, since my goal is to live off of my passive income stream, instead of liquidating assets to fund my retirement, capital gains are not a priority (I’m much more interested in capital preservation and risk reduction via attractive margin of safeties).

However, as silly as I think it may be to pay close attention to month-to-month returns, I know that many of my readers like to know how well my portfolio is performing overall (instead of just focusing on the passive income results like I do) and therefore, I’ll quickly provide that information as well.

Because of the difficulty of calculating time-weighted returns, I only do that once a year (during my year-end portfolio review). In the meantime, I use the portfolio index returns provided by Personal Capital when looking at my aggregate holdings.

During June, my portfolio index posted losses of 7.38%. Obviously, that’s not great. But, during that same 30-day period the S&P 500 was down by 8.39%, so my portfolio’s performance was relatively solid.

Through the first 6 months of the year, my portfolio index posted results just slightly ahead of the S&P 500’s (I was up, on a relative basis, by just 0.13%). However, being that my portfolio yields ~2.1% (well above the SPY’s 1.54% yield), my relative out-performance is likely to be a bit higher once dividends are factored into the equation.

I should note, I’m not sure exactly how the Personal Capital index results factor in new capital additions when calculating returns and therefore, I expect these results to be more relevant and accurate once I take the time to do the accounting work and calculate the time-weighted data. But, all in all, it appears that I’m tracking the S&P 500 closely, while generating a higher dividend yield and strong dividend growth, which means that my portfolio management strategy is going exactly as planned.

June Trades

With the capital gains out of the way, let’s move onto the trades that I made in June…

During the month I made a total of 13 trades, 11 purchases and 2 sales.

8 of these trades (all buys) came on 6/1/2022 when I put my May dividends to use via selective re-investment.

On 6/1/2022 I added to existing positions of Prologis (PLD) at $125.66, Intercontinental Exchange (ICE) at $102.37, Hormel (HRL) at $47.97, Lowe’s (LOW) at $192.03, Air Products and Chemicals (APD) at $243.70, Ecolab (ECL) at $162.15, Nvidia (NVDA) at $186.96, and Owl Rock Capital Corporation (ORCC) at $13.42.

All in all, I think this was a nice blend of defensive/core holdings (ECL & HRL), high dividend growth stocks (ICE & LOW), a couple of beaten down industrial/cyclical names (APD and PLD), beaten down high/speculative growth (NVDA), and a high yield play (ORCC).

ORCC and NVDA may not contribute to my dividend growth anytime soon; however, I think both stocks offer nice upside potential due to recent sell-offs. I don’t necessarily think that HRL, ICE, PLD, APD, or ECL are particularly cheap at those price points; however, I’m underweight in each of these holdings and they’re definitely positions that I want to increase my exposure to over time. Therefore, even without an attractive margin of safety, I’m happy to use the selective re-investment process to build those positions, slowly and steadily, over time. Lowe’s, however, looks extraordinarily cheap to me below $200 and therefore, I was pleased to add to that overweight position in my portfolio because of LOW’s strong dividend growth prospects combined with expectations of a double digit total return CAGR over the coming years.

Now, before I discuss the remaining trades I should note that I went on a wonderful vacation with my family during June (we visited Disney World for a few days and then spent the rest of the week in the Florida Keys; I had a blast with the kids at Disney and I was blown away by the beauty of the Keys ) and therefore, I didn’t have as much cash to invest as I usually do.

On 6/16/2022 I put the remainder of my monthly savings (after the trip expenses were deducted) to work, initiating a position in Sherwin-Williams (SHW) at $218.31.

