Microsoft: Wait For A Better Entry To Buy This Compounder (NASDAQ:MSFT)

The investment thesis

It has been more than six months now since I have written my first article for Seeking Alpha on Microsoft Corporation (NASDAQ:MSFT). If you’re interested in the business model, competitive advantages, and financials in general you can check out the article here.

Back then, I rated Microsoft stock a buy due to the premium quality of this business and attractive valuation, but there have been some developments over the past months. The stock outperformed the broader market by a wide margin, mainly driven by AI related hype. Besides, the latest earnings release turned me a little bit more cautious on future earnings growth rates. As a result, I have to downgrade my rating on Microsoft to a solid hold. I expect the stock to cool off as the AI hype tailwinds will eventually subside. Nevertheless, Microsoft remains a true compounding machine and great business to own for long term dividend investors.

In this article, I will discuss the recent stock and financial performance, and update my discounted cash flow model. I will also take a closer look at Microsoft’s ROIC and ROE metrics, and the potential of Microsoft as a dividend portfolio holding.

Six month stock performance

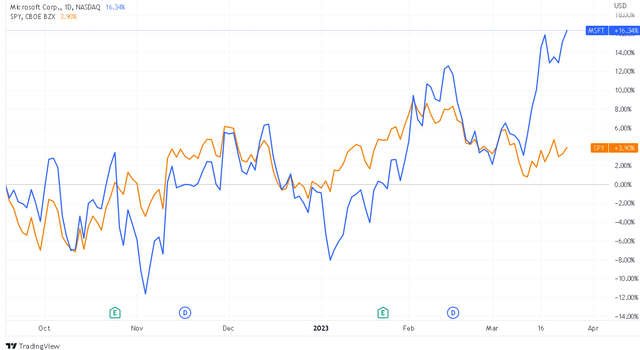

Microsoft posted a total return of 16.3% versus 3.9% for the S&P 500 index (SPY) since my first article was published. The majority of this outperformance has been realized over the last couple of weeks.

MSFT and SPY six-month total return (Tradingview)

The surge in share price has been mainly fueled by artificial intelligence related news, as Microsoft is starting to embed AI technology into its office suite. On top of that, there have been rumours that Microsoft could challenge search engine market leader Alphabet Inc. (GOOG) through the integration of OpenAI’s technology in Bing.

While I think that AI will enhance Microsoft’s competitive position in some of their business areas, it is hard to estimate how it will contribute to earnings. The recent run-up of the stock is therefore debatable, just like other AI stocks such as C3.ai, Inc. (AI) and NVIDIA Corporation (NVDA). It is likely that stock prices of all these companies will cool off once the hype subsides.

Growth is slowing in FY2023

Over the long term stock prices are driven by business fundamentals. Microsoft shareholders have been spoiled over the last couple of years. Between FY2018 and FY2022, revenue grew with a 15.8% CAGR. However, it seems that FY2023 is going to be a tough year in terms of revenue and earnings growth.

In the second quarter of FY2023, total revenue grew with only 2% to $52.7bn. Part of this slower growth is attributable to a stronger dollar. In constant currencies, net revenue grew with roughly 7%. Still, this is nowhere near the double-digit growth numbers investors were used to.

It is mainly More Personal Computing that negatively impacted total revenue as reported sales from this business segment decreased 19% (16% in constant currency). The PC and gaming markets continued to show weakness. Admittedly, the comps were very tough to beat as More Personal Computing posted record sales in Q2 FY22.

Luckily, Productivity & Business Processes and Intelligent Cloud offset the decline in More Personal Computing by posting steady growth numbers. Revenue from Productivity & Business Processes grew 7% (13% in constant currency), driven by Office Commercial, LinkedIn, and Dynamics. Intelligent Cloud sales grew 18% (24% in constant currency) driven by Azure and other cloud services.

