NextEra Energy: The Growth Priced In By The Market Is Too High (NYSE:NEE)

Daniel Balakov

Introduction

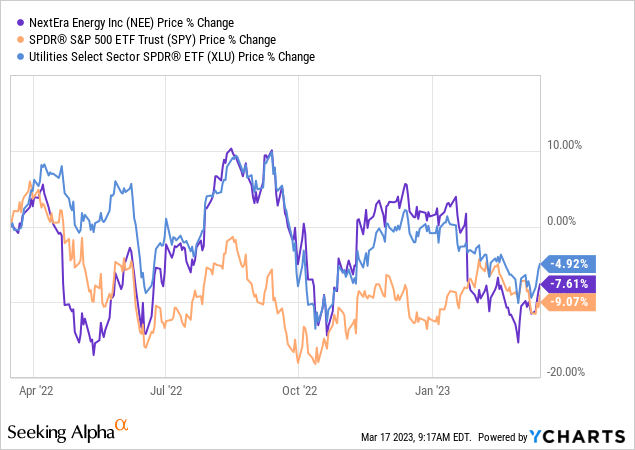

NextEra Energy, Inc., (NYSE:NEE) through its subsidiaries, generates, transmits, distributes, and sells electric power to retail and wholesale customers in North America. In the past year, due to the uncertain macroeconomic environment, many investors have started to turn towards more defensive stocks that offer at least some safety. Dividend paying firms in sectors, which are not directly impacted by the consumer confidence, including utilities or consumer staples, are often a popular choice in these turbulent times.

While the utilities sector and NextEra have in fact slightly outperformed the broader market over the past 12-month period, the question is: is the current price attractive enough to start a new position or to add to an existing one?

To answer this question, we will be using a multistage dividend discount model. First, based on this model, we will estimate, what is the implied dividend growth rate based on the current share price. Later, we will make our own assumptions regarding the growth and compare the two results.

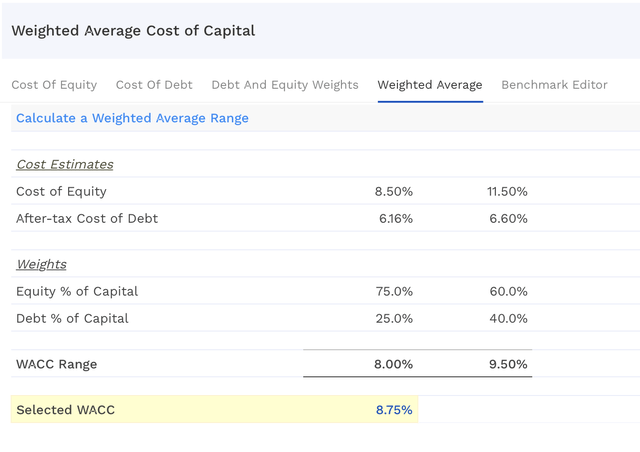

For both of the calculations, we will be using a required rate of return, which is in line with the firm’s weighted average cost of capital (WACC) of 8.75%.

Implied dividend growth by the market

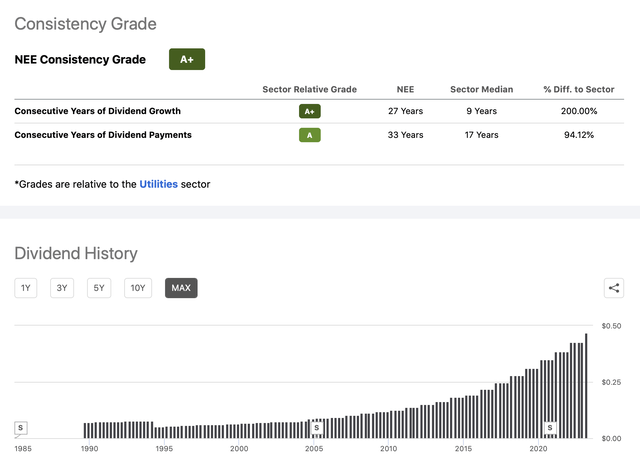

We assume two stage for this calculation, an initial stage of 5 years, described by relatively high and constant growth, and a second stage, which is a much slower rate of growth in perpetuity. You may ask, why this approach is suitable for valuation. The answer is: NEE has been committed to return value to its shareholders in the form of dividend payments for more than 30 decades. They have also managed to increase the amount of the dividend in each of the last 27 years.

Dividend history (Seeking Alpha)

The firm currently has a Dividend Payout Ratio (FY1) (Non GAAP), which is in line both with the sector median and with the firm’s own 5Y history. For this reason, we believe that the dividend is not in imminent danger of being cut or paused.

So let us go back to our original question of what the implied dividend growth rate is based on the current price. As the growth rate in perpetuity is much more uncertain than the near term growth rate, we will be putting our emphasis on the second stage of the dividend discount model.