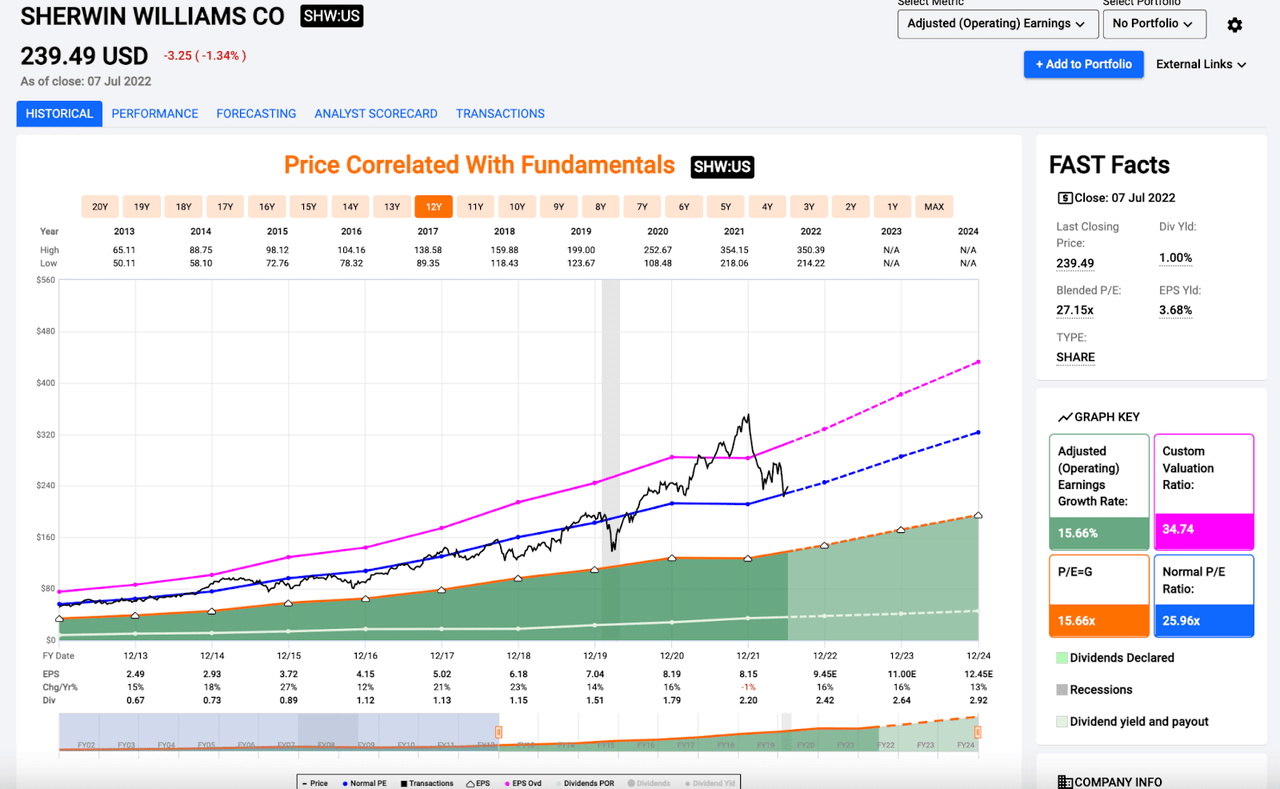

SHW is a stock that has been on my radar for years and years. Frankly, it’s one of those blue chips that never seems to look cheap (which is why I’ve been on the sidelines for so long) and therefore, when the stock dropped down to the ~23x forward area, I was happy to initiate exposure. As you can see on the F.A.S.T. Graph below, 23x forward also corresponded with the ~25.5x blended P/E level, which is the stock’s 10-year average multiple.

F.A.S.T. Graphs (F.A.S.T. Graphs )

Once again, I don’t think that SHW was cheap at this level. But, 23x is where I think fair value lies and therefore, I was very happy to wear my Buffett cap and buy shares of a wonderful company at a fair price.

In terms of total returns (SHW is up 449% during the last decade) and dividend growth (SHW’s 5 and 10-year dividend growth rates of 14.5% and 16.3%, respectively)…it doesn’t get much better than SHW.

This certainly isn’t a sexy company, but it’s best-in-breed in the paint/coating industry and as you can see on the chart above, analysts expect to see the stock compound its bottom-line at a ~15% clip for the next several years.

To me, that points towards dividend growth prospects in the ~15% area (in-line with historical averages) and therefore, I was pleased to pay fair value for a stock with that sort of potential.

It was a bit sad only having enough savings to buy shares of one beaten down company last month, but at the end of the day, coming into the month if I could have only chosen one name to buy off of my “don’t own it, but wish I did list” then SHW would have been a top choice.

And, moving forward, now that I’ve established a respectable stake, I can continue to build my SHW exposure via selective re-investment on a monthly basis (spoiler alert: this is exactly what I did on 7/1/2022 when I re-invested my June dividends).

While I love accumulating dividend growth stocks and accelerating the compounding process of my passive income stream, I think it’s important – first and foremost – to live below one’s means. The memories that we made as a family on vacation are priceless, so I definitely don’t have any regrets with regard to prioritizing an experience in the present over long-term investments with a significant chunk of my June savings. But, that did mean that I had to get a little creative when a couple of bargains popped up during June that I wanted to take advantage of…hence, the 2 sales.

The market struggled overall in June, which meant that other attractive deals popped up on my watch list. So, to take advantage of those prices I had to raise funds from within my portfolio (active management).