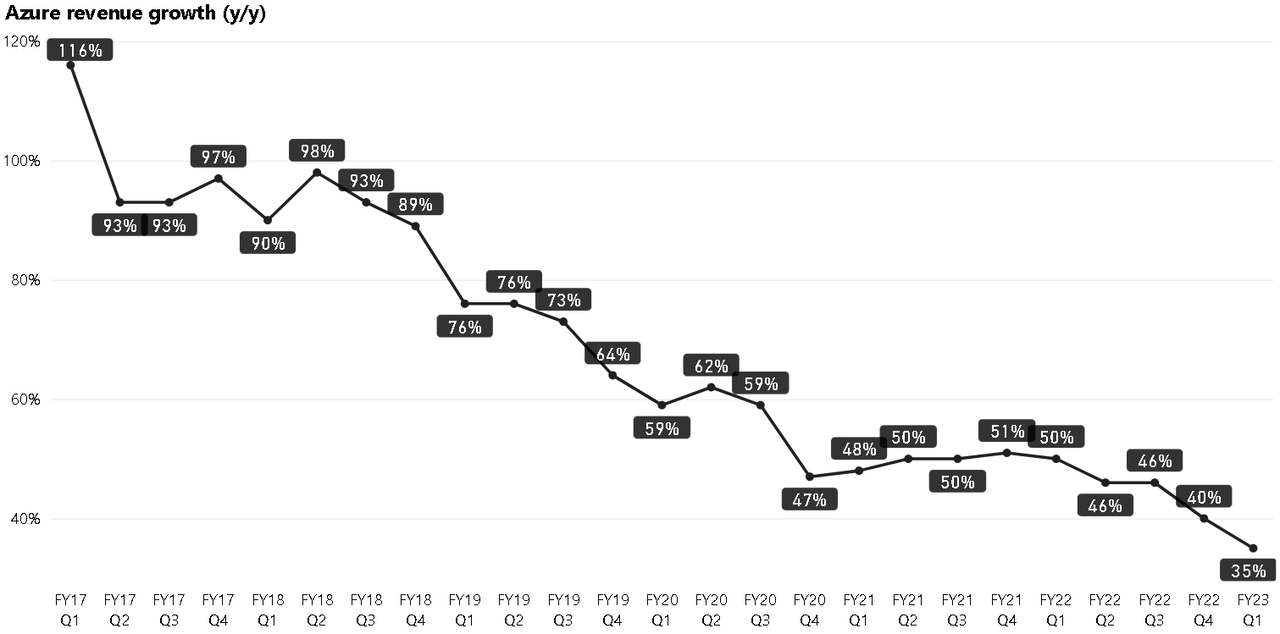

So it is good that these segments are still growing double-digits in constant currencies, but growth rates are slowing. Azure’s revenue growth declined to 35% YoY after trending in the 40%-50% range for two years (see figure below). LinkedIn is another example that showed explosive growth over the past quarters, however in Q2 FY23 sales growth fell below 20% YoY for the first time since COVID hit the markets.

Azure revenue growth YoY (Microsoft Investor Relations)

Margins have compressed slightly. The overall operating margin declined from 43.0% in Q2 FY22 to 38.7% in Q2 FY23. As a result, operating income declined 8% – it has been years since this happened for the last time.

Regarding AI, management gave a few examples during the earnings call how AI is helping its customers. However, like I said, no concrete numbers were given.

On the bright side, things are not looking that bad. It is normal for a company to have some challenging quarters after years of explosive growth. Furthermore, the long term secular growth trends are still intact. For full fiscal year 2023, analysts are currently expecting that total revenue will grow between 5%-6%. But, for the FY2024-FY2026 period analysts expect that sales will grow between 11%-13% annually. The operating margin is expected to bounce above FY2022 levels in FY2025, driving mid-to-high teens earnings growth during that period.

Now that I’ve gone through the most important recent events, it is time to zoom in on the return on invested capital and dividends.

