Neogen Stock: Thinning ROIC & Profit, Downside Risks Looking Ahead

Francesco Scatena/iStock via Getty Images

Investment Summary

Since our last publication on Neogen Corporation (NASDAQ:NEOG) we’ve observed nil statistical change to command a re-rating to a buy. As a reminder, we rated NEOG a hold based on a multitude of factors, including flat EPS growth, downturn of earnings forecasted into the coming periods, issues surrounding its merger with 3M’s (MMM) food safety business, and unsupportive valuations.

Turning to the present day, we noted similar traits in the company’s latest earnings [presented on September 30] and the price response to its forward-looking growth estimates. Alas, I’m back today to discuss our latest findings on Neogen Corporation stock, and explain how and why we continue to rate it a hold. We’ve also narrowed our valuation on NEOG substantially and see it trading fairly at the current market price of ~$14.80, thus supporting the neutral view.

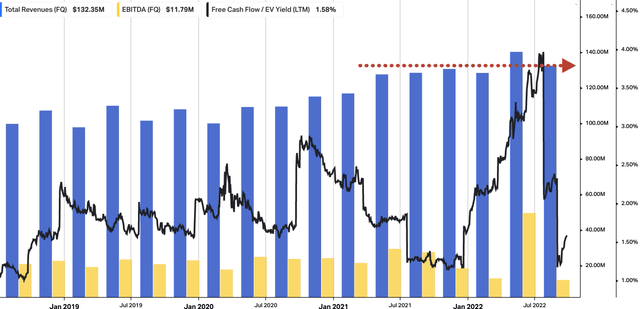

Exhibit 1. NEOG 18-month price evolution. Recently recovered to long-term resistance level, but continues to ride this to the downside [note: weekly bars, log scale]

NEOG Q3 earnings indicative of full-year trends

Turning to the company’s latest numbers, we noticed similar trends that clamped overall growth during the quarter. Note, NEOG reported its Q1 FY 2023 earnings, which roughly corresponds to Q3 in calendar year 2022.

We saw NEOG reported revenues of $132.3mm, an increase of 300bps compared to the same period last year. The company’s net income for the quarter was $5.2mm, or $0.05 per share, compared to $17.1mm, or $0.16 per share the previous year. Management says that, excluding deal costs associated with the 3M transaction, the company’s income would have been $17.1mm. You can see the headwind NEOG has faced over the last few quarters in driving revenue, core EBITDA upsides in Exhibit 2. Moreover, after a solid increase in free cash flow (“FCF”) yield, investors would now purchase the stock at a 1.6% trailing FCF yield.

Switching to the segment and geographical highlights, we noted several data points worth mentioning. To name a few:

- The food safety segment saw revenues of $64.6mm, a 300bps YoY increase. Excluding the impact of Forex (“FX”) headwinds, the segment’s overall sales increased by 900bps on organic revenues of 700bps. International revenues rose by 2% for the quarter, or 10% excluding the impact of FX headwind.

- It’s also worth noting that the animal safety segment recorded revenues of $67.7mm for the quarter, a 300bps increase over the previous year. The acquisitions of CAPInnoVet, Delf, GVS, and Thai-Neo Biotech contributed the bulk of the growth.

- NEOG’s China markets, on the other hand, decreased 18% YoY in USD terms, or 14% in CNY. This stemmed from the negative impact of COVID-19 lockdowns on business in the first quarter out of China. Further, we saw its Australian operations, which report through AUD, record a 700bps decrease in the first quarter.

- Organic growth for the UK operation in pounds was 12%, fronted by volumes of aflatoxin test kits, cleaners and disinfectants, genomic services, veterinary instruments, and animal care products. This growth was offset by lower sales in several diagnostic product lines, as well as tighter market conditions in Europe.

- Meanwhile, we saw the Brazilian operations recorded a 13% increase in sales for the quarter, underscored by sales volume of aflatoxin and deoxynivalenol test kits. This is underlined by the heightened presence of these mycotoxins during harvest season, requiring more testing. There was also uplift in sales of veterinary instruments and genomic services during the period. Overall, NEOG’s Latin-American operations recorded a 19% YoY increase in sales. This was spearheaded from sales of diagnostic test kits and culture media.