On 6/16/2022, shares of Alexandria Real Estate (ARE) dipped below my entry level price target and because I wanted to take advantage of that opportunity, I decided to raise cash from within my portfolio to fund a purchase. To do so I trimmed roughly 22% of my Bristol Myers Squibb (BMY) position at $72.39, locking in gains of approximately 52% and reducing my single stock risk (something that I am happy to do with bio-pharma names when they become overweight due to the difficulty of predicting long-term sales/earnings trends because of patent cliffs and M&A execution risks). I put those proceeds to work, buying shares of ARE at $130.96. At the time, I noted that BMY was up 17% on a year-to-date basis and ARE shares were down more than 40%. BMY is one of ARE’s largest tenants, so in a way, I still maintained exposure to the bio-pharma name. And, most importantly, by swapping out BMY for ARE, I used active management (buying low, selling high, and buying low again) to increase my passive income stream by 19.6%. Lastly, even after this trim, BMY remained a top 15 position for me, with a slightly overweight weighting. I was hoping to have the opportunity to average down into ARE further, but shares have rallied since then. I’d love to buy more ARE in the $120 area.

Moving onto the last trade that I made during June…

On 6/17/2022, I liquidated my entire stake in Tyson Foods (TSN) at $81.93, locking in profits of 6.47%, and used the proceeds from that sale to continue to average down into my recently established Parker-Hannifin (PH) stake into weakness (buying more shares of PH at $234.83).

This trade didn’t increase my income in a meaningful way (PH’s yield essentially in-line with TSN’s); however, I believe that PH is a much higher quality company than TSN, so while this trade didn’t improve my income prospects in the near-term, I think it does over the long term, due to PH having stronger dividend growth prospects (PH is a Dividend King with a 66-year streak of annual dividend growth and a 10-year DGR of 10.8%). PH recently increased its dividend by 29.1%. In 2021, PH increased its dividend by 17%. On the flip side of this trade, TSN’s last two dividend increases came in at 3.4% and 5.9%. That 3.4% raise put TSN on the chopping block for me (low single digit dividend growth isn’t acceptable in my portfolio unless the dividend yield is much higher than TSN’s) and therefore, I was happy to use my position to lock in profits and raise funds for a rainy day like we had in the middle of June.