Return on invested capital and return on equity

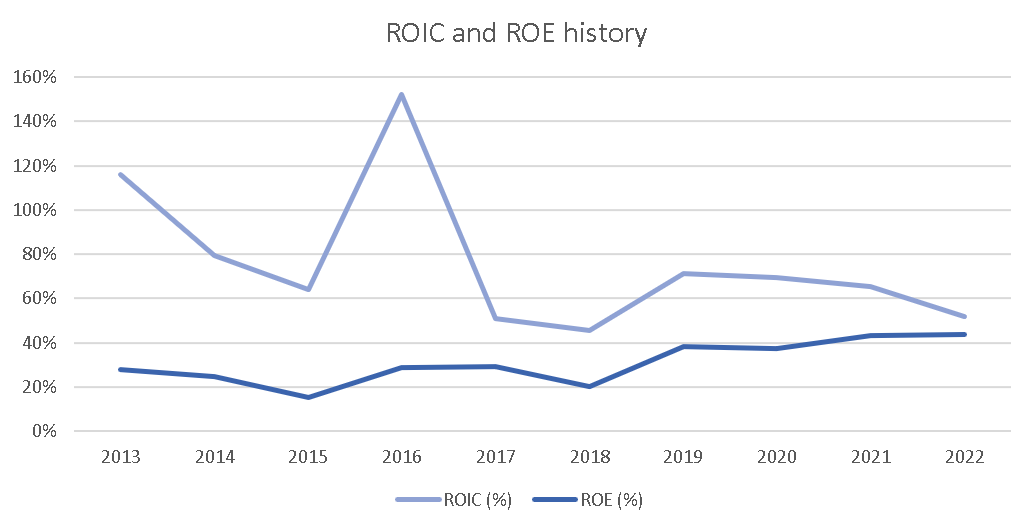

In my previous article, I briefly highlighted Microsoft’s excellent return on invested capital (or ROIC). Given the importance of this metric, I would like to discuss it here in more detail.

The theory is pretty simple: as an investor you want to maximize the return on capital you invest in a business. Therefore, you want to search for businesses that generate the highest returns on invested capital. If a company manages to gain for example 20% on their investment in a ‘normal’ year, it can thrive in any market environment, invest a lot in R&D and it indicates that the company has strong competitive advantages. Over time, its profits will grow exponentially through the famous compounding effect.

So the ROIC determines the quality (or moat) of a business, but there is another reason why I like the ROIC metric. It does not only include the shareholder equity, but also net debt. Many companies try to increase the return on equity by funding investments with borrowed money. This is not a bad thing per se, but you don’t want to take on too much leverage. The ROIC can be calculated with the following formula:

ROIC (%) = net income / (shareholder equity + net debt) * 100%

Microsoft is a special case because it has a net cash position. In that case, the return on equity (or ROE) is actually the most conservative metric to look at. The following graph shows the 10-year ROIC and ROE history. The ROE has been above 20% for nearly all years and even exceeded 40% last fiscal year. Those are some exceptionally good numbers, highlighting the premium quality of Microsoft as a company.

Microsoft 10-year ROIC and ROE history (Microsoft Investor Relations; Author)

A dividend aristocrat in the making

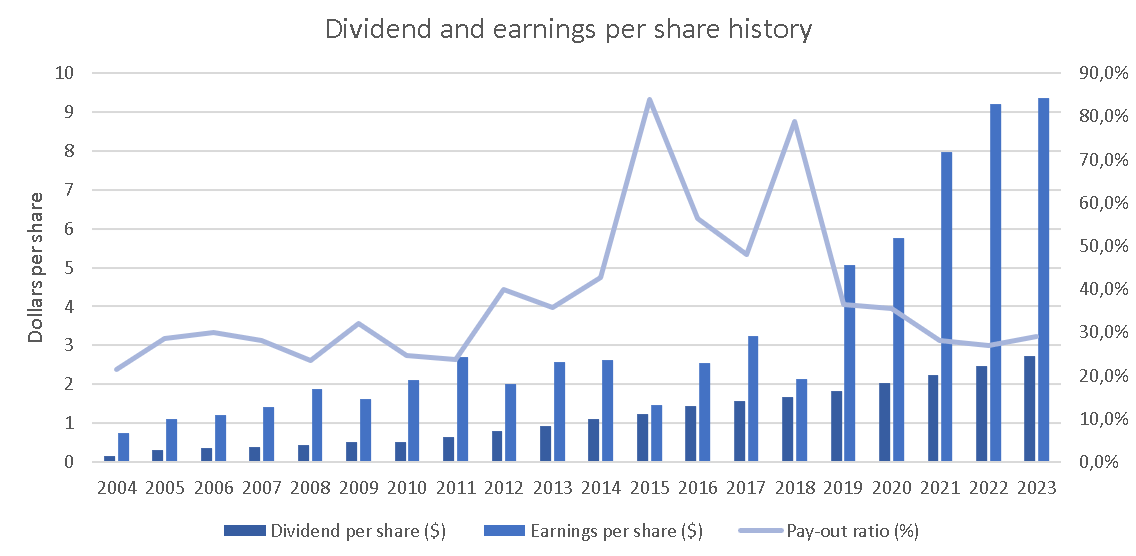

The great returns on invested capital/equity enable Microsoft to return a lot of excess capital to shareholders. Microsoft is currently yielding approximately 1.0% if you buy shares at the current price. At first sight, Microsoft stock may not appeal to most dividend investors as it will take some years to achieve a decent yield on cost. But, if your time horizon is 20+ years, Microsoft should be one of your core holdings in my opinion.