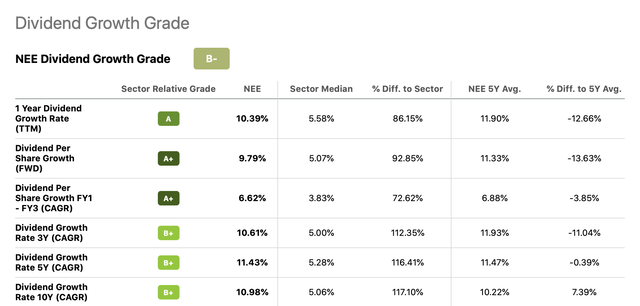

Dividend growth (Seeking Alpha)

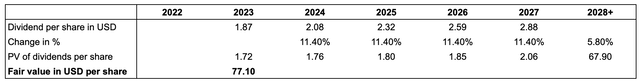

For the first 5 years (first stage), we assume that NEE will keep increasing its dividends at a 11.4% rate, corresponding to their 5Y CAGR. Afterwards, using the current market price, we will calculate the implied growth rate in perpetuity.

These results imply that the market is expecting the dividends to grow at a 5.8% rate in perpetuity.

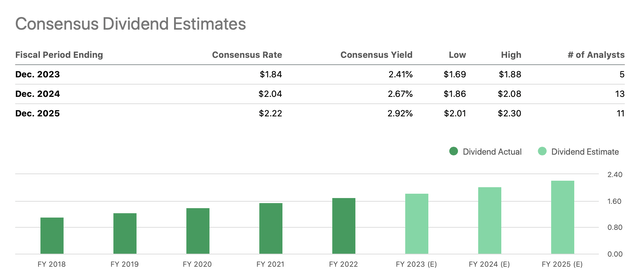

In our opinion, this growth rate in perpetuity is unreasonably high. We normally prefer to use perpetual growth rates in the range of 2-3%, which is close to the growth rate of the overall economy. Further, the growth rates used in the first stage are already very much optimistic. The average consensus estimate for the next years is quite a bit below our assumptions.

Dividend estimates (Seeking Alpha)

For these reasons, we believe that the market is pricing in too much growth, potentially both in the near- and long term, which we believe is not justified.

Our estimate

Our estimate is substantially more conservative.

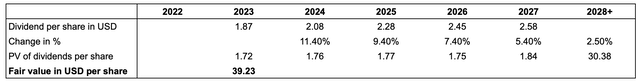

For this calculation, we will keep the required rate of return at the same level, and we will once again be using two distinctive growth stages. However, we will assume a perpetual growth rate of 3% and in the first stage we will assume a declining rate of dividend growth.

The following table summarizes our results:

Based on these estimates, the fair value appears to be way below the current market price, representing a downside of almost 50%.

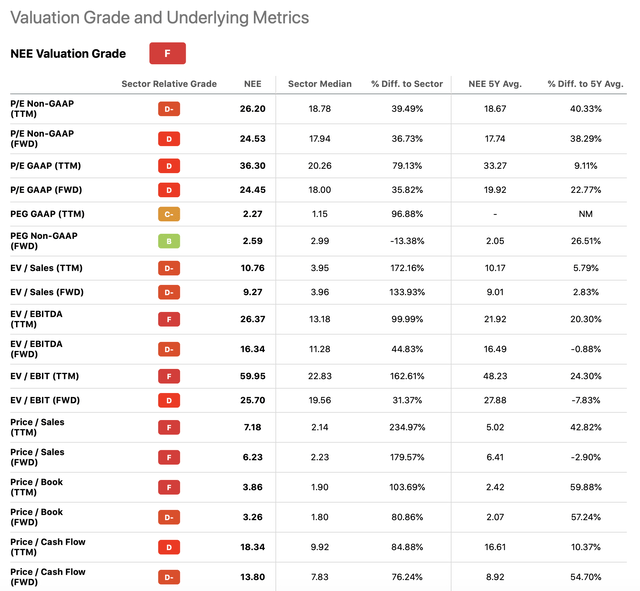

As this estimate appears to be very low, we have decided to cross check this with other valuation techniques. The following table summarizes the valuation of NEE, based on a set of traditional price multiples.

Also the price multiples are indicating that NEE is trading at a substantial premium compared to both the sector median and the firm’s own 5Y average. This premium can be partially explained by the above median profitability based on the ROE, and the firm’s above median growth within the industry, but we do not believe that it is entirely justified.

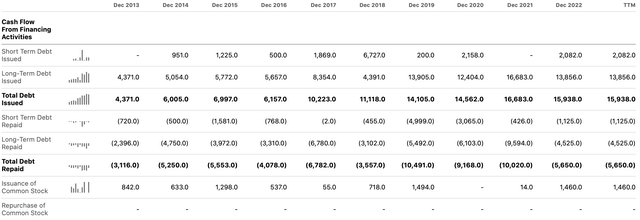

Further, when looking at the cash flow from financing activities, we can see that the firm has been regularly issuing shares in the past years, resulting in a diluting for the existing shareholders.

CF from financing (Seeking Alpha)

This is another factor, which makes the current valuation unattractive, in our opinion.

To sum up

The market appears to be pricing in significant growth both in the near- and in the long term. The near term dividend growth rate of 11.4% assumed is already on the high side, but to make the current share price justifiable, the perpetual dividend growth rate would need to be 5.8%, which we believe is too high.

When we make our assumptions more realistic and assume a slowing growth in the near term, along with a perpetual growth rate of 3%, close to the overall growth of the economy, our calculations yield a fair value of $39 per share.

The price multiples also imply that NEE’s stock is trading at a substantial premium compared to both the sector median and the firm’s own 5Y average, which we believe is not justified.

For this reason, our outlook is bearish on the stock.