Exhibit 2. After cyclical growth at the top-line from FY16–FY20, revenue growth has stagnated whilst core EBITDA, FCF yield has pulled to the downside

Data: HBI, Refinitiv Eikon, Koyfin

NEOG is also currently in the process of migrating 3M Food Safety’s commercial software and cloud capabilities to the Neogen cloud. Both teams are working together to expedite the commercial data and analytics roadmap. The company is also re-evaluating its global R&D platforms to potentially deploy capital towards a new R&D facility in Minnesota in the first quarter of CY2023. Management also said that its operational teams are striving to resolve the backorder situation that has impacted 3M Food Safety’s sales “by 5% to 6%” over the past two quarters.

NEOG deeper look at fundamentals

Pulling back the layers of the company’s 3 financial statements and performing a deeper analysis, it’s fairly clear where the company needs to improve in order to see it re-rate in fiscal 2023.

It’s also no secret the broad-based cost of capital [equity, debt] has surged to multi-decade highs in 2022, driven by a combination of central bank tightening, and rising yields on corporate debt, to name a few.

The effective U.S. corporate AAA yield [investment grade corporate debt] has lifted to 4.52% at the time of writing, just off highs of 5.13% in October. This is up from 2.05% this time last year.

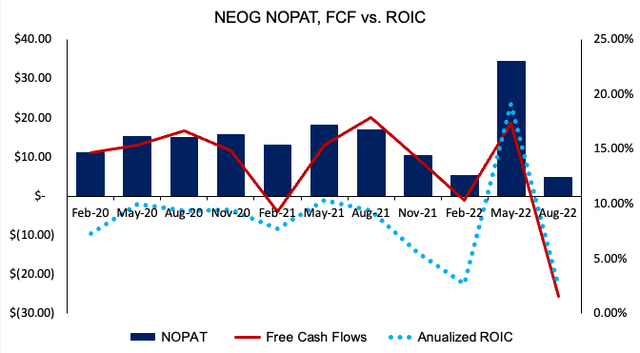

Hence, external financing of growth initiatives, even in profitable, short-duration equities has become a hinderance. Companies that can fund their own growth and create future economic value are therefore standouts looking ahead in our opinion. We benchmark this by checking return on invested capital (“ROIC”) against free cash flows in companies who are producing positive net operating profit after tax (“NOPAT”). Specifically, we look to see the amount of NOPAT generated from the previous period’s investments, and how this correlates to the free cash inflows/outflows the company is producing. Comparing this to the WACC hurdle examines economic value added.

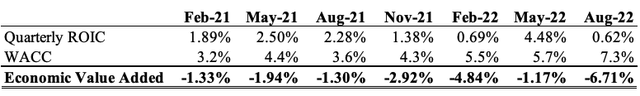

You’ll see below [Exhibit 3] that NEOG’s free cash flows have matched the trajectory of its ROIC over the last 2 years to date. This tells us that cash hasn’t been invested wisely, as, ideally, with free cash outflows/negative FCF, we’d see a corresponding uptick in ROIC to imply a positive return on those outflows. Instead, as free cash has flowed out of NEOG’s embrace, it has printed a corresponding negative return on its investments. You’ll see the same pattern reflected in Exhibit 4, with the negative economic value added since 2021.

As mentioned, we prefer to see profitable companies funding their own growth, and with the negative or declining FCF/ROIC prints from NEOG these past 2 years is a risk factor looking ahead in our opinion. This confirms our neutral view.

Exhibit 3. NEOG’s declining ROIC with corresponding free cash outflows hasn’t demonstrated ability to fund its future growth initiatives

Note: No reconciliations are made from GAAP earnings in the calculations provided. Free cash flow is calculated as [NOPAT – investments] whereas ROIC is calculated as [NOPAT / Invested capital]. Also note, that Invested Capital is calculated without the inclusion of Goodwill as an intangible asset. Goodwill is a non-cash, non-amortizable ‘asset’ that is provisioned each period, and isn’t required as an investment in the running of a company, unlike investments into fixed/tangible and/or intangible assets. (Data: HBI, Refinitiv Eikon, NEOG SEC Filings. )

Exhibit 4. Further evidence of the above is seen in the lack of economic value added

Note: Economic value added is calculated as [quarterly ROIC – quarterly WACC]. (Data: HBI, NEOG SEC Filings.)

