MongoDB: Headed For Q3 Earnings, Still Dominant In Its Space (NASDAQ:MDB)

Thinkhubstudio/iStock via Getty Images

Investment Thesis

MongoDB (NASDAQ:MDB) has seen its share price fully collapse by +70% in the past year. Even if the company was in hindsight too expensive, I have to question if today the same can still be said?

In my previous article, I stated,

[…] when everyone is so bearish on the company, there’s clearly room for a near-term bounce.

That’s where I want to continue. I remain of the opinion that with investors so bearish, flooding in negative sentiment, there’s bound to be a bounce higher in MongoDB.

What’s Happening Right Now?

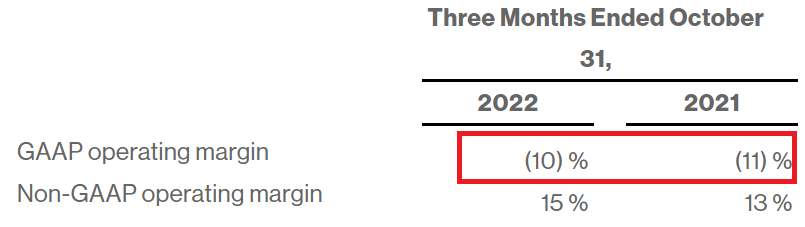

News of enterprises seeing a slowdown in their sales cycle is now coming in thick and fast. The latest example comes from CrowdStrike (CRWD). And what sticks out to me, is that CrowdStrike’s results weren’t even that bad. The only thing that is noticeably bad is that they simply struggle to report a GAAP profit.

Author’s work, CRWD

And that’s the thing with the market. For so many years, companies have been rewarded for focusing on growth, and the market has been more than content to stomach non-GAAP earnings, that when the market changed its mind, it hasn’t given companies enough time to reconfigure their business models.

That being said, I continue to believe that demand for non-relational databases is here to stay. Enterprises require database functionality for everyday productivity. MongoDB allows users to contextualize and operate through unstructured data. Indeed, to say that MongoDB is a general-purpose database platform doesn’t do MongoDB justice.

Taking a step back, as a reminder, the difference between non-relational and relational databases is that relational databases don’t scale.

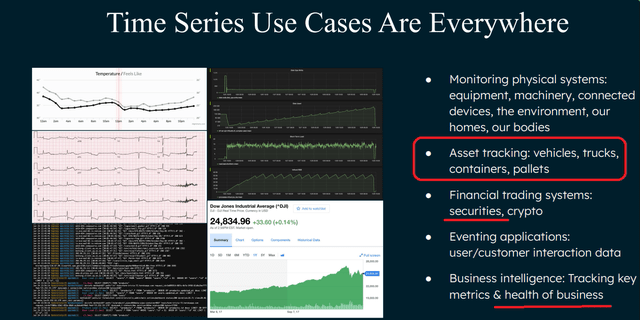

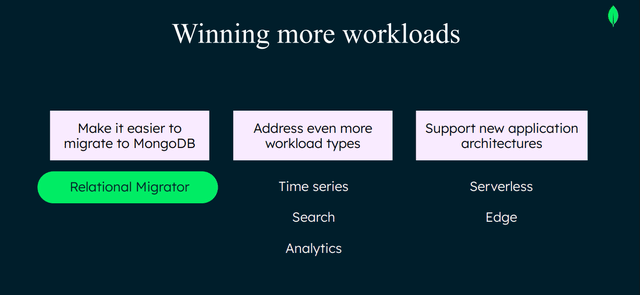

MongoDB allows customers the ability to interact across a time series, with analytics, and obviously, the most important function here is search.

The key growth engine for MongoDB is Mongo Atlas, its cloud platform.

Through Mongo Atlas, businesses don’t need to build and upkeep all the infrastructure required to run their databases. Outsourcing their infrastructure requirements allows them to cut back on costs and get up and running quicker, without having to invest in a whole IT team. It’s a win-win, for customers and MongoDB.

Essentially, MongoDB allows businesses to hold varieties of data applications with databases. That’s the key. The ability to organize and process data, that is non-relational. Data in different formats.

It could be a document or a website, or in a format where information is constantly changing. MongoDB is capable of digesting and organizing these various types of data side-by-side and gives developers the ability to search for answers. Think of searching through Twitter as an example, versus a static spreadsheet.

Next, let’s dig into its growth prospects.

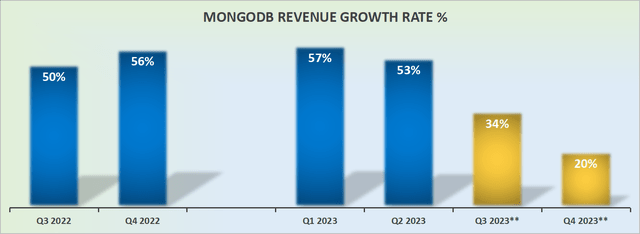

Revenue Growth Rates Are Coming Down

On the one hand, we have to remember, that MongoDB Atlas is its Database-as-a-Service offering. It makes up nearly 65% of total revenues and that grew at 73%.

But that naturally begs the question, how much is Atlas cannibalizing its on-premise offering? And that’s something we need to remain mindful of.

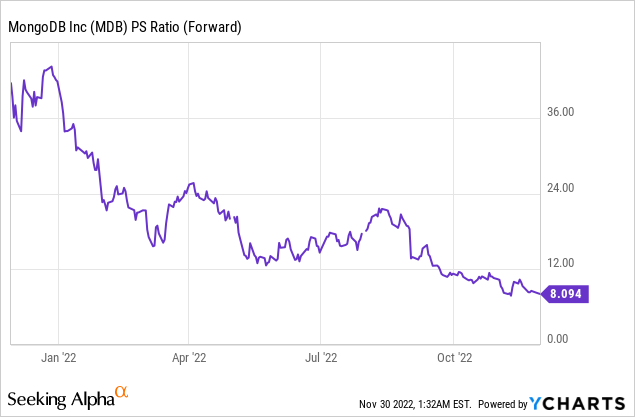

MDB Stock Valuation — 8x Forward Sales

The graphic that follows speaks for itself.

MongoDB’s multiple has fully compressed. Does that mean it can’t compress further? To answer that question, I’ll first highlight the following fact:

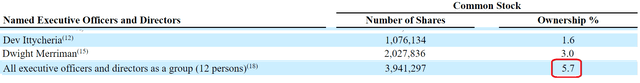

As you can see above, management holds approximately $500 million worth of stock. They too are down +70% in the past twelve months.

The main issue facing MongoDB, at its core, isn’t the lack of growth. It’s really the fact that the business remains unprofitable. But when management sees more than $1 billion worth of equity go up in smoke in 12 months, I can assure you that they are making all the necessary steps to get this business to be profitable, sooner, rather than later.

The Bottom Line

MongoDB has seen its valuation fully compress. There’s very little hope left in its valuation. Yet, the vast majority of IT still happens through relational and structured databases. Even though there’s no doubt that the digital transformation is underway. It’s just that investors got temporarily carried away with a story and took it too far.

I believe that when MongoDB announces its Q3 results next week, we are going to be hearing a lot of insights about how MongoDB is now repositioning its business for sustainable profitability. Stay tuned for updates.