Nicholas Ward’s Dividend Growth Portfolio

|

Core Dividend Growth |

57.48% | ||

| Company name | Ticker | Cost basis | Portfolio Weighting |

| Apple | AAPL | $24.26 | 14.36% |

| Microsoft | MSFT | $60.71 | 4.38% |

| Broadcom | AVGO | $234.30 | 3.03% |

| Qualcomm | QCOM | $76.14 | 2.61% |

| Johnson & Johnson | JNJ | $114.02 | 2.21% |

| BlackRock | BLK | $413.84 | 2.01% |

| Cisco | CSCO | $32.67 | 1.68% |

| Starbucks | SBUX | $48.10 | 1.81% |

| Bristol Myers Squibb | BMY | $49.47 | 1.57% |

| Cummins | CMI | $217.77 | 1.47% |

| Merck | MRK | $73.71 | 1.44% |

| PepsiCo | PEP | $93.35 | 1.41% |

| Lockheed Martin | LMT | $346.87 | 1.25% |

| Raytheon Technologies | RTX | $78.18 | 1.26% |

| Brookfield Renewable | BEPC | $33.49 | 1.22% |

| Coca-Cola | KO | $40.07 | 1.17% |

| Brookfield Asset Management | BAM | $35.58 | 1.12% |

| Honeywell | HON | $126.18 | 1.11% |

| Deere & Co. | DE | $347.85 | 0.99% |

| Amgen | AMGN | $136.07 | 1.09% |

| Texas Instruments | TXN | $95.19 | 0.88% |

| Pfizer | PFE | $30.48 | 0.96% |

| Brookfield Infrastructure | BIPC | $39.19 | 0.86% |

| Illinois Tool Works | ITW | $130.90 | 0.75% |

| Northrop Grumman | NOC | $376.97 | 0.61% |

| Parker-Hannifin | PH | $255.96 | 0.84% |

| Intel | INTC | $32.26 | 0.53% |

| Essex Property Trust | ESS | $228.98 | 0.52% |

| AvalonBay Communities | AVB | $156.60 | 0.48% |

| Diageo | DEO | $107.91 | 0.46% |

| Digital Realty | DLR | $49.87 | 0.45% |

| Alexandria Real Estate | ARE | $130.96 | 0.47% |

| Medtronic | MDT | $73.94 | 0.43% |

| Stanley Black & Decker | SWK | $139.75 | 0.48% |

| Air Products and Chemicals | APD | $237.16 | 0.36% |

| Hormel | HRL | $42.76 | 0.40% |

| McCormick | MKC | $35.71 | 0.28% |

| Ecolab Inc. | ECL | $156.01 | 0.29% |

| Prologis | PLD | $131.90 | 0.24% |

| High Yield | 15.04% | ||

| Realty Income | O | $62.24 | 2.30% |

| W. P. Carey | WPC | $65.23 | 1.66% |

| Altria | MO | $49.68 | 1.51% |

| AT&T | T | $28.83 | 1.63% |

| Agree Realty | ADC | $65.85 | 1.46% |

| AbbVie | ABBV | $79.08 | 1.44% |

| British American Tobacco | BTI | $37.89 | 0.71% |

| Enbridge | ENB | $36.00 | 0.78% |

| Federal Realty Investment Trust | FRT | $115.13 | 0.64% |

| Philip Morris | PM | $96.12 | 0.58% |

| National Retail Properties | NNN | $36.57 | 0.63% |

| STORE Capital | STOR | $22.91 | 0.57% |

| Verizon | VZ | $45.20 | 0.38% |

| Prudential | PRU | $100.58 | 0.38% |

| Pinnacle West | PNW | $81.67 | 0.37% |

|

High Dividend Growth |

12.89% | ||

| Visa | V | $74.29 | 2.36% |

| Comcast | CMCSA | $38.54 | 1.88% |

| Lowe’s | LOW | $148.28 | 1.61% |

| Nike | NKE | $59.52 | 1.49% |

| Home Depot | HD | $250.58 | 1.05% |

| Mastercard | MA | $81.40 | 1.00% |

| L3Harris Technologies | LHX | $185.82 | 0.74% |

| Domino’s Pizza | DPZ | $355.20 | 0.62% |

| Intercontinental Exchange | ICE | $99.04 | 0.51% |

| Booz Allen Hamilton | BAH | $75.49 | 0.43% |

| Roper | ROP | $418.69 | 0.34% |

| S&P Global | SPGI | $336.57 | 0.30% |

| Sherwin-Williams | SHW | $219.44 | 0.37% |

| ASML Holding | ASML | $643.47 | 0.19% |

| Non-Dividend | 9.07% | ||

| Alphabet | GOOGL | $838.11 | 5.39% |

| Amazon | AMZN | $87.86 | 1.35% |

| Adobe | ADBE | $484.48 | 0.66% |

| META | $180.50 | 0.43% | |

| Netflix | NFLX | $304.53 | 0.37% |

| Salesforce | CRM | $213.13 | 0.34% |

| Chipotle | CMG | $1,298.41 | 0.19% |

| PayPal | PYPL | $201.72 | 0.18% |

| Square | SQ | $170.31 | 0.16% |

| Palantir | PLTR | $16.16 | <0.10% |

|

Special Circumstance |

4.45% | ||

| Walt Disney | DIS | $91.69 | 1.84% |

| NVIDIA | NVDA | $35.23 | 1.41% |

| Constellation Brands | STZ | $172.19 | 0.41% |

| Owl Rock Capital | ORCC | $14.94 | 0.24% |

| Blackstone | BX | $106.71 | 0.24% |

| Scotts Miracle-Gro | SMG | $153.56 | 0.11% |

| Carrier | CARR | $20.97 | 0.10% |

| Otis | OTIS | $58.65 | 0.10% |

| Crypto | Diversified Basket | n/a | 0.41% |

| Cash | 0.66%* | ||

| Most | Recent | Update: | 7/10 |

*I should note that this is just the cash in my brokerage accounts; right now I’m keeping the majority of my cash in bank accounts (where I can get a little bit of yield). Overall, my cash position sits at ~4.9%.

Conclusion

During the last couple weeks of June, the S&P 500 rallied, so I didn’t make any more trades. I was hoping that we’d see the major index hit the -25% threshold so that I could invest my next bear market bucket (I’ve already put my -10%, -15%, and -20% bucks to work…-25% is next). We were within mere points of that threshold at the market’s recent lows, but we didn’t quite get there. But, bear market rallies happen all of the time, so I’ll be willing and ready to continue to average down into this macro sell-off if the recent bullish sentiment shifts back to bearish territory and the market’s negative trend persists moving forward.

And…in the meantime, I’m very happy to sit back and watch my passive income compound. I hit an all-time high, as far as monthly passive income goes, in June of 2022 and I look forward to breaking that record, time and time again, as the months/years/decades go by!