NextNav: This Next-Gen GPS Company Has A Huge TAM (NASDAQ:NN)

gorodenkoff/iStock via Getty Images

Investment Thesis

NextNav (NASDAQ:NN) is a U.S.-based geolocation software company founded in 2007 by Ganesh Pattabiraman. It has a huge ambition of transforming the current GPS (Global Positioning System) landscape. NextNav is a next-generation GPS that provides geographical location services with highly accurate vertical positioning so that it reflects the 3D world around us, unlike the current GPS which is 2D. GPS technology had not improved in a long period of time, NextNav is trying to take GPS to the next level to meet the growing needs in the different industries such as ride-sharing, delivery, indoor mapping, gaming, autonomous vehicles, etc.

NextNav went public last year through a SPAC merger with Spartacus Acquisition Corporation. The company got caught in the broad market sell-off and is down almost 80% from its SPAC price of $10, now trading at $2.8. I believe the current price is a great entry point for a potential disruptor in the GPS space. The TAM for the company is huge and has a wide range of use cases that make its technology very valuable. It is also growing quickly as it is starting to ramp up more customers. Therefore, I rate the company as a buy.

Next-Gen Products

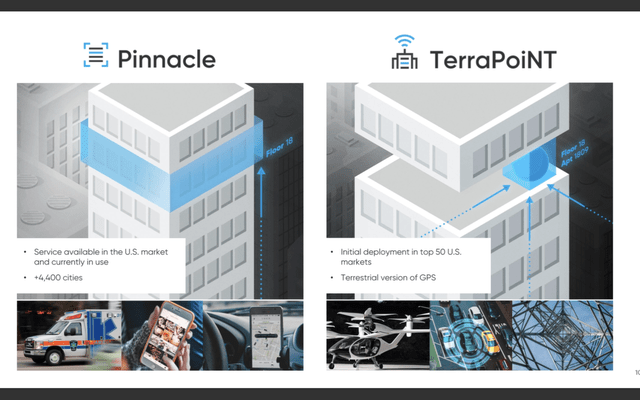

NextNav currently offers two products, which are NextNav Pinnacle and NextNav TerraPoiNT. NextNav Pinnacle is able to add a new dimension to the current GPS and make it 3D. It delivers precise, “floor level” vertical positioning for any geolocation application and is one of the most reliable z-axis services available in the market right now. This allows different users to pinpoint a location much more accurately, knowing also the vertical location of where the signal is being sent from. The application is easy to deploy as it leverages the barometric sensors already available in phones, tablets, and many other devices. It can also be easily integrated, as developers can add Pinnacle to their application using NextNav’s software development kit and APIs.

NextNav TerraPoiNT is an accurate, secure, and resilient PNT (Position, Navigation, and Timing) system that complements and enhances existing GPS capabilities. NextNav TerraPoiNT uses a dedicated, terrestrial network of transmitters to deliver critical PNT services in both indoor and urban areas, where GPS can’t. Unlike national space-based systems, the proximity of NextNav’s transmitters makes the signal strength 100,000 times that of GPS. It is also secure and offers fully encrypted signals resistant to GPS spoofing and jamming, providing much better security and reliability.

Market Opportunity

NextNav has a strong potential as it has a wide range of use cases in multiple industries. This includes public safety, autonomous vehicles, eVTOLs, deliveries, gaming, IoT, and more. According to the company, its TAM (total addressable market) is estimated to be over $100 billion. The TAM in the US alone is around $49 billion. I believe NextNav’s technology is able to increase the capability and efficiency of different industries, which will open up a lot of opportunities for the company moving forward.

Public Safety

First responders rely heavily on accurate and reliable geographical location data. NextNav’s solution now allows first responders to have access to the vertical position of where the signal is being sent out. Before we might only know which building the person is in but we might not know which floor and wherein the floor the person is at. Now with NextNav’s technology, we are able to pinpoint the person’s exact location and this allows first responders to react faster and more efficiently.

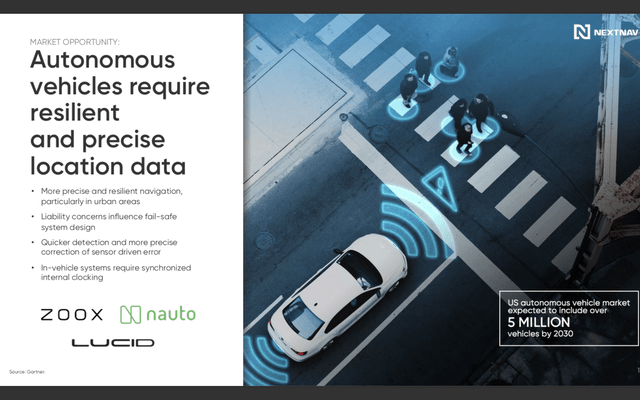

Autonomous Vehicles, eVTOLs And UAVs

The autonomous vehicles’ industry is growing rapidly. As more and more autonomous vehicles hit the road in the future, it is important to have resilient and precise location data. NextNav’s technology is able to provide accurate and reliable data for autonomous vehicles to navigate effectively, especially in crowded urban areas. The data also allows the vehicle to make quicker detection and more precise correction of sensor-driven errors.

eVTOLs (Electric Vertical Takeoff and Landing) and UAVs (Unmanned Aerial Vehicle) are rising in popularity. One of the biggest concerns for both eVTOLs and UAVs is their safety. Similar to Autonomous vehicles, NextNav is able to provide reliable navigation in urban areas that requires precise location awareness. 3D situational awareness is required for urban air mobility to assure safety, and this is something GPS could not provide with its 2D technology.