At the time of writing, Microsoft has increased its dividend for 18 consecutive years. The 5 and 10-year dividend CAGRs are 10.1% and 11.4% respectively. The following graph shows the dividend per share, earnings per share (both on the left y-axis), and pay-out ratio (right y-axis) since 2004.

Microsoft 10-year dividend and EPS history (Microsoft Investor Relations; Author)

It will only take 7 more years to achieve the dividend aristocrat status. Given the pay-out ratio around 30% and earnings growth outlook, it is almost certain that Microsoft will be a future dividend aristocrat.

So what future yield on cost could you expect from holding Microsoft shares for 20 years? The dividend growth rate will probably decline over the years as it becomes harder and harder to maintain double-digit revenue growth. But, a growth rate between 5% and 10% is achievable. The following table provides some scenarios for different dividend growth rates and the potential yield on cost in 20, 30, and 40 years (using today’s stock price of $280.57).

|

Average dividend growth rate |

YoC in 20 years |

YoC in 30 years |

YoC in 40 years |

|

5% |

2.6% |

4.2% |

6.8% |

|

6% |

3.1% |

5.6% |

10.0% |

|

7% |

3.8% |

7.4% |

14.5% |

|

8% |

4.5% |

9.8% |

21.1% |

|

9% |

5.4% |

12.9% |

30.5% |

The 20-year yield on cost numbers may not be that exciting, but things really get interesting after 30 and 40 years of holding Microsoft. I can hear you thinking: “well, there are also stocks out there that give me a 5%+ yield right away”. That’s true, however these companies often have a higher pay-out ratio and significantly less growth potential, and thus a higher probability to cut the dividend in the future. Besides, I focus on total returns: it is very likely that the stock price will grow at the same rate as earnings over the long term. That’s why holding Microsoft for the dividend only makes sense for investors with a very long time horizon. If you need income now, there are plenty of other opportunities that might fit your strategy better.

Updating my fair value

It is safe to say that Microsoft is a great business with solid fundamentals. Ideally, you want to pick up shares below the intrinsic value.

An often used method to calculate the intrinsic value of a company is the discounted cash flow analysis. I will use this method to calculate the intrinsic value of Microsoft. The following figure shows my main assumptions.

All current and historical financials can be found on Seeking Alpha’s financials page. Total sales growth through FY2026 is in-line with the current analyst estimates. After FY2026, I assume a gradually decreasing total revenue as the company grows more and more mature. Moreover, I assume a gradually increasing EBIT margin as high-margin SaaS solutions are becoming a larger part of total revenue.

The income tax expense, D&A, capital expenditures, and change in working capital are excluded from the figure, but for all I of them I made historically conservative assumptions. The resulting projected free cash flows are shown in the green cells.

DCF model inputs Microsoft (Seeking Alpha Financials; Author)

The output is a table with the fair value per share for different combinations between the required rate of return and perpetuity growth rate. At the current share price ($280.57), Microsoft stock is overpriced for most scenarios. For me it only makes sense to buy individual companies if they have the potential to outperform the index. My personal required rate of return is therefore 10% or higher. Assuming a required rate of return of 10% and perpetuity growth rate of 3.5%, I would be interested to buy Microsoft below $220.00 per share. Note that Microsoft stock traded below this price target in October / November last year and in January this year.

DCF model output (Author)

Final thoughts

There is a lot to like about Microsoft. The company is in the forefront of implementing AI technology, and secular growth trends (such as the rise of cloud computing and shift towards SaaS solutions) remain intact. I showed that Microsoft is achieving extraordinarily high returns on invested capital, indicating the premium quality of this company. This enables Microsoft to continue growing the dividend and eventually become a dividend aristocrat. Despite the current low yield, Microsoft is a great addition to any long term investors’ dividend portfolio.

But should you buy Microsoft now? The company is experiencing some tough quarters after years of exceptional growth. Meanwhile, the stock surged over the past couple of weeks partly driven by AI hype. That makes the stock pretty overvalued for a 10% expected annual return at the current price. I therefore advise long term investors to wait for a better opportunity in the coming few months.