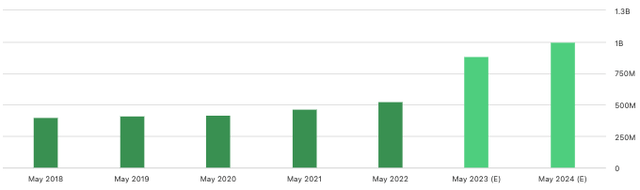

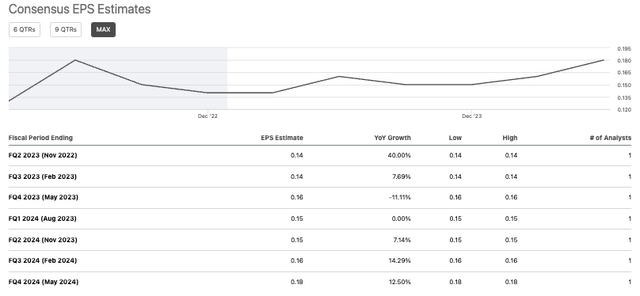

Looking downstream at NEOG’s earnings forecasts, we also noted a divergence in its top-line to bottom-line estimates. As you can see below, whilst the consensus revenue ramp for NEOG into 2024 looks to be a positive, this isn’t carried through to any EPS upside.

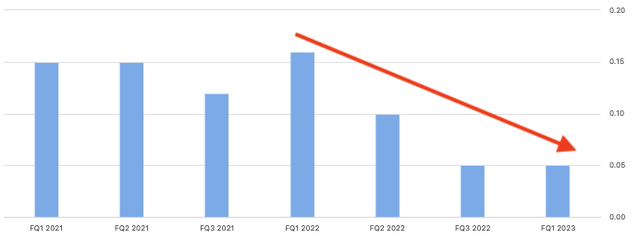

In fact, the consensus view is for the company to recognize single-digit EPS growth into February 2024. Moreover, the EPS decline over the course of CY2022 [Exhibit 7] has been well reflected in the price response seen in the NEOG share price.

Exhibit 5. Revenue ramp for NEOG looks to be appealing into 2024

Data: Seeking Alpha. NEOG, see: “Revenue””

Exhibit 6. Despite the above projections, this isn’t carried through to its bottom-line growth assumptions into 2024

Data: Seeking Alpha. NEOG, see: “Earnings Estimates”

Exhibit 7. EPS upsides over fiscal 2021–2022 haven’t been supportive of NEOG stock to re-rate

Data: Seeking Alpha. NEOG, see: “Earnings Per Share”

Valuation and conclusion

The question now turns to what these financial results mean to NEOG’s valuation. We’d note that consensus values the stock at 25.2x forward P/E [non-GAAP estimates], and 13.7x forward EBITDA.

Both of these sit at a premium to the sector median respectively, and also above the S&P 500’s forward P/E of ~18.8x for FY23′. At 25.2x consensus non-GAAP forward EPS estimates of $0.59 derives a valuation of $14.80, supporting our neutral viewpoint.

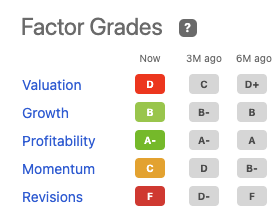

Checking Seeking Alpha’s quantitative factor gradings for NEOG, we find support in the fact that it rates NEOG a “D” for valuation, as seen below.

Exhibit 8. Seeking Alpha Quant gradings place NEOG at a low rating for valuation as well

Data: Seeking Alpha. NEOG quote page.

Net-net, there’s been no statistical change in any of NEOG’s financial or market metrics in order to revise our hold thesis on Neogen Corporation stock. Checking its ability to fund future growth without external financing is also a clamp on its ability to create future economic value for shareholders in our opinion. Moreover, EPS upside looks to be tight into the coming periods, and this is reflected in the stock’s valuation. As such, we continue to rate Neogen Corporation a hold.