Deliveries And Gaming

For food delivery companies and commercial delivery companies, the delivery person is now able to locate your location in detail. In urban areas with multi-stories buildings everywhere, delivers may be able to find the location of the building you’re at but may not know which floor you’re at. With NextNav’s pinnacle, the delivery person is able to easily locate and deliver your goods to your doorstep but not at the front desk anymore. This reduces the time for drop-off and increases delivery efficiency.

More and more developers are now adding geolocation capabilities to their games to provide a more interactive experience. One of the prime examples is Pokemon GO, which opened up a whole new gaming experience by integrating geolocation features into the game. It recently partnered with Unity (U) to allow developers leverage NextNav’s solution easily through Unity.

Financials And Valuation

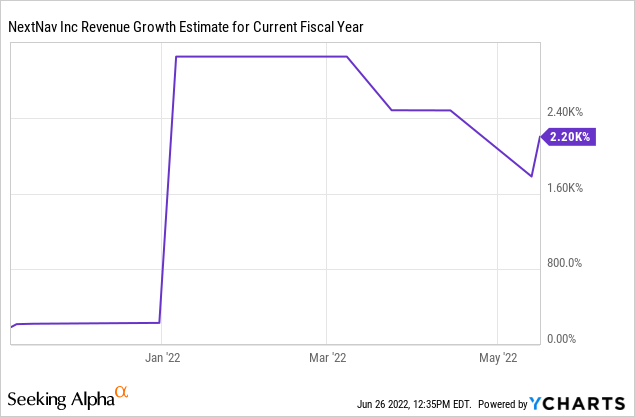

NextNav recently reported its first-quarter earnings for 2022, and it is showing strong top-line growth. The company reported revenue of $1.2 million, up 478% YoY (year over year) from $251,000. The increase is primarily driven by the increase in revenue from technology and services contracts with commercial customers. However, the bottom line is still weak as the company is still in the very early growth stages. Operating expense was $17.2 million, compared to $12.9 a year ago. Research and development expense alone was $4 million, or 3.3x its quarterly revenue. Operating loss for the quarter was $16 million, which widened 27% from $12.6 million a year ago. Operating cash flow was negative $(6.1) million compared to negative $(8.5) million, a slight improvement YoY. Diluted EPS was negative $(0.1) compared to $(4.8) a year ago. The company’s balance is very strong with $93.8 million in cash and no debt, which gives them a buffer for its cash burn.

Ganesh Pattabiraman, CEO, on first-quarter earnings

“We are off to a solid start to the year as we expand on the foundational work behind building the future of next generation GPS. We continue to see strong momentum in the adoption of vertical location capabilities with our Pinnacle service across markets, including public safety, gaming and IoT, helping to drive $1.2 million in revenue in the first quarter. We are also making strong progress building towards the launch of our TerraPoiNT network, with its market leading accuracy and reliability continuing to be validated by independent agencies and groups at both the government and industry level. We remain encouraged by the traction we’re gaining in key markets and with notable platforms and partners and are excited for the opportunities ahead.”

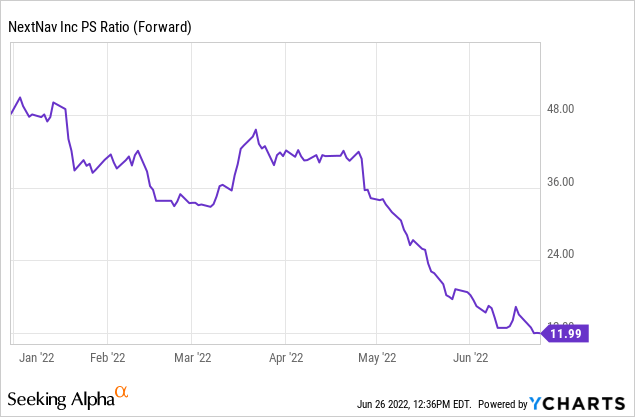

It is hard to value NextNav using most traditional metrics. Only the PS ratio can be used in this case as the company is still making minimal revenue with no profit and cash flow. It is worth noting that the company is still in the very early growth stages and I believe a lot of its opportunities can’t be quantified as they haven’t translated into revenue yet.

NextNav is currently trading at a fwd PS ratio of 11.99. This is expensive compared to most tech stocks. The Technology Select Sector SPDR Fund (XLK) is a good benchmark for tech companies, and it is currently trading at a PS ratio of 5.88, a 50%+ discount compared to NextNav. However, the revenue growth for XLK is 14.2% while NextNav’s revenue growth is much faster at 478%. According to Seeking Alpha’s analyst estimate, the company is forecasted to post triple-digit growth from 2022 out to 2025. The rapid growth will compress its revenue multiple quickly, its fwd 23 PS ratio is estimated to be 3.44, much more in line with XLK. I believe the current valuation is justified as the company is growing rapidly and have a huge TAM to grow into.

Conclusion

I believe NextNav has a huge potential. The total addressable market for the company is huge, and it is disputing the current GPS market. Its next-gen technology is crucial to emerging spaces like autonomous vehicles, eVTOLs, metaverse, and interactive gaming. An accurate and reliable geolocation solution is needed in order for these industries to operate efficiently and effectively. NextNav has a first-mover advantage and is already deployed in over 4,400 cities. It is also actively seeking partnerships with blue-chip companies like Unity and Qualcomm (QCOM) to expand use cases. The company is growing quickly, with revenue up 478% in the latest quarter as it starts to land more commercial customers. The current valuation is steep compared to the tech companies’ average, but it will compress quickly as revenue is expected to grow exponentially. Therefore, I rate the company as a buy and I believe it will grow into its valuation quickly given the huge opportunities ahead.